The transient’s key findings are:

- Our 2023 Small Enterprise Retirement Survey seems to be at why some small corporations supply a retirement financial savings plan and others don’t.

- Elements that have an effect on whether or not small corporations supply a plan embody agency measurement, wages, and business, in addition to beliefs on whether or not it is going to assist entice staff.

- The principle limitations to providing a plan are issues in regards to the stability/measurement of the agency and the perceived prices of a plan.

- Considerations about prices are pushed by misperceptions; many corporations are unaware of lower-cost choices for employers and tax credit.

- The outcomes additionally recommend that state auto-IRA applications usually tend to encourage than discourage corporations from providing their very own plan.

Introduction

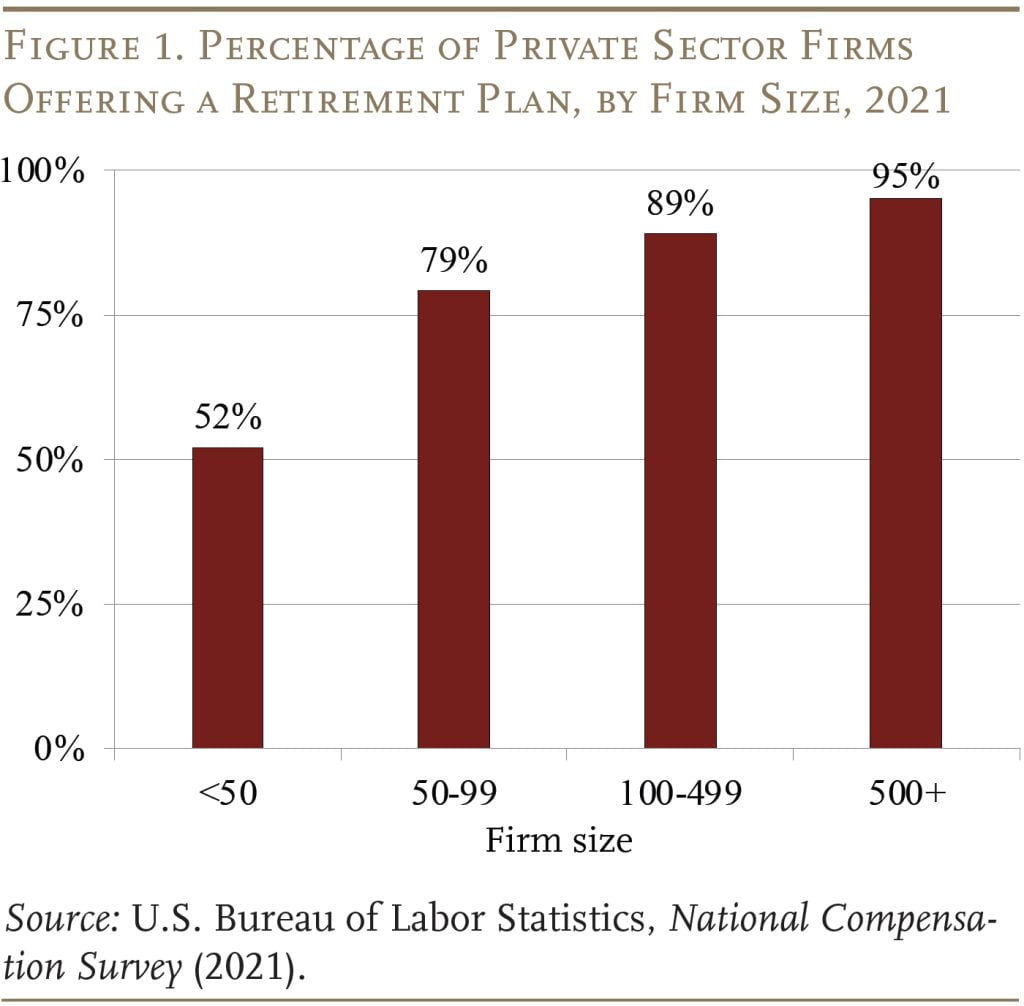

At any given time, solely about half of U.S. non-public sector staff are lined by an employer-sponsored retirement plan, and few staff save with out one. The protection hole, which undermines the retirement safety of the nation’s staff, is pushed by a scarcity of protection amongst small employers. Apparently, nevertheless, about half of corporations with lower than 100 workers do supply a plan for his or her workers. This transient, which is predicated on a latest examine, presents the outcomes of a brand new survey of small employers to grasp why some supply retirement plans and others don’t.

The dialogue proceeds as follows. The primary part describes the brand new survey and identifies components that make a agency possible to offer protection. The second part reviews the limitations that corporations understand to providing a plan and assesses the accuracy of those perceptions. The third part examines whether or not the presence of state-sponsored retirement applications – which usually require corporations and not using a plan to enroll their staff within the state program – shifts agency perceptions.

