The temporary’s key findings are:

- Millennials began their careers in weak labor markets, so initially they lagged behind Late Boomers and Gen Xers on the similar ages in life occasions and wealth.

- Strikingly, knowledge for 2022 present an enormous reversal: Millennials had caught up on most indicators, and so they surpassed earlier cohorts in wealth accumulation.

- The principle motive was an enormous runup in housing wealth, which soared throughout COVID, however positive aspects in monetary wealth additionally boosted steadiness sheets.

- It’s not clear, nevertheless, what this excellent news means for retirement safety, since home costs could reverse and few retirees faucet their fairness for consumption.

Introduction

The discharge of the Federal Reserve’s 2022 Survey of Shopper Funds gives an opportunity to atone for the retirement saving of Millennials – these born throughout 1981-1999. This group, regardless of being extra educated than earlier cohorts, confronted early challenges, as many left college with giant scholar loans and started their careers within the powerful job market following the bursting of the dot.com bubble and the Nice Recession. These elements delayed main life milestones, equivalent to getting married and proudly owning a house, and restricted their means to build up wealth. Our preliminary 2016 snapshot confirmed Millennials means behind earlier cohorts, on the similar ages, on each dimension.1

Our subsequent check-in with Millennials was 2019.2 After three years of a powerful financial system simply previous to the pandemic, this cohort had caught up in some ways: that they had related homeownership and marriage charges, labor pressure participation, and earnings. Nonetheless, they had been nonetheless behind earlier cohorts in retirement readiness – measured by the online worth-to-income ratio – primarily as a consequence of excessive ranges of scholar loans.

Since 2019, the nation has skilled a world pandemic and financial disruption. On the similar time, the federal government offered unprecedented fiscal assist, employment remained sturdy, residence values rose considerably, and the inventory market – even with the drop in 2022 – ended up considerably larger than in 2019. The query addressed on this temporary is how all these elements affected the retirement preparedness of Millennials.

The dialogue proceeds as follows. The primary part defines Millennials and the sooner generations which can be used as a foundation for comparability. The second part presents wealth-to-income ratios from the Survey of Shopper Funds for Millennials, Gen-Xers, and Late Boomers, exhibiting that by 2022 Millennials are outpacing earlier cohorts. The third part explores the explanations for this reversal – primarily the rise in home costs but in addition positive aspects in monetary property as a consequence of elevated saving and a powerful inventory market. The fourth part concludes that whereas Millennials’ steadiness sheets now look strong in comparison with these of earlier cohorts on the similar ages, the majority of the achieve comes from housing and it’s unclear the extent to which housing fairness ought to be counted as “retirement saving.”

Defining the Train

Journalists and social scientists usually give names to generations who grew up in related circumstances. Those that lived by means of the Nice Melancholy and fought in World Warfare II have been characterised because the “Greatest Generation,” and those that got here after – born within the Twenties to mid-Forties – the Silent Technology. With the sharp uptick in fertility charges after World Warfare II, these born from the mid-Forties to mid-Sixties had been known as Child Boomers. Technology X – these born within the mid-Sixties and Nineteen Seventies – adopted. The Millennial Technology (additionally known as Technology Y) consists of People born through the Nineteen Eighties and Nineties. Determine 1 reveals how the present U.S. inhabitants breaks down by age cohort and start 12 months.

The main target right here, and in our prior collection, is on the section of Millennials who had been ages 31-41 in 2022, which suggests these born from 1981-91. These people are in comparison with Gen-Xers and Late Boomers once they had been the identical ages. The Gen-Xers had been the identical ages in 2010 (which covers these born from 1969-79), and the Late Boomers had been the identical ages in 1995 (which covers these born from 1954-64).

