Canadian expertise highlights the problem of beating low-fee passive investments.

I’m a fantastic fan of the Canada Pension Plan (CPP) and infrequently cite it as an exquisite instance of the way to add equities to belief fund investments. But, the CPP’s most up-to-date annual investments report exhibits that the returns from even this much-lauded effort have fallen in need of the plan’s primary “Reference Portfolio” – an 85%/15% combine of world public equities and Canadian authorities bonds. The truth that even the CPP can’t beat listed investing buttresses the case that U.S. state and native pension plans ought to reassess their dedication to energetic administration and various investments.

A little bit background. The CPP was initially arrange in 1966 as a pay-as-you-go plan with a modest reserve, just like the U.S. Social Safety program. Nevertheless, inside a number of a long time, decrease start charges, longer life expectations, and decrease actual wage progress led to rising plan prices. To enhance equity throughout generations and make sure the long-term monetary sustainability of the plan, Canada enacted laws in 1997 that elevated payroll contributions to its projected long-term fee and started investing among the fund accumulations in equities.

To implement the funding technique, the laws created the CPP Funding Board. The Board’s mandate is to take a position CPP revenues not wanted to pay present advantages to realize the utmost return, with out incurring undo danger, for the only real good thing about CPP contributors and beneficiaries. Initially, Canada adopted a easy fairness/bond technique, however, in 2006, determined to shift to complicated investments and energetic administration. Since then, the CPP Funding Board has constructed a broad-based portfolio that features not simply shares and bonds, but in addition actual property, infrastructure tasks, and personal fairness (see Determine 1).

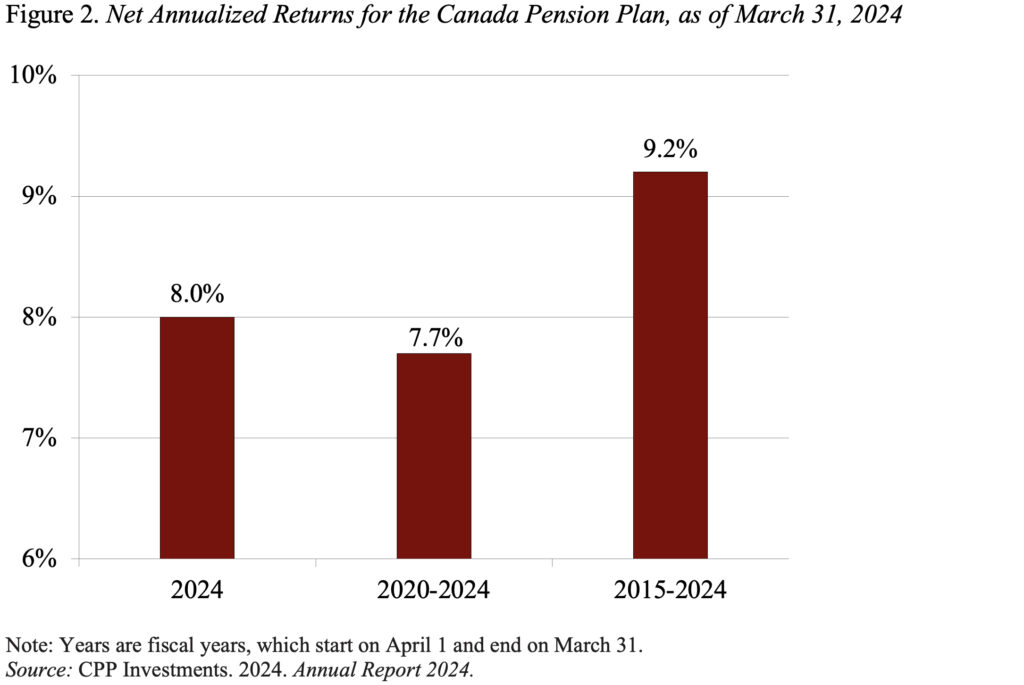

Whereas the CPP Funding Board has one fund, it has six departments that make investments and handle the belongings. The managers are in-house, extremely compensated people, and the worldwide employees has grown from 100 in 2006 to 2,125 in 2024. The fund earned 8 % on its investments in 2024 and has had annualized web returns of 9.2 % during the last 10 years (see Determine 2).

