The best way again to “affordability” just isn’t for costs to drop however for wages to rise, they usually have.

The general public dialogue in regards to the economic system appears to confuse “inflation” with “high prices.” The inflation downside is basically solved, however the worth downside stays – making many really feel that issues are not reasonably priced. The very fact is that costs usually are not going to fall to pre-inflation ranges – nor would that be an excellent sign for the economic system. As an alternative, the best way again to affordability is rising wages. Right here, we’ve made so much progress, however nonetheless have a solution to go.

Inflation is a course of that includes rising costs and wages, and the inflation fee is the proportion change in items and companies over a time period. Whereas specialists take a look at a wide range of inflation measures, the commonest is the Client Value Index for all City Shoppers (CPI-U). Inflation, after 4 many years of comparatively regular costs, took off in mid-2021 and hit a peak of 9 p.c in June 2022 (see Determine 1). Since then, nevertheless, the speed of inflation has declined sharply, and in the latest report stood at 2.9 p.c. Whereas this fee continues to be greater than the Fed’s 2-pecent goal, we’re conquering inflation.

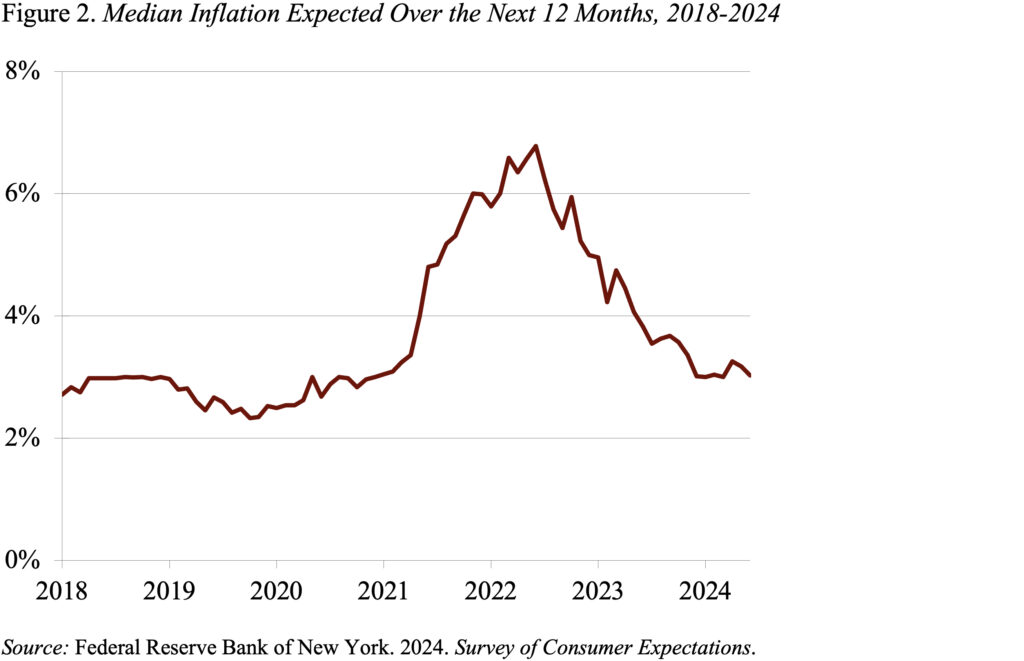

And Individuals do acknowledge the speed of inflation has declined. Surveys present that expectations of future worth will increase are virtually again to what they had been earlier than the latest spurt (see Determine 2).

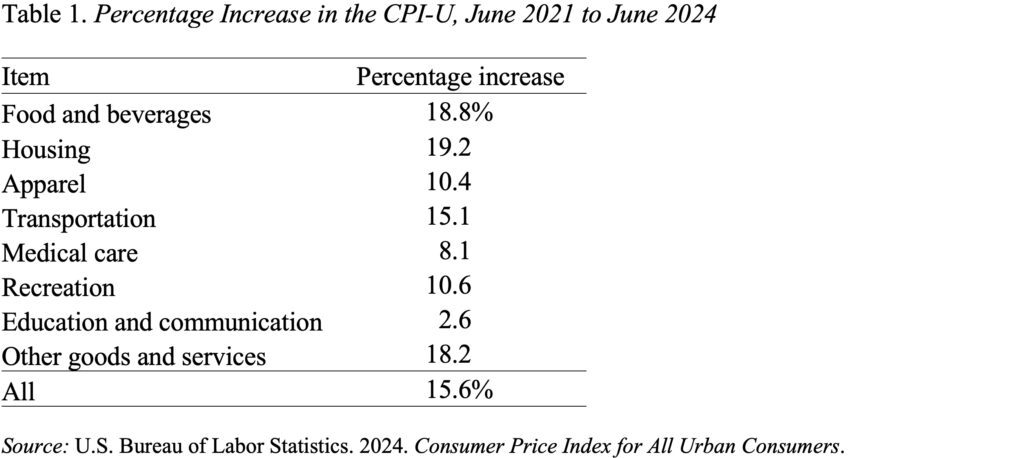

However figuring out that the inflation fee has declined doesn’t compensate for the truth that the costs have ended up significantly greater than they had been earlier than the spurt in inflation. Desk 1 exhibits that the expenditure-weighted improve in costs between June 2021 and June 2024 was about 16 p.c.

