In its practically 250-year historical past, the U.S. has skilled extra durations of inflation than deflation. The final large interval of deflation occurred throughout The Nice Despair.

There was one other smaller interval throughout the Nice Monetary Disaster. Each coincided with a recession. Throughout a recession and deflation, individuals lose their jobs, demand drops, and with it, costs.

However for many who are capable of cling on to their jobs and have investments, what ought to they take a look at for among the greatest investments throughout a deflationary interval? On this article, we’ll clarify how deflation works and provide a couple of methods for defending in opposition to it.

What Is Deflation?

Whereas inflation is a rise in costs, deflation is a lower in costs.

As talked about within the introduction, deflation normally happens throughout a recession. As layoffs start, demand begins dropping. That leads to corporations decreasing costs in an try to draw prospects. However attributable to their suppressed costs and income, corporations are additionally extra inclined to cut back their wages or lay off much more staff.

Although merchandise are extra inexpensive, if prospects are making much less cash or don’t have jobs in any respect, they can not purchase like they used to. So gross sales keep depressed or might even decline additional.

The above situation can create a viscous provide and demand cycle. As corporations decrease costs, their revenue margins compress. This results in the necessity to cut back price, which ends up in extra layoffs. However extra layoffs additional lower demand, fueling the cycle.

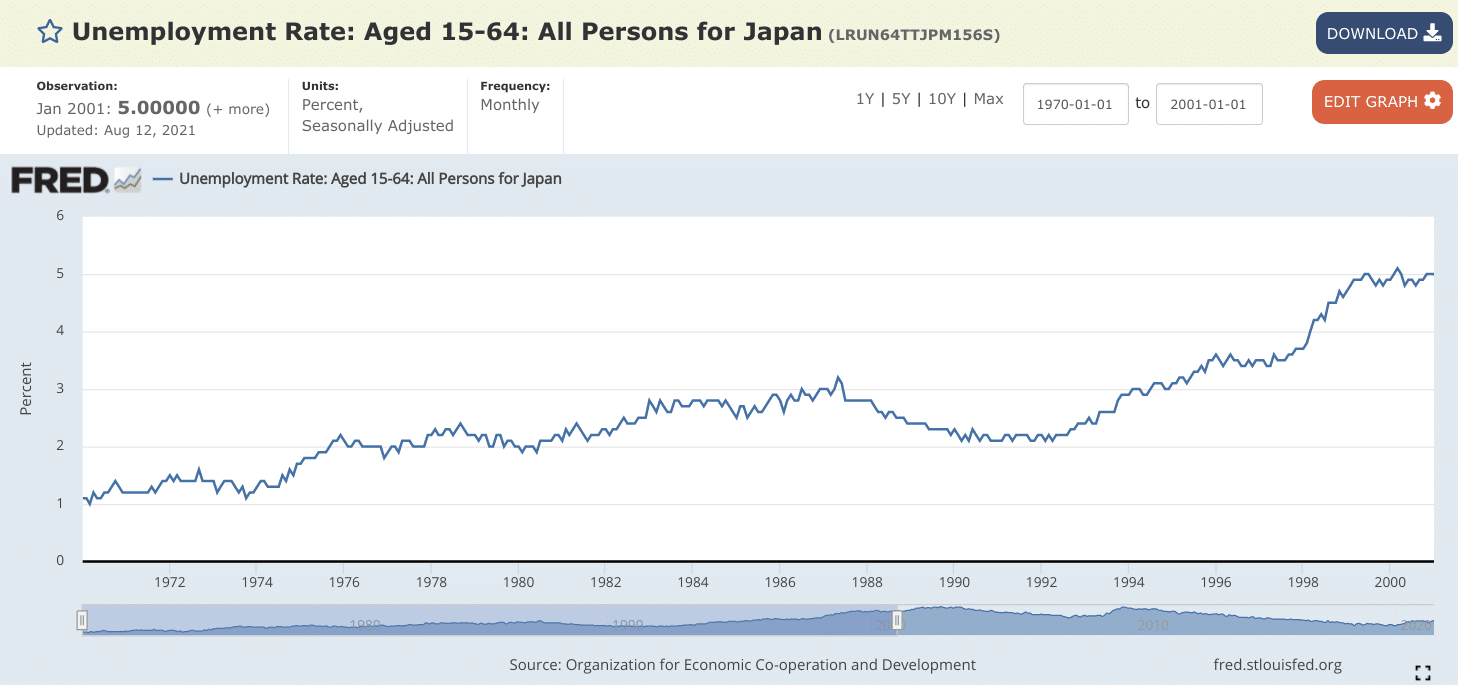

Japan’s “Misplaced Decade” from 1990 to 2001 is probably essentially the most well-known instance of how deflation can decimate an economic system. The graph under from the Federal Reserve Financial Knowledge (FRED) exhibits the regular climb of Japanese unemployment throughout these tough years.

Ought to U.S. Buyers Be Apprehensive About Future Deflation?

Deflation is not an issue proper now in the US. Actually, the Federal Reserve has been extra targeted recently on containing inflation issues which have been introduced on by pandemic-related provide chain points in a number of industries.

