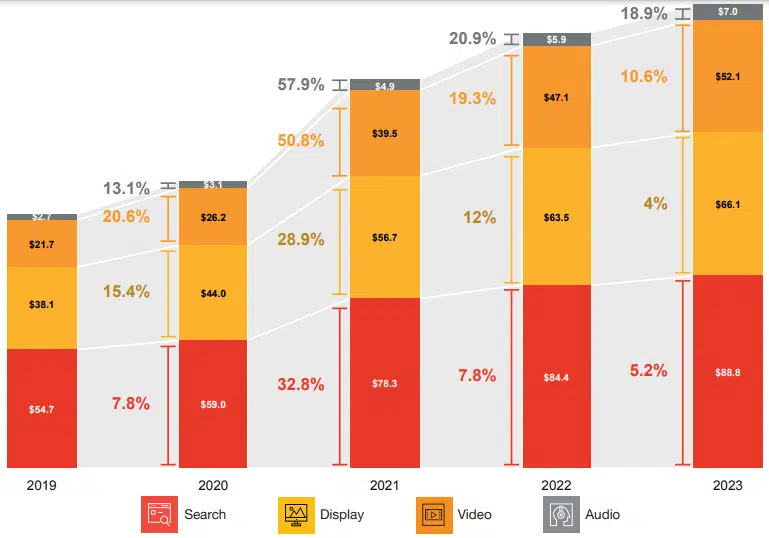

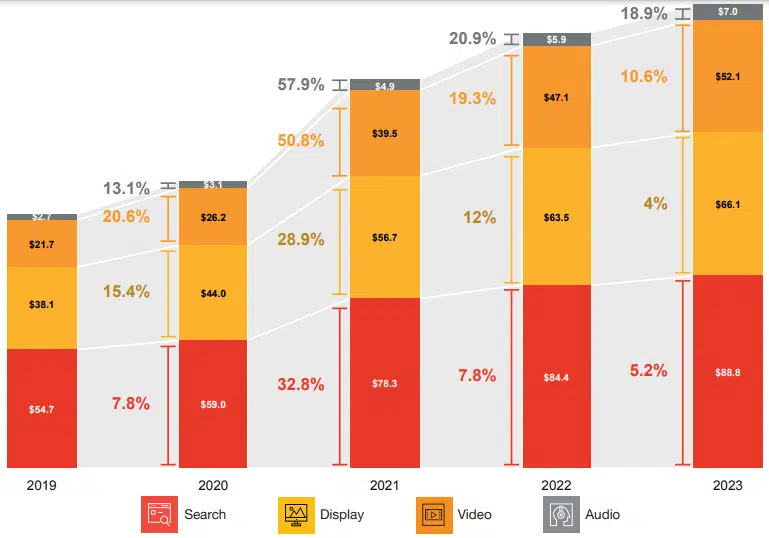

U.S. web promoting reached a document $225 billion in 2023, a 7.3-percent enhance year-over-year, based on the most recent IAB report on U.S. advert income, performed by PwC.

Digital adverts boomed within the fourth quarter when the expansion charge spiked to 12.3% — in 2022 the expansion charge for the quarter was 4.4%.

Prime channels included CTV, retail media and audio, which all noticed double-digit progress in 2023.

“Regardless of inflation fears, rates of interest at document highs, and persevering with world unrest, the U.S. digital promoting business continued its progress trajectory in 2023,” mentioned IAB CEO David Cohen, in a launch.

Why we care. The digital advert ecosphere has met challenges as a result of snowballing privateness laws and the deprecation of third-party cookies. However advertisers, going through aggressive pressures, nonetheless see digital adverts as an efficient approach to attain clients in any respect levels of their journeys and due to this fact proceed to extend their digital spend.

Dig deeper: Google’s Privateness Sandbox: What it’s worthwhile to know

Video. Video promoting noticed 10.6% YoY progress in 2023 as income rose to $52.1 billion. Forty-two % of the income got here in CTV and OTT, based on “IAB/PwC Web Advert Income Report, FY 2023.”

Though progress was down marginally from 2022, CTV is predicted to drive video up within the coming years with added stock from ad-supported subscription tiers launched by main streaming providers like Netflix.

Retail media. Even larger progress got here from retail media networks (RMNs), which noticed a 16.3% enhance in income YoY, reaching $43.7 billion. RMNs are a lovely approach for advertisers to achieve clients due to the amount of first-party knowledge retailers have and the tech options obtainable to leverage the information in a privacy-compliant approach.

Different non-retail shopper manufacturers are creating related advert media platforms. Lately, JP Morgan Chase introduced Chase Media Options, the primary bank-led platform of this type.

Dig deeper: Why we care about retail media networks

Digital audio. Though comparatively small in comparison with different channels, digital audio noticed the very best progress of any channel — 18.9% YoY. In 2023, income reached $7 billion.

The report cited new ad-supported tiers from audio subscription providers, in addition to AI-powered personalization, as contributors to future progress within the channel.

Social rebound. Social media advert income rose 8.7% YoY to achieve $64.9 billion in 2023.

A lot of the expansion got here within the second half of the yr, which noticed $4.1 billion of the $5.1 whole progress.

Longer view. After large progress in 2021, following the primary yr of the COVID-19 pandemic, digital promoting spending cooled in 2022. The 2023 numbers present areas of promising double-digit progress and a few signal of normalcy in in any other case turbulent occasions.

“With important business transformation unfolding proper earlier than our eyes, we imagine that these channels with a portfolio of privacy-by-design options will proceed to outpace the market,” mentioned Cohen. “For 2023, the winners had been retail media, CTV, and audio which noticed the very best progress.”

Report. The “IAB/PwC Web Advert Income Report, FY 2023” report (registration required) was commissioned by the IAB and performed by PwC Advisory Companies LLC. It makes use of knowledge and data reported on to PwC from firms promoting promoting on the web, in addition to publicly obtainable company knowledge. Launched quarterly, “IAB Web Promoting Income Report” was initiated by the IAB in 1996.

Gasoline in your advertising technique.