Ramit’s investing method: Comply with the Ladder of Private Finance

There are six steps it’s best to take to speculate.

Every rung of the ladder builds on the earlier one, so once you end the primary, go on to the second. When you can’t get to the sixth step, don’t fear—do your finest for now.

Right here’s the way it works:

Rung #1: Contribute to your 401k

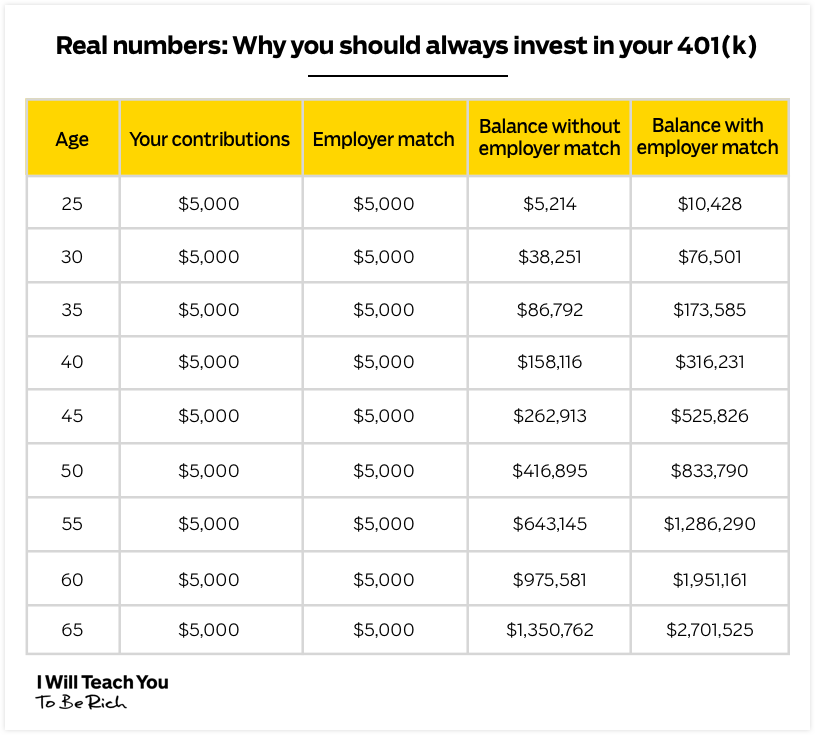

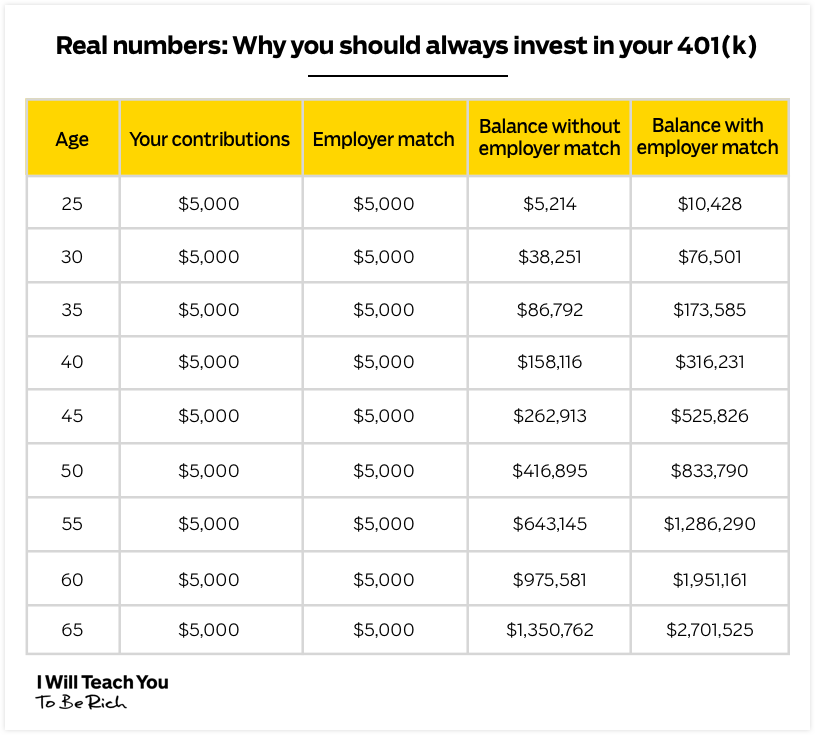

Every month try to be contributing as a lot as you want to in an effort to get essentially the most out of your firm’s 401k match. Meaning if your organization presents a 5% match, try to be contributing AT LEAST 5% of your month-to-month earnings to your 401k every month.