Associated: These Are The Greatest Investments For Inflationary Durations

However some economists are involved that when these provide points are resolved, demand should not return to pre-pandemic ranges. Unemployment and shopper concern are two of the most important components that result in deflation. And each may stay excessive even after corporations are again to producing at full capability.

There’s nonetheless a powerful likelihood that the US may avoid deflation. And the Federal Reserve will definitely take each motion that it could actually to guarantee that occurs. Nonetheless, it is a potential menace that buyers will need to keep watch over over the subsequent three to 5 years.

3 Greatest Investments For Deflationary Durations

For a lot of, deflationary durations are marked by conservation and even survival. However for some, they’re capable of preserve their investments and proceed with no important lower of their life-style.

Deflation might sound like a good time for buyers as a result of costs are falling. However the issue is that costs can preserve falling. There is no solution to know for positive when the underside has been reached.

Somewhat than chasing costs decrease, it might be higher to have a look at investments that preserve their worth or at the least do not drop as quick. Under are three examples of investments that have a tendency to stay sturdy throughout deflationary durations.

1. Funding-Grade Bonds

Funding-grade bonds embody Treasuries and people of high-quality, blue-chip corporations. A majority of these bonds work effectively throughout a deflationary atmosphere due to the standard of the entity behind them.

The federal government isn’t going broke, which implies buyers can believe that they’ll proceed to obtain common funds and ultimately their principal.

It’s the identical with high-quality corporations. These corporations have been round for a very long time, have nice administration and stable stability sheets. Their merchandise are in demand. It’s unlikely these corporations will exit of enterprise, even throughout a recession.

Need To Be taught How To Construct A Diversified Bond Portfolio?

2. Defensive Shares

Defensive shares are these of corporations that promote services or products that we individuals cannot simply minimize out of their lives. Shopper items and utilities are two of the most typical examples.

Assume of bathroom paper, meals, and electrical energy. It doesn’t matter what the financial situations are, individuals will at all times want these items and providers.

In case you do not need to spend money on particular person shares, you could possibly spend money on ETFs that observe the Dow Jones U.S. Shopper Items Index or the Dow Jones U.S. Utilities Index.

For shopper items, widespread ETFs embody iShares US Shopper Items (IYK) and ProShares Extremely Shopper Items (UGE). And ETF choices for utilities embody iShares US Utilities (IDU) and ProShares Extremely Utilities (UPW).

3. Dividend-Paying Shares

Dividend-paying shares stay in demand throughout a recession due to their earnings. Whereas the inventory worth might decline, buyers can depend on the dividends to proceed offering regular passive earnings.

Buyers ought to give attention to high-quality dividend-paying corporations, slightly than merely in search of corporations which have excessive dividend yields. An abnormally-high dividend yield may very well be a warning signal as a result of it may point out that the inventory’s worth has lately taken a nosedive.

In case you’re in search of sturdy, dividend-paying corporations, the “Dividend Aristocrats” generally is a excellent spot to start out. Dividend aristocrats are corporations which have elevated their dividends for at the least 25 consecutive years. As of September 2021, there are 63 corporations that meet these necessities.

Need To Begin Investing In The Dividend Aristocrats?

3 Different Methods To Defend In opposition to Deflation

Investments aren’t the one solution to make it by way of a deflationary occasion. Individuals who can’t make investments could make issues a bit of simpler on themselves by following two key methods:

1. Construct Money Reserves

Holding money ought to rank excessive on the listing throughout a deflationary interval. It’s because money could have extra shopping for energy as costs drop. Deflation is a contraction of the cash provide and credit score. That will increase the greenback’s worth.

For anybody who has tried to get a mortgage throughout a recession, they know it may be very tough. That makes retaining your emergency fund fully-funded all of the extra necessary. And you could need to save up much more money if you understand you’ve a big expense coming quickly.

Are You Incomes Sufficient Curiosity On Your Financial savings?

2. Maintain Liquid Belongings

Holding liquid belongings like certificates of deposits (CDs) or cash market accounts (MMAs) can be necessary since buyers can simply convert them into money.

Sure, liquid belongings will lose worth as effectively throughout deflation. However not like illiquid belongings akin to actual property, vehicles, and collectibles, liquid belongings can shortly grow to be a supply of money throughout an emergency.

3. Pay Down Debt

Debt doesn’t lower in worth attributable to deflation. Actually, it usually solely turns into extra of a burden throughout deflationary durations.

Wages sometimes stagnate or fall throughout deflation whereas debt quantities both keep the identical or develop attributable to amassed curiosity expenses. And think about if somebody loses their job and has to go on unemployment throughout a deflation cycle. Their earnings can be a lot decrease whereas their debt load stays the identical.

We’d say that decreasing debt is nearly at all times an excellent technique regardless of the financial atmosphere. But it surely’s particularly a wise concept throughout a deflationary atmosphere.

Last Ideas

For a lot of, deflation means pulling within the reins and battening down the hatches. And that is okay when it means reducing out pointless bills. However investing in your retirement and future targets aren’t issues that you need to minimize off of your price range throughout deflation should you can presumably assist it.

In case you proceed to speculate all through the downturn, you will be in even higher form when costs rebound. Within the meantime, realizing what works and what doesn’t may be the distinction between sustaining a sure stage of stability throughout your investments vs. watching them fully crash and burn.