The ultimate part concludes that necessary drivers to providing a plan, presently or within the close to future, are a agency’s beliefs, corresponding to whether or not they suppose retirement plans matter for worker hiring and retention. Importantly, many employers and not using a plan maintain misperceptions in regards to the monetary and time prices of providing one. Subsequently, higher consciousness of the various accessible choices for small corporations could assist shut the protection hole. Lastly, state-sponsored retirement applications usually tend to encourage than discourage the adoption of employer plans.

The 2023 Small Enterprise Retirement Survey

The 2023 Small Enterprise Retirement Survey, which was produced in collaboration with the Worker Profit Retirement Institute (EBRI) and Greenwald Analysis, was performed between February and April 2023 and contains 703 corporations with 100 or fewer workers. This survey replicates the final main survey centered on small enterprise retirement plans, which was performed in 1998 by EBRI and Greenwald Analysis. What is exclusive in regards to the 2023 survey is that it features a pattern of 100 corporations with 0-4 workers – a gaggle normally excluded from surveys of small employers. Amongst all corporations sampled, 46 % provided a retirement plan, whereas the opposite 54 % didn’t. Since 92 % of all small corporations have fewer than 20 workers, this sample is pretty in keeping with nationwide information (see Determine 1).

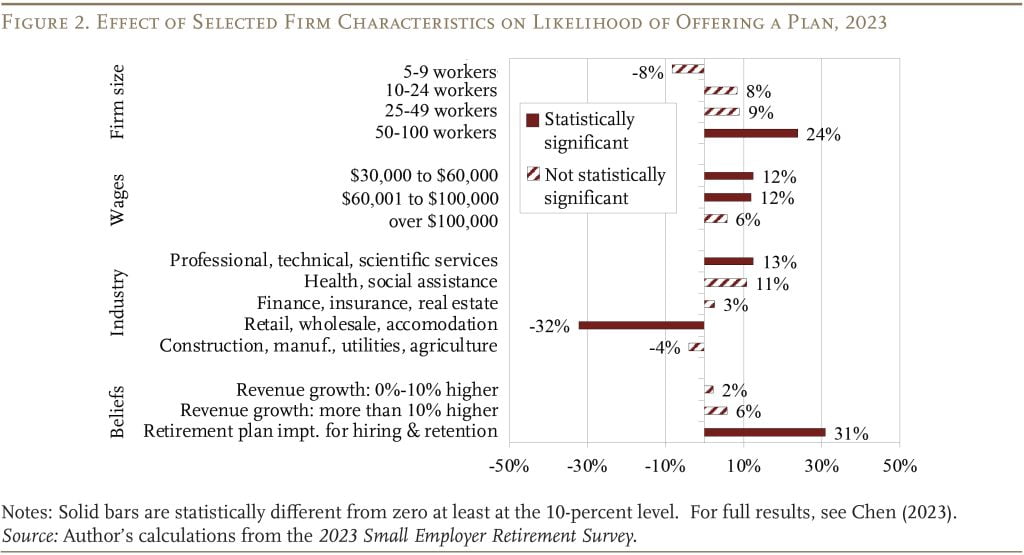

The survey responses can relate varied components to the probability of a agency providing a plan (see Determine 2). As anticipated from earlier research, corporations with 50-100 workers, these with larger common salaries, and corporations in skilled, technical, and scientific companies industries are more likely to supply a retirement plan. In the meantime, corporations in retail gross sales, wholesale gross sales, and lodging (hospitality and meals companies) are a lot much less more likely to supply a plan. However different components additionally mattered. Beliefs about whether or not having a retirement plan is necessary for hiring and retaining good workers are additionally a robust driver. Notably, a agency’s beliefs about income progress had little to no impact on having a retirement plan. Apparently, for corporations and not using a plan, beliefs are additionally an necessary predictor of their probability of adopting a plan within the close to future.

What Retains Companies from Providing a Plan?

