Let’s speak about how one can apply for and take out a pupil mortgage. Whether or not you want a Federal pupil mortgage, or a non-public pupil mortgage, there are particular issues it’s essential find out about how one can take out a pupil mortgage.

Whereas it might be nice to cowl all of your school prices utilizing a mix of financial savings, assist from relations, scholarships, and your private earnings, these funds aren’t all the time going to chop it. Many college-bound college students might want to apply for pupil loans to cowl the hole between the price of schooling and their restricted assets.

This information explains how one can apply for pupil loans, and how one can choose the quantity to borrow whenever you take out the loans.

place to begin: How To Discover The Greatest Pupil Mortgage Charges >>

Apply for a Federal Pupil Mortgage

For U.S. residents making use of for academic loans within the U.S., the FAFSA utility is the start line for Federal pupil loans. Right here’s the way you apply for Federal pupil loans.

Standards And Necessities For A Federal Pupil Mortgage

Should you’re seeking to get a federal pupil mortgage right here’s the factors:

- Have a sound Social Safety quantity.

- Males have to be registered with the selective service. Male college students between 18-25 should register with the selective service to obtain loans.

- Be a citizen or eligible noncitizen. Undocumented immigrants aren’t eligible to obtain federal or state funding. Everlasting residents with inexperienced playing cards can apply for support. Immigrants with T-1, battered-immigrant-qualified alien, or refugee standing may be eligible.

- Have a highschool diploma or equal, corresponding to a GED or certificates from a homeschooling program.

- Enroll in an eligible faculty. College students at unaccredited faculties may not qualify for federal support. Some faculties additionally select to not obtain federal support.

- Fill out the Free Utility for Federal Pupil Assist. Any excessive schooler involved in monetary support must fill out the FAFSA, a type that asks for your loved ones’s monetary info to find out how a lot you qualify for. Even these with little to no demonstrated want may be eligible for pupil loans, so officers encourage everybody to use. With out the FAFSA, you gained’t obtain any federal loans, scholarships or grants.

- Be in good standing with federal monetary support. College students can’t be in default on different federal loans or owe cash on a federal grant.

- Preserve a 2.0 GPA. College students want to take care of a 2.0 cumulative GPA or danger shedding monetary support till their grades enhance.

- Be at part-time standing or extra. College students have to be thought-about part-time to be eligible for loans. Every school determines what part-time and full-time standing means, so ask your monetary support officer what number of credit you’ll must take.

Fill Out the FAFSA

Making use of for Federal pupil loans begins by filling out the Free Utility for Federal Pupil Assist (FAFSA). To fill out the applying, you’ll want your info and your mother and father’ info from tax submitting from two years in the past (for the 2024-2025 faculty yr, you’ll want the 2022 tax returns), plus details about your mother and father’ property, your property, and different monetary particulars.

When you submit the FAFSA, your faculty (or faculties of selection when you’re nonetheless deciding the place to attend) will create a pupil support report for you. This report will embody details about free support (corresponding to grants, scholarships, and extra). It’ll additionally present details about work-study choices and, after all, pupil loans.

In the USA, nearly all faculties use the FAFSA to challenge need-based support to college students. Even when you don’t plan to take out pupil loans, you ought to be finishing the FAFSA. You could study that you just qualify for grants or additional scholarships out of your faculty of selection based mostly in your monetary standing.

Evaluation the Assist Provide from Your Faculty

About two weeks after you submit the FAFSA to your faculty, you may anticipate to obtain an support supply. The supply will embody details about all sources of support together with:

Typically, you need to take all of the free cash you will get. Meaning accepting the scholarships and the grants. Should you plan to dwell on campus, it’s possible you’ll need to think about taking the work-study supply too.

Nonetheless, think about work-study as a baseline to your earnings, not a cap. Typically, work-study jobs don’t pay very effectively. Aspect hustles like reffing soccer or basketball, tutoring, ready tables and tending a bar, or any type of expert labor sometimes pay significantly better.

