With out a will, asset dispersal could be problematic.

This weblog publish experiences on the outcomes of a survey that requested members whether or not or not they’ve a will and why. Subsequent week’s publish will current the outcomes of an experiment, for these with out a will, to find out whether or not combining will-writing with the mortgage course of – NOT a very good concept – would encourage extra individuals to put in writing wills.

The distinction between having some wealth and relying solely on present revenue is large. The simplest approach to make sure that wealth transfers go to the supposed recipients is for the donor to have a will. With out a will, belongings can get dispersed amongst a number of heirs, which generally is a specific drawback for individuals whose main asset is their residence.

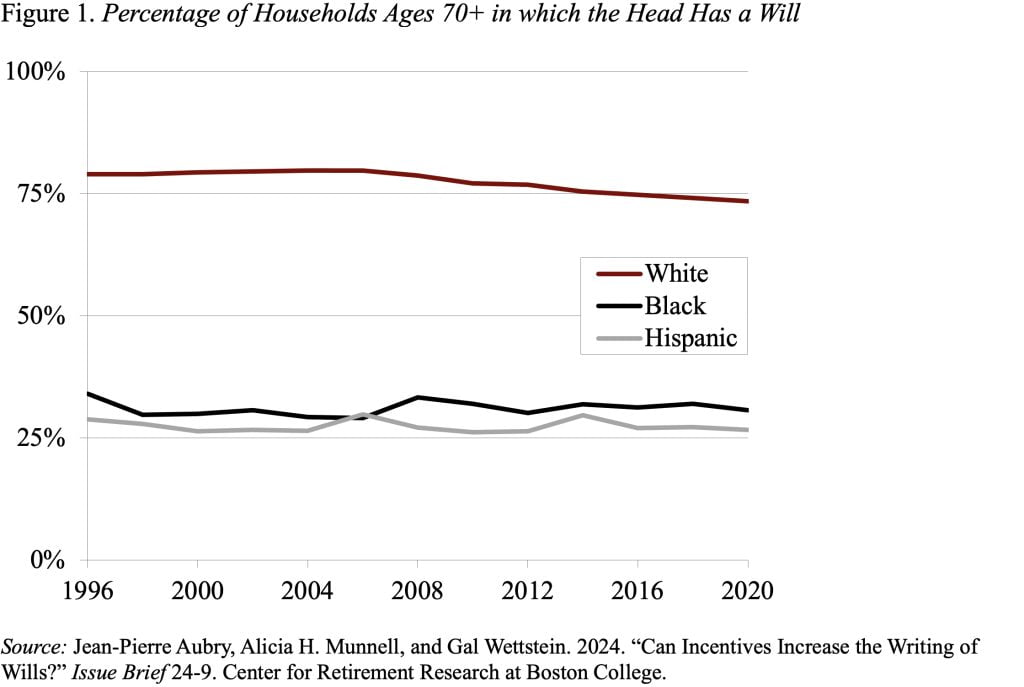

Regardless of the benefits of having a will, solely about two-thirds of households with heads ages 70 and older had a will in 2020, and the share of White households with a will was greater than twice that for Black and Hispanic households (see Determine 1).

The query of curiosity to us was whether or not focused bequests could be elevated by an intervention that promotes will-writing. To reply that query, we performed a survey – utilizing the AmeriSpeak panel run by NORC on the College of Chicago – that requested members a sequence of questions on whether or not or not they’ve a will and why. These with out a will then participated in an experiment to find out whether or not varied incentives would encourage them to put in writing a will.

The survey confirmed that 34 p.c of all respondents ages 25 and over had a will. These people had been older, with extra training, extra more likely to personal a house, extra more likely to be White, and had considerably larger revenue.

