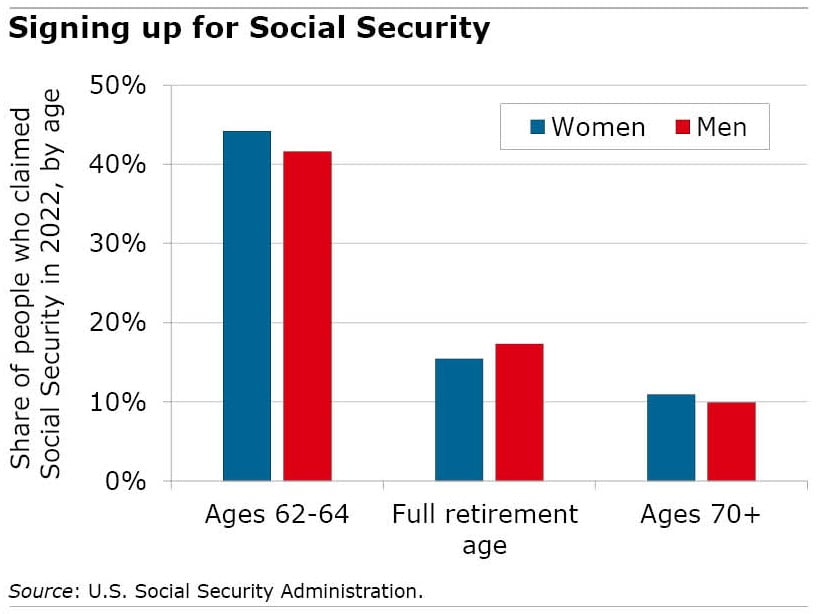

Monetary advisers typically encourage older employees to delay signing up for his or her Social Safety so long as potential to maximise their month-to-month revenue.

However a number of of our weblog’s readers level out, rightly, that this isn’t at all times potential for folks in bodily taxing jobs. Blue-collar employees are in an actual Catch-22, caught between the unforgiving monetary calls for of retiring and a physique that may’t take any extra work.

“That’s me,” a reader named George L. commented on a current weblog, “The Psychology Behind Beginning Social Safety at 62.” Psychology had little to do together with his resolution to begin Social Safety. “I labored unskilled arduous labor all my life so I used to be able to retire at 62,” he mentioned.

One other reader, Ellis, mentioned he is aware of retired linemen, building employees and truck drivers.

“They had been simply worn out by 62, and persevering with to work of their occupations can be exceedingly taxing and harmful on account of declining talents,” he mentioned. “Work like that may take years off a life.”

However for an additional reader, monetary safety – his spouse’s – was the first consideration in deciding when to begin Social Safety. David Scarborough mentioned he earns greater than his spouse and desires to verify she has a big sufficient spousal profit from his Social Safety since “I’m fairly prone to die earlier than she does.”

It’s, he mentioned, “in each of our pursuits for me to delay claiming.”