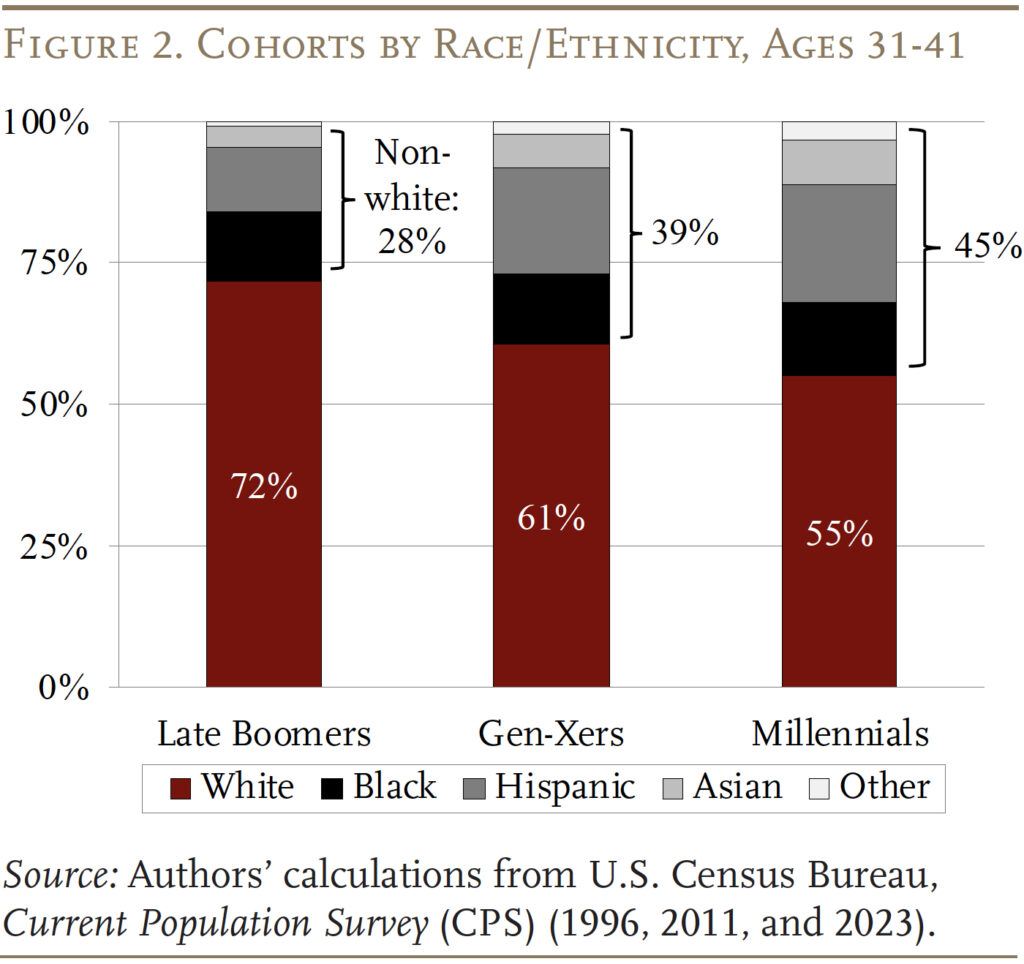

Millennials are distinctive in quite a lot of methods. They had been the primary full era to develop up with computer systems. Social scientists are likely to characterize them as self-confident and optimistic since their mother and father tended to be attentive and supportive.3 They’re additionally extra ethnically numerous than earlier cohorts; as proven in Determine 2, the share of Whites declined from 72 p.c of Late Boomers to 55 p.c of Millennials.

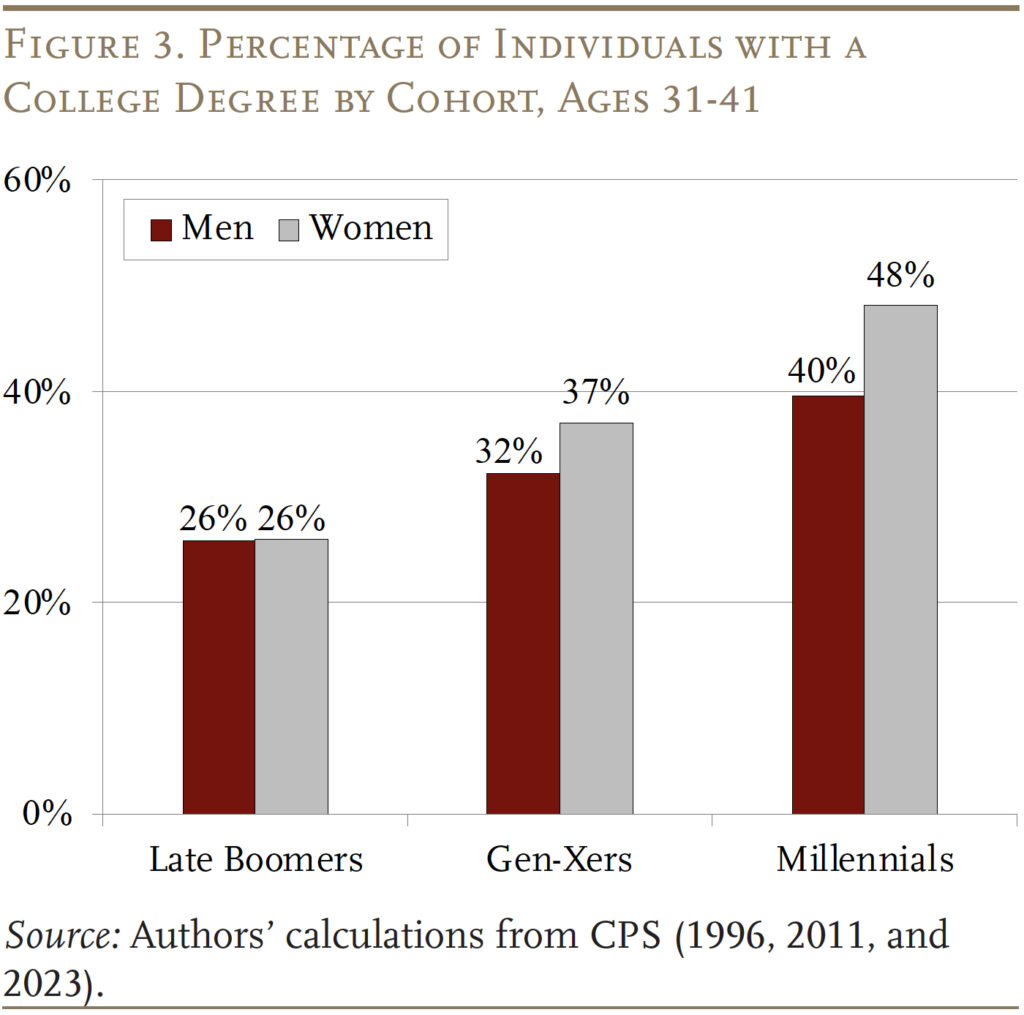

Millennials are additionally extra educated than earlier cohorts, with nearly half of girls and 40 p.c of males having a university diploma, in comparison with solely 1 / 4 of Late Boomers and a 3rd of Gen-Xers (see Determine 3). One would count on that this larger stage of schooling would bode nicely for work, earnings, and wealth accumulation.

Sadly, as famous, Millennials entered the labor market throughout powerful occasions.4 The group examined right here turned 21 between 2002 and 2012, which meant that they had been popping out of faculty throughout a interval that included the bursting of the dot.com bubble and the Nice Recession. This expertise was notably laborious on Millennial males, who had labor pressure participation charges beneath these in earlier cohorts.

