The transient’s key findings are:

- Trainer pension prices have doubled as a share of payroll since 2001, elevating considerations about managing this burden amid different training spending wants.

- Whereas college districts rely closely on state help, comparatively little is thought about state funding for instructor pensions particularly.

- Strikingly, about two-thirds of states explicitly present funds for instructor pensions, with 15 of those states paying the complete price on behalf of faculties.

- The remaining third of states implicitly assist with pensions by primary state assist to varsities, however this assist appears to have fallen considerably behind rising prices.

Introduction

Many who’re aware of state and native authorities funds are involved that rising pension contributions could possibly be crowding out essential authorities providers. And, some tutorial literature does discover that increased pension contributions are related to lowered employment in native governments and college districts. The difficulty is especially acute for varsity districts, which should preserve a comparatively massive workforce in comparison with different authorities items.

Importantly, college districts are completely different from different native authorities entities in that a good portion of their prices are coated by transfers from state authorities. So, because the employer portion of instructor pension prices has risen from about 8 % of payrolls in 2001 to virtually 20 % at the moment, discussions in regards to the function of states in funding lecturers’ pensions have grown extra frequent. To assist inform the discourse, this quick primer investigates how, and the way a lot, states contribute to instructor pensions.

This primer has 4 sections. The primary part focuses on states that present specific help for some portion of instructor retirement advantages – describing the varied forms of preparations, in addition to the dimensions and scope of the funding. The second part focuses on the remaining states – right here, the varsity districts are anticipated to pay for nearly all of instructor retirement prices, however the states implicitly help some portion of those prices by common state-aid applications. The third part paperwork vital modifications made by states since 2001. The ultimate part concludes that about two-thirds of states explicitly help some portion of instructor pension prices, with 15 of those states paying the complete price of instructor pensions. The remaining third of states implicitly assist with pensions by the state-aid course of, however this help appears to have fallen considerably behind precise prices.

Which States Explicitly Fund Trainer Pensions?

Only a few research have explored the function of states in funding instructor retirement prices. And, sadly, every of those research presents a considerably completely different pattern of states that explicitly fund instructor pensions and excludes some key particulars on every state’s funding association. So, to higher perceive the scenario, the CRR reviewed the present research, pored over present state statutes on pension funding and college finance, and skim the monetary studies of all of the state and native retirement techniques that present retirement advantages to lecturers. Under is a abstract of the findings.