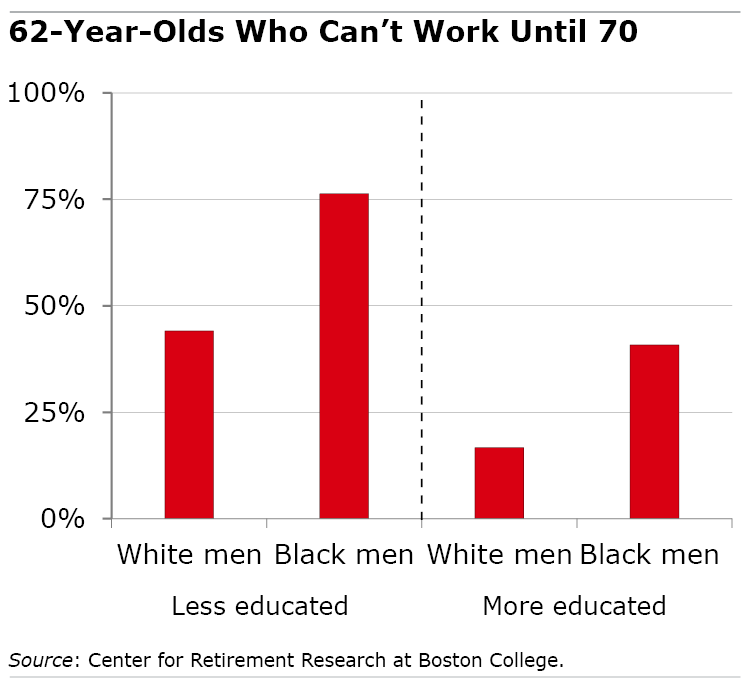

Analysis reveals that how a lot somebody earns is an enormous consider once they determine to retire. Folks in bodily demanding jobs, who might really feel they will’t work any longer, additionally are inclined to earn much less and might need lots to achieve from delaying their advantages – if solely they may. Employees who’ve the luxurious of delaying are sometimes in comparatively soft or high-paying workplace jobs or are doing work that energizes them, somewhat than carrying them out.

“It’s simple for an accountant or librarian to remain working full-time till 70,” Dr. Edward Hoffer mentioned, “however not really easy for a roofer or custodian.”

A 2021 research revealed this deep socioeconomic hole, which runs alongside racial traces. Just one out of 5 college-educated White males wouldn’t be bodily capable of work till 70. On the different finish of the spectrum, three out of 4 less-educated Blacks couldn’t make it that lengthy.

Though readers centered on the monetary points concerned, some acknowledged one psychological facet of deciding when to begin Social Safety: the expectation of how lengthy they may reside.

The analysis featured on this weblog reveals that individuals who anticipate to reside longer delay claiming their advantages. The distinction is with individuals who maintain the other view – that “life is brief” – and really feel that it’s vital to seize the advantages as quickly as potential and luxuriate in their retirement years.

“I’ve seen sufficient of my friends/household cross away of their 60s and 70s,” mentioned Deanna, one other reader.

The best way Social Safety’s system works is that the bigger checks a retiree receives by delaying will, in the event that they reside lengthy sufficient, ultimately make up for the “misplaced” years of advantages attributable to ready. Yearly of delay will enhance the scale of that month-to-month profit examine by 7 % to eight %, which is substantial. Claiming at age 62 or 64 to get pleasure from retirement has a steep monetary price for folks with common or above-average life expectancy.

Brian Krech and his spouse plan to separate the distinction. Krech, who mentioned he has critical well being points, plans to begin his advantages early. His spouse will wait till 70.

“If you’re comparatively wholesome and longevity runs in your loved ones, it’s a no brainer to carry off and declare at 70 to maximise your advantages,” he mentioned.

However that is an choice that wouldn’t work for different {couples}. First, the Kreches each have comparable earnings, eliminating the problem of needing to maximise the spousal profit – in distinction to the reader who earns greater than his spouse. And Krech’s spouse apparently has the form of job that permits her to delay Social Safety – in distinction to ageing blue-collar employees who wrestle to maintain up with the bodily calls for of their jobs.

“Every private and household scenario is so totally different that it’s vital to take a look at all choices and rationale earlier than claiming your Social Safety advantages,” Krech mentioned.

Each employee’s scenario is totally different. However the capability to work longer can be an enormous a part of the equation.

To learn the research by Suzanne Shu and John Payne, see “Social Safety Claiming Intentions: Psychological Possession, Loss Aversion, and Data Shows.”

The analysis reported herein was derived in complete or partially from analysis actions carried out pursuant to a grant from the U.S. Social Safety Administration (SSA) funded as a part of the Retirement and Incapacity Analysis Consortium. The opinions and conclusions expressed are solely these of the authors and don’t symbolize the opinions or coverage of SSA, any company of the federal authorities, or Boston School. Neither the US Authorities nor any company thereof, nor any of their workers, make any guarantee, categorical or implied, or assumes any authorized legal responsibility or accountability for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any particular business product, course of or service by commerce title, trademark, producer, or in any other case doesn’t essentially represent or suggest endorsement, advice or favoring by the US Authorities or any company thereof.