Whereas COVID was raging, the bounce in home costs and a rising inventory market have been dramatically bettering U.S. staff’ retirement funds.

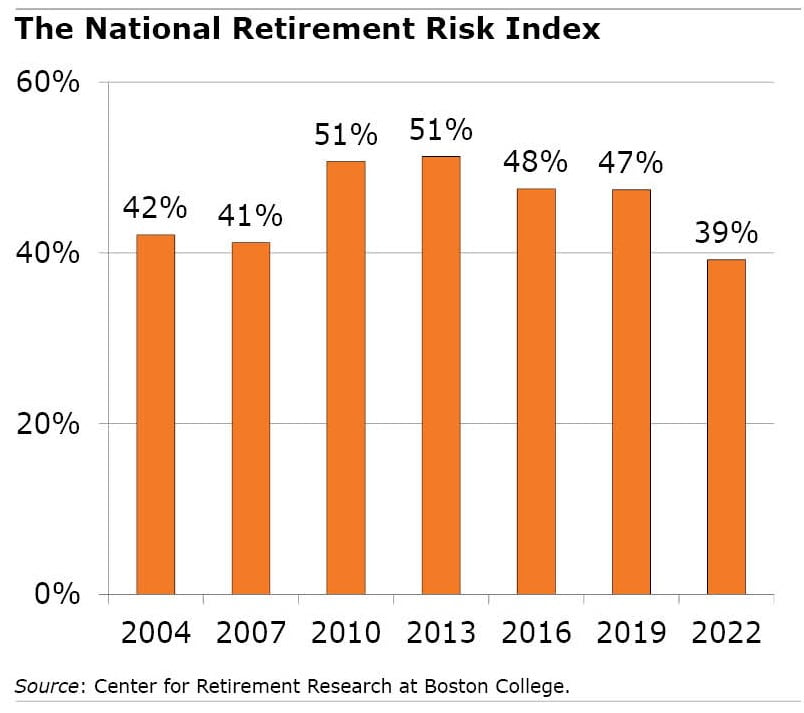

In 2022, the share of households that weren’t saving sufficient to take care of their way of life after they retire dropped to 39 p.c, from 47 p.c in 2019, based on the Heart for Retirement Analysis, which sponsors this weblog.

That 39 p.c is the bottom stage within the practically 20 years the middle has been analyzing the information within the Federal Reserve Board’s Survey of Shopper Funds, which is carried out each three years.

However the information isn’t fairly pretty much as good because it seems, as a result of the rise in home costs in 2020 by 2022, which continues at present, was the biggest single purpose for the development.

Sure, People are wealthier on paper, because of a mix of previous mortgages with low rates of interest and rising home costs fueled by sturdy housing demand throughout COVID in suburban and rural markets. Among the many narrower group of people that personal their houses, the share of households in danger dropped sharply, from 34 p.c to 24 p.c.

However it is usually pretty uncommon for retirees to capitalize on their housing wealth by changing it into revenue by downsizing to a cheaper residence or taking out a reverse mortgage. A conversion by a reverse mortgage is a core assumption within the middle’s evaluation. In 2022, solely 64,437 householders took out the federally insured reverse mortgage that turns into an choice at age 62.

The rise in residence costs wasn’t the one factor boosting retirement wealth, nevertheless. A rising inventory market was the second most necessary purpose for the improved outlook.

The Commonplace & Poor’s 500 inventory index – regardless of the 2022 market hunch – gained greater than 20 p.c after inflation throughout the three-year interval. These features primarily benefited the rich, the place inventory possession is concentrated – in addition they are likely to personal their houses.

However funding portfolios additionally grew for lower- and middle-income staff who’re saving in an employer’s 401(okay)-style retirement plan. Amongst households with a 401(okay), the share at-risk fell from 42 p.c to 35 p.c.

Decrease- and middle-income staff additionally padded their financial savings accounts when Congress supplied a beneficiant package deal of economic help to assist them deal with the financial slowdown within the first yr of the pandemic.

The development in People’ retirement funds is encouraging. However even this conservative estimate that counts little-used residence fairness as retirement wealth leaves 4 out of ten households with the potential of a drop of their way of life as soon as they retire.

This, the researchers conclude, “affirm[s] that we have to repair our retirement system in order that Social Safety is financially sound and employer plan protection is common.”

Squared Away author Kim Blanton invitations you to comply with us @SquaredAwayBC on X, previously often known as Twitter. To remain present on our weblog, be a part of our free e mail record. You’ll obtain only one e mail every week – with hyperlinks to the 2 new posts for that week – once you join right here. This weblog is supported by the Heart for Retirement Analysis at Boston School.