Individuals are actually confused.

We’ve launched into a bunch of research about long-term care. One part of that effort is to evaluate the general public’s understanding of how these prices are financed. A bunch of surveys during the last 10 years point out that persons are confused; most suppose that Medicare performs a serious position. In reality, Medicare doesn’t cowl any sort of long-term care, whether or not in a nursing house, assisted dwelling neighborhood or at house.

Medicare covers medical companies – hospital care (Half A), doctor care (Half B), and pharmaceuticals (Half D). It gained’t pay for a keep in a long-term care heart or the price of custodial care, similar to help with the actions of each day dwelling like bathing, dressing, consuming and utilizing the toilet — if that’s the one care wanted. One potential supply of confusion could also be that Medicare can pay for short-term stays in a talented nursing facility inside 30 days of three+ days in a hospital. Nevertheless, over half of Medicare-covered expert nursing facility stays are for 20 days or much less, and over 90 p.c for 60 days or much less. Medicare additionally supplies hospice care to people assembly a minimal stage of want threshold. Since a lot of the care coated by Medicare is brief time period and related to an acute occasion, nobody ought to anticipate Medicare to cowl their day-to-day long-term-care wants as they age.

When it comes to long-term care, the main public participant is Medicaid – a joint federal-state program – which covers about 20 p.c of the nation’s complete care hours offered and pays a substantial portion of the nation’s nursing house payments. With a view to qualify for Medicaid, nevertheless, retirees will need to have each a sure stage of practical limitations and low ranges of earnings and property. As a result of the earnings and asset limits are so low, even with allowable exemptions, it may be arduous for people to qualify for Medicaid after they initially develop care wants. Nevertheless, over time, a few of these with intensive wants spend down their property and do find yourself qualifying. Due to this fact, Medicaid performs a much bigger position than one would suppose at first look.

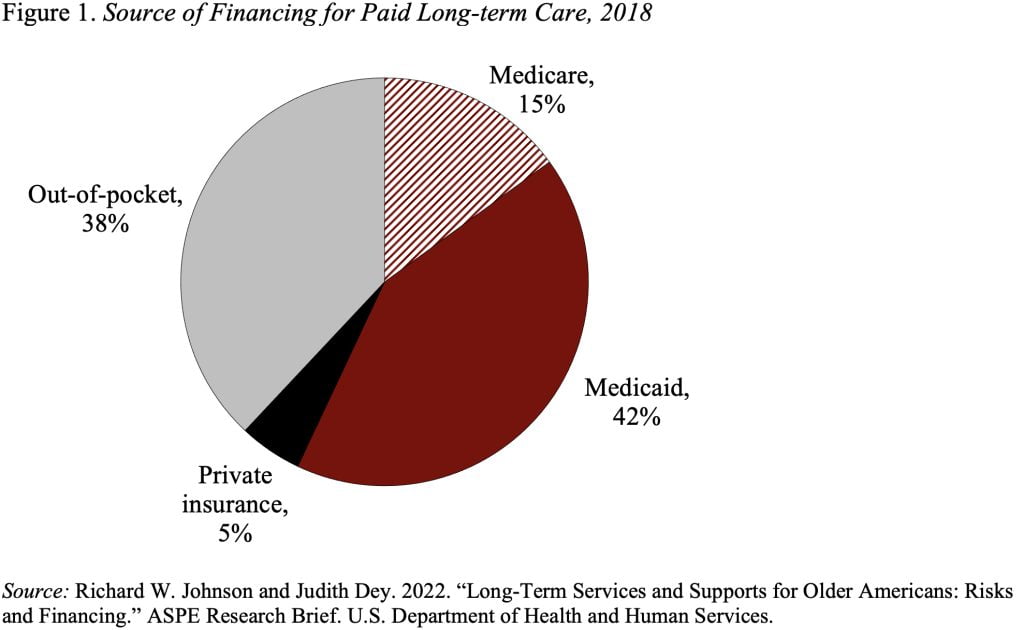

A current research projected expenditures for folks ages 65 by way of loss of life for customers of paid care; this calculation confirmed that 42 p.c of the entire got here from Medicaid and one other 38 p.c from out of pocket (see Determine 1). The small quantity attributable to Medicare is especially hospice care – not one thing conventionally thought of as conventional long-term care. Personal insurance coverage pays for under a sliver since most individuals wouldn’t have long-term care insurance coverage.