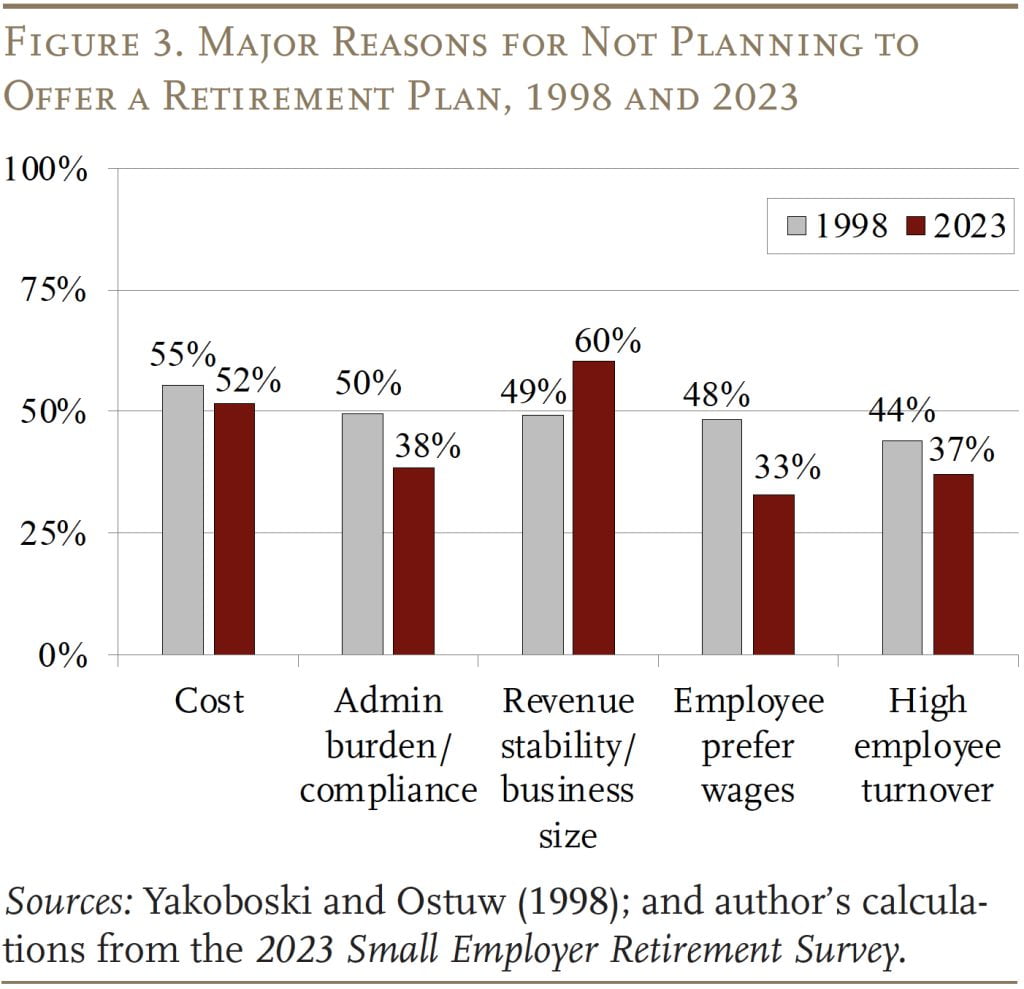

Traditionally, small corporations that don’t supply a plan have cited three major causes: 1) unsure revenues; 2) prices; and three) worker preferences for wages. The third motive, worker preferences for wages, has dropped down the record, however prices stay necessary, whereas issues about income stability/measurement have grown to turn into the largest barrier (see Determine 3).

