There’s numerous enthusiasm for Roth IRA conversions and Mega Backdoor Roth IRAs—and for good purpose. Paying taxes upfront in your retirement accounts could be a savvy transfer, particularly if you happen to’re in a mid-to-lower federal earnings tax bracket, because it permits for tax-free withdrawals sooner or later.

That mentioned, due to the newest customary deduction quantities and earnings thresholds for paying no long-term capital good points tax, extra Individuals now have the chance to make bigger tax-free withdrawals from their taxable brokerage accounts. For 2025, that tax-free earnings quantity is as much as $68,860 for a single individual and $126,700 for a married couple.

The overwhelming majority of Individuals may stay comfortably in retirement on $68,860 or $126,700. In spite of everything, the median particular person earnings in our nation is about $43,000 earlier than taxes.

This text will present you how you can earn and withdraw six figures whereas paying no taxes. I’ll additionally present a information on how a lot it’s best to save for retirement if these earnings ranges are adequate to your wants. As I am not a tax skilled, simply an fanatic, be at liberty to problem me and share some additional insights if you’re one.

Associated: 2025 Federal Earnings Tax Charges And The New Splendid Earnings

A Taxable Brokerage Account Will increase In Significance

For these pursuing FIRE, rising your taxable brokerage account is essential, because it generates the passive earnings you may depend on in retirement. Not like retirement accounts, there are not any contribution limits, and no required minimal distributions. Moreover, you may take tax-free withdrawals, as you may see under.

For those who’re planning to retire early, I like to recommend maxing out your tax-advantaged retirement accounts annually whereas working to develop your taxable brokerage account to 3 occasions the dimensions of your tax-advantaged accounts. Reaching this stability can set you up for monetary freedom. Since beginning Monetary Samurai in 2009, I’ve encountered many individuals who uncared for their taxable brokerage accounts, which finally left them constrained.

Beneath is a case examine displaying how a lot you may intention to build up in taxable investments alongside your tax-advantaged accounts. Whereas this will look like a stretch objective for some, it is my beneficial framework for constructing long-term wealth. At age 50, you probably will not must pay any earnings taxes.

Normal Deduction Limits And Earnings Thresholds For 0% Tax

To grasp how you can obtain tax-free withdrawals from taxable brokerage accounts we should first know two key components:

- The most recent customary deduction quantities: $15,000 for singles and $30,000 for married {couples} for 2025.

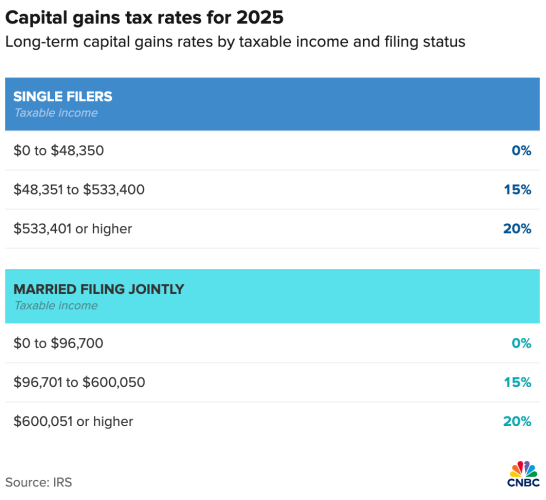

- The earnings threshold for the 0% tax bracket on certified dividends and long-term capital good points: $53,850 for singles and $96,700 for married {couples}.

By including the usual deduction to the earnings threshold based mostly in your marital standing, we are able to calculate the tax-free earnings and withdrawal limits. For 2025, these limits are:

- $68,850 for singles

- $126,700 for married {couples} submitting collectively

Nevertheless, to keep away from paying taxes on $68,850 or $126,700, the composition of your earnings is essential. Let’s illustrate this with an instance for a married couple submitting collectively. All the time examine the newest customary deduction and earnings threshold quantities, as they modify yearly.

Meet Chris and Taylor – Semi-Retired And Consulting Half-time

Chris and Taylor are of their early 60s, semi-retired, and residing off a mixture of passive earnings from investments and part-time consulting work. They’ve constructed a $2 million taxable retirement portfolio throughout their working years and now concentrate on optimizing their tax state of affairs to stay comfortably.

How They Earn Tax-Free Earnings in 2025

- Normal Deduction

The usual deduction for married {couples} submitting collectively is $30,000 in 2025. This deduction shields the primary $30,000 of their earnings from federal earnings taxes. - 0% Lengthy-Time period Capital Positive aspects Tax Price

The 0% tax fee on long-term capital good points and certified dividends applies so long as their taxable earnings (after deductions) stays under $96,700. - Combining the Two

By combining their customary deduction with the 0% capital good points tax threshold, Chris and Taylor can earn:- $30,000 in extraordinary earnings (e.g., consulting earnings or IRA withdrawals)$96,700 in long-term capital good points or certified dividendsThis offers them a complete tax-free earnings of $126,700 in 2025.

Chris and Taylor’s Half-Time Consulting

Chris and Taylor earn $30,000 from part-time consulting—a pursuit I extremely encourage for semi-retirees or retirees to remain mentally energetic and engaged with society. This extraordinary earnings is absolutely offset by their $30,000 customary deduction, which means they pay 0% federal tax on their consulting earnings.

After listening to my podcast interview with Invoice Bengen, the creator of the 4% Rule, they really feel comfy withdrawing between 4% to five% yearly from their $2 million taxable portfolio. This yr, they promote investments, realizing $96,700 in long-term capital good points. As a result of their taxable earnings (after accounting for the usual deduction) matches the $96,700 threshold for the 0% federal long-term capital good points tax fee, they owe 0% federal tax on these good points as nicely.

