Grants for school are a supply of economic support that is successfully free cash.

If you happen to’re making use of for school, you’ve in all probability heard college students complain about grants and scholarships – all the things from the applying course of to the stringent necessities. But it surely’s extraordinarily doable to seek out grants to pay for school.

If you happen to discover all your choices and maintain monitor of your outcomes, the method doesn’t need to be painful. We’ve reduce down in your analysis by offering you with assets that can show you how to discover grants best for you.

Whereas scholarships are awarded on benefit and wish, grants are primarily awarded based mostly on want. For many grants, grades aren’t a figuring out issue. It’s no marvel that grants are essentially the most wanted type of monetary support – grants are like “free money” that can be utilized for tuition and different faculty bills.

Under, we’ll present you the place to search for grants and the way to apply. Maintain studying!

The Distinction Between Scholarships And Grants

Not like pupil loans, you don’t need to pay again grants or scholarships. Each scholarships and grants for school are free cash choices that can assist you pay for larger training. Gants are usually awards by the Federal and state authorities, whereas scholarships are awarded by the school or non-public organizations.

Individuals usually confuse grants and scholarships or use the phrases interchangeably as a result of grants and scholarships share many similarities.

The largest distinction between faculty grants and scholarships is that grants for school are usually need-based, whereas scholarships could also be need-based or merit-based. What does merit-based imply? It means the scholarship is awarded based mostly on one thing you do, similar to a capability, interest or achievement.

Like grants, scholarships will also be awarded based mostly on ethnicity, faith, or different background associated standards. Grants are thought of free cash for school that doesn’t need to be paid again besides underneath these uncommon circumstances.

Discover Free Cash For School With Federal Grants

What’s a grant? A federal grant is a type of federal monetary help the place the U.S authorities redistributes its assets to eligible recipients who exhibit monetary want.

Under, we’ve acquired you coated for Federal grants, State Grants, School Grants, and different grants in particular conditions. Simply observe these steps, and also you’ll have the next probability of uncovering grants which might be the proper match for you.

Discover this infographic helpful? You’ll be able to obtain the total model right here.

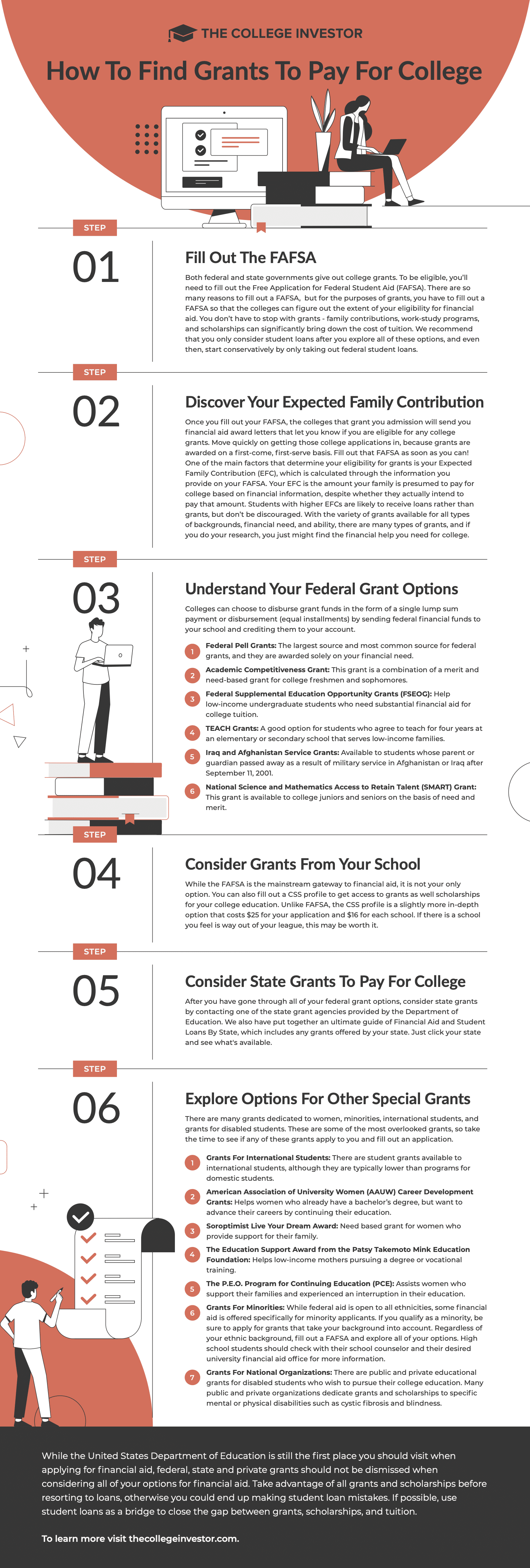

Step 1: Fill Out The FAFSA

Each federal and state governments give out faculty grants. To be eligible, you’ll have to fill out the Free Software for Federal Scholar Help (FAFSA).