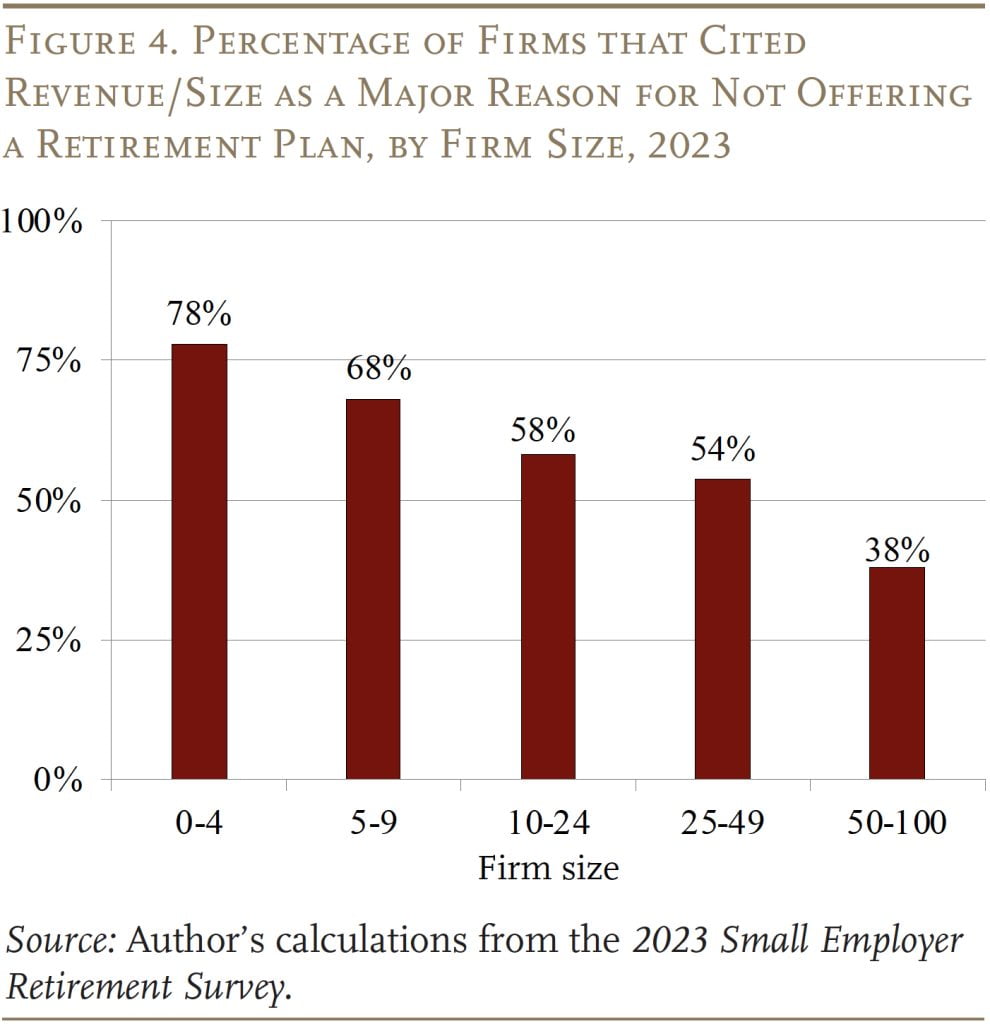

As one would count on, concern about revenues declines as agency measurement will increase (see Determine 4). Certainly, near 80 % of corporations with 0-4 workers cited income and measurement as a serious barrier to providing a plan. The smallest of those small corporations could merely have an excessive amount of on their plate so as to add an extra profit. For established corporations, prices and administrative burdens turn into a very powerful issue for not providing a plan.

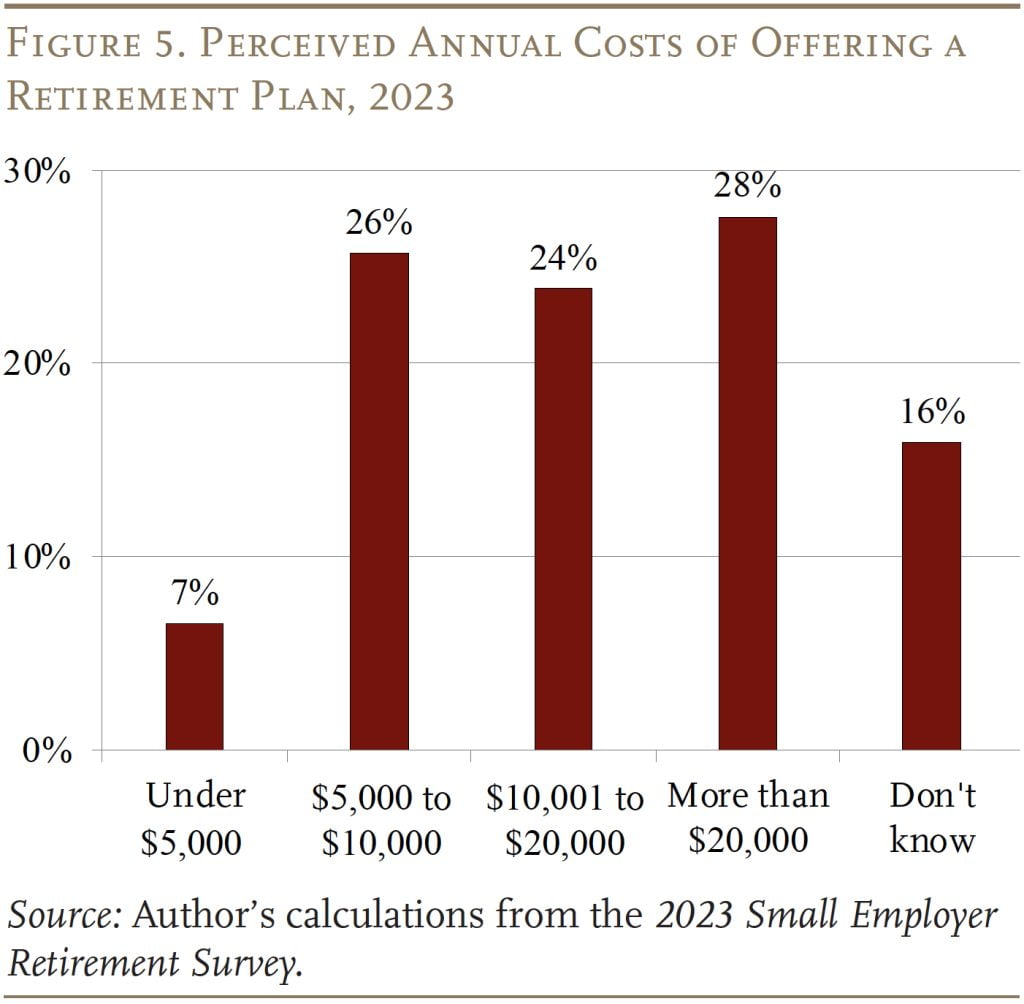

Apparently, most corporations surveyed that cite prices and administrative burden/compliance as limitations should not have sense of how a lot cash or time is definitely required to arrange a plan. A fast Google search yielded a number of 401(okay) choices the place annual employer prices would solely be about $2,500 for a agency with 10 workers and $5,000 for a agency with 50 workers. However, over half of small corporations imagine offering a retirement plan would price greater than $10,000 per yr; and practically 30 % suppose it might price greater than $20,000 per yr (see Determine 5).