And, after all, beginning a enterprise could also be one of the best ways to earn cash throughout school.

The final type of support will likely be pupil loans. These will embody backed loans, which have a decrease rate of interest (and curiosity doesn’t accrue when you’re in class), and unsubsidized loans (the place curiosity begins accruing straight away).

Learn our full information to paying for faculty right here >>

Take Out The Applicable Pupil Mortgage Quantity

When you assessment the supply, you may settle for any a part of the give you need. You don’t should take out all of the loans. Actually, I like to recommend borrowing as little as attainable to pay to your tuition and different upfront prices. You additionally should content material with federal pupil mortgage borrowing limits, that are very low.

Between financial savings, frugal dwelling, and dealing, most undergraduate college students pays for his or her dwelling bills with out borrowing cash.

Pupil loans aren’t free cash. You’ll have to pay them again. It all the time is smart to search for alternate options to borrowing to pay to your schooling.

It might appear good to borrow slightly additional now, however I counsel towards that. After school, you will have a wage of $50,000 to $60,000 to start out (and even decrease in lots of fields). That appears like some huge cash, however paying again $50,000+ of pupil loans on a starter wage is a large problem.

Take into consideration your future self, and restrict your borrowing in the present day. You may additionally need to be sure you full the pupil mortgage entrance counseling first so you could have a very good understanding of the expectations for compensation.

