Expenditures are excessive and projected to rise as a result of nationwide healthcare prices are uncontrolled.

The 2024 Medicare Trustees Report (launched this spring) obtained nearly no consideration, contained no dangerous information. It’s true that, beneath present regulation, Medicare Half A – the Hospital Insurance coverage (HI) program – faces a long-term deficit, however that deficit is the smallest it has been for greater than a decade and the 12 months of depletion of belief fund reserves has been pushed out 5 years to 2036. Sure, the remainder of the Medicare program would require growing quantities of normal revenues, however they’re similar to these anticipated final 12 months. Regardless of the comparatively sanguine 2024 report, nonetheless, it’s necessary to keep in mind that the Medicare program operates in a particularly pricey well being system.

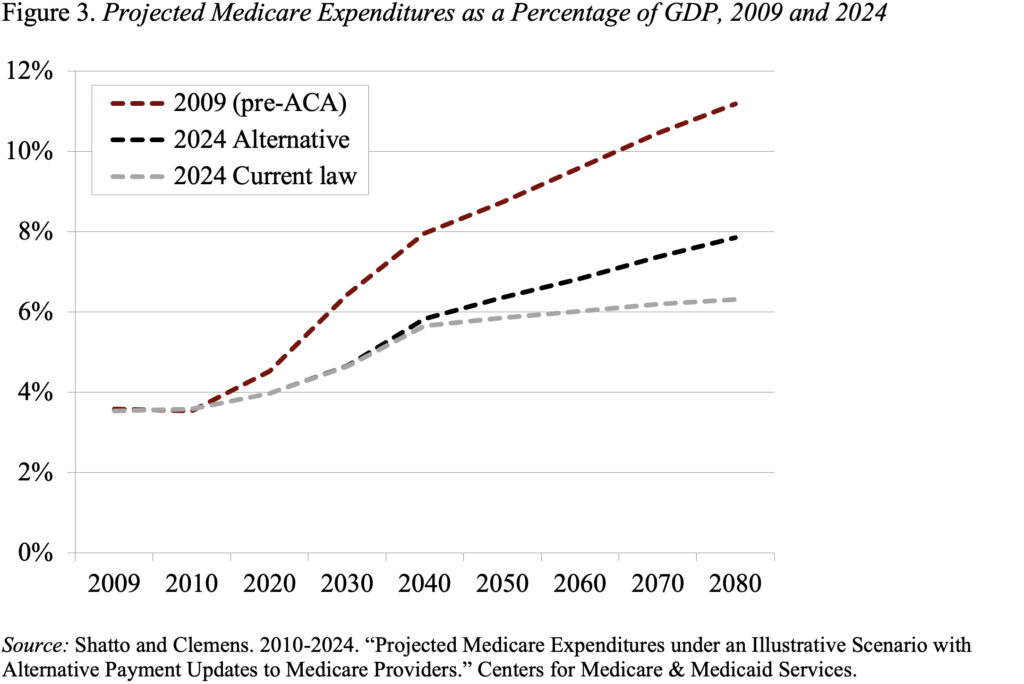

The Medicare Trustees venture this system’s funds beneath two units of assumptions – present regulation and an alternate situation that limits the cost-control provisions of earlier laws.

Assuming present regulation, the Trustees venture a 75-year HI deficit of 0.35 p.c of taxable payrolls. This deficit is on the low finish of the diminished deficits that emerged within the wake of the Reasonably priced Care Act (see Determine 1). On account of the improved outlook, the HI belief fund now is not going to deplete its reserves till 2036 – 5 years later than projected in final 12 months’s Trustees Report. As soon as the fund is depleted, persevering with program revenue will likely be enough to pay 89 p.c of scheduled advantages.