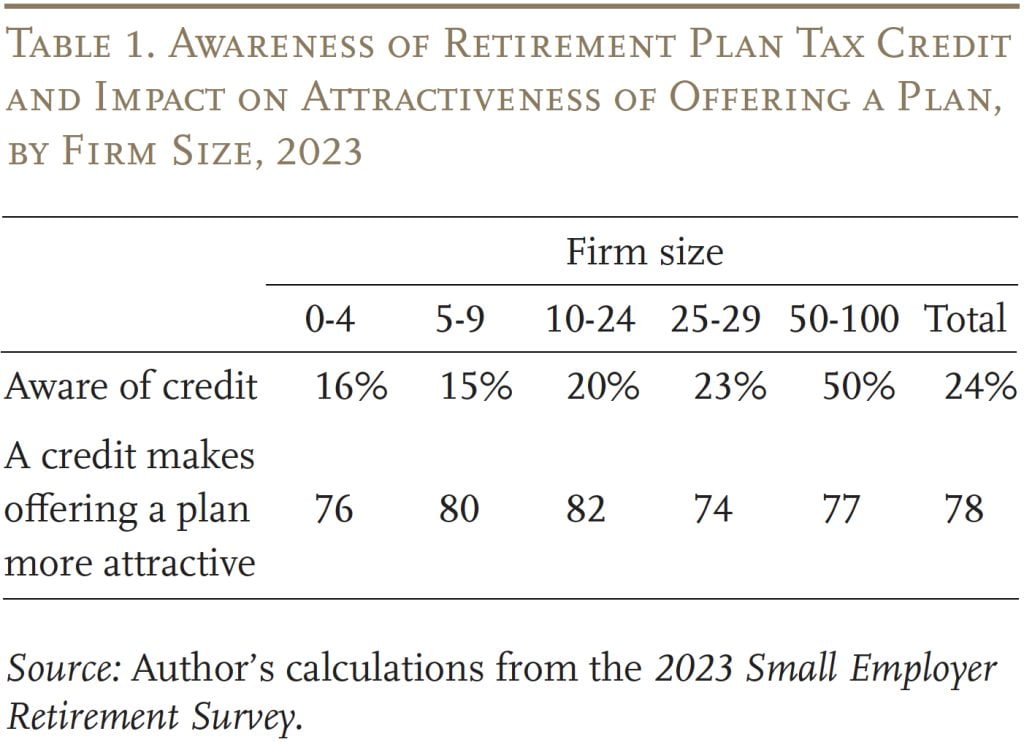

Not solely do small corporations overestimate the price of providing a plan, however the overwhelming majority – significantly these with fewer than 50 staff – should not conscious that they will declare a tax credit score of as much as $5,000 for 3 years to assist offset the prices of beginning a plan (see Desk 1). Apparently, about 80 % of employers say that such a credit score would make providing a plan extra engaging.

