A better have a look at the Boeing negotiations solely makes the query extra puzzling.

Boeing employees lately accepted the corporate’s third provide. The settlement doesn’t embody reopening the Boeing outlined profit pension plan, which was cited as the key motive that the union rejected the second provide. Though the strike is over, I discover the truth that reopening the pension plan performed such a outstanding position within the negotiations actually fascinating.

After many years of serious about retirement plans, my conclusion is that protection is the key situation. A lifetime of participation in any sort of employer-sponsored plan just about ensures a safe retirement. In my opinion, the 401(okay)/DB debate is a diversion.

But, the reopening of the pension plan was clearly essential to Boeing employees. I can consider two causes that may be the case: 1) the idea that the employer pays for advantages underneath an outlined profit plan whereas the employee pays for 401(okay) advantages; or 2) the advantages provided underneath the Boeing outlined profit plan had been increased than these ensuing from mixed worker/employer 401(okay) contributions.

No economist can settle for the notion that the employer contribution to an outlined profit plan is an “add-on” that prices the worker nothing. Reasonably, the employer decides on a bucket of cash that it might probably pay in complete compensation – wages, medical insurance, retirement and many others. – after which allocates it among the many varied parts to create probably the most fascinating bundle. If workers clarify they need extra employer contributions to an outlined profit plan, they may over time obtain much less in wages, well being care, or different advantages. In different phrases, the worker pays no matter whether or not retirement advantages are offered by 401(okay)s or outlined profit plans.

The second situation requires evaluating the advantages payable underneath Boeing’s outlined profit plan and its 401(okay) association. The agreed-upon contract included provisions for every:

- Outlined profit plan: In 2015, Boeing ended all profit accruals for present and future hires, however some lively employees nonetheless have credit within the plan. Boeing will improve the greenback per credited service (i.e., service earned earlier than 2015) for all lively employees from $95 to $105.

- 401(okay) plan: Boeing will improve the employer matching contribution from 50% of the primary 8% of an worker’s contributions to 100%. As well as, the corporate will make a supplementary 4-percent employer contribution program out there to all workers (at the moment, it is just for these employed after 2015).

My colleagues JP Aubry and Yimeng Yin constructed a spreadsheet for employees at two wage ranges based mostly on the next assumptions:

- Wage: Development 3% per yr.

- Age: Beginning at 35 and ending at 65.

- 401(okay): Whole contribution 20% (8% worker, 8% employer match, and 4% employer complement).

- Outlined profit: Greenback per credited service $150 (reflecting a continuation of the expansion within the credited quantity between 2009 and the brand new contract).

- Fee of return: 6% and 4%.

- Annuitization of 401(okay) balances (for comparability to outlined profit cost) based mostly on immediateannuities.com.

You may see the outcomes of this train in Desk 1. The profit quantities look actually excessive as a result of all of the calculations are in nominal, not inflation-adjusted, {dollars}. What we’re focused on is the distinction between the outlined profit and 401(okay) quantities. The underside line is that the 401(okay) persistently outperforms the outlined profit plan. And the discrepancy is bigger at increased salaries, which isn’t stunning provided that the outlined profit is a flat quantity per yr of service (albeit with a flooring associated to a employee’s last wage) whereas the 401(okay) contributions are based mostly on earnings.

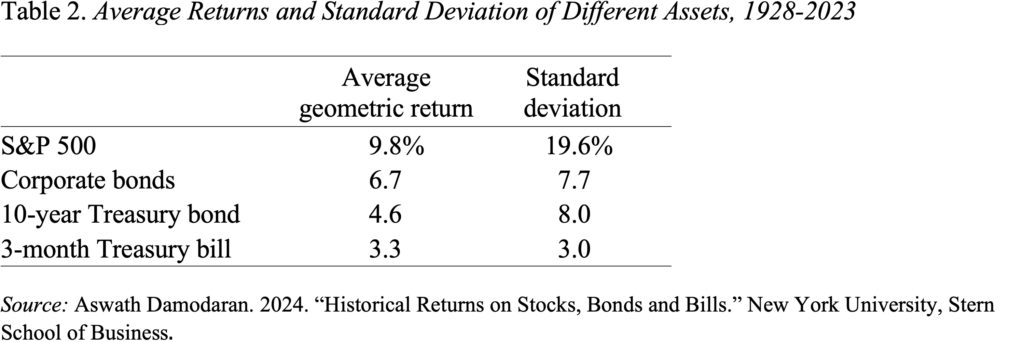

However what’s extra fascinating to me is even at a 4-percent return – lower than the historic common return on 10-year Treasuries (see Desk 2) – the 401(okay) plan does barely higher on the decrease wage stage. That signifies that a really risk-averse particular person may make investments their 401(okay) property solely in Treasuries and are available out forward of the Boeing outlined profit plan.

After all, this easy train entails loads of caveats – workers could not select to contribute the complete 8% to the 401(okay), salaries could develop extra slowly, and many others. However the outcomes do make it onerous to know employees’ unwavering devotion to outlined profit plans.