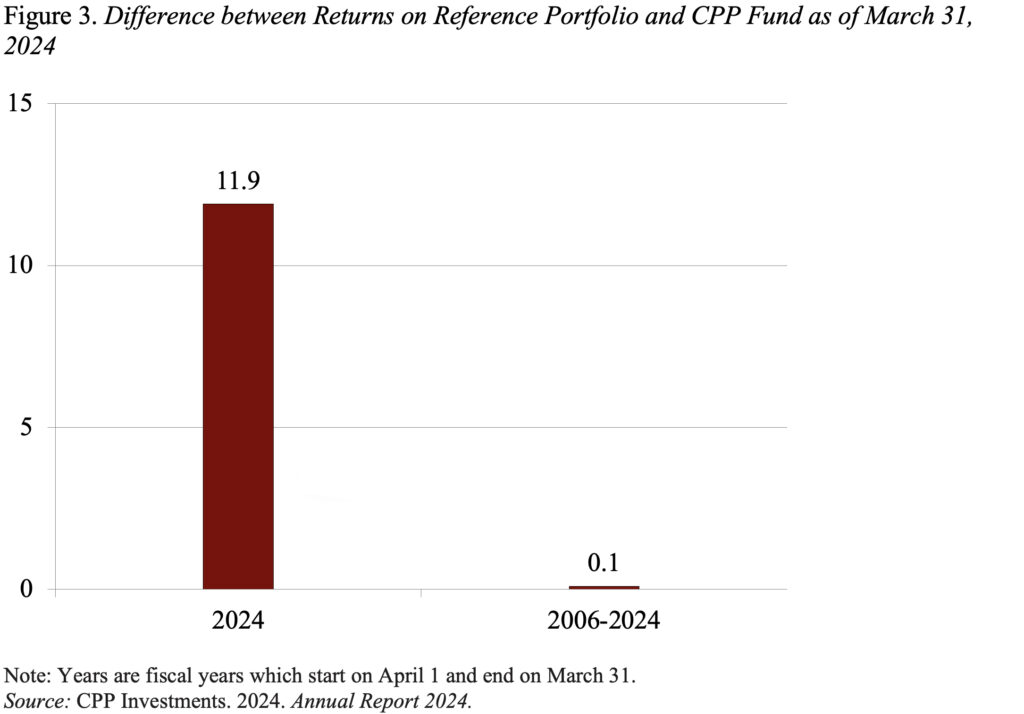

Whereas the returns look spectacular, they’ve fallen in need of the Board’s 85/15 primary Reference Portfolio. The distinction was notably stark in 2024, as U.S. equities, which account for half the fairness holdings within the Reference Portfolio, soared (see Determine 3). Because of these extraordinary good points, over your complete interval 2006-2024 the Reference Portfolio edged out the Fund by 0.1 %. That’s, by not investing in an 85/15 mixture of listed shares and bonds, the fund forfeited 42.7 billion CAD because the inception of energetic administration in 2006. To be honest, in fact, the outcomes are very delicate to the tip yr chosen.

The aim right here is to not criticize the efficiency of the CPP Funding Board. It follows strict fiduciary requirements, makes use of its affect within the non-public sector solely to boost long-run returns, and the President’s letter within the 2024 Report pushed again on stress from Alberta to extend investments in Canada. The Board appears to do every little thing proper, and has constantly been ranked as one of many prime performing pension funds on the planet over a 10-year interval. The issue is that it may be very tough to beat a low-fee listed portfolio. The Canadian expertise must be a cautionary story for all traders and notably these managing outlined profit plans.