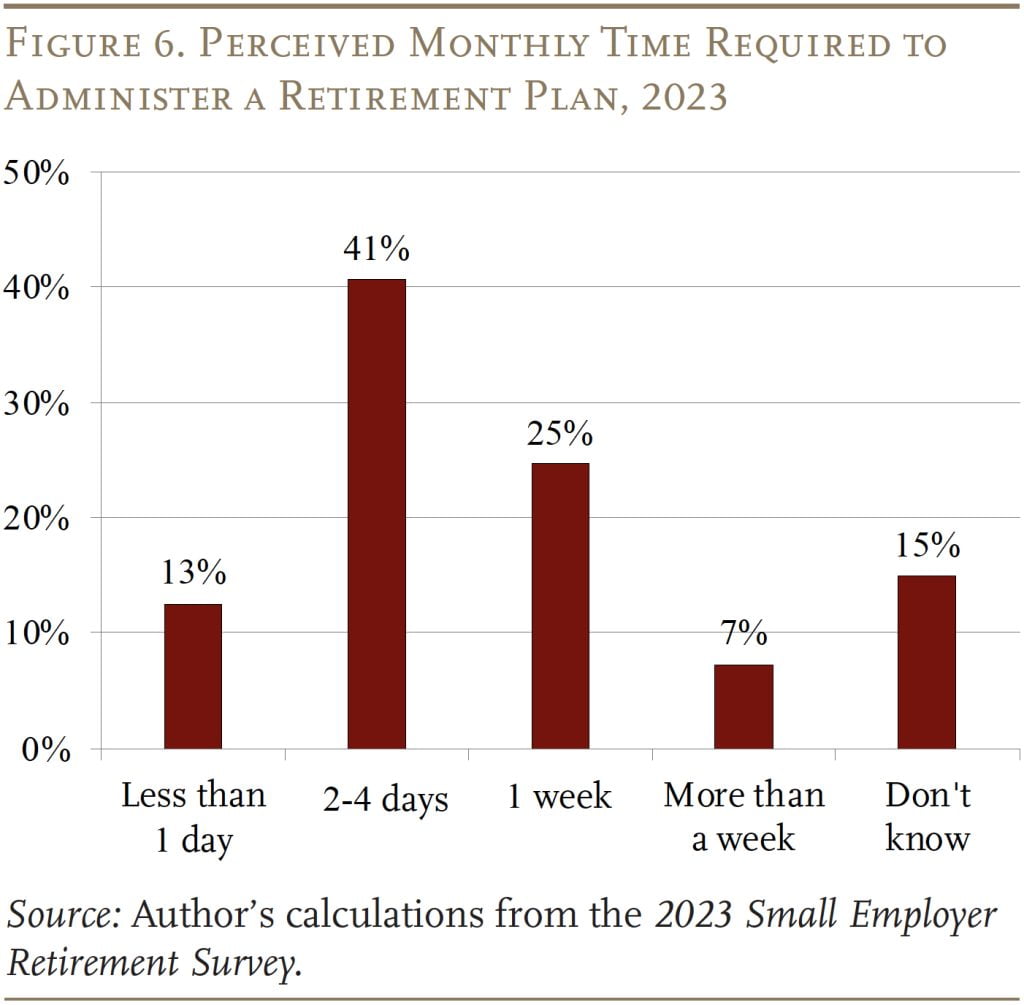

Moreover, small corporations should not have sense of how a lot time it might take to manage a retirement plan (see Determine 6). Most corporations imagine it might take a number of days to an entire week each month. However in actuality, after the preliminary set-up, working a retirement plan ought to solely take a couple of hours a yr.

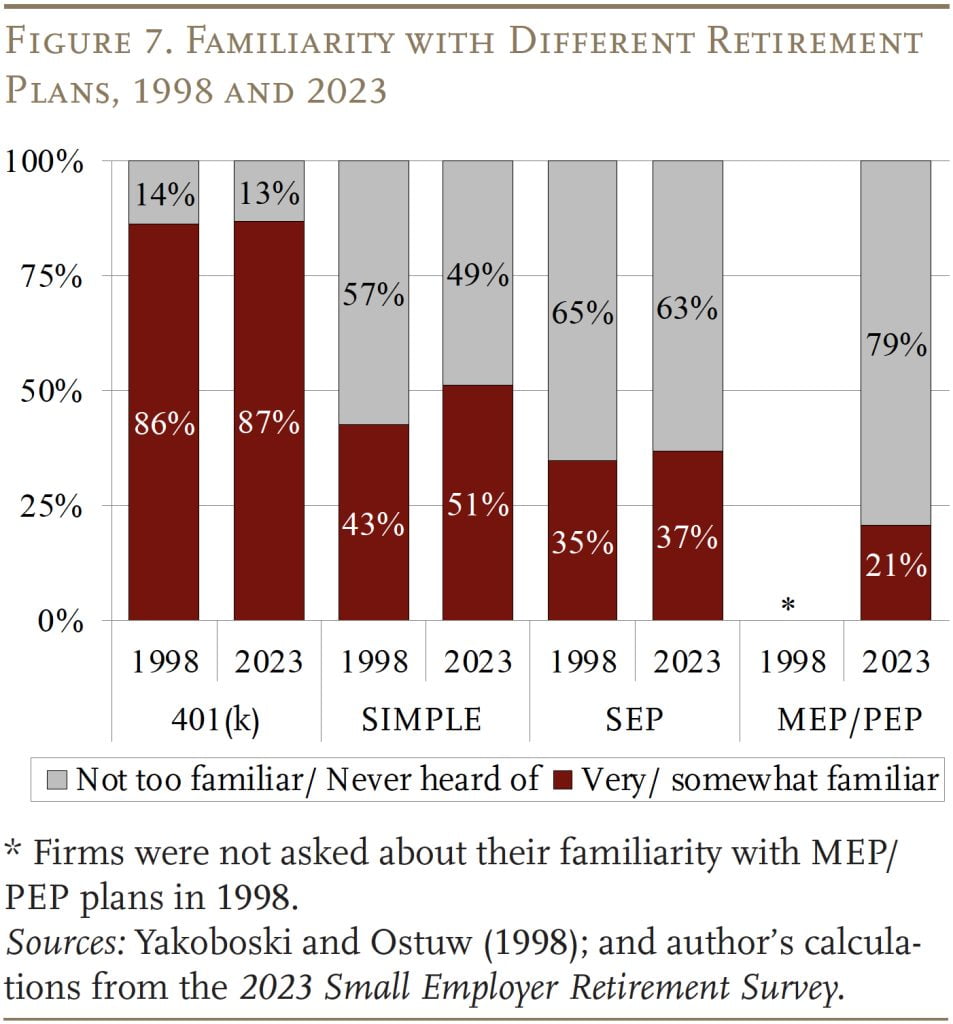

Many small corporations are additionally unfamiliar with the varied retirement plan choices which might be designed to assist ease the fee and administrative burden of providing a plan. Whereas most small corporations are not less than considerably acquainted with 401(okay)s, the overwhelming majority should not acquainted with SIMPLE, SEP, and MEP/PEP plans (see Determine 7). And this share has barely budged within the final 25 years.