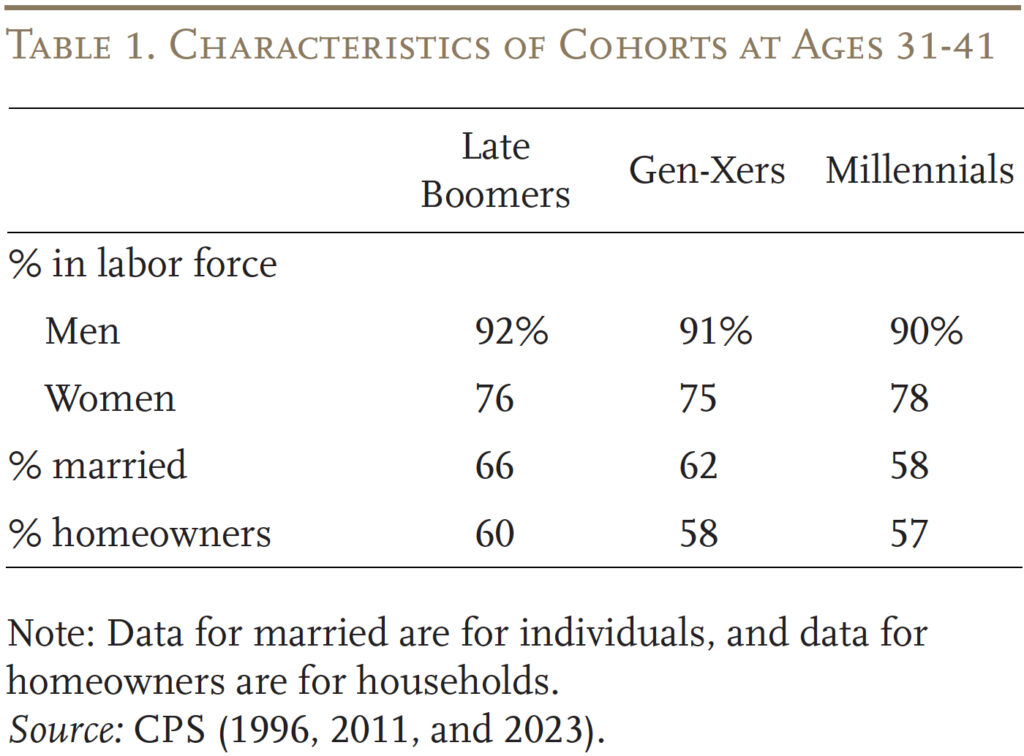

In line with the 2019 replace, knowledge for 2022 present that just about all the sooner shortfall between Millennials and earlier cohorts in labor market exercise, marriage, and homeownership has disappeared (see Desk 1). Towards this background, the important thing query is what has occurred to the wealth of Millennials throughout and after the pandemic and the way they now evaluate to earlier generations once they had been the identical age.

Wealth Holdings by Cohort

In 2019, pre-pandemic, even though Millennials had caught up on many metrics, their wealth holdings nonetheless lagged considerably behind the accumulations of earlier cohorts, largely as a consequence of their excessive ranges of scholar loans. The low wealth of Millennials has been a supply of significant concern provided that they’ll dwell longer – and have to assist extra years of retirement than earlier cohorts – and that, with the rise in Social Safety’s Full Retirement Age to 67, they’ll obtain decrease advantages relative to pre-retirement revenue than earlier cohorts.