As famous, costs usually are not going to go down. The primary purpose is {that a} huge fall in costs requires an enormous decline in wages and employers are very reluctant to chop wages. They consider that reducing wages would harm morale and that the price of that harm would exceed any financial savings in wage expenditures.

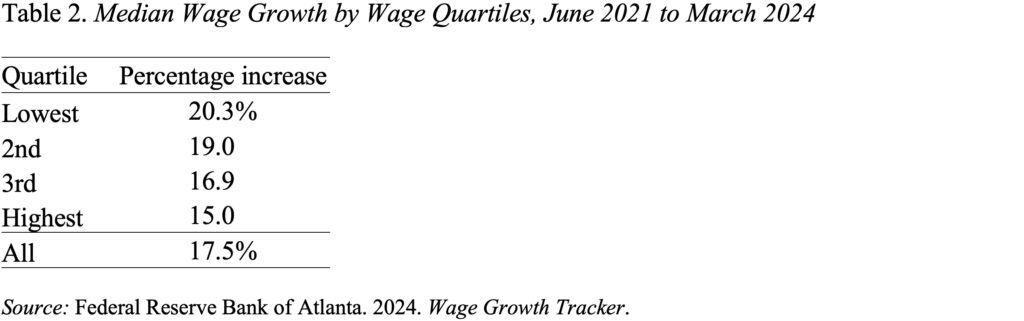

Since costs usually are not going again down, the one manner for issues to develop into reasonably priced once more is for wages to extend. That’s, if – over the interval June 2021-June 2024 – the value of meals, housing, transportation, and many others. has gone up 16 p.c, wages want to extend by 16 p.c for households to duplicate previous spending patterns. Information from the Atlanta Fed counsel that wages throughout the board have grown greater than 17 p.c, with the best positive factors for the bottom paid (see Desk 2).

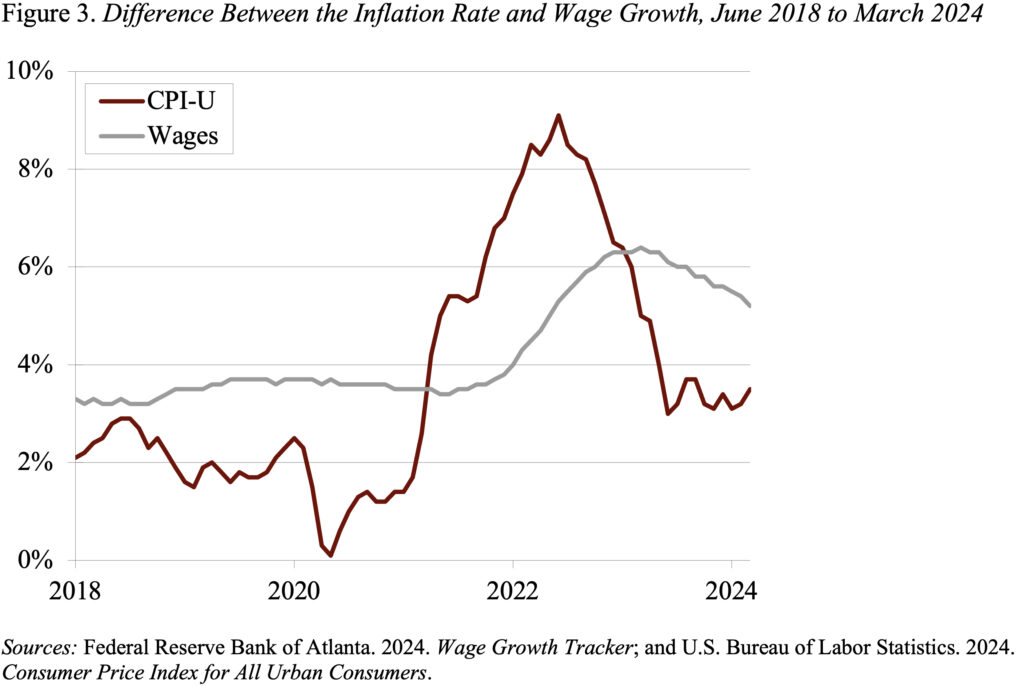

With wage positive factors exceeding worth will increase, folks, on common, ought to have the ability to duplicate their previous spending patterns. However standing nonetheless just isn’t sufficient; most wish to see their way of life enhance over a three-year span. Right here too the outlook is sweet. Whereas wage positive factors usually lag inflation early within the cycle, they’ve now pulled forward (see Determine 3). Now most individuals ought to begin to expertise enhancements of their way of life.

However this entire story looks like a tough promote.