These outcomes recommend that many corporations overestimate the monetary and time prices required to supply a plan, so higher consciousness of precise prices in addition to accessible choices might assist scale back the limitations that small corporations understand.

Will State-sponsored Applications Impression Agency Habits?

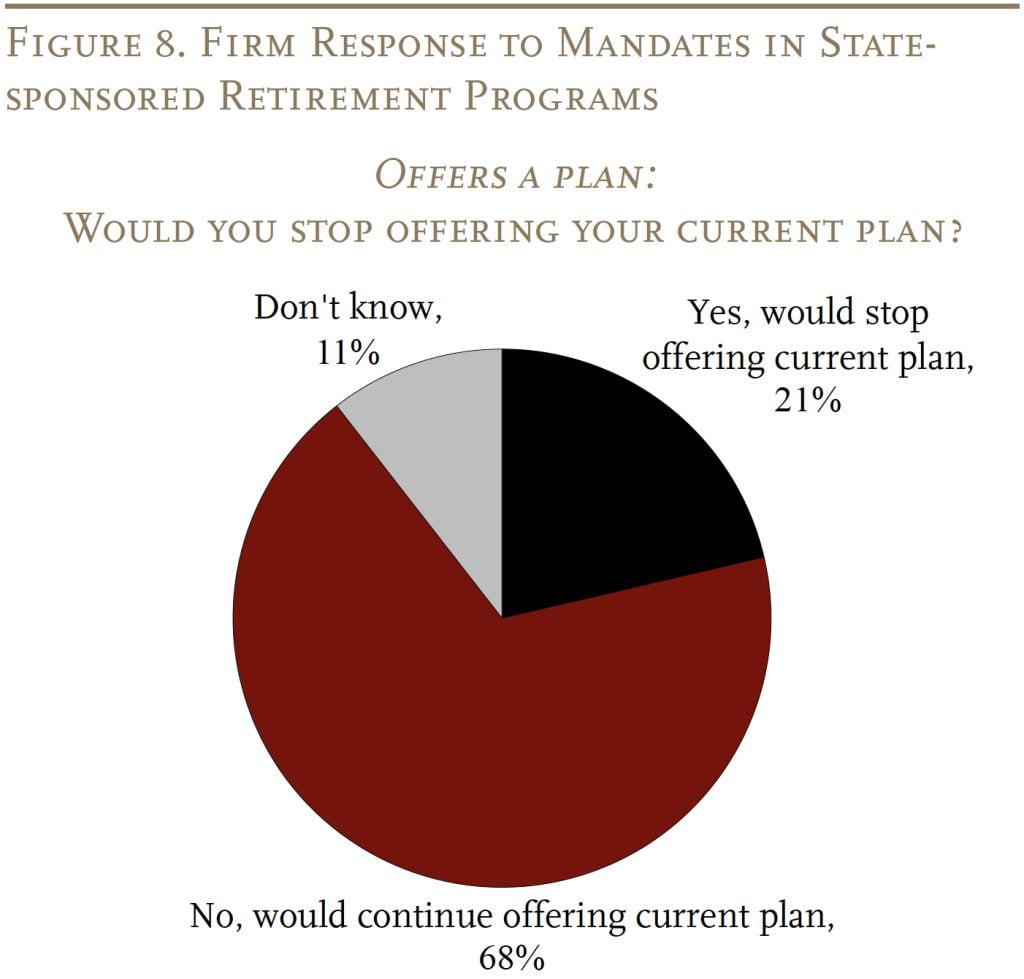

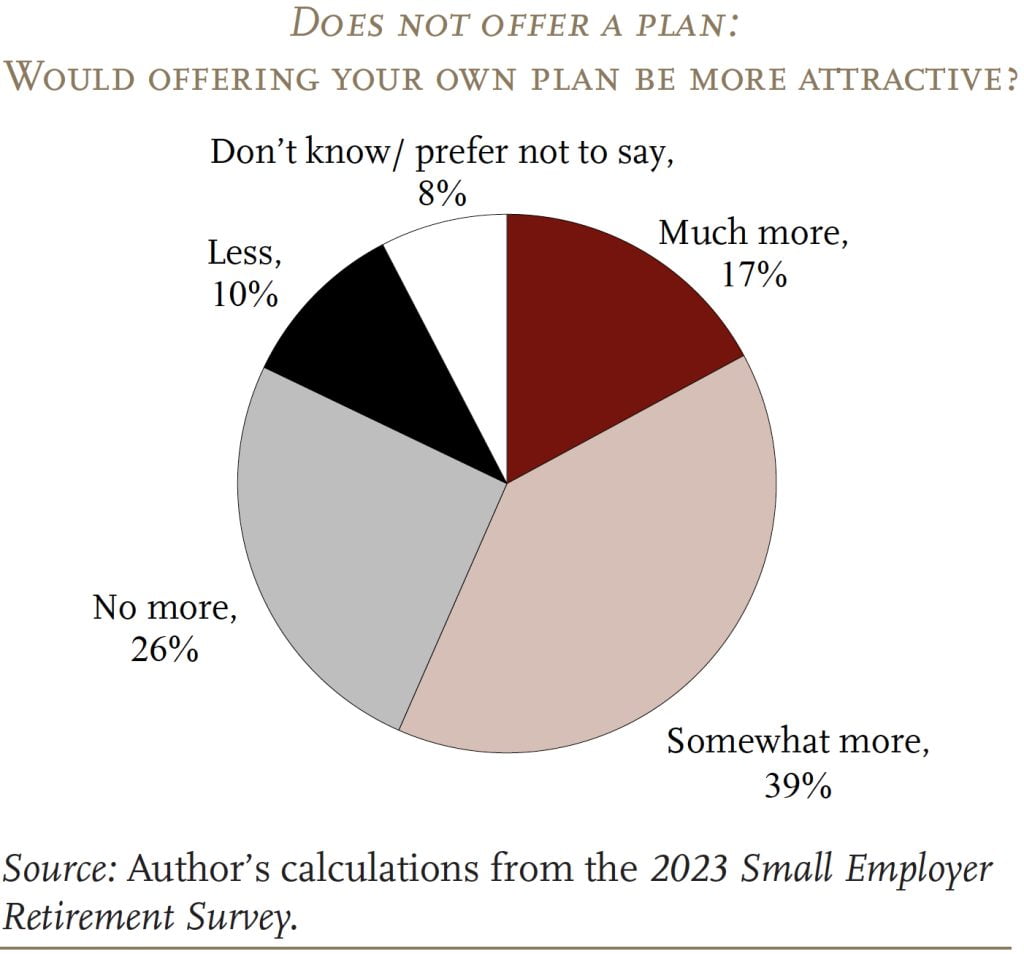

Presently, 14 states have launched or are getting ready to launch applications requiring employers and not using a plan to robotically enroll their workers in an Particular person Retirement Account (“auto-IRAs”). The survey requested all employers within the pattern – not simply these in states with auto-IRAs – whether or not the presence of such a program would make them much less or extra more likely to have their very own plan.

The outcomes present that, total, the presence of state-sponsored applications doesn’t make corporations much less more likely to supply their very own retirement plan (see Determine 8). Amongst corporations that already supply a plan, about 70 % say they’d proceed to supply their very own if their state launched a mandate. Amongst corporations that didn’t supply a plan, nearly 60 % stated a mandate would really make providing their personal retirement plan extra engaging.

Conclusion

The protection hole is a urgent concern for the nation’s retirement earnings safety, and the hole is pushed by small employers. To be able to encourage progress in protection, it is very important perceive the traits of small corporations that do and don’t supply a plan.

For corporations that supply or are contemplating providing a retirement plan within the close to future, their beliefs are necessary – corresponding to whether or not they suppose retirement plans matter for worker hiring and retention.

For corporations that don’t supply a plan, two main longstanding limitations – income stability/measurement and prices or administrative burden of getting a plan – stay high issues amongst small corporations as we speak.

