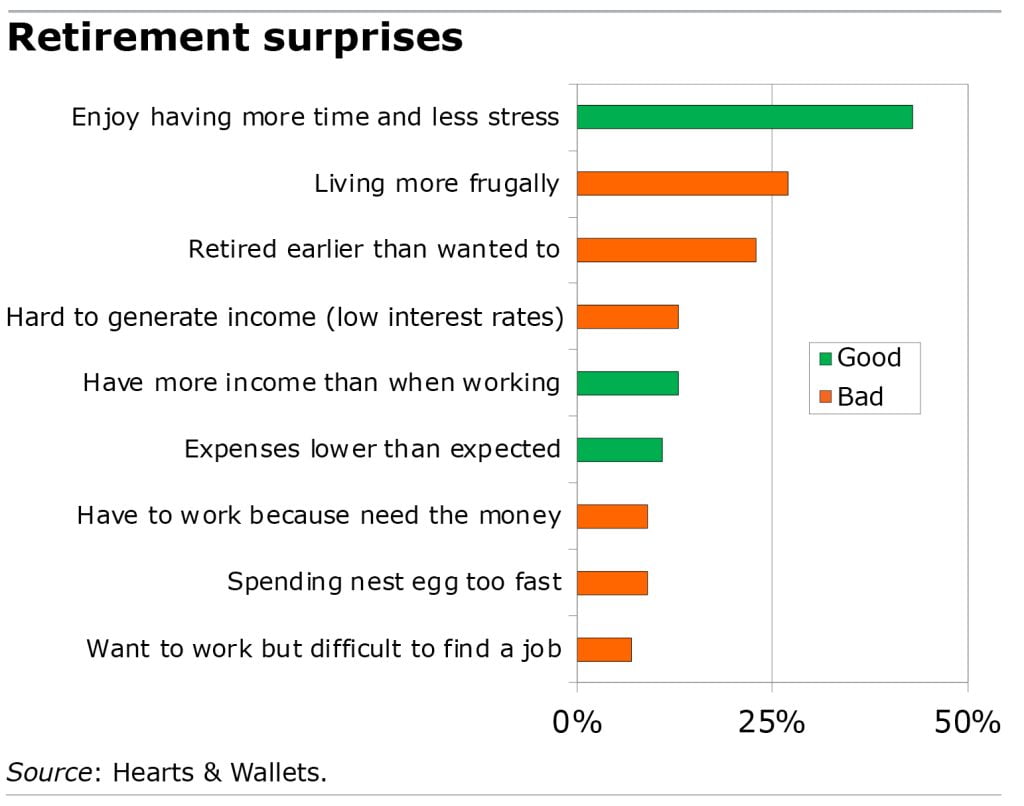

In a brand new survey asking retirees what stunned them about being retired, the massive winner – for 43 p.c – was how a lot they’re having fun with it.

The remainder of the survey signifies that the liberty that comes with leaving the labor power typically serves to leaven the appreciable sacrifices some must make for monetary causes.

One in 4 retired households, for instance, agree they’re “compelled to dwell extra frugally than we wished,” and one in 10 stated they’re “spending their nest egg too quick,” based on the survey, fielded in 2023 by Hearts & Wallets, which gives knowledge to the monetary business.

I additionally suspect that one nice shock – having extra earnings than after they had been working – primarily occurs to individuals who didn’t fear a lot earlier than they retired. Some retirees had been glad to see their bills are decrease than they’d anticipated. One instance they could take into consideration: much less earnings means paying much less in taxes.

To attenuate the surprises, Hearts & Wallets’ report instructed areas the place monetary advisers would possibly discover methods to assist older staff and retirees. One space entails retirees who’re cut up into two extremes: “chunk or nothing” spending of their retirement financial savings. One camp withdraws chunks of cash out of necessity or for extraordinary bills. The opposite camp withdraws little or nothing, sacrificing a extra snug way of life to their concern of needing the cash later. The agency’s analysis since 2010 persistently has proven that the majority retirees interact in a single or the opposite.

Anthony Webb, an economist at The New Faculty, estimates that withdrawing 3 p.c of property yearly is a greater wager than the well-known 4 P.c Rule if retirees desire a thumbnail rule to scale back the percentages of operating out of cash. Practically half of retirees informed Hearts & Wallets they withdraw 3 p.c or much less from financial savings, however most of them are withdrawing lower than 1 p.c, which might be too cautious and lessens the enjoyment.

An often-neglected technique is discovering methods to trim family bills – one automotive as an alternative of two, fewer holidays – to align them with the drop in earnings after retiring. Owners who want extra earnings even have the choice of downsizing to allow them to spend a few of their appreciable fairness raised from promoting a house. Nevertheless, about half of retirees say they don’t wish to transfer to a smaller home.

Absent from Hearts & Pockets’s recommendations is the effectiveness of working so long as attainable earlier than signing up for Social Safety. Delay provides considerably – 7 p.c to eight p.c per 12 months – to the month-to-month examine that pays the payments. Nevertheless, one in 4 retirees stated they needed to retire sooner than they’d deliberate, which signifies they didn’t wish to work longer or couldn’t for bodily or medical causes.

It’s price it for older staff planning for retirement to suppose forward in regards to the surprises that popped up on this survey.

Squared Away author Kim Blanton invitations you to comply with us @SquaredAwayBC on X, previously generally known as Twitter. To remain present on our weblog, be part of our free e-mail record. You’ll obtain only one e-mail every week – with hyperlinks to the 2 new posts for that week – if you enroll right here. This weblog is supported by the Heart for Retirement Analysis at Boston Faculty.