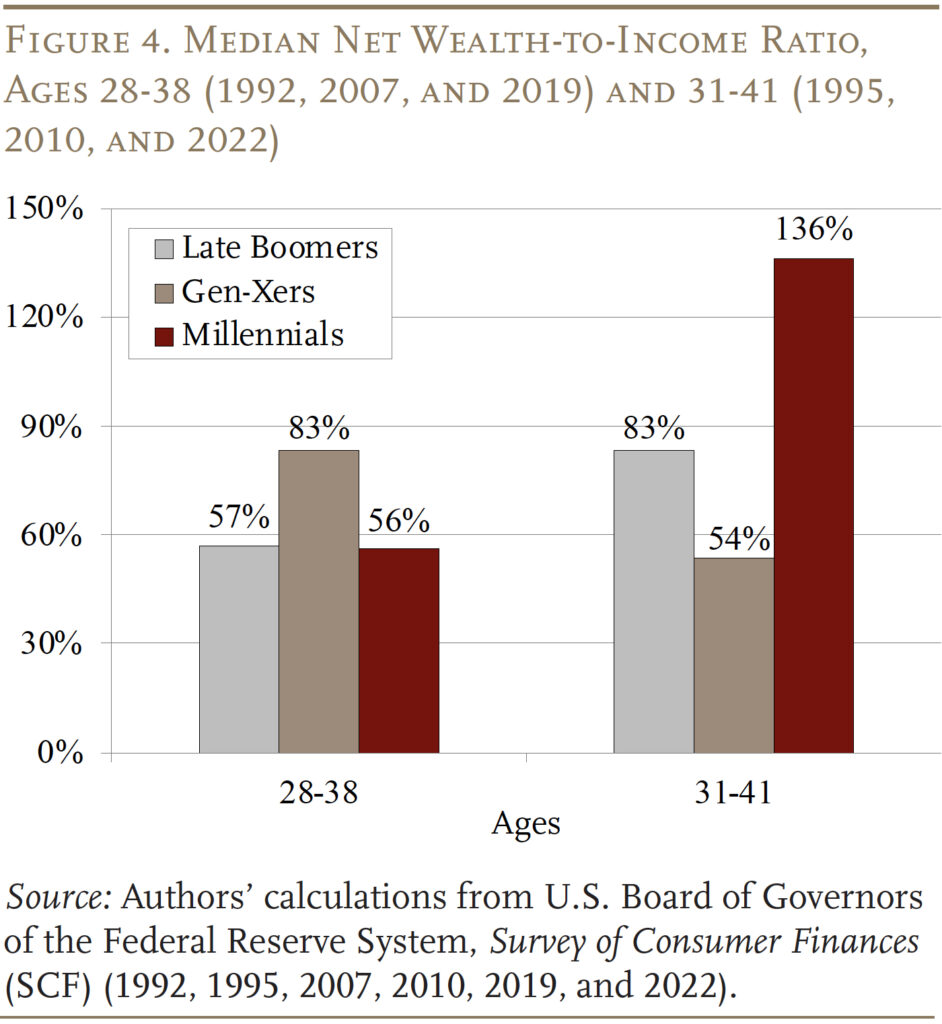

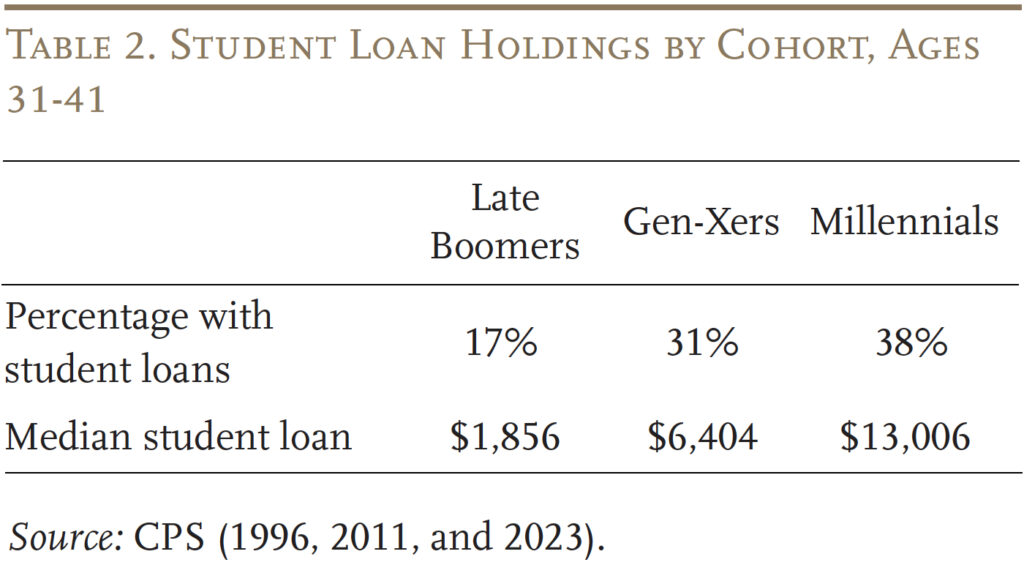

Information for 2022, nevertheless, present a dramatic reversal within the fortunes of Millennials (see Determine 4).5 The primary group of bars present the wealth-to-income ratios for these ages 28-38 in every cohort, at which level Millennials had been behind. Three years later, in 2022, when this group was 31-41, the sample had dramatically reversed, with Millennials pulling means forward of earlier cohorts. Whereas Millennials are nonetheless extra more likely to have scholar debt and the worth of their debt is larger (see Desk 2), clearly different elements have greater than compensated for that burden.

The relative positive aspects of Millennials in wealth-to-income ratios must be interpreted with some warning. First, the success relative to Gen-Xers is a little bit exaggerated as a result of Gen-Xers had been 31-41 in 2010, when fairness and home costs had been battered by the Nice Recession. Second, the wealth measure used on this evaluation excludes two main sources of retirement wealth: Social Safety and outlined profit pensions – each of which had been bigger for earlier cohorts.

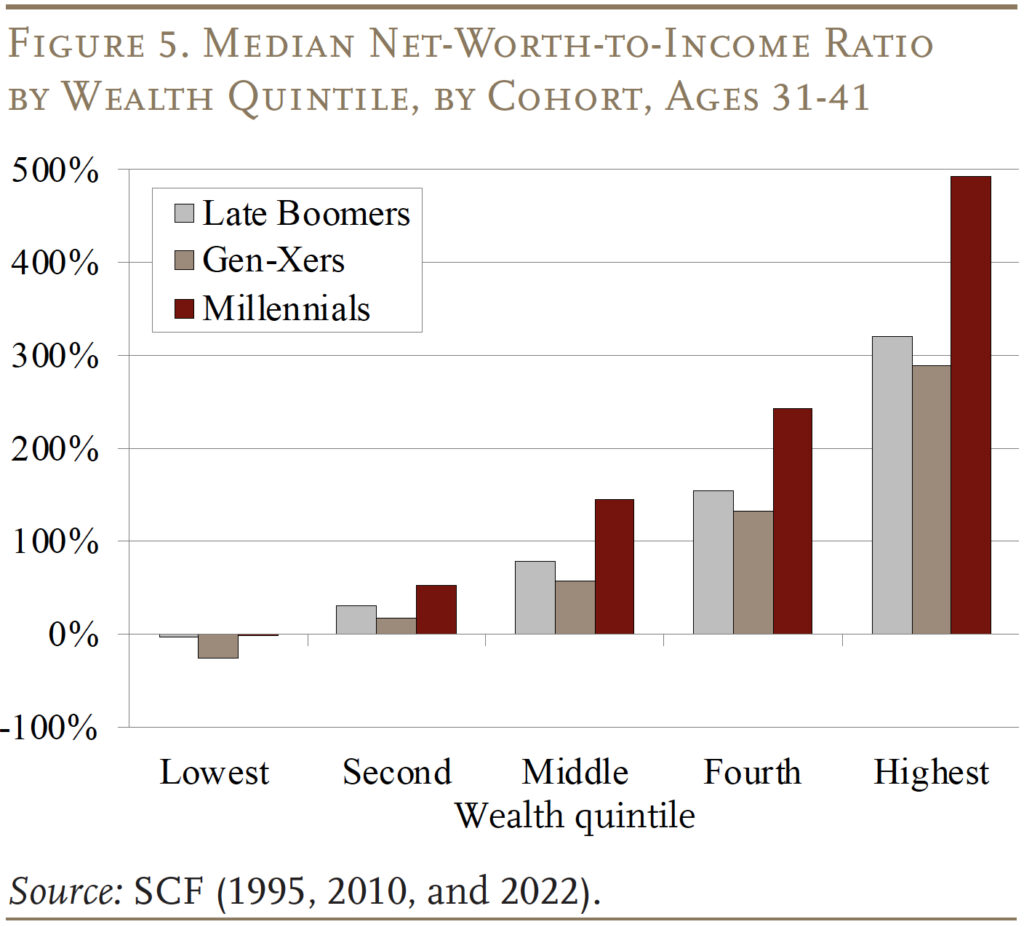

On a extra constructive word, the advance in wealth holdings amongst Millennials was not simply concentrated among the many rich, however somewhat occurred throughout the entire wealth distribution (see Determine 5). Strikingly, Millennials in every wealth group are higher off.