A 401k is among the strongest funding autos at your disposal.

Right here’s the way it works: Every time you get your paycheck, a proportion of your pay is taken out and put into your 401k pre-tax.

This implies you’ll solely pay taxes on it after you withdraw your contributions once you retire.

Usually, your employer will match your contributions as much as a sure proportion.

For instance, think about you make $150,000 per yr and your organization presents 3% matching with their 401k plan. When you invested 3% of your wage (round $5,000) into your 401k, your organization would match your quantity, successfully doubling your funding.

Right here’s a graph showcasing this:

This, my mates, is free cash (aka one of the best sort of cash).

Not all firms supply an identical plan — but it surely’s uncommon to seek out one which doesn’t. If your organization presents a match, it’s best to at the least make investments sufficient to take full benefit of it.

The place’s my 401k cash going?

You might have the choice to decide on your investments once you put cash right into a 401k. Nevertheless, most firms additionally provide the choice to entrust your cash with knowledgeable investing firm. They’ll provide you with quite a lot of funding choices to select from and might help reply any questions you’ve gotten about your 401k.

The opposite wonderful thing about a 401k is how simple it’s to arrange. You simply must decide in when your organization’s HR division presents it. They’ll withdraw solely as a lot as you need them to speculate out of your paycheck.

When can I withdraw cash from my 401k?

You possibly can take cash out of your 401k once you flip 59 ½ years outdated. That is the start of the federally acknowledged retirement age.

In fact you CAN take cash out earlier — however Uncle Sam goes to hit you with a ten% federal penalty in your funds together with the taxes it’s a must to pay on the quantity you withdraw.

That’s why it’s so essential to maintain your cash in your 401k till you retire.

When you ought to ever resolve to go away your organization, your cash goes with you! You simply want to recollect to roll it over into your new firm’s plan.

Rung #2: Repay high-interest debt

When you’ve dedicated your self to contributing at the least the employer match on your 401k, you want to ensure you don’t have any debt. When you don’t, nice! When you do, that’s okay. I’ve 4 methods that will help you get out of debt shortly.

Rung #3: Open a Roth IRA

When you’ve began contributing to your 401k and eradicated your debt, you can begin investing right into a Roth IRA. Not like your 401k, this funding account permits you to make investments after-tax cash and also you gather no taxes on the earnings. There’s a most for the way a lot you’ll be able to contribute to your Roth IRA, so keep updated on the yearly most.

Not like a 401k, a Roth IRA leverages after-tax cash to present you a fair higher deal. This implies you place already-taxed earnings into investments akin to shares or bonds and pay no cash once you withdraw it.

When saving for retirement, your best benefit is time. You might have time to climate the bumps out there. And over time, these tax-free good points will show a tremendous deal.

Your employer received’t give you a Roth IRA. To get one, you’ll must undergo a dealer.

There are loads of components that may decide your resolution, together with minimal funding charges and inventory choices.

A couple of brokers we propose are Charles Schwab, Vanguard (that is the one I take advantage of), and E*TRADE.

NOTE: Most brokers require a minimal quantity for opening a Roth IRA. Nevertheless, they may waive the minimal in the event you arrange a daily automated funding plan.

The place does the cash in my Roth IRA get invested?

As soon as your account is ready up, you’ll have to really make investments the cash.

Let me say that once more, when you arrange the account and put cash into it, you continue to want to speculate your cash.

When you don’t buy shares, bonds, ETFs, or no matter else, your cash will simply be sitting in a glorified financial savings account not accruing substantial curiosity.

My suggestion for what it’s best to spend money on? An index fund that tracks the S&P 500 and is managed with barely any charges.

For extra, learn my introductory articles on shares and bonds to achieve a greater understanding of your choices. Or, you’ll be able to watch my deep dive into how one can select a Roth IRA: