Determining find out how to pay for faculty can usually lead you to suppose that pupil loans are your solely selection. Suppose once more!

Though many college students depend on pupil loans, they need to be the final resort. Scholar loans accrue curiosity, have lengthy reimbursement intervals, and may put households into monetary hardship.

In truth, a examine from the OneWisconsin Institute finds that it takes graduates of Wisconsin universities 19.7 years to repay a bachelor’s diploma and 23 years to repay a graduate diploma.

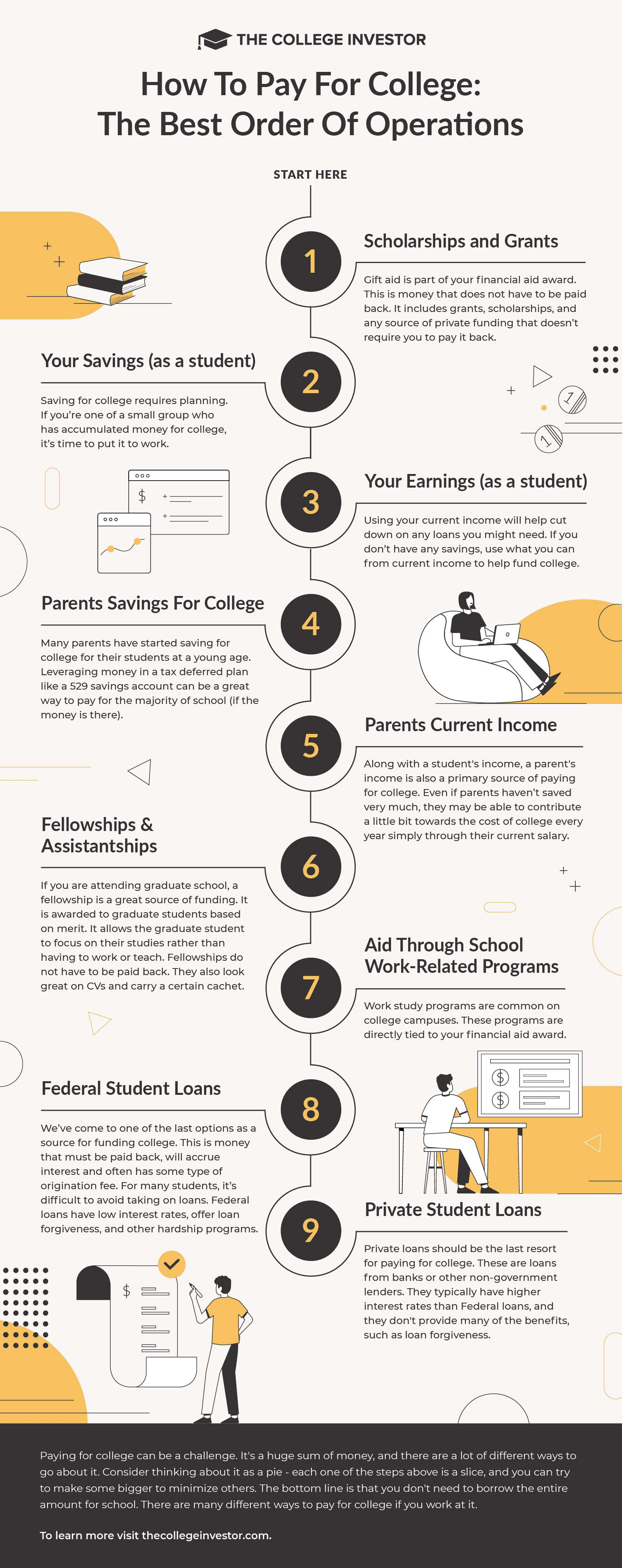

Earlier than you’re taking out pupil loans, it’s best to know that there are different methods to pay for faculty. We checklist them so as, from finest to worst. Begin with the highest group and work your manner all the way down to the final (i.e., worse) choice, which is pupil loans. By following this information, there’s an opportunity you may cut back the quantity of pupil loans wanted to finance faculty. For a fortunate few, they could discover pupil loans should not even essential.

Here is our tackle the ‘finest’ order of operations to pay for faculty. It is essential to notice that that is extra like a “pie” than a strict order. The extra you may contribute from the “earlier” slices, the much less you may must borrow. And there’s no “strict” guidelines right here – however it’s best to undoubtedly use free cash earlier than different funds.

1. Scholarships and Grants

Present support is a part of your monetary support award. That is cash that doesn’t must be paid again. It consists of grants, scholarships, and any supply of personal funding that doesn’t require you to pay it again.

In fact, it depends upon getting your FAFSA submitted on time.

Some college students would possibly understand a considerable amount of scholarships and grants. Others may not be capable to get as a lot.

Remember to use for personal scholarships and grants as nicely – do not simply rely in your college. This sounds loopy, however I like to recommend excessive schoolers apply to not less than 50 scholarships. This even is true if you happen to’re planning on being a part-time pupil.

To make it simple, we even have this information to Scholarships and Grants By State.

Try these guides:

2. Your Personal Financial savings (as a pupil)

Saving for faculty requires planning. Should you’re one in every of a small group who has accrued cash for faculty, it’s time to place it to work.

Possibly you have been saving your commencement cash, otherwise you’ve acquired birthday funds over time. Possibly grandma even left you some cash to pay for faculty if you have been youthful.

You probably have your individual pupil financial savings, utilizing it to pay for faculty is a good first step.

3. Your Earnings (as a pupil)

Moreover, utilizing your present revenue will assist reduce down on any loans you would possibly want. Should you don’t have any financial savings, use what you may from present revenue to assist fund faculty.

Lots of people overlook that they’ll earn cash earlier than going to high school (i.e. the very best summer season jobs for faculty college students), and even work full time throughout college.