Supply of the Enchancment

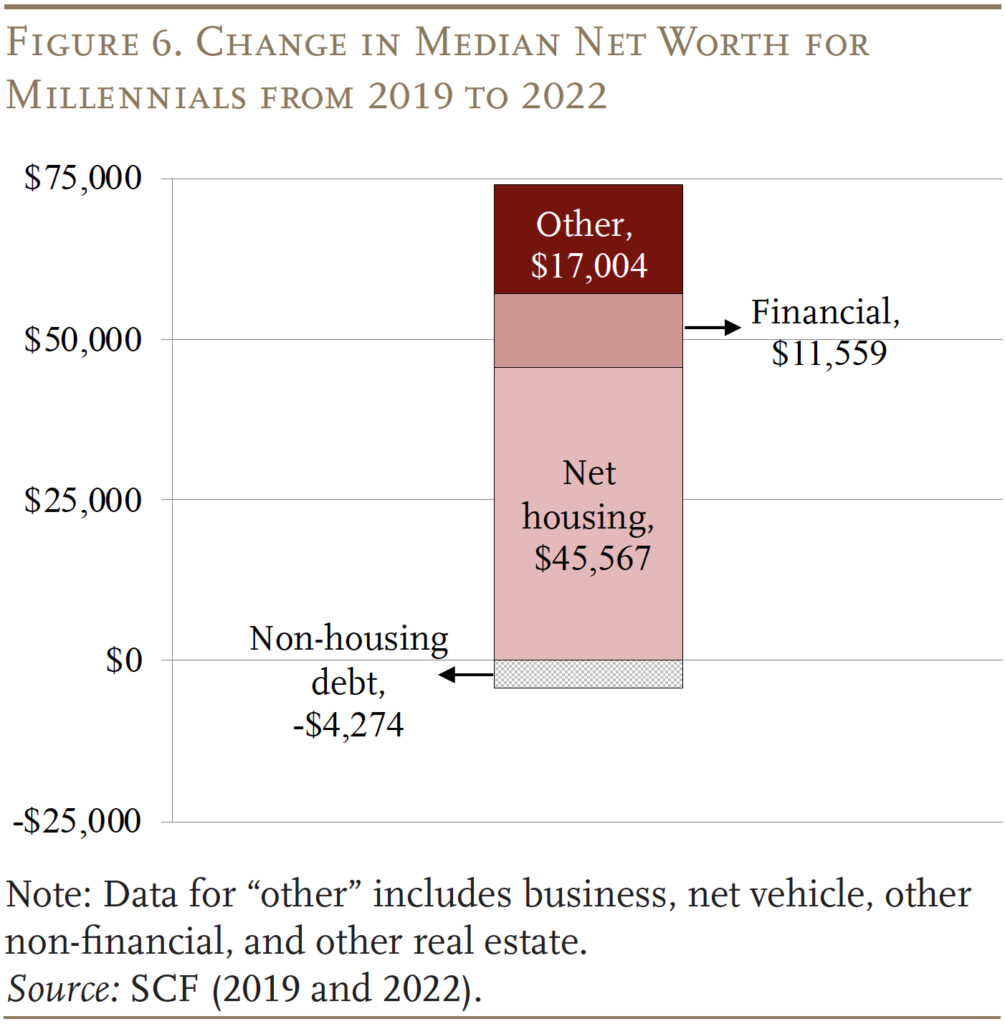

Why did Millennials pull forward? Determine 6 breaks down the supply of the rise in median internet price ($72,280) by element. Many of the wealth achieve – 63 p.c – has come by means of housing, however monetary property have additionally elevated.

