Picture supply: Getty Photographs

The Rolls-Royce (LSE:RR.) share worth has been the standout performer amongst FTSE 100 shares over the previous two years, rising almost 400%. What a outstanding turnaround it’s been since Covid-19 almost destroyed the enterprise.

So, what components underpin the aerospace and defence inventory’s unbelievable efficiency? And might the expansion trajectory proceed?

Right here’s what the charts say!

Increasing margins

CEO Tufan Erginbilgiç’s tenure has been characterised by strategic initiatives and a value effectivity drive. Quickly after taking the job at first of 2023, he derided the agency as a “burning platform” that was underperforming opponents.

Since these feedback, the corporate’s undergone successive rounds of job cuts and adopted a extra streamlined enterprise mannequin. These modifications have paid off handsomely.

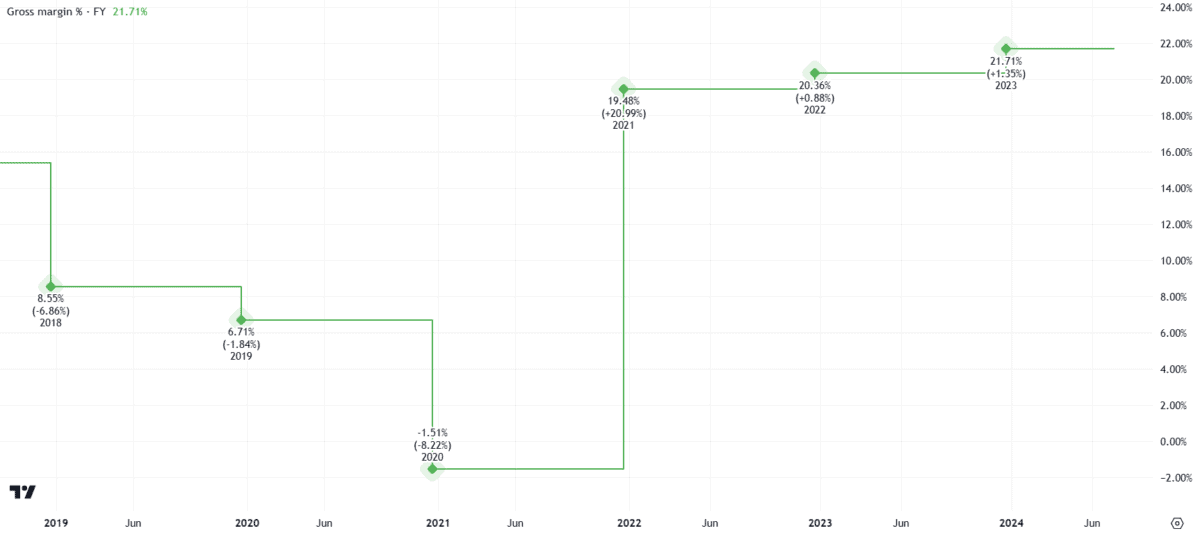

Rolls-Royce’s underlying working margin greater than doubled in FY23 to 10.3%. Furthermore, the gross margin of 21.7% is at a five-year excessive.

These figures are a window into the monetary well being of the enterprise, with implications for pricing methods, effectivity, and progress potential.

There’s little doubt a robust margins restoration has been a major issue within the Rolls-Royce share worth surge.

Debt discount

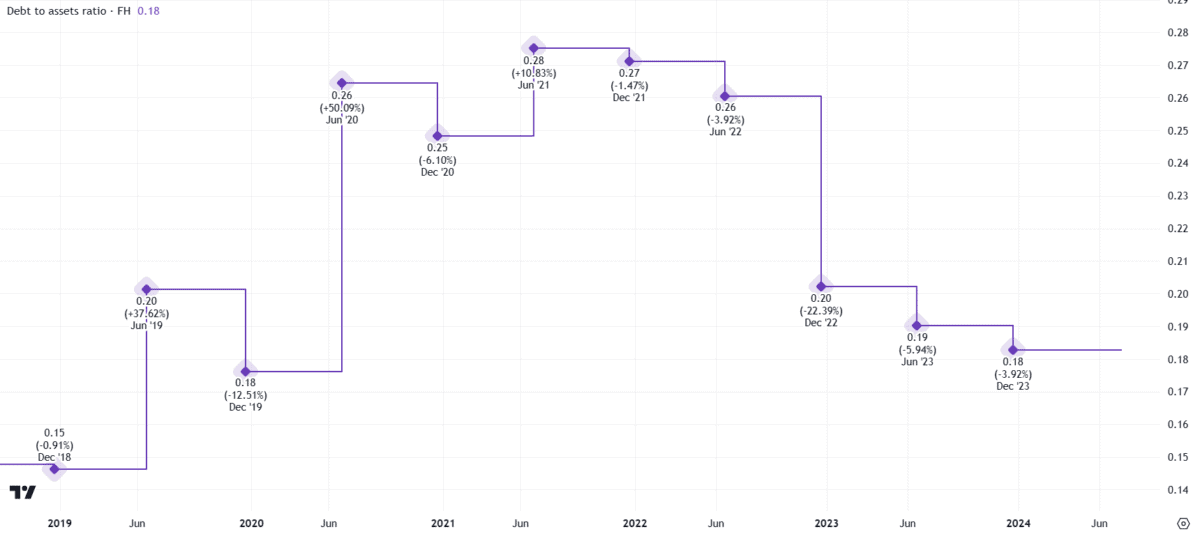

So too has the substantial steadiness sheet enchancment.

