Picture supply: Getty Photographs

A current journey to the Cheshire Oaks outlet buying centre resulted in me unexpectedly taking a place in JD Sports activities Style (LSE:JD.), the FTSE 100 sports activities/trend retailer. Shopping for shares was the very last thing on my thoughts however I used to be persuaded by what I noticed.

Of the 140 shops on-site, three had queues to get inside.

The recognition of Crocs and Birkenstock didn’t shock me. However the massive variety of customers ready exterior each of them was partly as a result of small dimension of their shops. Nonetheless, it was the truth that folks have been ready to attend to enter Nike (NYSE:NKE) — presumably the biggest store on web site — that bought me considering.

God of victory

The obvious recognition of the American sportswear model seems to buck a wider development. In recent times, Nike’s determined to focus on promoting by its personal shops on to the buyer (DTC) moderately than through third events, like JD Sports activities.

Nonetheless, on 27 June, the corporate revealed that throughout the three months ended 31 Might 2024, its DTC gross sales fell 8%. On the identical day it additionally introduced a reduce in its 2025 gross sales forecast.

The information brought on a 20% fall in its inventory value. It’s now solely 16% greater than when the pandemic was wreaking havoc.

Regardless of the queues in Cheshire, some business consultants declare that Nike has misplaced its method.

It seems to rely an excessive amount of on its legacy manufacturers. For instance, Michael Jordan final performed an NBA basketball recreation in 2003. Does anyone beneath the age of 35 actually know who he’s?

A greater thought?

The JD Sports activities share value has undoubtedly been affected by Nike’s issues. It fell 5% when the American firm offered its gloomy replace in Might. It’s now 30% decrease than its 52-week excessive.

This isn’t shocking provided that estimates recommend Nike accounts for 50%-55% of JD Sports activities’ income. However the retailer is greater than only one model.

Nike’s technique has opened the door for some lesser-known rivals to achieve market share. Castore, On Working and Hoka are the brand new youngsters on the block. JD Sports activities sells all three, in addition to Crocs and Birkenstock that are additionally in vogue in the meanwhile.

And regardless of its issues, my go to to Cheshire confirms that Nike’s merchandise stay fashionable. By stocking these, together with established favourites like Adidas, Puma and New Stability, I feel JD Sports activities is nicely positioned to cowl all budgets and demographics.

As well as, I’m certain the Olympics can have boosted gross sales within the quick time period.

Some issues

However there are dangers. The corporate operates 3,400 shops in 38 nations which is a logistical nightmare. And these account for 75.7% of gross sales, so JD stays weak to pure play on-line retailers who don’t should pay property taxes.

As well as, its dividend is miserly which implies many revenue buyers will look elsewhere.

Nonetheless, with a ahead price-to-earnings ratio of 9.4 — under the FTSE 100 common — I imagine now’s a great time for me to purchase.

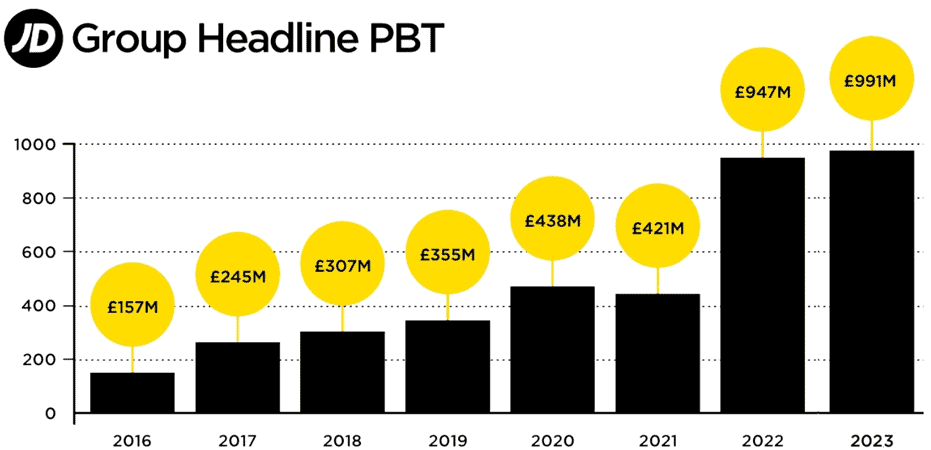

I subsequently hope to capitalise on JD Sports activities’ robust observe file in rising its earnings, each organically and thru acquisition.

The corporate’s as a result of launch its first-half outcomes later this month (August). These ought to give me an early indication as as to if I’ve made the proper determination.