Income issues are extremely related to agency measurement, significantly corporations with fewer than 10 workers. It’s comprehensible that corporations could have to turn into established earlier than organising a office retirement plan is seen as a viable choice.

Views on price or administrative burdens, nevertheless, appear to be pushed by misperceptions in regards to the monetary prices and the time it might take to function a plan. These outcomes recommend that higher consciousness of the particular prices in addition to plan choices designed for small corporations might assist scale back the limitations that small corporations understand.

Lastly, the expansion of state-sponsored retirement applications may very well encourage corporations and not using a plan to undertake one.

References

Bloomfield, Adam, Kyung Min Lee, Jay Philbrick, and Sita Slavov. 2023. “How Do Companies Reply to State Retirement Plan Mandates.” Working Paper 31398. Cambridge, MA: Nationwide Bureau of Financial Analysis.

Heart for Retirement Analysis at Boston School, Worker Profit Analysis Institute, and Greenwald Analysis. 2023. 2023 Small Employer Retirement Survey.

Chen, Anqi. 2023. “Small Enterprise Retirement Plans: The Significance of Employer Perceptions of Advantages and Prices.” Particular Report. Chestnut Hill, MA: Heart for Retirement Analysis at Boston School.

Drobleyn, Eric. 2023. “How A lot Time Does Annual 401(okay) Administration Take?” Cell, AL: Worker Fiduciary.

Guzoto, Theron, Mark Hines, and Allison Shelton. 2022. “State Auto-IRAs Proceed to Complement Personal Marketplace for Retirement Plans.” Washington, DC: Pew Charitable Trusts.

U.S. Bureau of Labor Statistics. Enterprise Employment Dynamics, 2022. Washington, DC.

U.S. Bureau of Labor Statistics. Nationwide Compensation Survey, 2021. Washington, DC.

Yakoboski, Paul and Pamela Ostuw. 1998. “Small Employers and the Problem of Sponsoring a Retirement Plan: Outcomes of the 1998 Small Employer Retirement Survey.” Concern Temporary Quantity 202. Washington, DC: Worker Profit Analysis Institute.