Housing Wealth

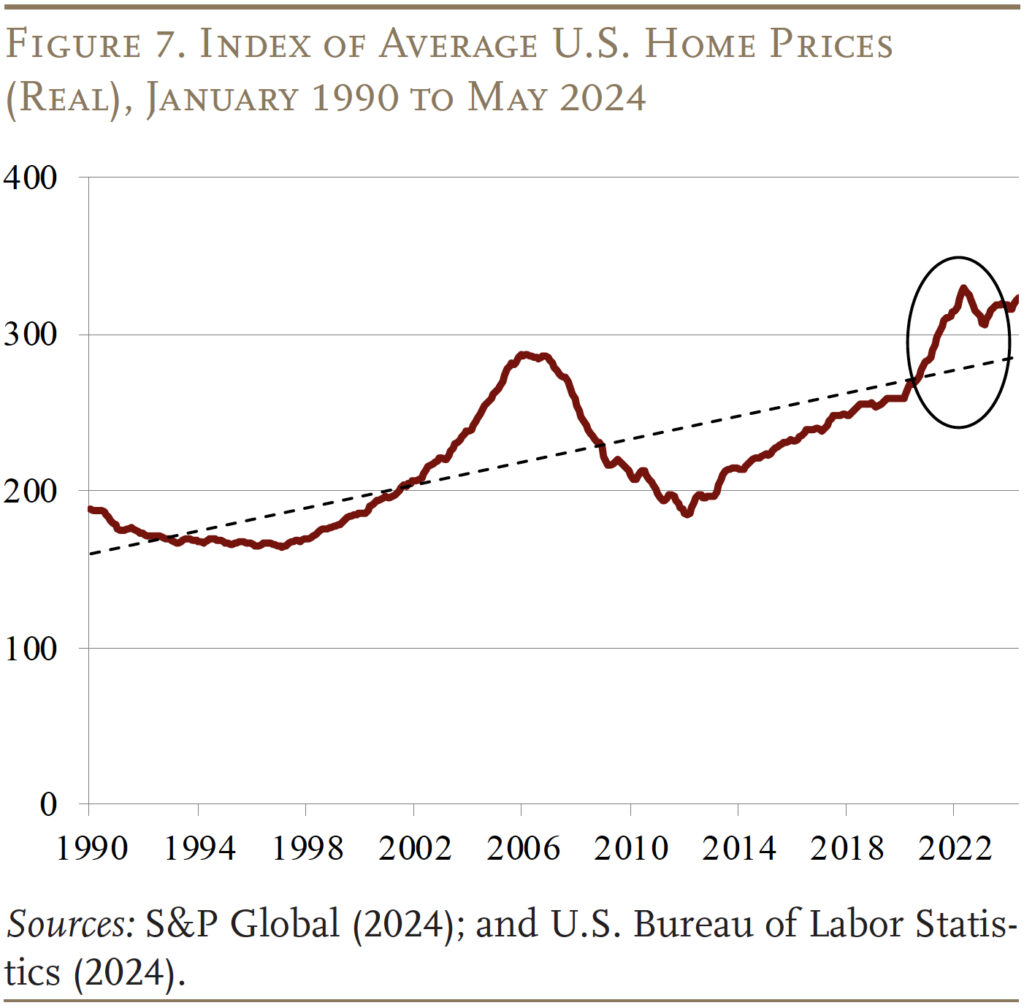

The rise in housing wealth displays the dramatic improve in home costs that occurred through the pandemic (see Determine 7). When excited about retirement saving, nevertheless, it’s not clear assess housing wealth. The home is an illiquid asset, and few individuals reap the benefits of their residence fairness to assist their consumption in retirement.6 Slightly they have a tendency to carry their housing fairness in reserve to cowl any long-term care wants towards the top of life or to go away as a bequest to their kids. Furthermore, present residence costs are about 16 p.c above their development over the past 30 years and should nicely revert again to the development over time.

Not all Millennials have loved the pandemic housing market growth. Millennial renters pay a better share of revenue for housing prices than prior generations, and the costly housing market could imply they’ll have a more durable time changing into owners and having fun with future positive aspects within the housing market.

Monetary Wealth

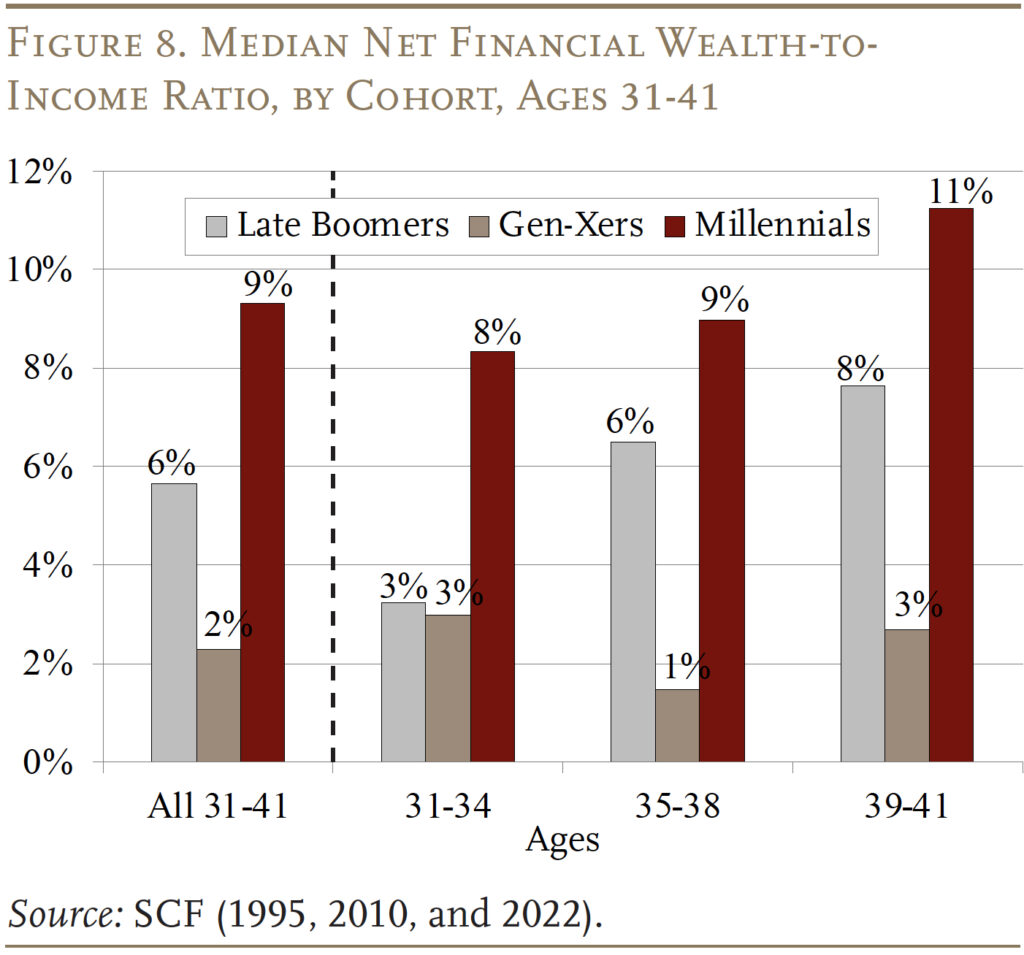

Despite the fact that housing wealth is the primary motive Millennials are doing comparatively higher than older cohorts, they’re additionally forward on monetary property (see Determine 8). This enchancment displays each elevated saving and a run-up in fairness costs.