There are such a lot of causes to fill out a FAFSA, however for the needs of grants, it’s a must to fill out a FAFSA in order that the universities can determine the extent of your eligibility for monetary support.

You don’t need to cease with grants – household contributions, work-study applications, and scholarships can considerably deliver down the price of tuition. We suggest that you just solely contemplate pupil loans after you discover all of those choices, and even then, begin conservatively by solely taking out federal pupil loans.

Study why federal pupil loans are one of the best type of pupil mortgage you possibly can take out (if that you must take out a mortgage in any respect).

Step 2: Uncover Your Scholar Help Index

When you fill out your FAFSA, the universities that grant you admission will ship you monetary support award letters that allow you to know if you’re eligible for any faculty grants.

Transfer rapidly on getting these faculty functions in, as a result of grants are awarded on a first-come, first-serve foundation. Fill out that FAFSA as quickly as you possibly can!

One of many major components that decide your eligibility for grants is your Scholar Help Index. This can be a new metric that replaces the Anticipated Household Contribution.

Your SAI is quantity your loved ones is presumed to pay for school based mostly on monetary info, regardless of whether or not they truly intend to pay that quantity. College students with larger SAIs are prone to obtain loans relatively than grants, however don’t be discouraged.

With the number of grants out there for all sorts of backgrounds, monetary want, and talent, listed here are many forms of grants, and in case you do your analysis, you simply may discover the monetary show you how to want for school.

Step 3: Perceive Your Federal Grant Choices

Faculties can select to disburse grant funds within the type of a single lump sum fee or disbursement (equal installments) by sending federal monetary funds to your faculty and crediting them to your account.

Step 4: Take into account Grants From Your College

Whereas the FAFSA is the mainstream gateway to monetary support, it isn’t your solely possibility. You may as well fill out a CSS profile to get entry to grants as effectively scholarships in your faculty training.

Not like FAFSA, the CSS profile is a barely extra in-depth possibility that prices $25 in your software and $16 for every faculty. If there’s a faculty you are feeling is manner out of your league, this can be value it.

Step 5: Take into account State Grants To Pay For School

After you have got gone by means of all your federal grant choices, contemplate state grants by contacting one of many state grant businesses offered by the Division of Training.

We even have put collectively this final information of Monetary Help and Scholar Loans By State, which incorporates any grants provided by your state. Simply click on your state and see what’s out there.

States like California have their Cal-Grant program, which can require you to use or create one other portal software as effectively.

Step 6: Discover Your Choices For Different Particular Grants

There are a lot of grants devoted to girls, minorities, worldwide college students, and grants for disabled college students. These are a number of the most missed grants, so take the time to see if any of those grants apply to you and fill out an software.

Grants For Worldwide College students

There are pupil grants out there to worldwide college students, though they’re usually decrease than applications for home college students. You’ll be able to analysis your choices right here to get began.

Grants For Girls

Girls’s grants make it doable for feminine college students of all backgrounds to pursue academic applications and careers which have traditionally not been out there to girls. Many organizations have taken steps to help girls for equal footing in training, alternatives, and profession improvement.

Grants For Minorities

Whereas federal support is open to all ethnicities, some monetary support is obtainable particularly for minority candidates. If you happen to qualify as a minority, you should definitely apply for grants that take your background into consideration.

No matter your ethnic background, fill out a FAFSA and discover all your choices. Ethnic foundations, non-public companies and authorities businesses every situation faculty grants that ought to be thought of by minority college students.

Ethnic minority grants assist help academic development for minorities. There are totally different grants out there based mostly on ethnic background similar to Asian Individuals, Native Individuals and Hispanics. Highschool college students ought to examine with their faculty counselor and their desired college monetary support workplace for extra info.

Grants For Nationwide Organizations

There are private and non-private academic grants for disabled college students who want to pursue their faculty training. Many private and non-private organizations dedicate grants and scholarships to particular psychological or bodily disabilities similar to cystic fibrosis and blindness.

Last Ideas

Whereas the US Division of Training continues to be the primary place it is best to go to when making use of for monetary support, federal, state and personal grants shouldn’t be dismissed when contemplating all your choices for monetary support.

Reap the benefits of all grants and scholarships earlier than resorting to loans, in any other case you could possibly find yourself making these pupil mortgage errors. If doable, use pupil loans as a bridge to shut the hole between grants, scholarships, and tuition.

What’s your expertise with grants? If you happen to have been awarded a grant, was it from any of the sources listed above, or from some place else? Inform us your expertise with faculty grants within the feedback beneath.