Picture supply: Getty Photos

I’m an enormous fan of utilizing dividend shares as a strategy to earn additional earnings. However not all dividend-paying corporations are dependable. Vodafone dissatisfied me just lately by slashing its 10% yield in half, prompting me to promote my stake within the firm.

Now I’m extra cautious concerning the earnings shares I put money into. At the moment, my high three picks are Phoenix Group (LSE: PHNX), British American Tobacco (LSE: BATS) and Authorized & Basic (LSE: LGEN).

Right here’s why I believe they’re value traders contemplating.

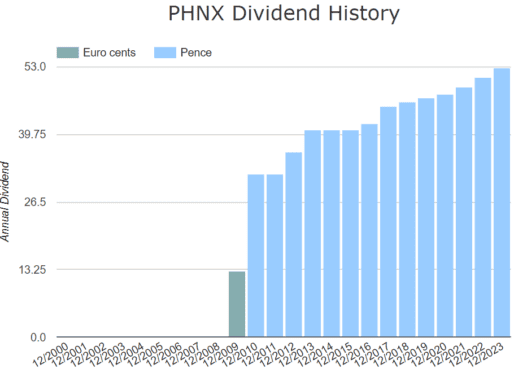

Phoenix Group

Phoenix Group’s 9.5% yield might quickly be the best on the FTSE 100 after Vodafone drops down to five.2%. The insurer hasn’t been paying dividends for very lengthy however has elevated them yearly for the previous six years.

As one of many UK’s greatest insurance coverage corporations, it faces stiff competitors from Authorized & Basic and Prudential. Sadly, there’s one obvious concern, it’s at present unprofitable. Years of low earnings have pushed up its debt too, which is now virtually double its fairness.

That doesn’t sound very promising.

However a current increase in income’s helped push the corporate again in direction of profitability. It’s prone to grow to be worthwhile once more subsequent 12 months, with earnings probably reaching £280m by the top of 2025.

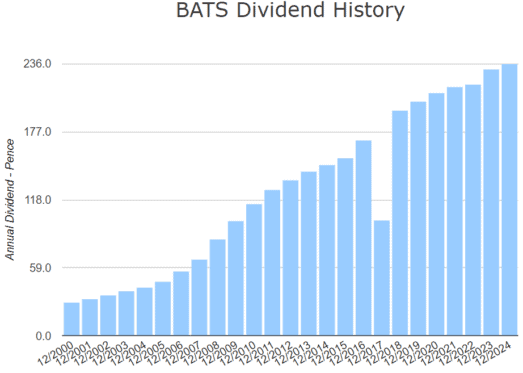

British American Tobacco

With an 8.5% yield, British American Tobacco might quickly be the fourth-highest FTSE 100 yield after Burberry reduce its dividend. Barring a short discount in 2017, it’s been paying a dependable and rising dividend for over 20 years.

At the moment, it’s unprofitable however forecast earnings progress provides it a ahead price-to-earnings (P/E) ratio of 8.3. And with future money flows anticipated to extend, the shares are estimated to be undervalued by virtually 60%.

However tobacco’s a dying trade so it’s exhausting to have an excessive amount of religion within the firm’s long-term prospects. To not point out the ethical implications.

Nevertheless, British American Tobacco is targeted on shifting in direction of tobacco-free merchandise as tighter rules threaten its backside line. Its Vuse product is the most well-liked vaping model on this planet, in line with the corporate. It’s actively legislating for stricter guidelines and bans on disposable vapes and child-appeal flavours to assist cut back underage smoking.

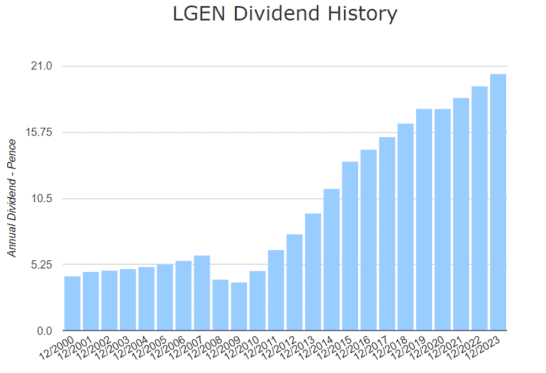

Authorized & Basic

At 8.9%, Authorized & Basic’s the third highest yield on the FTSE 100, barely under fellow insurer M&G. However as a purely income-focused inventory, it doesn’t supply a lot in the best way of value progress. It’s solely up 1.6% up to now 5 years.

Funds are super-reliable although, having elevated persistently since 2009 with solely a short pause in 2020. Its dividends boast a compound annual progress fee (CAGR) of 13.3%, with the yield anticipated to succeed in 10% within the subsequent three years.

Like Phoenix, low earnings have pushed its P/E ratio as much as 48 and left it with loads of debt. If forecasts are right, improved earnings might deliver it nearer to the trade common of 11. However with a debt load twice its market-cap, it’s an extended strategy to go.

If it weren’t for the spectacular observe file of paying dividends, I’d most likely give it a miss. However on this case, I believe the reward’s definitely worth the threat.