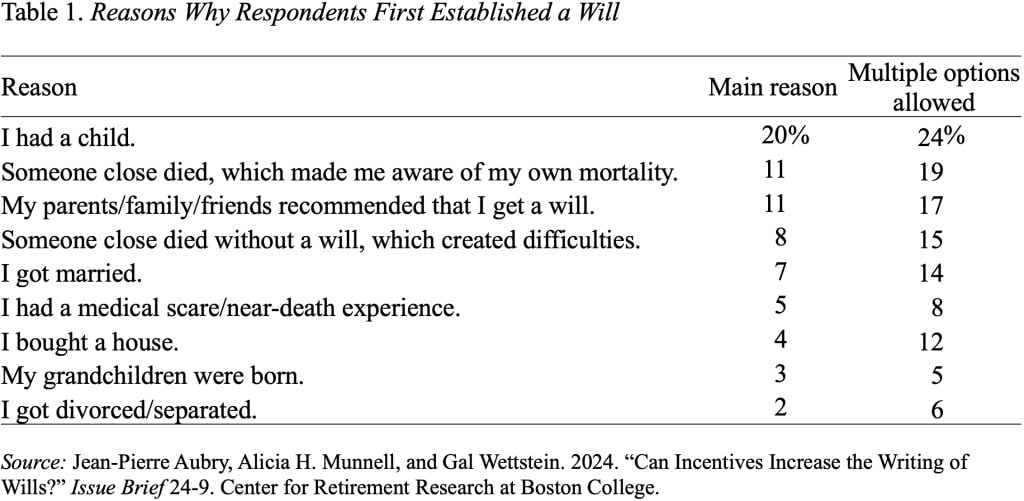

A very powerful motivating life occasion for writing a will was having a toddler (see Desk 1). The following two causes had been extra exterior: 1) somebody near the person died, highlighting their very own mortality; and a pair of) dad and mom/household/good friend really helpful that the person set up a will.

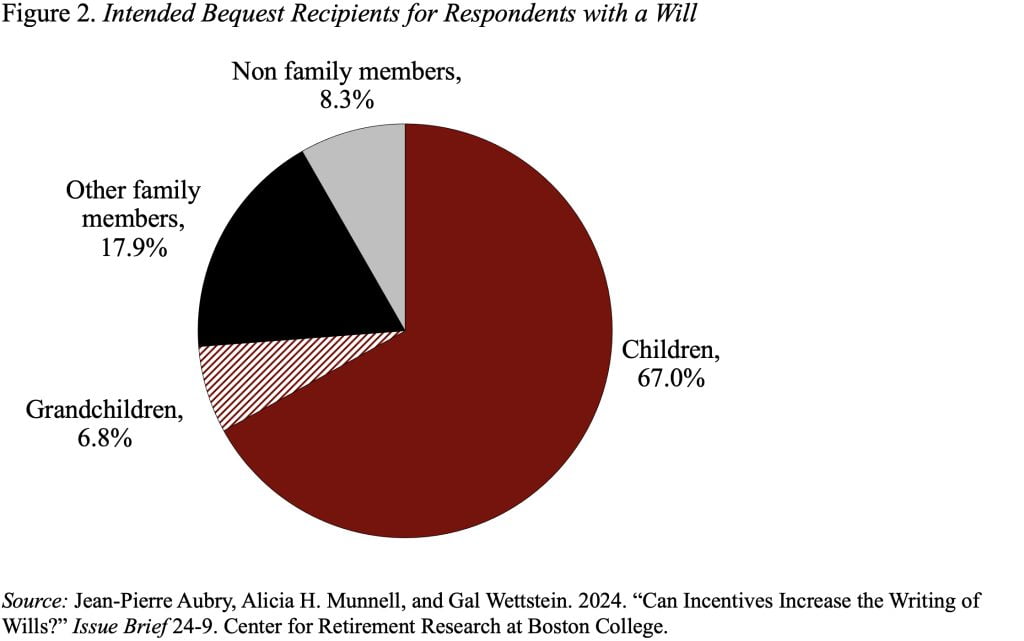

The survey additionally requested about supposed recipients. The outcomes present that youngsters account for two-thirds of the entire and grandchildren 7 p.c. Different members of the family account for 18 p.c and non-family – each unrelated people and non secular or charitable organizations – 8 p.c (see Determine 2).

The remaining 66 p.c of people didn’t have a will. The main motive provided for not having written a will (44 p.c) was: “I simply haven’t acquired round to it but.” This response is according to earlier research displaying procrastination is a serious drawback in relation to will-writing. The second main motive is that some might have thought that they had taken care of bequests, responding “I’ve named beneficiaries for many of my monetary belongings (401(ok), life insurance coverage, and so forth.)” Most of the different responses urged that folks had been usually baffled by the method.

Subsequent week’s weblog publish will report whether or not the prospect of together with will-writing within the mortgage course of would make issues higher or worse and what we discovered from that.