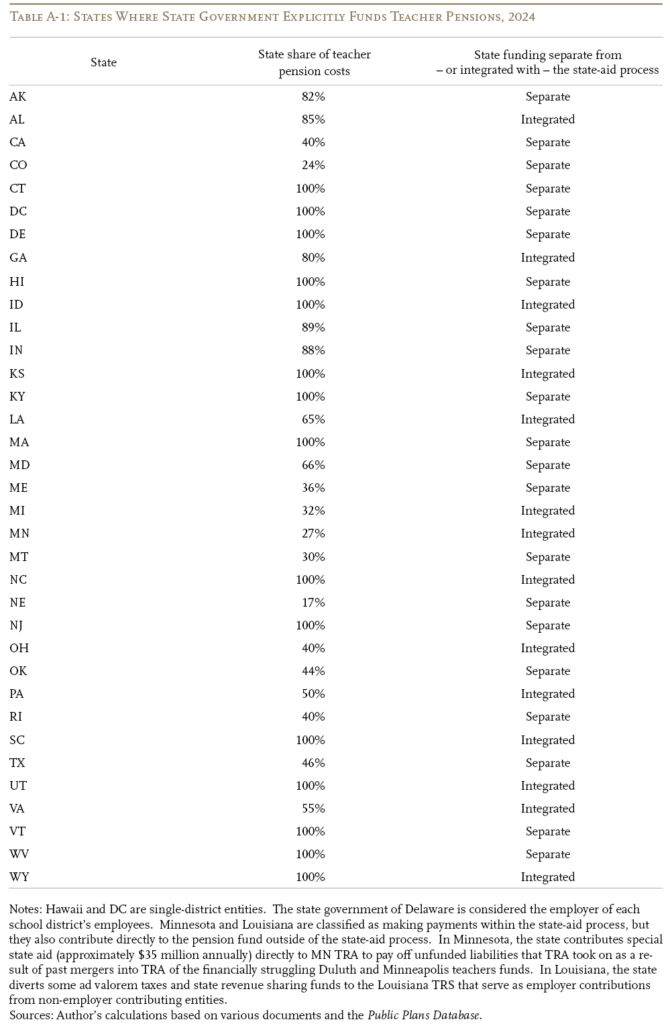

As of June 2024, 35 states (together with DC) explicitly present funds for some portion of the retirement advantages promised to highschool district lecturers (see Determine 1). Whereas most states cowl lecturers by a state-run plan, just a few even have regionally run plans for lecturers. General, then, states explicitly present some extent of standard funding for 39 separate instructor pension plans.

To raised perceive the nuances of every state’s funding association and the way it may impression in-state discourse on instructor pension prices, it’s useful to have a look at two features of every state’s coverage. The primary is the quantity of funding that the state gives for instructor pension prices – that’s, whether or not a state funds all the prices or fairly contributes a selected portion, such because the funds to amortize the unfunded legal responsibility. The second facet is the pathway by which the state gives the funds – that’s, whether or not it’s completely separate from the state-aid course of or considerably built-in.

