The temporary’s key findings are:

- When the employer value for employer-sponsored medical health insurance (ESHI) rises, it slows wage progress and erodes Social Safety’s tax base.

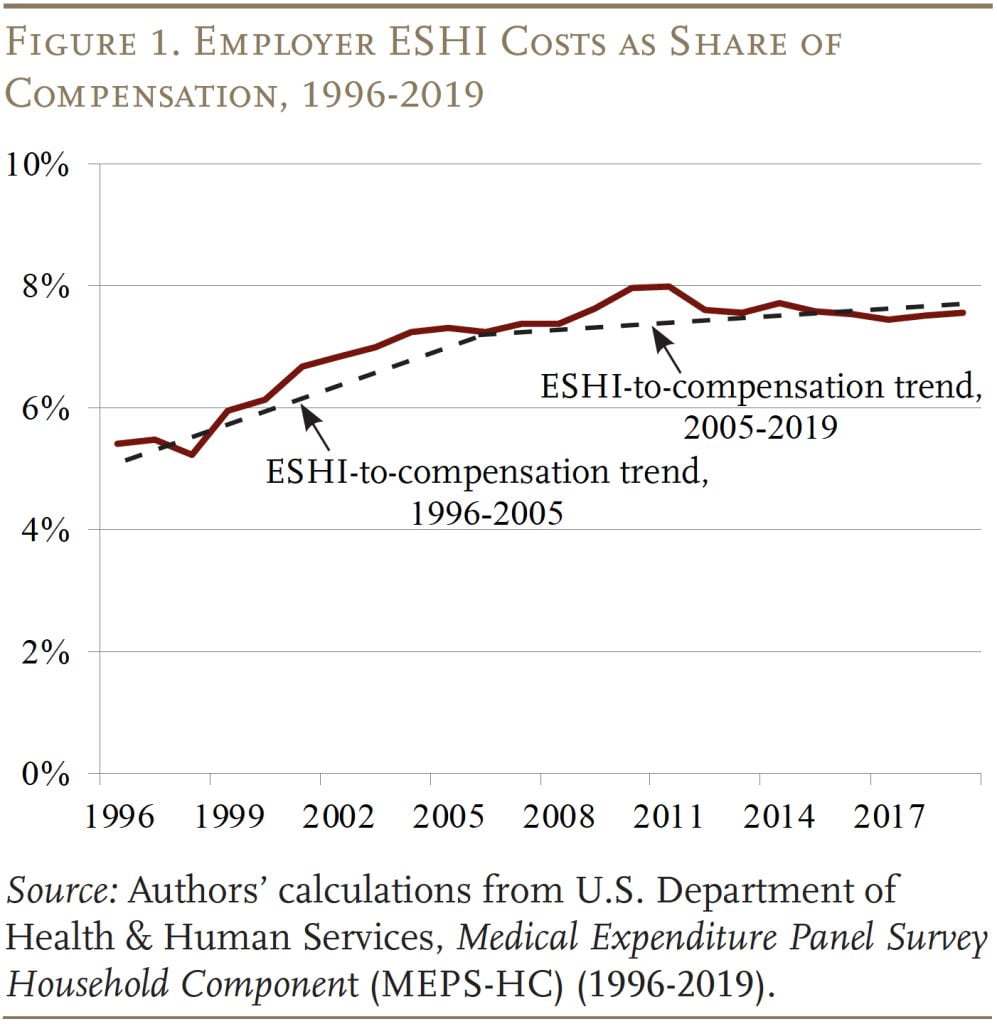

- Each these results had been evident from 1996-2005, however the state of affairs stabilized throughout 2005-2019.

- Why did the ESHI-to-compensation ratio stabilize?

- Throughout each intervals, the key driver was the overall rise in nationwide well being prices.

- From 2005-2019, this impression was largely offset by much less ESHI participation by decrease earners and fewer demand for household plans.

- Going ahead, rising well being prices might once more push up the ESHI-to-compensation ratio, until the components which were offsetting this progress proceed.

Introduction

The rising value of employer contributions to employer-sponsored medical health insurance (ESHI) can sluggish wage progress and erode the Social Safety wage base. Each these results had been evident within the many years earlier than 2005, as ESHI elevated as a share of compensation. Thankfully, the ratio of ESHI contributions to compensation plateaued after 2005, stabilizing wages and halting the erosion of the share of compensation topic to Social Safety’s payroll tax. The query is whether or not this stabilization is short-term or everlasting.

This temporary, which is predicated on a latest paper, makes use of the Medical Expenditure Panel Survey (MEPS) to find out why ESHI contributions rose as a share of compensation previous to 2005 and why this ratio stabilized lately. These findings are then used to mission potential ratios of ESHI to compensation over the following decade.

The dialogue proceeds as follows. The primary part identifies the key components that might impression the ratio of ESHI to compensation. The second part describes the MEPS information. The third decomposes the position of the varied components within the improve and subsequent stabilization of the ESHI-to-compensation ratio. The fourth part makes use of these outcomes and projections of Nationwide Well being Expenditures (NHE) from the Facilities for Medicare & Medicaid Providers (CMS) to estimate what the ratio could seem like over the following 10 years.

