Picture supply: Getty Photographs

In hindsight, we all know that the Rolls-Royce share value between 2020 and 2022 was a inventory market cut price. So, it stands to motive that there are in all probability different golden FTSE 100 alternatives staring us proper within the face.

May BT Group (LSE: BT.A) inventory be one? Let’s have a look.

A price lure

I first thought-about BT shares a number of years in the past and I’m now glad that I didn’t make investments. They’ve fallen 62% throughout a decade and 15% in 5 years.

BT has lengthy been a worth lure. That is the place a inventory seems to be like a shiny cut price as a result of its value is low. However as a substitute of rebounding, it traps buyers by staying caught within the cut price bin or falling even additional.

This might be for any variety of causes, corresponding to poor prospects, underlying points, or repeated cuts to the dividend (which undermines investor confidence). I’d say BT ticks all these packing containers.

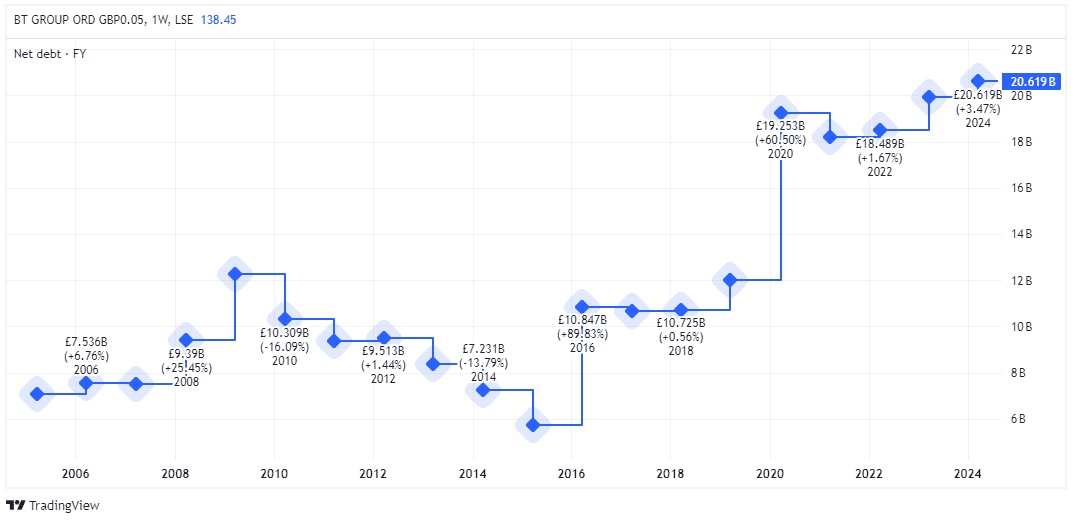

First, it’s working in a mature telecoms business with low development prospects. There’s additionally lengthy been a large underlying debt situation, whereas its long-term file of rising the dividend is just dreadful.

BT dividend per share (2005-2023)

Good buyers see worth

Since I final thought-about BT shares in April, they’ve soared by 32%. They usually jumped 6.2% to 138p in the present day (12 August) after it was introduced that Indian billionaire Sunil Bharti Mittal’s conglomerate would purchase a 24.5% stake from BT’s largest shareholder.

Commenting on the funding, Bharti mentioned: “BT has a strong portfolio of market leading brands, high-quality assets and an experienced management team…BT is playing a vital role to expand access to full-fibre broadband infrastructure for millions of people across the UK.”

This stake, valued at about £3.2bn, is clearly a optimistic improvement for shareholders. Curiously, the Bharti conglomerate hasn’t requested for a seat on the BT board, which is a vote of confidence within the turnaround underway by new CEO Allison Kirkby.

In June, Carlos Slim, the Mexican telecoms billionaire, individually paid £400m for a 3% stake in BT. So a number of business veterans see nice worth right here. I’m now questioning whether or not I ought to get onboard too.

A FTSE 100 cut price?

BT’s income, the one factor it’s important to admit is that it’s remarkably constant.

| Monetary 12 months (ending March) | Annual income |

| FY26 (forecast) | £20.9bn |

| FY25 (forecast) | £20.8bn |

| FY24 | £20.6bn |

| FY23 | £20.7bn |

| FY22 | £20.8bn |

Regardless of this lack of top-line development, the inventory may nonetheless be a strong funding. That’s as a result of BT’s free money circulation is anticipated to enhance now that its huge investments in increasing full-fibre broadband have doubtless peaked.

Certainly, the group sees normalised free money circulation reaching £3bn by 2030, up from £1.3bn final 12 months. That is very important as a result of BT nonetheless has a large web debt place of roughly £20bn.

In addition to paying down debt, this money may additionally help a rising dividend. The ahead yield is at present 6% and seems well-covered.

In the meantime, the forward-looking price-to-earnings (P/E) a number of is round 7.5. That’s cheaper than each the broader FTSE 100 and BT’s peer group. So I can see why sector buyers are licking their chops at a possible cut price right here.

Nevertheless, I can’t ignore BT’s debt pile when this exceeds its £13.8bn market capitalisation. It stays an enormous concern, as does stagnant income development and rising competitors.

All issues thought-about, I reckon there are higher alternatives elsewhere for my cash.