TransUnion is among the three main U.S. credit score bureaus. It additionally affords a paid credit score monitoring service.

A good credit score rating is crucial to constructing a strong monetary basis. That is why it’s essential to know precisely what your credit score rating is and monitor it for any adjustments.

Watching your rating can assist you determine any downside areas and make the mandatory changes. TransUnion permits you to maintain observe of your credit score. Be taught extra about this software in our evaluate.

|

|

What Is TransUnion?

TransUnion entered the credit score enterprise in 1969 when it bought the Credit score Bureau of Prepare dinner County. Since then, it has grown into one of many high three credit score bureaus in the US.

On one aspect, the corporate helps lenders and monetary establishments make selections primarily based on credit score data it collects about customers. However it additionally affords customers detailed details about their private credit score.

What Does It Supply?

TransUnion affords a month-to-month subscription that features credit score monitoring, id theft help, and extra. We take a better have a look at the options of the plan beneath.

Entry To Credit score Report And Rating

A low credit score rating might result in paying extra curiosity in your loans or not getting authorised for the financing you want for main purchases, like a house or car.

As part of TransUnion’s month-to-month plan, you’ll get limitless entry to updates made to your TransUnion credit score report and credit score rating. In case you are intently monitoring your credit score forward of an enormous financing buy, these particulars will be helpful.

If one thing is added to your credit score report, you’ll get an electronic mail replace.

Credit score Monitoring

TransUnion will let you understand if somebody applies for a credit score account in your identify. Since a fast response would possibly make it easier to cease an issue in its tracks, this can be a useful characteristic.

You’ll even have the flexibility to lock and unlock your TransUnion and Equifax credit score experiences. However you do have the choice to freeze and unfreeze your credit score report by means of each of those credit score bureaus without cost with none month-to-month subscription prices.

Credit score Rating Simulator

TransUnion affords a credit score rating simulator that will help you decide precisely how a selected credit score selection might impression your credit score rating. For instance, in case you are planning to open a bank card, the rating simulator might make it easier to challenge the way it would possibly have an effect on your credit score rating.

That is an particularly useful gizmo in case you are working to construct your credit score. You may run some simulations to see what could occur earlier than committing to an motion. For actions that might damage your credit score rating, this might make you suppose twice.

Customized Info About Your Debt And Credit score

TransUnion affords a customized debt evaluation that will help you create a debt repay plan that optimizes your credit score rating.

You can too use it to watch developments in your credit score rating. Hopefully, you’ll watch your credit score rating develop. However in case you discover a downward development, you will discover out why your credit score rating could be falling.

Identification Theft Help

In case you suspect that your id has been stolen, you may attain out to TransUnion’s id theft specialists for help. They will information you thru the method of getting your monetary life again on observe.

Moreover, you may faucet into as much as $1,000,000 of id theft insurance coverage by means of your TransUnion membership. The coverage would not cowl cash that was stolen from a financial institution. However it should cowl misplaced wages, journey bills, authorized consultations, and dependent care.

Are There Any Charges?

TransUnion affords easy pricing, with a month-to-month subscription costing $29.95, plus tax.

How Does TransUnion Evaluate?

TransUnion isn’t the one service you should use to dig into your credit score rating. Right here’s the way it stacks up.

In case you are searching for a free choice, Credit score Sesame affords credit score monitoring and id theft insurance coverage. You should use the corporate to watch your Vantage 3.0 credit score rating. And Credit score Sesame makes use of TransUnion knowledge to breed your credit score report. The catch is that Credit score Sesame will present you adverts for different credit score associated merchandise, like bank cards and private loans.

In case you don’t thoughts paying a month-to-month price and need to monitor your credit score throughout all three credit score bureaus, myFICO’s paid plans could be a greater match. The detailed credit score monitoring provides you with extra data, however you’ll pay $29.95 to $39.95 per thirty days. It does supply a restricted, free plan.