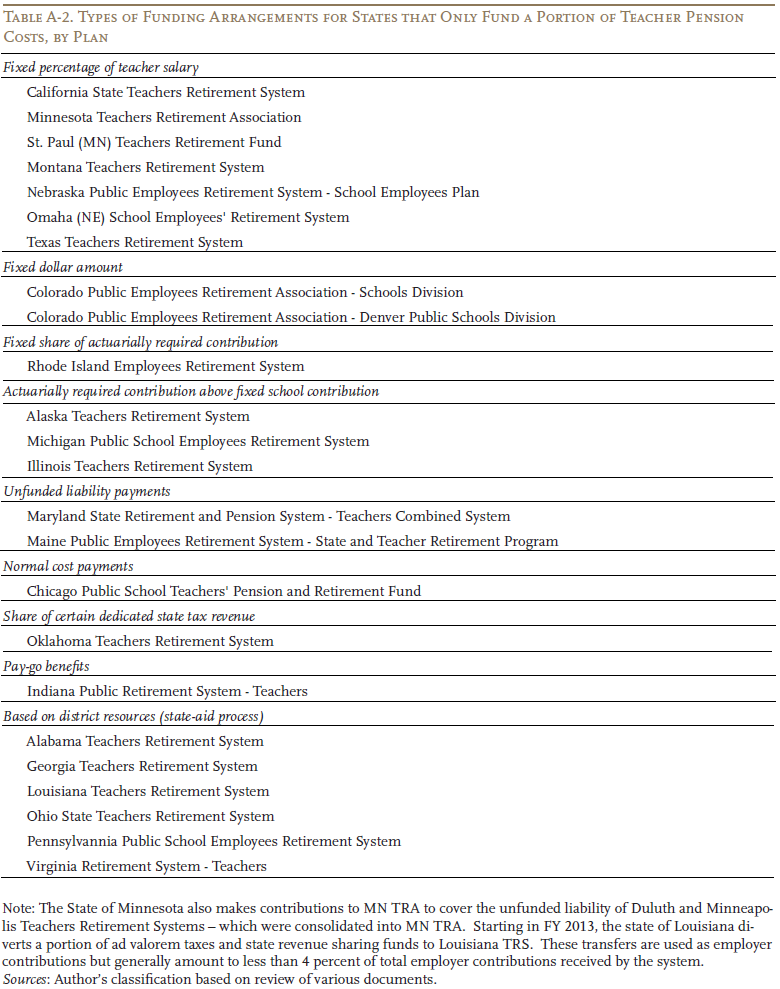

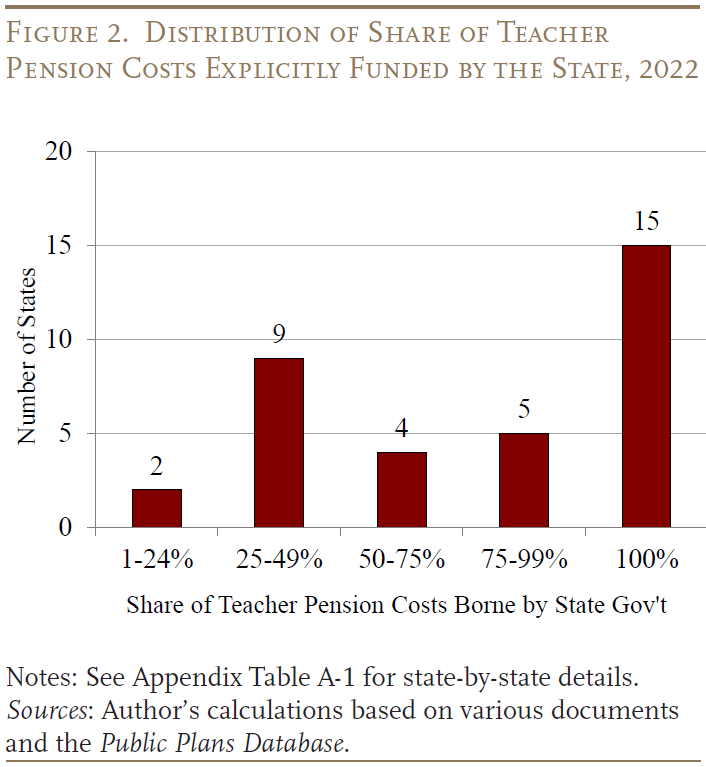

At present, 15 states (15 plans) explicitly fund nearly all instructor pension prices; and 20 states (24 plans) present funds for a portion of prices. Utilizing the main points from paperwork describing the funding preparations for every state and knowledge from the Public Plans Database, Determine 2 exhibits that – among the many states offering funds for a portion of the prices – 11 of 20 pay lower than half.

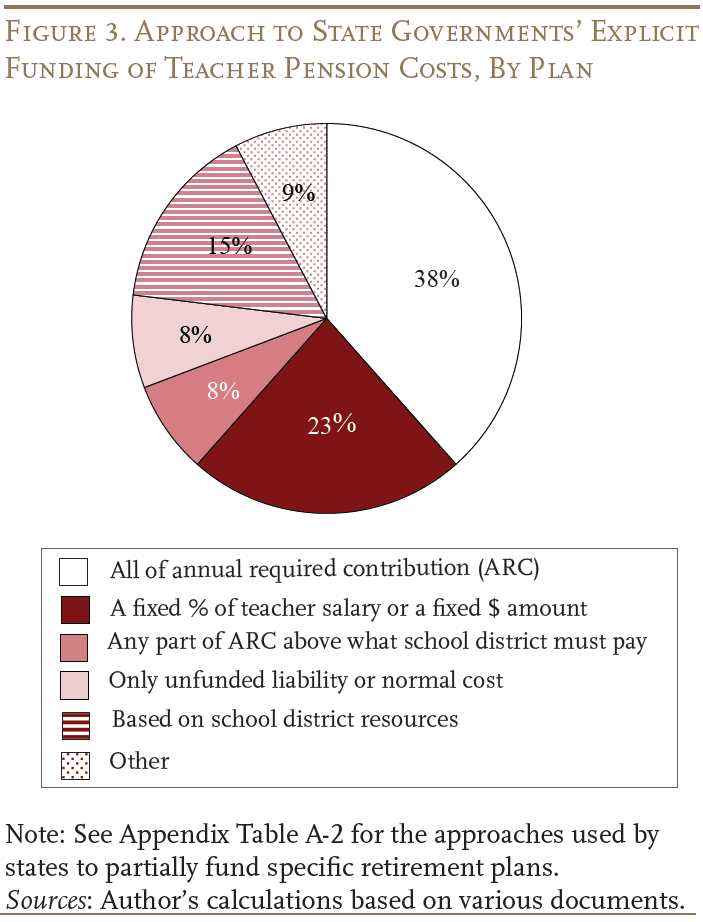

States use numerous approaches to find out their funds. The most typical method – protecting 38 % of instructor pension plans – is for states to pay all the annual required contribution (ARC) (see Determine 3). In instances the place the state doesn’t pay the complete ARC, essentially the most frequent coverage – protecting 23 % of plans – is to pay a hard and fast share of wage or a hard and fast greenback quantity.