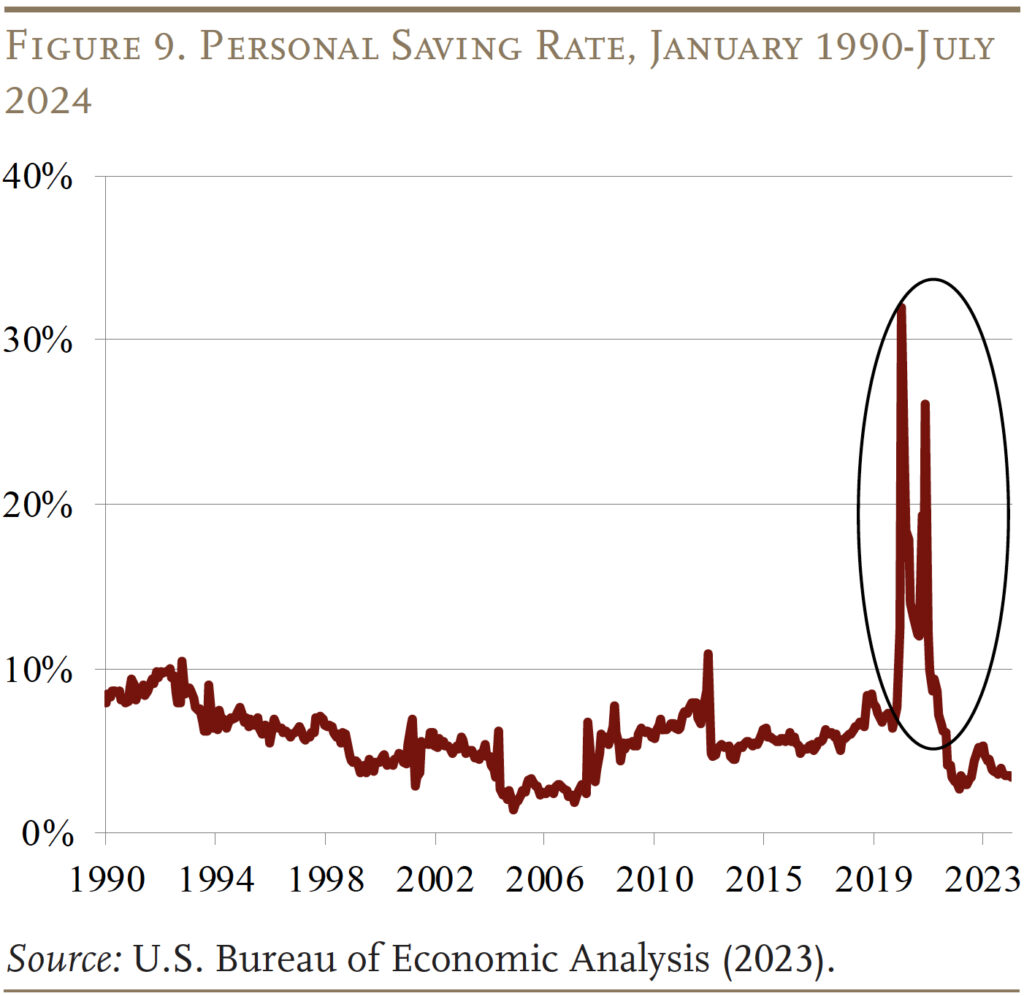

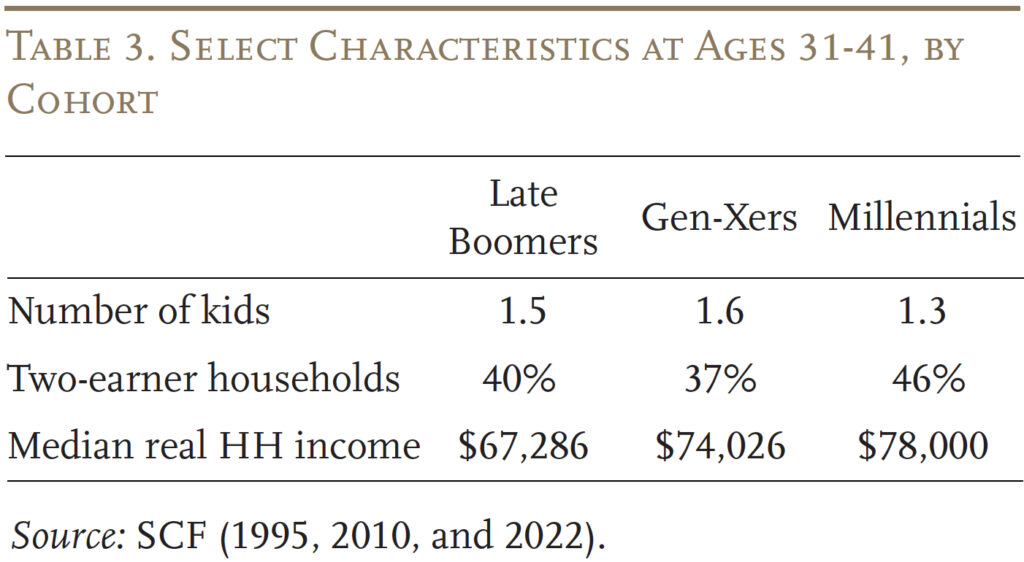

Fueled by the federal stimulus spending and scholar mortgage pause, private financial savings jumped to over 30 p.c through the first two years of the pandemic (see Determine 9). All households, together with the Millennials, had been capable of construct up financial savings and make their steadiness sheets stronger. Millennials, nevertheless, usually tend to be in two-earner households, have larger family incomes, and fewer youngsters – all of which supplies extra room for financial savings on high of stimulus checks (see Desk 3).