Nevertheless, Chris and Taylor reside in California, the place all capital good points and dividends are taxed as extraordinary earnings. At their marginal California state earnings tax fee, they owe $5,365 in state taxes on their mixed earnings of $126,700, leading to an efficient state tax fee of 4.23%. Not dangerous, however one thing to contemplate.

$126,700 Tax-Free Earnings Is Equal To ~$170,000 In Wages

To stroll away with $126,700 after taxes, you would want to earn roughly $170,000 in gross earnings at a 25% efficient tax fee (together with FICA taxes), assuming no state earnings taxes. For those who stay in states like California, New Jersey, or New York, the place state taxes considerably impression your take-home pay, you’d probably must earn nearer to $180,000 in gross earnings to realize the identical after-tax quantity.

For Chris and Taylor to keep away from paying state earnings taxes completely on their $126,700 earnings, relocating to one of many 9 no-income-tax states—similar to Texas, Florida, or Tennessee—is one answer. Alternatively, states like Illinois, Pennsylvania, or South Carolina, which tax earnings extra favorably or exclude sure earnings sorts, may additionally present significant tax financial savings relying on how their earnings is structured.

This gross earnings comparability underscores the worth of saving and investing for retirement. Diversifying retirement funds by way of a Roth IRA or Mega Backdoor Roth IRA is one other efficient technique, relying how wealthy you assume you may be.

Nevertheless, if you happen to anticipate staying under sure internet price thresholds in retirement, the Roth IRA’s advantages could diminish, as you may obtain tax-free withdrawals from taxable brokerage accounts regardless.

$3 Million Retirement Portfolio Threshold To Begin Worrying About RMDs

One problem that some rich or frugal retirees face is the requirement to take Required Minimal Distributions (RMDs) beginning at age 73, as mandated by the SECURE 2.0 Act. These RMDs, that are handled as extraordinary earnings, can doubtlessly push retirees into the next tax bracket.

Nevertheless, if you happen to do not anticipate retiring with greater than $3 million in your 401(okay) or IRA as a married couple, you’re probably protected from paying important taxes in retirement. This security comes from the customary deduction and the growing earnings thresholds for 0% tax on long-term capital good points. Even when factoring within the common Social Safety earnings for a few $40,000 in in the present day’s {dollars}, many retirees can nonetheless handle a comparatively low tax burden.

For singles, shoot for a retirement portfolio of $1.5 million and really feel protected from paying taxes resulting from RMDs. $1.5 million can also be $200,000 extra from how a lot staff of their 50s mentioned they wanted to retire comfortably in a 2023 Northwestern Mutual survey. The retirement portfolio threshold quantities might be listed to inflation over time. However these are two simple to recollect figures if individuals wish to shoot for internet price targets.

RMD Instance With Little-To-No Taxes To Pay

Beneath is a graphical instance of a retiree compelled to take RMDs at age 73 with a $3 million 401(okay). The calculation assumes:

- A withdrawal fee of three.8%, as decided by the Uniform Lifetime Desk calculation.

- No further contributions are made after retirement.

- An annual funding development fee of 5%.

By the point you flip 73, the earnings threshold for the 0% tax fee will probably be increased than the RMD quantities mentioned above. Moreover, the customary deduction may doubtlessly eradicate most, if not all, of your Social Safety earnings from being taxed.

As well as, to decrease your RMD quantities, you may clearly begin withdrawing before age 73.

Alternatively, if you happen to anticipate having retirement portfolios nicely over $1.5 million / $3 million, you’ll have a higher incentive to make the most of Roth IRA conversions and Mega Backdoor Roth IRAs earlier in your profession. The perfect time to implement these methods is when your earnings is at its lowest, similar to after a layoff or throughout an early retirement part.

Abstract Of Tax-Free Withdrawals From Retirement Accounts

To realize tax-free withdrawals and earnings in retirement, retirees ought to keep inside the usual deduction and 0% tax bracket for long-term capital good points and certified dividends. In 2025, this implies protecting taxable earnings underneath $68,850 (single) or $126,700 (married), which incorporates the usual deduction ($15,000 single, $30,000 married) and the tax-free threshold for capital good points/dividends.

Required Minimal Distributions (RMDs) from 401(okay)s and IRAs begin at age 73 and are taxed as extraordinary earnings. To keep away from increased taxes, restrict pre-tax account balances to $1.5 million (single) or $3 million (married), and contemplate Roth conversions earlier in retirement.

Social Safety must also be managed to keep away from taxes. As much as 85% of advantages might be taxed if mixed earnings exceeds $34,000 (single) or $44,000 (married). By balancing RMDs, dividends, and capital good points, retirees can get pleasure from tax-free earnings.

Worst case, if you happen to accumulate extra money than anticipated, you’ll simply pay extra taxes—not a nasty downside to have!

Readers, do you know that Individuals can now earn and withdraw a lot with out paying any taxes? If that’s the case, why are some individuals nonetheless making an attempt to build up far more than $1.5 million per individual for retirement?

Subscribe To Monetary Samurai

Hear and subscribe to The Monetary Samurai podcast on Apple or Spotify. I interview consultants of their respective fields and focus on a number of the most attention-grabbing subjects on this website. Your shares, rankings, and critiques are appreciated.

To expedite your journey to monetary freedom, be part of over 60,000 others and subscribe to the free Monetary Samurai publication. Monetary Samurai is among the many largest independently-owned private finance web sites, established in 2009. The whole lot is written based mostly on firsthand expertise and experience as a result of cash is simply too essential to be left as much as the inexperienced.