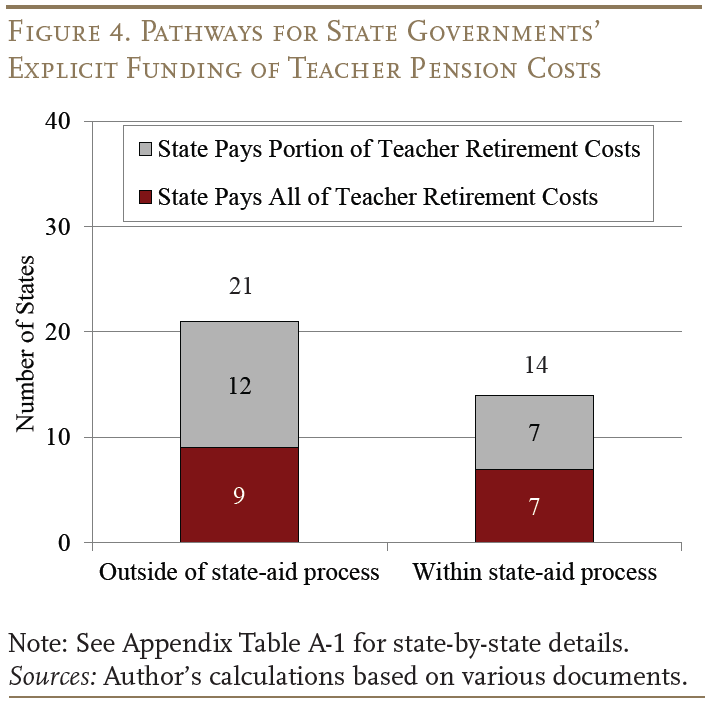

Lastly, Determine 4 exhibits that 21 of the states that explicitly fund instructor retirement advantages select to switch cash on to the pension fund, absolutely separate from the state assist course of, whereas 14 states combine their funding of instructor pensions with the state-aid course of. The method taken right here might matter due to its potential affect on college district decision-making. If states ship cash on to the pension fund, it bypasses the varsity district, making the funding much less seen to key stakeholders on the school-district stage. If states as a substitute combine funding for pensions by the state-aid course of, then college district decision-makers could also be extra aware of pension prices.

States Implicitly Serving to By means of Normal State Help

Importantly, even the varsity districts within the states with out specific funding implicitly obtain assist with their pension prices by the supply of common state training assist. At a excessive stage, state assist offered to highschool districts is a perform of two parts. The primary element is the state’s estimate of the overall price to supply college students satisfactory primary training – also known as the “foundation amount.” The second element is the state’s estimate of every college district’s capability to pay for primary training from its personal fiscal sources. Generally, state assist to highschool districts is supposed to assist districts that can’t help the prices of satisfactory primary training by their very own sources. The important thing query for this primer is to what extent states’ estimates for the price of primary training incorporate the rise in pension prices over the previous 20 years.