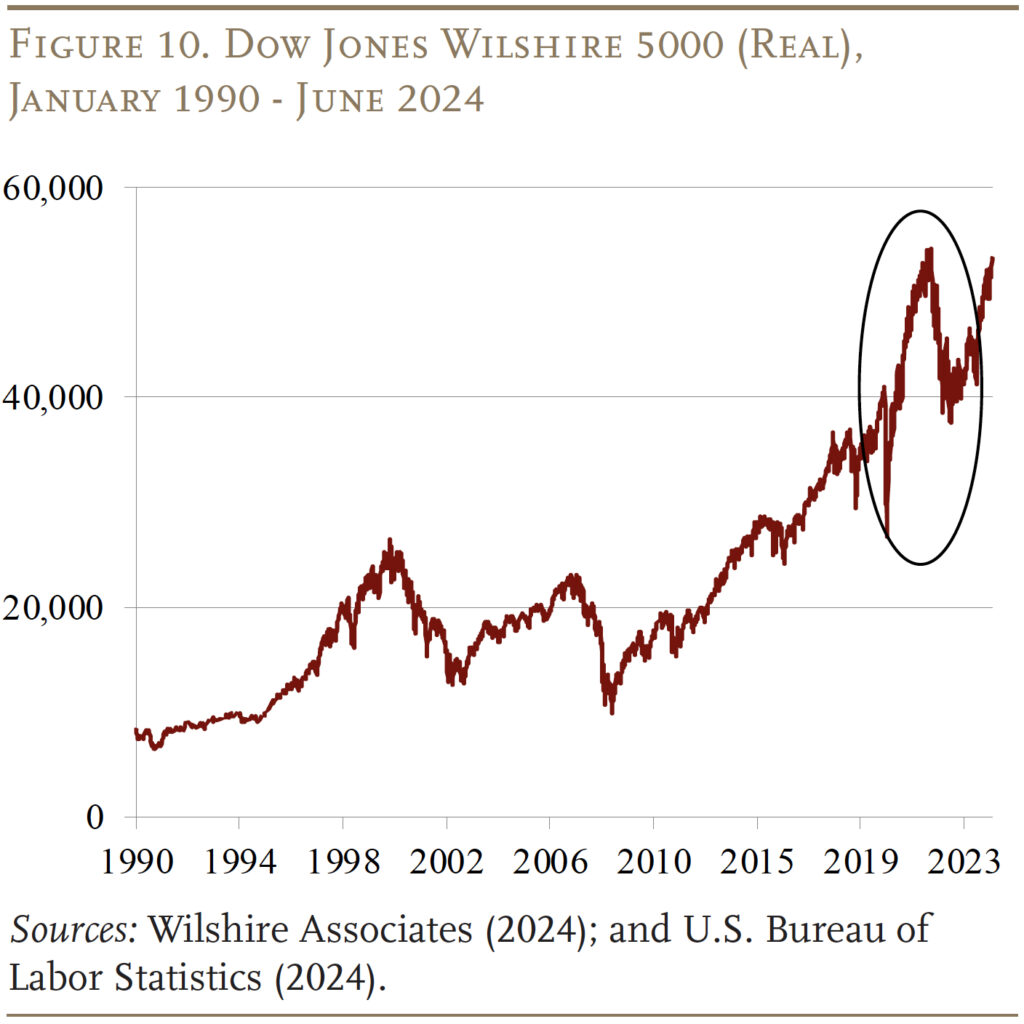

Equally, whereas all cohorts profit from a rising inventory market, Millennials are additionally extra more likely to spend money on shares. Over 60 p.c of Millennials maintain some equities, primarily of their retirement accounts, in comparison with 48 p.c of Gen Xers and 37 p.c of Late Boomers on the similar ages. Moreover, near 1 / 4 of Millennial households maintain shares exterior of their retirement accounts – roughly twice the share of earlier cohorts.7 Because of their broad holdings in equities, they had been well-situated to profit from a powerful inventory market (see Determine 10).

Conclusion

Millennials now have extra internet wealth relative to revenue of their 30s than Gen Xers and Late Boomers had, regardless of nonetheless having extra scholar debt. Many of the enchancment of their steadiness sheets is because of the fast improve in housing costs through the pandemic. Additionally they have larger non-housing wealth as nicely, due to elevated saving and being positioned to revenue from a powerful inventory market.

Regardless of all of the enhancements, the great fortune of the Millennials depends totally on housing. The home is an illiquid asset, and few individuals reap the benefits of their residence fairness to assist their consumption in retirement. Therefore, it’s not clear the extent to which housing fairness ought to be counted as retirement saving.

References

Chen, Anqi and Alicia H. Munnell. 2021. “Millennials’ Readiness for Retirement.” Concern in Temporary 21-3. Chestnut Hill, MA: Middle for Retirement Analysis at Boston Faculty.

Harris, Malcolm. 2017. Youngsters These Days: Human Capital and the Making of Millennials. Boston, MA: Little, Brown and Firm.

Hernandez Kent, Ana and Lowell R. Ricketts. 2024. “Millennials and Older Gen Zers Made Significant Wealth Gains in 2022.” On the Financial system Weblog (February 24). St. Louis, MO: Federal Reserve Financial institution of St. Louis.

Johnson, Richard W. and Karen E. Smith. 2024. “How Gloomy is the Retirement Outlook for Millennials?” In Actual-World Shocks and Retirement System Resiliency, edited by Olivia S. Mitchell, John Sabelhaus, and Stephen Utkus. New York, NY: Oxford College Press.

Howe, Neil and William Strauss. 2000. Millennials Rising: The Subsequent Nice Technology. New York, NY: Classic Books.

Munnell, Alicia H. and Wenliang Hou. 2018. “Will Millennials Be Ready for Retirement?” Concern in Temporary 18-2. Chestnut Hill, MA: Middle for Retirement Analysis at Boston Faculty.

Pinsker, Joe and Veronica Dagher. 2024. “The Dramatic Turnaround in Millennials’ Finances.” (August 13). New York, NY: The Wall Road Journal.

S&P International. 2024. “S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index.” New York, NY: S&P Dow Jones Indices.

Tolentino, Jia. 2017. “Where Millennials Come From.” (December 4). New York, NY: The New Yorker.

Twenge, Jean M. 2014. Technology Me-Revised and Up to date: Why At present’s Younger People Are Extra Assured, Assertive, Entitled – and Extra Depressing Than Ever Earlier than. New York, NY: Simon and Schuster.

U.S. Board of Governors of the Federal Reserve System. Survey of Shopper Funds, 1992, 1995, 2007, 2010, 2019, and 2022. Washington, DC.

U.S. Bureau of Financial Evaluation. 2024. “Personal Saving Rate Data (accessed from FRED database).” Washington, DC.

U.S. Bureau of Labor Statistics. 2024. “Consumer Price Index.” Washington, DC.

U.S. Census Bureau. Present Inhabitants Survey, 1996, 2011, and 2023. Washington, DC.

U.S. Census Bureau. 2024. “National Population by Characteristics: 2020-2023.” Washington, DC.

Wilshire Associates. 2024. “Dow Jones Wilshire 5000 (Full Cap) Price Levels Since Inception.” Santa Monica, CA. Information for Nominal Greenback Ranges.