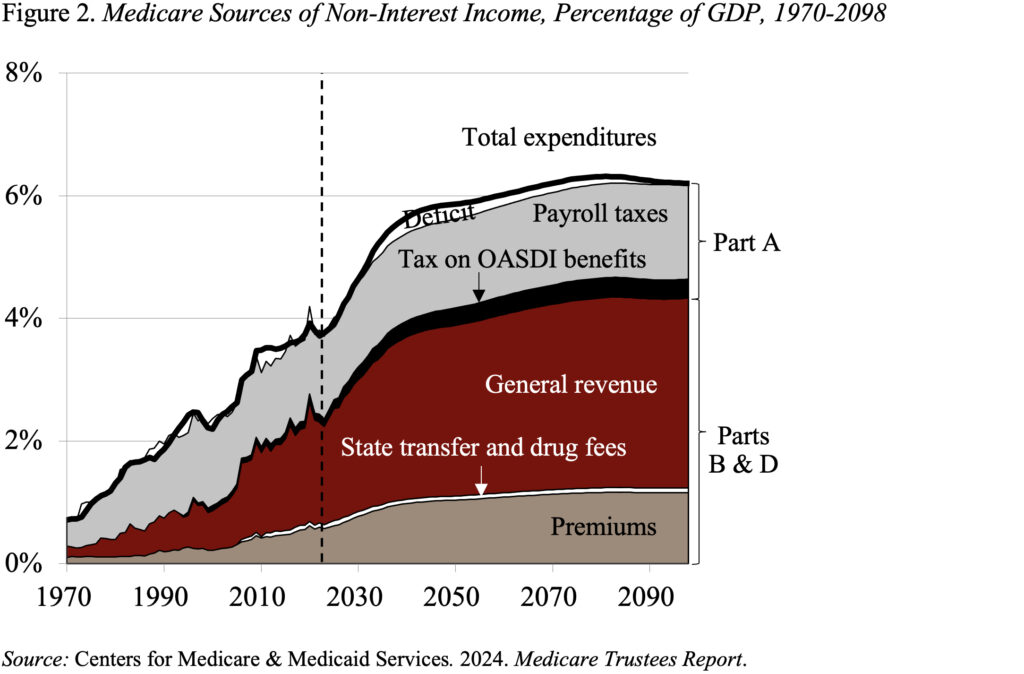

Half B, which covers doctor and outpatient hospital companies, and Half D, which covers pharmaceuticals, are each adequately financed for the indefinite future as a result of the regulation gives for normal revenues and participant premiums to fulfill the subsequent 12 months’s anticipated prices. In fact, an growing declare on normal revenues places strain on the federal funds and rising premiums place a rising burden on beneficiaries (see Determine 2).

Along with projections based mostly on present regulation, the actuaries additionally put together an alternate set of projections that chill out the cost-saving provisions within the Reasonably priced Care Act and subsequent laws. Beneath these various assumptions, by 2090, the full price of Medicare is about 2 p.c of GDP greater beneath the choice than beneath the current-law provisions. Notice, nonetheless, that even these greater expenditures are approach under the pre-ACA projections (see Determine 3).

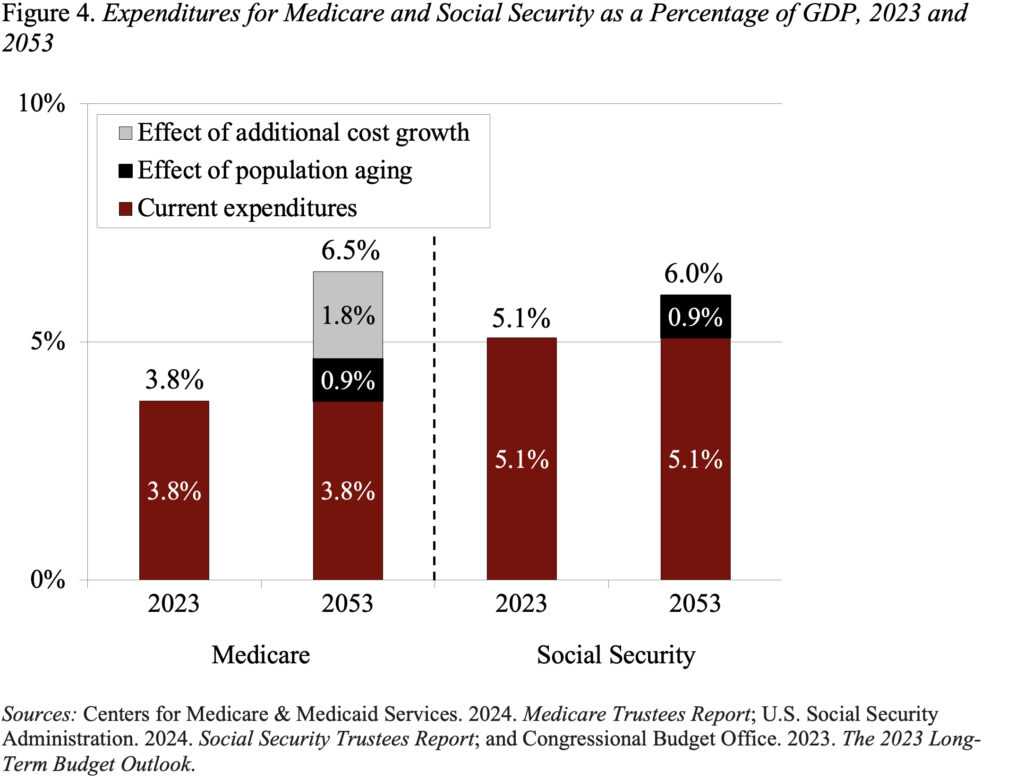

Whereas the 2024 Trustees Report produced comparatively excellent news on the Medicare entrance, this system’s prices are excessive and are projected to develop as a share of GDP. In distinction to Social Safety, the place inhabitants getting older can clarify all the expansion in expenditures over the subsequent 30 years, an getting older inhabitants explains a lot lower than half of the projected future progress in Medicare (see Determine 4). The remaining comes from the prices for hospital and doctor companies rising sooner than GDP. The underside line is that the one option to management Medicare prices is to get nationwide healthcare spending beneath management.