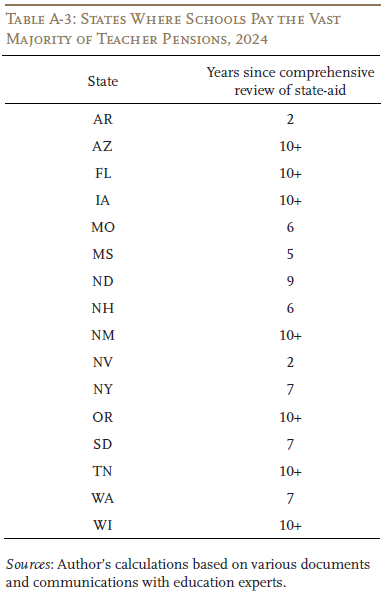

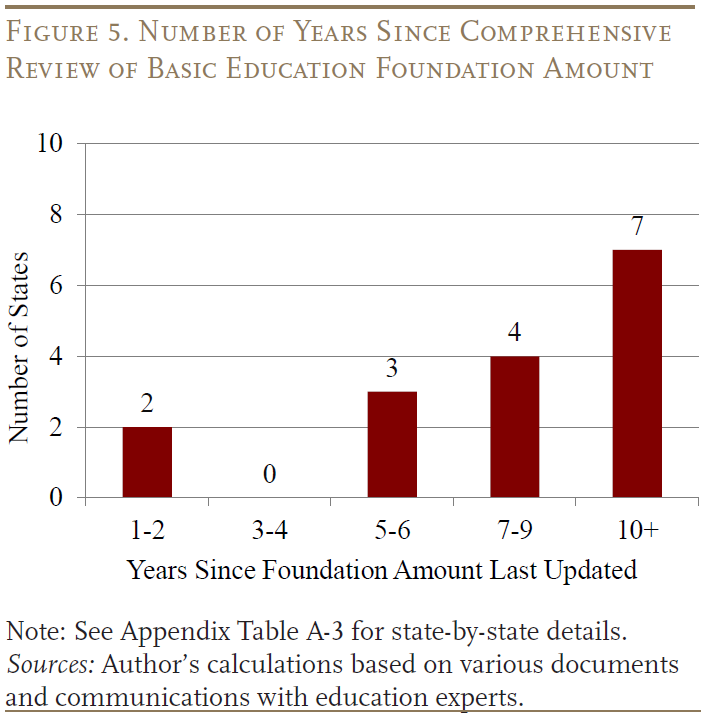

To raised perceive states’ processes for figuring out the price of primary training and the way that may impression college districts in periods of rising pension prices, the CRR reviewed coverage briefs by training finance consultants, tutorial papers, and state laws on training funding. The evaluation revealed two essential details. The primary is that the price of primary training in lots of states is meant – in idea – to incorporate college district pension prices. The second is that states’ estimated prices of primary training are solely intermittently up to date to account for precise modifications at school district prices. As a substitute, rigorously derived estimates of primary training prices are usually elevated by inflation for a number of years till it’s decided that one other complete evaluation is required. Certainly, as of June 2024, 7 of the 16 states the place colleges are chargeable for the lion’s share of instructor pension prices had not comprehensively reassessed the adequacy of their state assist for over 10 years (see Determine 5).

For college districts chargeable for a big portion of instructor pension prices, the impression of a considerably delayed adjustment could be significant. For instance, instructor pension prices have risen from about 8 to twenty % of payroll from 2001 to 2024. If state assist was designed to help roughly 50 % of common college district prices (together with pension contributions) in 2001, a typical inflation adjustment of three % would have resulted in primary training prices that cowl solely about 40 % of college district pension prices in 2024.

How Has Coverage Modified Over Time?

