Picture supply: Getty Photographs

There’s little question that Nvidia‘s (NASDAQ:NVDA) monetary outcomes over the previous yr have been one thing particular. Earnings have soared as chip demand for the synthetic intelligence (AI) revolution has boomed. However as an investor, I really feel that its spectacular buying and selling is now baked into its elevated share worth.

At $122.60 per share, Nvidia trades on an enormous price-to-earnings (P/E) ratio of 45.5 occasions for 2024.

Tech shares normally command giant premiums due to their vital development potential. Nonetheless, the chipmaker seems to be massively costly in comparison with nearly all its sector rivals.

Fellow tech giants and AI shares Microsoft and Alphabet, as an example, commerce on ahead P/E ratios of 37.5 occasions and 24 occasions, respectively.

This heady valuation leaves little room for scope for unhealthy information. A worldwide financial slowdown, product growth points, or issues with assembly orders are just a few dangers that — in the event that they turned actuality — may trigger Nvidia’s share worth to sink.

Early days

There’s one other drawback that I’ve with shopping for Nvidia shares at present costs.

The microchip maker has been one of many AI pacesetters up to now. However at this early stage of the race, it’s troublesome to inform who would be the eventual winners from this new tech frontier.

Every of ‘The Magnificent Seven’ shares — which incorporates Nvidia, Microsoft and Meta, alongside Amazon, Apple, Alphabet, and Tesla — are all spending huge sums in generative AI and machine studying. We could look again and baulk at Nvidia’s huge valuation just a few years from now.

Higher AI shares?

One technique to get round this could possibly be to purchase AI-related shares reasonably than the expertise corporations themselves. This strategy will give me the possibility to hedge my bets in addition to keep away from the huge premiums these development corporations appeal to.

With this in thoughts, listed below are some I believe could possibly be nice methods to revenue from the AI revolution.

Energy surge

A considerable quantity of computational energy is required for AI functions, particularly these involving deep studying and large-scale knowledge processing. This in flip is resulting in fast growth of information centres that maintain the required {hardware}, and with it a pointy rise in electrical energy demand.

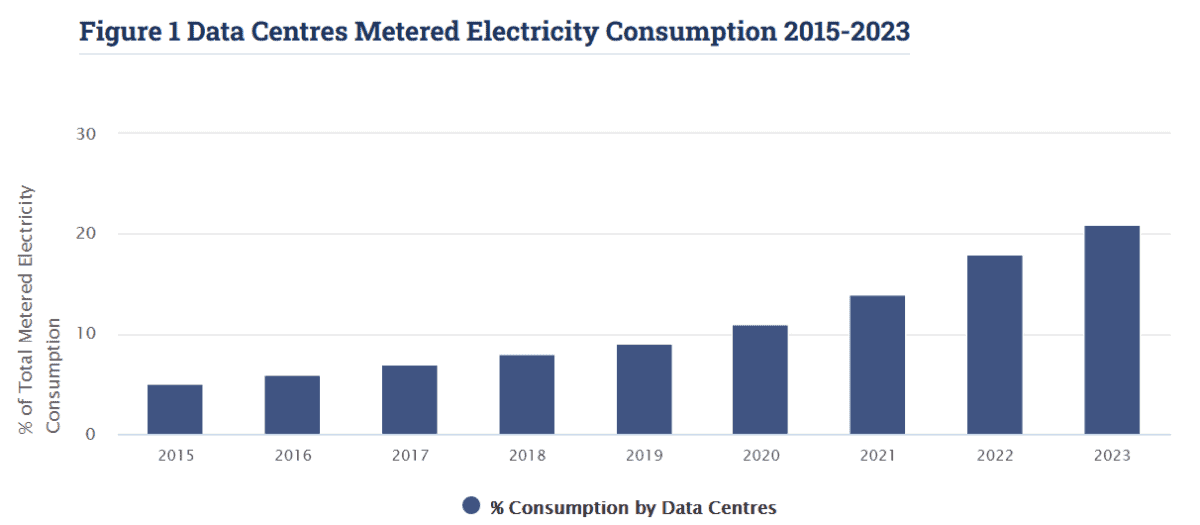

Vitality utilization knowledge from Eire this week underlines simply how a lot juice it takes to run these hubs. Electrical energy consumption by the nation’s knowledge centres soared by a fifth between 2022 and 2023. The sector now accounts for 21% of all Eire’s energy, greater than all of city households within the nation mixed.

With AI quickly rising, nations are in extreme hazard of lacking their internet zero insurance policies. The consequence could possibly be a ramping up of renewable power creation throughout the globe.

Greencoat Renewables is one such enterprise that might profit from Eire’s energy drain. It owns and operates primarily onshore and offshore wind farms throughout Europe, the vast majority of that are positioned on the Emerald Isle.

Different sturdy renewable power shares embody The Renewable Infrastructure Group — a share I personal in my very own portfolio — and FTSE 100 wind power big SSE. There are in truth dozens of such shares for traders to select from as we speak.

Unfavourable climate durations can play havoc with power technology and earnings at corporations like these. However like Nvidia, in addition they carry appreciable development potential because the battle in opposition to local weather change intensifies.