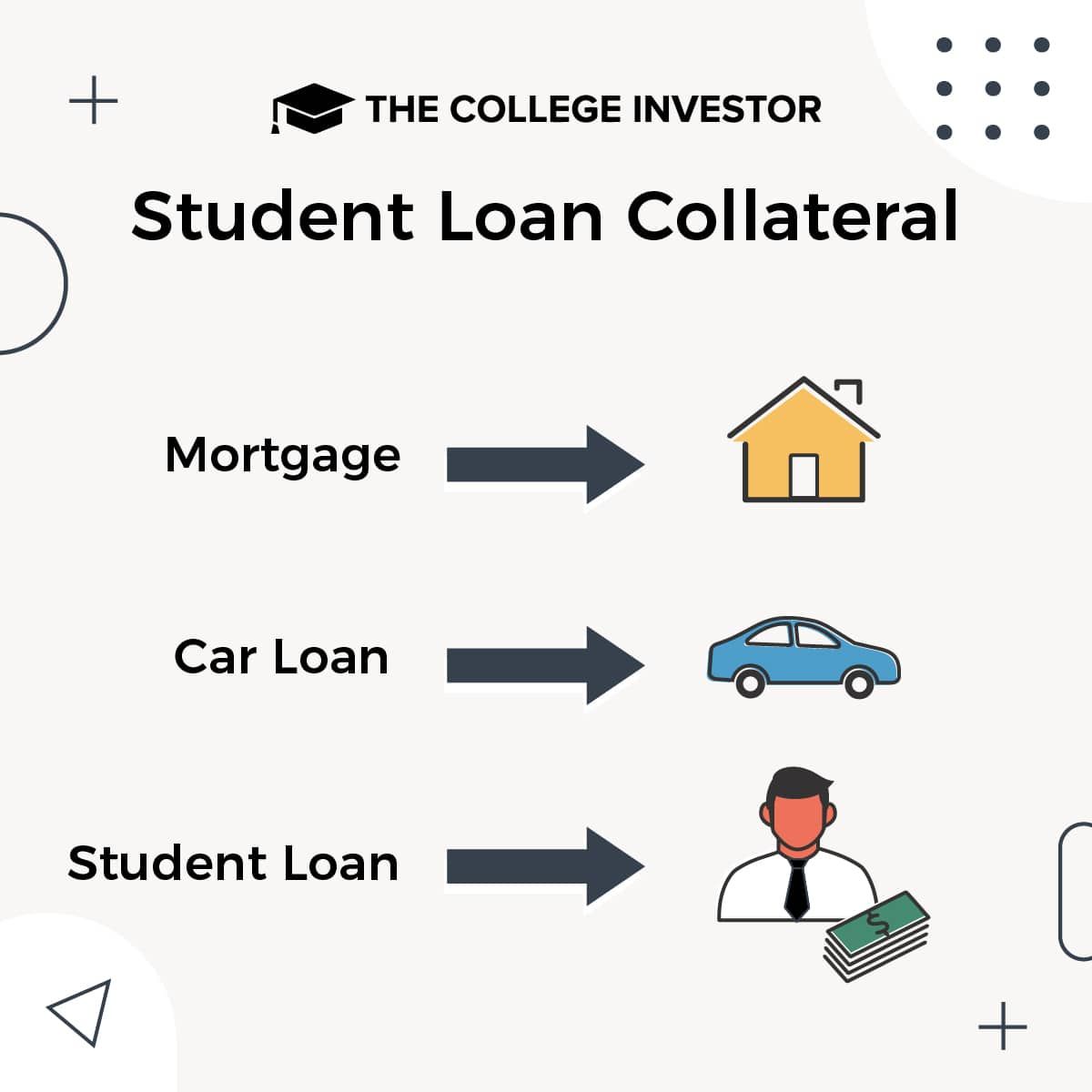

Lastly, keep in mind that the collateral for pupil loans is your future earnings!

Apply for Personal Pupil Loans

In some instances, college students within the U.S. might need to apply for personal pupil loans quite than Federal pupil loans. A number of causes to contemplate non-public loans embody:

- You need to attend a non-accredited academic alternative (corresponding to a coding bootcamp).

- You intend to take one course at a time (you want at the least half-time enrollment to qualify for many Federal packages).

- You’re not a U.S. citizen, so that you don’t qualify for Federal loans.

- You will have a robust earnings and a robust credit score rating, so non-public lenders might supply higher charges than the unsubsidized Federal loans.

- You’re refinancing your current pupil loans to a non-public lender with a considerably decrease rate of interest.

If one in all these conditions applies to you, then observe these steps beneath to use for personal pupil loans.

Collect All Your Paperwork

If you apply for any mortgage, you’ll want paperwork to show your earnings, credit score rating, and whether or not you could have property. Typically, you’ll want the next:

- Tax returns or W-2 varieties from the earlier years.

- Employment pay stubs.

- Private identification info (driver’s license, and so forth.).

- Financial institution statements.

- Should you’re making use of for personal loans whereas attending faculty, you’ll want details about the price of attending.

- When you’ve got a cosigner, you’ll want their info too.

- Mortgage paperwork for current pupil loans (if refinancing).

Evaluate Charges from a Few Lenders

When you’ve gathered up the data, begin doing a little mortgage procuring. We suggest the lenders on our Greatest Locations To Discover Personal Pupil Loans checklist.

Many lenders let you preview charges with out having a tough credit score pull. It’s also possible to “store” for charges utilizing websites like Credible.

Evaluating charges utilizing an aggregation website (like Credible) will aid you get a really feel for the rates of interest and phrases out there to you.

Apply for Similar Loans from at Least Two Lenders

After unofficially evaluating charges, apply for loans from at the least two lenders. That manner you may choose the very best rate of interest. The underwriting and approval course of can take wherever from just a few hours to some weeks relying on the lender.

Keep in mind to additionally evaluate key options like mortgage compensation phrases, mortgage discharge choices (like incapacity discharge), and extra.

Take Out The Greatest Pupil Mortgage Provide

When you could have just a few mortgage presents in hand, evaluate them to see which mortgage is one of the best for you. Then signal the mortgage paperwork and transfer ahead together with your schooling or paying off your loans.

When you’ve got a cosigner, you may additionally need to get a time period life insurance coverage coverage to guard your cosigner ought to something occur to you. A time period life insurance coverage coverage for the mortgage steadiness (whenever you’re a younger grownup) may be very cheap.

Keep in mind, some non-public pupil loans require instant funds, so be sure you double-check your lender and their compensation plans earlier than you commit.