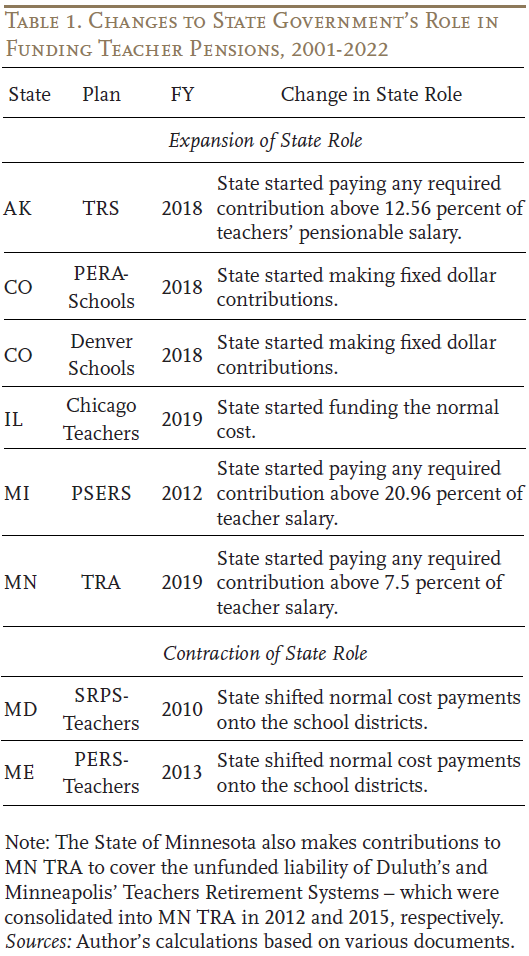

Generally, the state’s function in funding instructor pensions has modified comparatively little since pension prices have been at their lowest level prior to now 20 years. That stated, just a few notable shifts have occurred. Desk 1 particulars the significant modifications made in seven states since 2001. 5 of the states shifted from no state involvement to some type of specific state funding. However, curiously, two states lowered the state’s function by shifting a significant portion of prices onto college districts.

Conclusion

College districts are completely different from different native authorities entities in that a good portion of their general expenditures are associated to personnel prices; they usually rely closely on state authorities transfers for income. So, as instructor pension prices have risen from about 8 % of payrolls in 2001 to virtually 20 % at the moment, discussions over methods to handle these prices – and the potential function of state authorities – have grown extra pressing. To assist inform the discourse, this quick primer investigated the present function of states within the funding of instructor retirement advantages. It discovered 35 states at the moment present some specific help for instructor pensions, with 5 states starting to take action comparatively not too long ago. Importantly, solely 15 of those states pay for all of the instructor pension prices on behalf of college districts. And, within the instances the place state governments don’t present specific help for instructor retirement advantages, it looks like the training state assist course of has fallen considerably behind the rise in pension prices.

References

Anzia, Sarah F. 2019. “Pensions in the Trenches: How Pension Spending is Affecting US Local Government.” City Affairs Overview.

Costrell, Robert M., Collin Hitt, and James V. Shuls. 2019. “A $19-Billion Blind Spot: State Pension Spending.” Academic Researcher.

Eide, Stephen D. 2015. “California Crowd-out: How Rising Retirement Benefit Costs Threaten Municipal Services (Civic Report No.98).” New York, NY: Manhattan Institute.

Griffith, Michael. 2012. “Understanding State School Funding.” The Progress of Schooling Reform. Vol 13(3). Denver, CO: The Schooling Fee of the States.

Kim, Dongwoo, Cory Koedel., and P. Brett Xiang. 2021. “The Trade-off between Pension Costs and Salary Expenditures in the Public Sector.” Journal of Pension Economics & Finance 20(1): 151–168.

Nation, Joe 2017. “Pension Math: Public Pension Spending and Service Crowd-Out in California, 2003-2030.” Coverage Report. Palo Alto, CA: Stanford Institute for Financial Coverage Analysis.

Public Plans Database. 2001-2024. Middle for Retirement Analysis at Boston Faculty, MissionSquare Analysis Institute, Nationwide Affiliation of State Retirement Directors, and the Authorities Finance Officers Affiliation.

Randazzo, Anthony, Amy Dowell, and Nicki Golos. 2021. “Who Benefits? How Teacher Pension Financing Impacts Student Equity in Connecticut.” Analysis Report. Lengthy Island Metropolis, NY: Equable Institute.

Randazzo, Anthony, Jonathan Moody, Max Marchitello, and Patrick Murphy. 2023. “Pension Debt Challenges for Equity in Education: The Effect of Teacher Pension Debt Costs on K–12 Education Funding in California.” Analysis Report. Equable Institute.

Schuster, Adam. 2018. “Tax Hikes vs. Reform: Why Illinois Must Amend Its Constitution to Fix the Pension Crisis.” Chicago, IL: Illinois Coverage Institute.

Appendix