Picture supply: Getty Photographs

The UK inventory market is loaded with a glittering show of high-yield dividend shares. Many have the potential to generate long-term passive revenue for my portfolio.

Nonetheless, Authorized & Common (LSE: LGEN) particularly can be my best choice if I had to decide on only one inventory. It gives the proper mixture of excessive returns mixed with a observe document of reliability and a protracted historical past of wonderful efficiency.

I’ve held the inventory for a while in my portfolio and plan to proceed contributing to it over time.

Right here’s why.

Fee observe document

On first look, Authorized & Common won’t seem as such a scorching ticket proper now. The share worth plunged 12% in June after it revealed plans to cut back dividend development from subsequent yr.

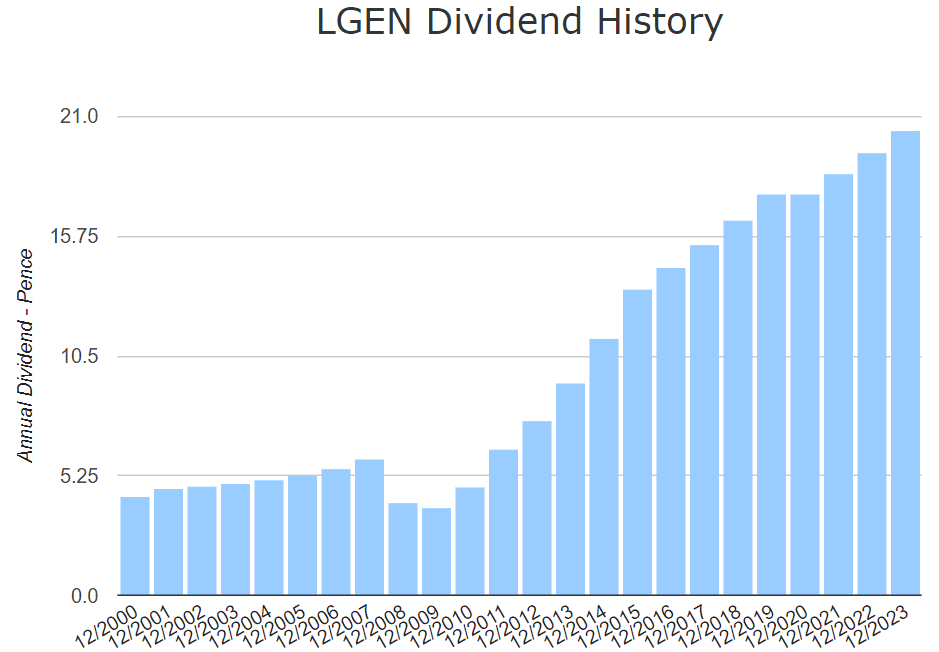

However its observe document retains me . Moreover a minor drop after the 2008 monetary disaster, dividends have been growing constantly for over 20 years. Its 15-year dividend development fee is 11.34% — significantly larger than most different shares.

When investing for the long run, I attempt to ignore minor blips. Historical past tells me that the discount in dividend development in all probability gained’t final lengthy.

Lengthy-term development

Current efficiency apart, Authorized & Common reveals first rate development over prolonged intervals. For instance, over the previous 30 years, it’s up 457%, delivering annualised returns of 5.89%. That’s barely beneath the FTSE 100’s common yearly development however a lot larger when including dividends to the combination.

Even when L&G’s common yield over that interval was solely 5%, the full returns would nonetheless be larger.

However engaged on right this moment’s 9% yield and accounting for worth development, a £10,000 funding would web me dividends of round £930 after a yr. Depart it to take a seat for 20 years whereas reinvesting the dividends and it might develop to round £145,000, paying me an annual dividend of £11,800.

Now that’s not unhealthy!

Dangers

Insurance coverage is a aggressive trade within the UK and Authorized & Common will not be with out rivals (though I’m invested in a few of these too, simply to be secure!). Its predominant opponents embody Aviva, Prudential, and Admiral Group.

Regardless of the falling worth, Authorized & Common’s price-to-earnings (P/E) ratio of 30 is so much larger than most rivals. However with earnings anticipated to develop 178% within the coming 12 months, that quantity might come all the way down to 10.8. Then it will be extra in keeping with different UK insurance coverage corporations.

If earnings don’t improve, additional worth development will probably be hindered. This, mixed with decreased dividend development, would considerably scale back the corporate’s worth. With a 20p annual dividend and earnings per share (EPS) at solely 7p, the payout ratio is already nearly triple (therefore plans to cut back dividend development).

Large boots to fill

All issues thought of, my religion in Authorized & Common stays unshaken. The brand new CEO António Simões actually has some giant boots to fill. This yr, he took over from Sir Nigel Wilson who acquired a knighthood for his distinctive work on the firm.

To this point, Simões appears extremely motivated to fill these boots… after which some. His plans embody a £200m share buyback programme, organisational restructuring, and the sale of Cala, the corporate’s housebuilding enterprise.

Whether or not his ambitions spell success stays to be seen, however I count on they’ll.