For context, Rolls-Royce was pressured to lift £7.3bn in debt and fairness on the peak of the pandemic. Right now, the enterprise was burning by means of money to remain afloat whereas plane fleets remained grounded.

The outlook’s modified dramatically. Rolls-Royce has regained an investment-grade credit standing from all main businesses. Internet debt’s fallen to £2bn, down from £3.3bn on the finish of FY22.

Crucially, the debt-to-assets ratio has plummeted to only 0.18. Consequently, the steadiness sheet seems significantly more healthy at present.

Valuation

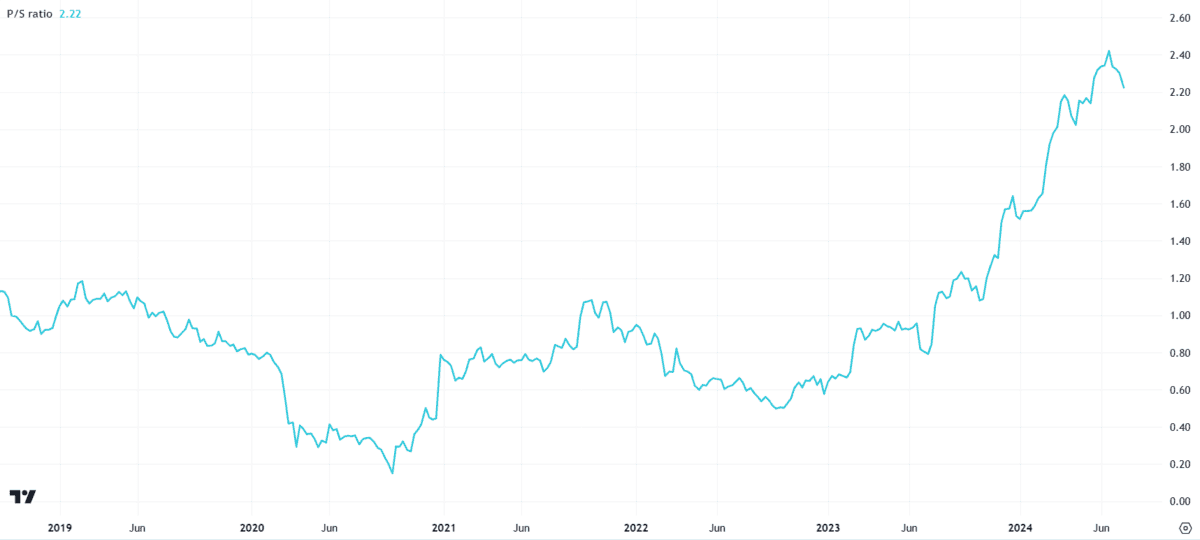

Nonetheless, the corporate now has the next valuation.

Historically, a price-to-sales (P/S) ratio between one and two is fascinating from an investor’s perspective. For Rolls-Royce, that a number of’s now eclipsed this higher restrict. The P/S ratio is at the moment 2.22.

This implies the Rolls-Royce share worth is now not the discount it was throughout the pandemic. The next valuation poses dangers to future returns.

I wouldn’t be shocked if the corporate’s inventory market efficiency over the approaching years isn’t as stellar because it’s been lately.

Rolls-Royce shares might have additional room to run if future earnings are good, however they’re in all probability nearer to being pretty valued than undervalued at present.

Future targets

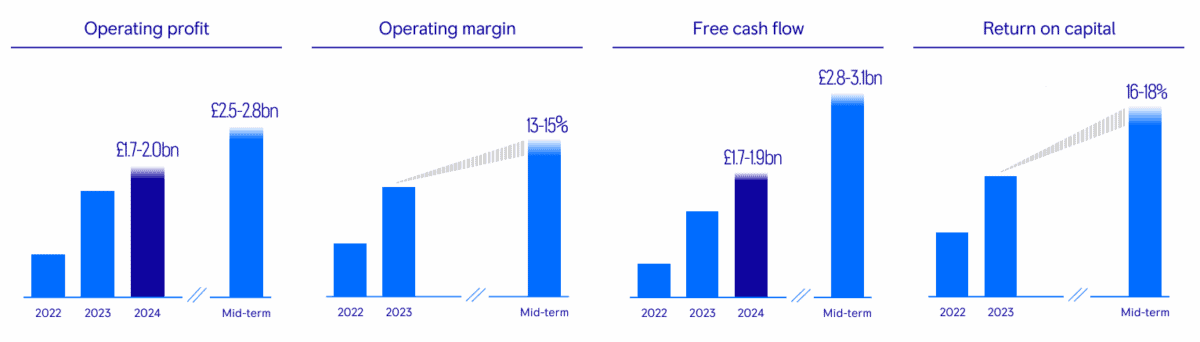

Nonetheless, Erginbilgiç doesn’t lack ambition. Mid-term targets spanning a spread of metrics counsel there’s potential for additional enhancements in step with a 2027 timeframe.

The group’s indicated these advances can be “progressive, however not essentially linear“. Accordingly, buyers ought to anticipate share worth volatility alongside the best way.

However, the large image’s broadly encouraging. The Civil Aerospace division ought to proceed to profit from an ongoing restoration in giant engine flying hours. Plus, the Defence arm has a number of potential progress alternatives, such because the deployment of micro-reactor nuclear applied sciences in submarine fleets.

On steadiness, I feel the Rolls-Royce share worth progress story stays intact, however we’ve in all probability seen the lion’s share of the positive aspects already. I’ll proceed to carry my shares for now.

Traders who’re eager to enter a place might take into account pound-cost averaging their share purchases to capitalise on any potential dips over the approaching quarters.