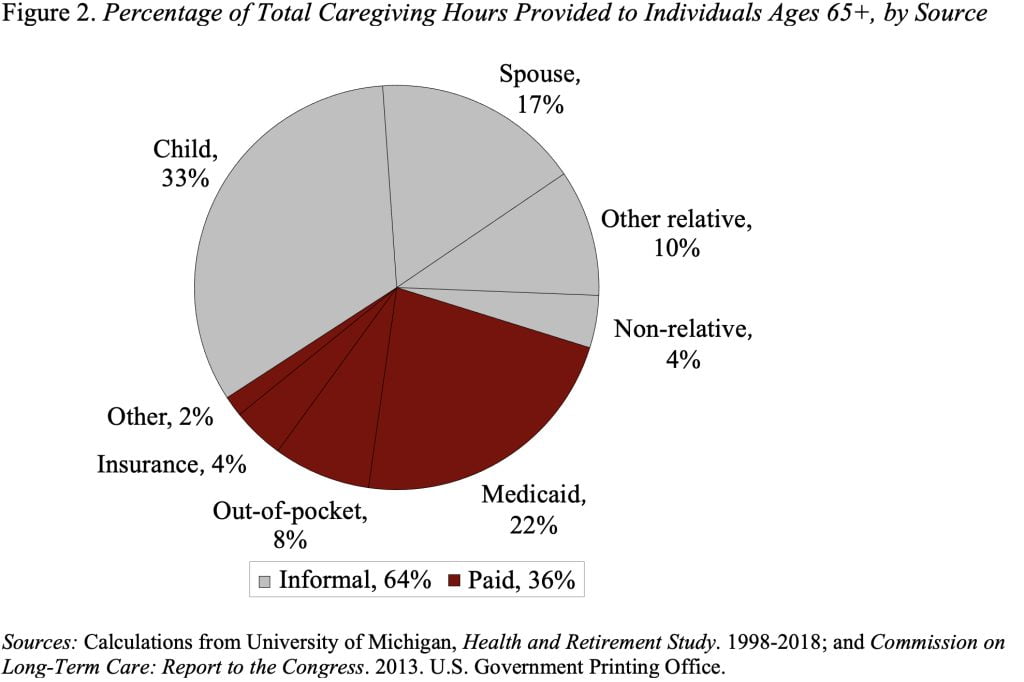

It’s vital to notice that our estimates present that paid long-term care covers solely 36 p.c of complete hours of care offered; most comes from casual care offered primarily by household (see Determine 2).

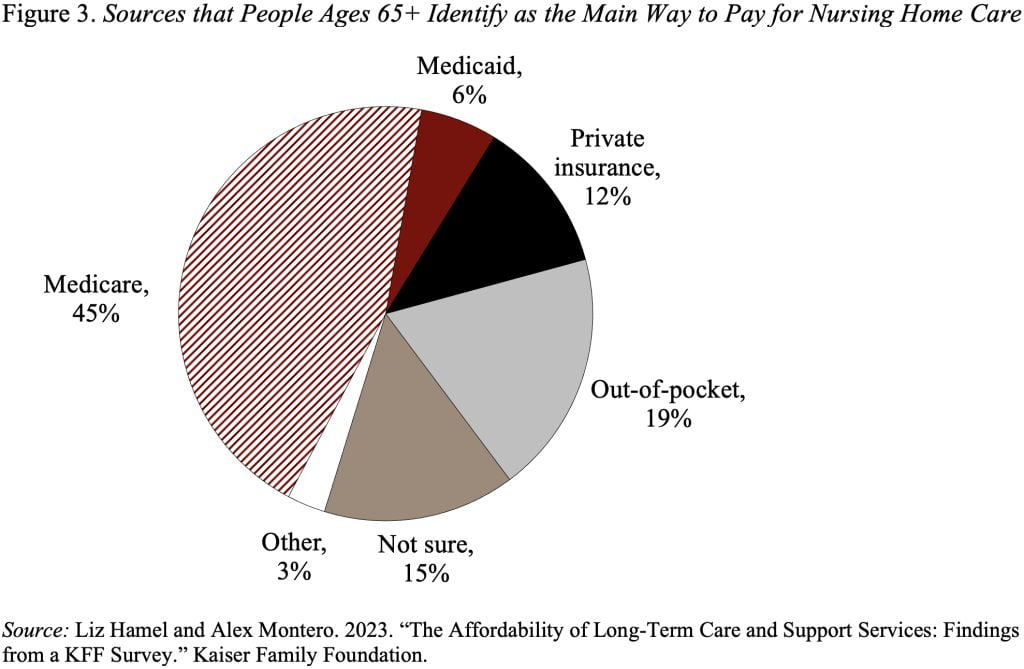

All that mentioned, in a current survey KFF requested members: “Should you or a member of the family had a long-term sickness or incapacity and had to enter a nursing house, how would the invoice primarily be paid?” The responses for these 65+, that are proven in Determine 3, point out that 45 p.c of respondents believed that Medicare would cowl the associated fee.

Clearly, now we have not finished an excellent job explaining the necessity for long-term care, how it’s at present offered (largely by household), and the way the formal care is financed.