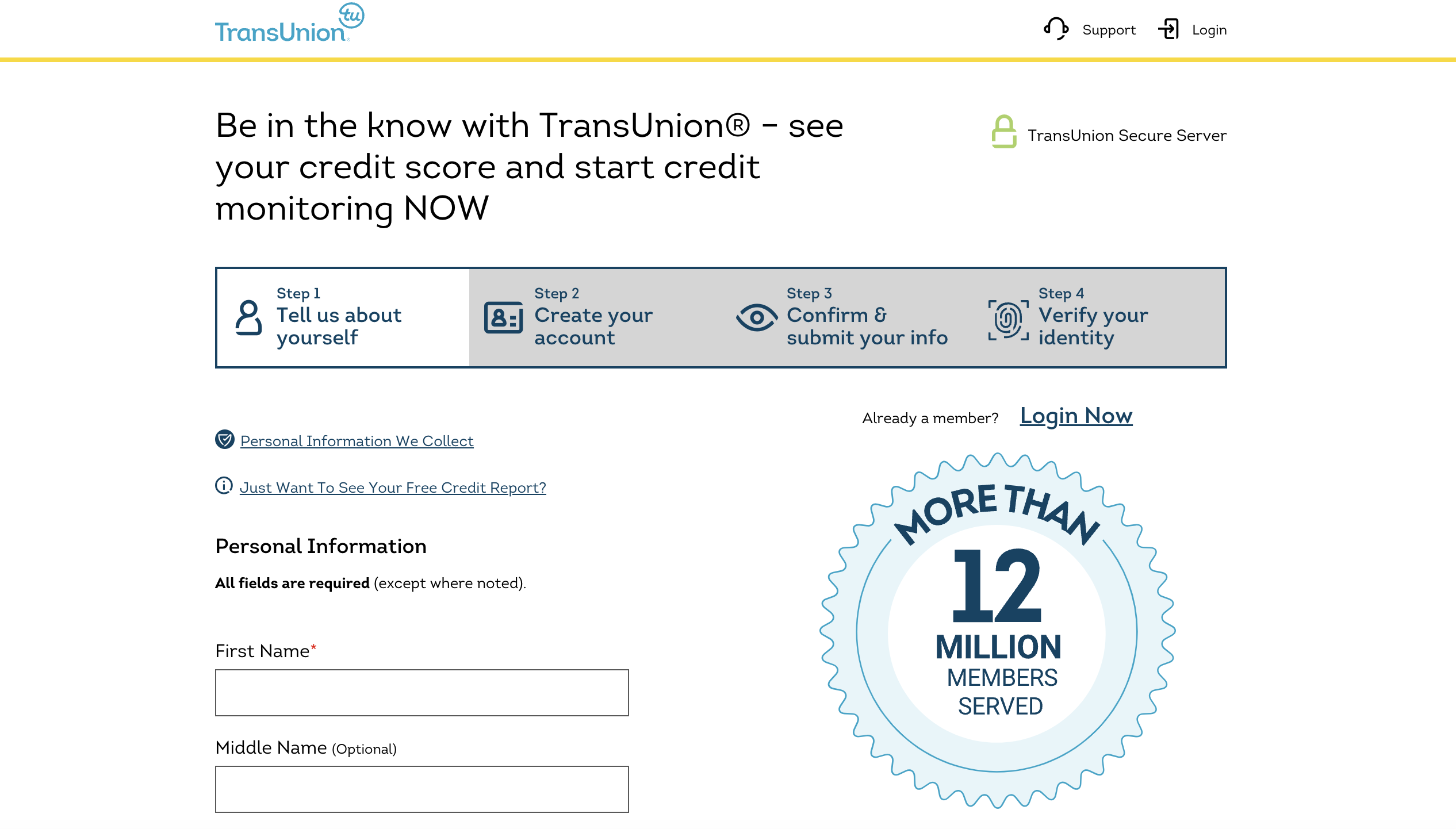

How Do I Open An Account?

If you wish to work with TransUnion, you’ll want to supply some fundamental data, resembling your identify, birthday, final 4 digits of your Social Safety quantity, electronic mail, handle, and cellphone quantity. Additionally, you’ll want to supply a fee technique.

Is It Secure And Safe?

Utilizing TransUnion to watch your credit score gained’t have an effect in your credit score report. Past that, the corporate has a variety of safety measures, together with encryption, in place to guard your knowledge.

How Do I Contact TransUnion?

If you could get in contact with TransUnion, you may name 1(855) 681-3196. The help crew is obtainable on weekdays from 8 a.m. to 9 p.m. and weekends from 8 a.m. to five p.m. in Japanese Commonplace Time.

Is It Value It?

For an in depth have a look at your credit score knowledge from TransUnion, the month-to-month subscription price might be value the price. Nonetheless, if paying $29.95 per thirty days isn’t in your finances, you would possibly need to test your credit score report without cost as an alternative, and faucet into free credit score monitoring providers.