I personally labored full time whereas going to school. I labored 5 days per week – Monday, Wednesday, and Friday nights, and in the course of the day on Saturdays and Sundays. I attempted to schedule my lessons for Tuesday and Thursday, or if essential, earlier than work on the opposite days.

Do not find out about methods to earn as a pupil? Try our 100+ Methods To Make Cash In School.

4. Dad and mom Financial savings For School

Subsequent on the checklist is any cash your dad and mom could have put apart for college. This might be within the type of a 529 faculty financial savings account, or different financial savings car.

Many dad and mom have began saving for faculty for his or her college students at a younger age. Leveraging cash in a tax deferred plan like a 529 financial savings account might be an effective way to pay for almost all of college (if the cash is there).

Dad and mom may additionally produce other financial savings put aside for his or her youngster. It is essential to have conversations about parental contributions early, so that everybody concerned within the “paying for faculty” debate is aware of what to anticipate.

Professional Tip: Here is our information to correctly structuring your 529 plan distributions.

5. Dad and mom Present Revenue

Together with a pupil’s revenue, a mum or dad’s revenue can also be a major supply of paying for faculty. Even when mum or dad’s have saved very a lot, they are able to contribute just a little bit in direction of the price of faculty yearly merely via their present wage.

Some dad and mom might be able to contribute rather more than others, however each little bit that may be despatched in to keep away from borrowing for college is a big win.

Word: Some states give tax deductions or tax credit for 529 plan contributions. You possibly can contribute and withdraw in the identical 12 months in most states – making it probably worthwhile to make use of your present revenue to contribute to a 529 plan, then pay for faculty from there.

See our information: 529 Plan Guidelines By State.

6. Fellowships and Assistantships

In case you are attending graduate college, a fellowship is a good supply of funding. It’s awarded to graduate college students based mostly on benefit. It permits the graduate pupil to deal with their research slightly than having to work or train. Fellowships should not have to be paid again. Additionally they look nice on CVs and carry a sure cachet.

“It’s principally the Harry Potter scar in your brow indicating you’re an incredible scholar,” acknowledged Meredith Drake Reitan, affiliate dean for graduate fellowships on the USC Graduate College.

“The fellowship program is about analysis potential,” she stated. “School members would possibly say, ‘They’re not prepared to use to for the NSF Fellowship as a result of their analysis hasn’t fairly jelled.’ However that’s truly proper the place the NSF needs them — it’s designed to be an early profession accelerator.”

The takeaway: don’t suppose you aren’t certified for a fellowship. They’re actually value making use of to. Communicate along with your instructional counselor or advisor about how and which of them could have the best potential for profitable acceptance.

7. Assist By means of College Work-Associated Applications

We proceed down the checklist and are available to work-related applications that should present a versatile schedule round your lessons. At this level, you’ve exhausted all types of funding that don’t require work alternate or loans. We’re now shifting into funding sources that may require some type of payback.

Work research are frequent on faculty campuses. These applications are normally tied into your monetary support award. They can help you work on campus inside a versatile schedule. Pay is normally minimal wage, however you may’t beat the versatile schedule offered by these applications. Whereas it’s a smaller supply of funding, relying in your class schedule, it may be the one sort of job you may tackle.

Assistantships are normally reserved for graduate college students. These applications are just like work research besides they’re educating positions. Usually the scholar will train lower-level lessons in areas they’re very aware of.

Try our information to Federal Work-Examine Applications.

8. Federal Scholar Loans

We’ve come to one of many final choice as a supply for funding faculty. That is cash that should be paid again, will accrue curiosity and sometimes has some sort of origination payment. For a lot of college students, it’s troublesome to keep away from taking over loans.

Federal loans have a reasonably low rate of interest, which regularly doesn’t exceed the only digits. As reported by StudentAid.gov, loans first disbursed on or after July 1, 2024 and earlier than July 1, 2025 have the next rates of interest:

- Direct Backed (undergraduate): 6.53%

- Direct Unsubsidized (undergraduate): 6.53%

- Direct Unsubsidized (graduate or skilled): 8.08%

- Direct PLUS: (dad and mom and graduate or skilled college students): 9.08%

In regard to loans for faculty, you aren’t prone to discover a higher deal anyplace else.

Do not imagine us? Try the Greatest Scholar Mortgage Charges right here.

If you have to get a pupil mortgage, here is the method on How To Take Out A Scholar Mortgage (Each Federal and Non-public).

9. Non-public Scholar Loans

Non-public loans are one other and ultimate choice. These could also be loans from banks or different lenders which might be non-government. They may sometimes have larger rates of interest than authorities loans and gained’t present the identical benefits akin to mortgage forgiveness, hardship choices, and versatile reimbursement plans.

Non-public pupil loans ought to actually be a final resort, and earlier than borrowing, it’s best to actually do a full Return On Funding Calculation of your faculty bills to even see if faculty is value it.

We advocate college students store and examine non-public mortgage choices earlier than taking them out. Credible is a wonderful selection as a result of you may examine about 10 completely different lenders in 2 minutes and see what you qualify for. Try Credible right here.

You too can see the complete checklist of personal pupil mortgage choices right here: Greatest Non-public Scholar Loans.

Infographic

Should you agree with this order of operations, share this helpful infographic along with your family and friends that must know this:

Ultimate Ideas

Paying for faculty could be a problem. It is an enormous sum of cash, and there are a number of alternative ways to go about it. Even these most costly faculties have the potential to be considerably extra inexpensive with monetary support.

I like to consider it as a pie – every one of many steps above is a slice, and you may attempt to make some greater to reduce others.

The underside line right here is that you simply needn’t borrow the complete quantity for college. There are numerous alternative ways to pay for faculty if you happen to work at it.