Let’s see if we agree on what the retirement age is at present.

With the projected depletion of the Social Safety belief fund belongings within the 2030s, policymakers are searching for methods to bridge the hole. One of many main proposals is to extend the retirement age. Definitely, with common life expectancy rising, longer careers could possibly be a technique to make sure an satisfactory retirement with much less reliance on Social Safety.

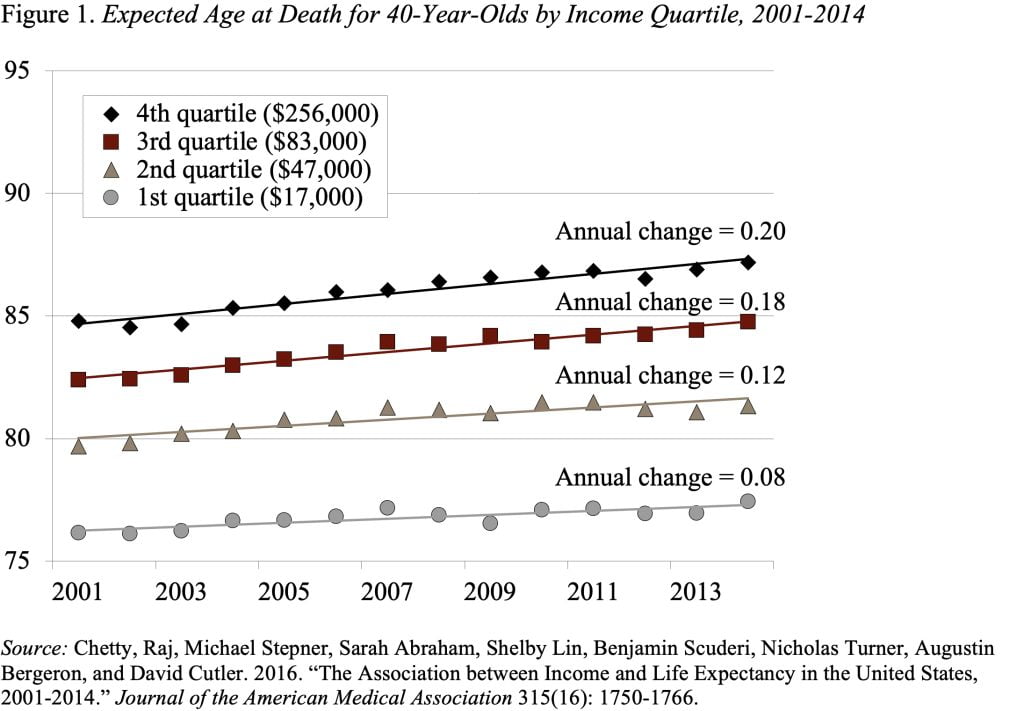

The issue is that life expectancy varies considerably throughout the revenue spectrum, and the features in life expectancy have been a lot larger for the rich than for the poor (see Determine 1). Thus, rising the retirement age across-the-board for all employees ought to be a non-starter. However incorporating later retirement into the system the place potential could avert sweeping adjustments that would do hurt to the weak.

Earlier than we do something, nonetheless, we have to no less than agree on the retirement age within the present Social Safety system. In the present day employees can declare their advantages any time between 62 and 70. Advantages claimed earlier than age 70 are actuarially decreased, based mostly on common life expectancy. In different phrases, the claiming age impacts month-to-month advantages however, on common, is meant to not alter complete advantages paid over the lifetime.

Even if 70 is the age at which Social Safety pays the very best profit, the coverage dialog focuses on elevating the “Full Retirement Age” (FRA), which was once the age at which employees obtained the very best lifetime advantages. For a very long time, the FRA was 65, however the 1983 Social Safety amendments elevated the FRA from 65 to 67 over a 23-year interval. The rise to age 66 was phased in between 2000 and 2005, adopted by an 11-year hiatus, and from 66 to 67 between 2017 and 2022.

Many recommend shifting the FRA increased. Elevating the FRA, nonetheless, isn’t just a query of “suspending” claiming for many who can work longer; it’s a profit lower. For instance, in comparison with when the FRA was 65, those that are in a position to delay retirement to 67 obtain two years much less of advantages and those that can not modify their retirement conduct get decrease advantages as a result of elevated actuarial adjustment. Importantly, these compelled to assert at 62 used to obtain 80 % of the total profit, however now they obtain solely 70 %. If the FRA have been elevated to age 70, that quantity falls to 55 %. So, altering the FRA is a blunt instrument that impacts each those that can work longer and those that can not.

We want a unique strategy. We have to determine the fellows who’re going to finish up within the fourth quartile of the revenue distribution and alter the foundations so they need to work longer to get their present advantages. The query is how to do this operationally. One possibility is to easily use, say, the very best 10 years of common listed earnings to determine the winners. However for the reason that ultimate rating isn’t completely clear until the tip of the sport, such an strategy could not depart employees with sufficient time to plan properly. Another is to determine the retirement age based mostly on components that happen early in life, akin to stage of schooling – the proof means that faculty graduates have the flexibility to retire a lot later than these with out a faculty schooling.

The necessary level is that the inhabitants isn’t homogenous. The extra privileged in our society reside longer and more healthy lives; however the majority haven’t seen nice features in life expectancy, a lot much less in wholesome life expectancy. Let’s be intelligent right here and lift the retirement age for many who can work, with out doing any additional harm to those that can not.