Ownwell is a service that helps you enchantment and decrease your property taxes.

The price of proudly owning a property goes far past the acquisition worth. Even when you repay your mortgage, you’ll nonetheless be on the hook for property taxes. Sadly, an unfair evaluation might push your property tax prices larger and take an enormous chew out of your price range.

As a property proprietor, you may have the fitting to enchantment the assessed worth of your house, which may also help you decrease your property taxes. However the time-consuming course of forces owners to leap by means of many hoops. That’s the place Ownwell is available in to barter for you and enable you save in your property tax invoice.

We discover how Ownwell works so you possibly can resolve if it’s an excellent match in your scenario.

|

Texas, California, Washington, Georgia, Florida, Illinois, and New York |

|

What Is Ownwell?

Ownwell is an Austin-based firm that works with property house owners to decrease their property taxes. The corporate makes use of a workforce of specialists supported by know-how to assist owners efficiently enchantment unfair assessments.

Whereas being a comparatively new firm, they did over 170,000 property tax appeals in 2023.

What Does It Provide?

Ownwell will enchantment the valuation of you residence on which your property taxes are primarily based. You solely pay if the enchantment is profitable.

They are saying they’ve an 86% success fee and count on to do between 400,000 and 500,000 appeals in 2024, with the typical buyer saving over $1,100.

Attraction Your Property Taxes

Property taxes are an unavoidable value. However that doesn’t imply you need to overpay. When the tax workplace assesses the worth of your house, that may instantly affect how a lot you’ll pay in property taxes that yr.

The excellent news for property house owners is that you’ve the fitting to enchantment your evaluation. The unhealthy information is that doing so by yourself could be a tedious and time-consuming course of. Ownwell affords to take over the appeals course of for you.

Once you work with Ownwell, the method works by offering the corporate with particulars like a picture of your property tax invoice. From there, Ownwell will make a case for you and submit it to the suitable tax physique. All through the method, a devoted Property Tax Advisor is an area professional answerable for your case. Relying on the scenario, Ownwell may meet with the county assessors or attend enchantment board hearings.

In the event that they’re profitable, you’ll get notified about your financial savings and pay a share of the financial savings because the charge to Ownwell.

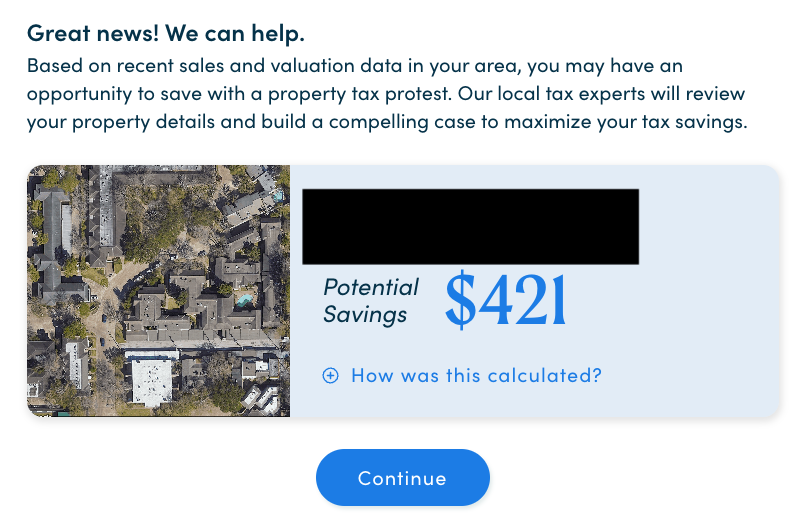

This is what it appears to be like like once you enter your tackle:

Large Financial savings Attainable

As of writing, Ownwell says that single-family owners save a median of $1,148 per yr when working with Ownwell. Additionally, the corporate claims that over 85% of consumers see a discount of their property tax invoice. However, in fact, the quantity you might save varies from place to put.

It’s value noting that property house owners in Washington and Georgia might see their taxable worth enhance after a overview, which might result in extra property taxes. But when Ownwell sees that as a threat, they are going to forgo submitting your enchantment.

Restricted Availability

The most important draw back of Ownwell is that it’s not out there in all places. The corporate presently operates in Texas, California, Washington, Georgia, Florida, Illinois, and New York.

Moreover, even in locations like California, there’s solely a restricted quantity of choices as a result of insurance policies like Prop 13, which cap your property tax charges.

Are There Any Charges?

Once you work with Ownwell, you received’t encounter any upfront charges. If the corporate can’t prevent cash, you received’t pay something. But when the corporate does prevent cash, it can take 25% to 35% of these financial savings.

For instance, let’s say Ownwell saves you $1,000 in your property taxes. You’ll pay them $250 to $350 for his or her service.

How Does Ownwell Examine?

If you’re in search of a streamlined property tax discount service with none upfront value, Ownwell is a top-tier alternative. It’s true that you might undergo the paperwork your self. However when you don’t have the time or vitality to decide to the method, it could possibly be value parting with 25% of the financial savings. And keep in mind, if they do not prevent something, you do not pay something!

Another choice is to rent an area property tax legal professional. Relying on the scenario, these professionals may find a way that can assist you by means of the appeals course of. However you need to count on extra upfront prices with this feature. And you may seemingly pay for this service whether or not or not you get monetary savings.

Lastly, you possibly can all the time do it your self. This may require filling out particular types, understanding what your property worth is, after which working with the county on any hearings.

How Do I Open An Account?

Based on Ownwell, the signup course of takes lower than three minutes. Begin by getting into your tackle and answering some primary questions on your property. You’ll additionally must add a duplicate of your property tax invoice. Ownwell will take over from there.

Is It Protected And Safe?

Ownwell protects your private info by means of “a system of organizational and technical safety measures.” Sadly, the privateness coverage is a bit imprecise on how they defend your info. However many of the info they require is publicly out there by means of your tax assessor’s workplace, so they do not have entry to a lot most people already cannot see.

How Do I Contact Ownwell?

If you wish to get in contact with Ownwell, you possibly can name their assist workforce. Right here’s the numbers for every state they work in:

- California: 310-421-0191

- Georgia: 678-890-0767

- New York: 516-518-3334

- Washington: 206-395-8382

- Florida: 305-901-2905

- Illinois: 312-500-3131

- Texas: 512-886-2282

Is It Price It?

If you’re a property proprietor, Ownwell might enable you save in your property taxes. It’s an particularly good service when you’ve just lately seen a spike within the assessed worth of your house. However because you don’t must pay an upfront charge, those that dwell throughout the firm’s service space might discover loads of worth by means of Ownwell.

I’d like to make use of Ownwell for my major residence. Sadly, it’s not out there in my space. But when it’s an choice for you, contemplate looking for financial savings with Ownwell right this moment.

Ownwell Options

|

Texas, California, Washington, Georgia, Florida, Illinois, and New York |

|

|

|