The ultimate part concludes that the expansion within the well being spending-to-GDP ratio was the key driver of the ESHI-to-compensation ratio each earlier than and after 2005, however after 2005 this impression was largely offset by the decline in participation in ESHI plans amongst decrease earners and the decline in demand for household well being plans. Wanting ahead, CMS tasks that the NHE/GDP ratio will rise from 17.6 % in 2019 to 19.6 % in 2031. If nothing else adjustments, ESHI as a share of compensation will improve as properly. However, if ESHI participation and demand for household plans decline from 2019-2031 as they’ve from 2005-2019, the ESHI-to-compensation ratio ought to stay secure.

Main Drivers of ESHI Developments

Economists usually assume that the prices of employer advantages, equivalent to medical health insurance, are handed onto the worker via slower wage progress. Consequently, the rising value of ESHI has been recognized as a significant contributor to wage stagnation and the key cause for the decline within the share of compensation topic to the Social Safety payroll tax. The excellent news is that between 2005 and 2019 – with a short lived spike in the course of the Nice Recession – the ratio of ESHI to compensation stabilized (see Determine 1).

Prior analysis identifies three main components that drive the price of ESHI as a share of compensation: 1) common tendencies in healthcare spending; 2) whether or not these signing up are high- or low-compensated staff; and three) the kind of protection chosen – household vs. particular person plan.

Total Healthcare Prices

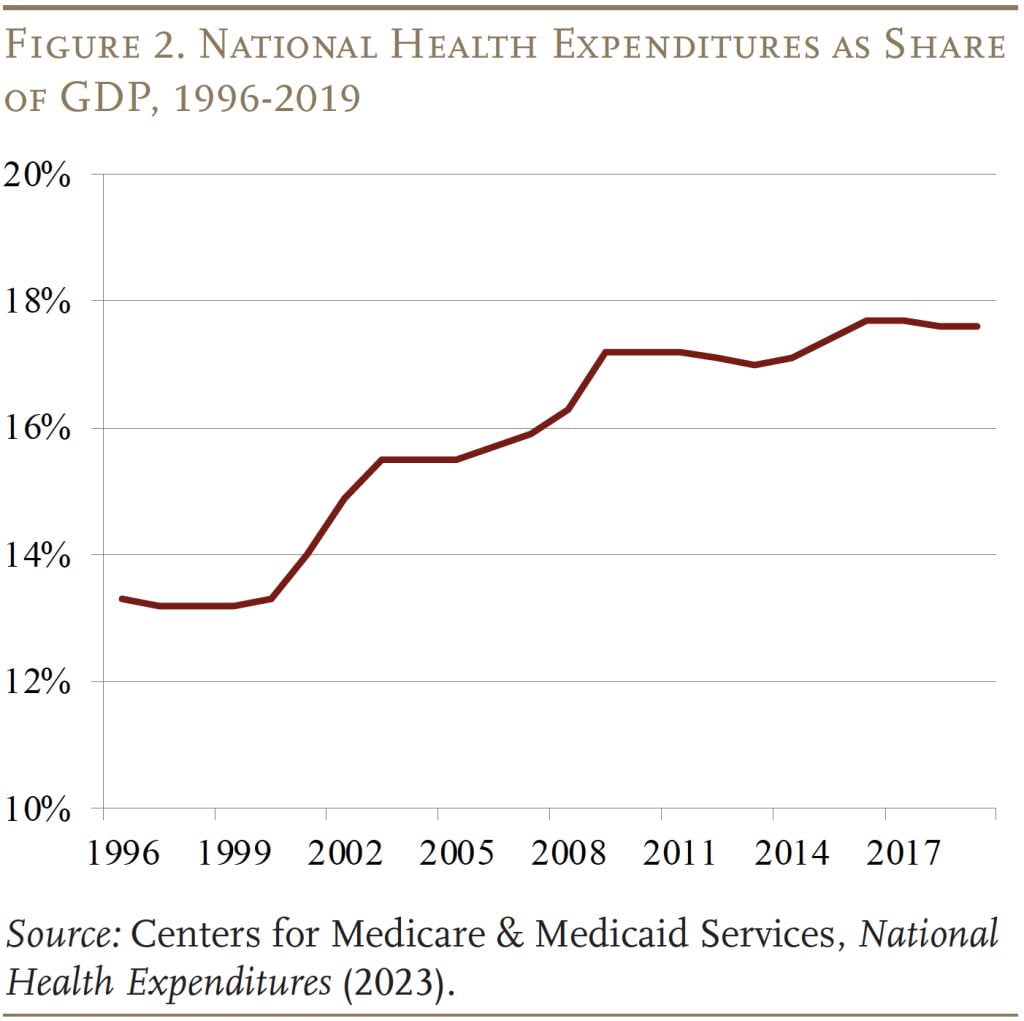

Basic tendencies in healthcare spending are, not surprisingly, an necessary driver for tendencies in ESHI. Reflecting each will increase in costs and utilization, nationwide well being expenditures elevated from about 13 % of GDP within the mid-Nineties to round 17 % of GDP in 2009, earlier than plateauing via 2019 (see Determine 2).

Traits of ESHI Members

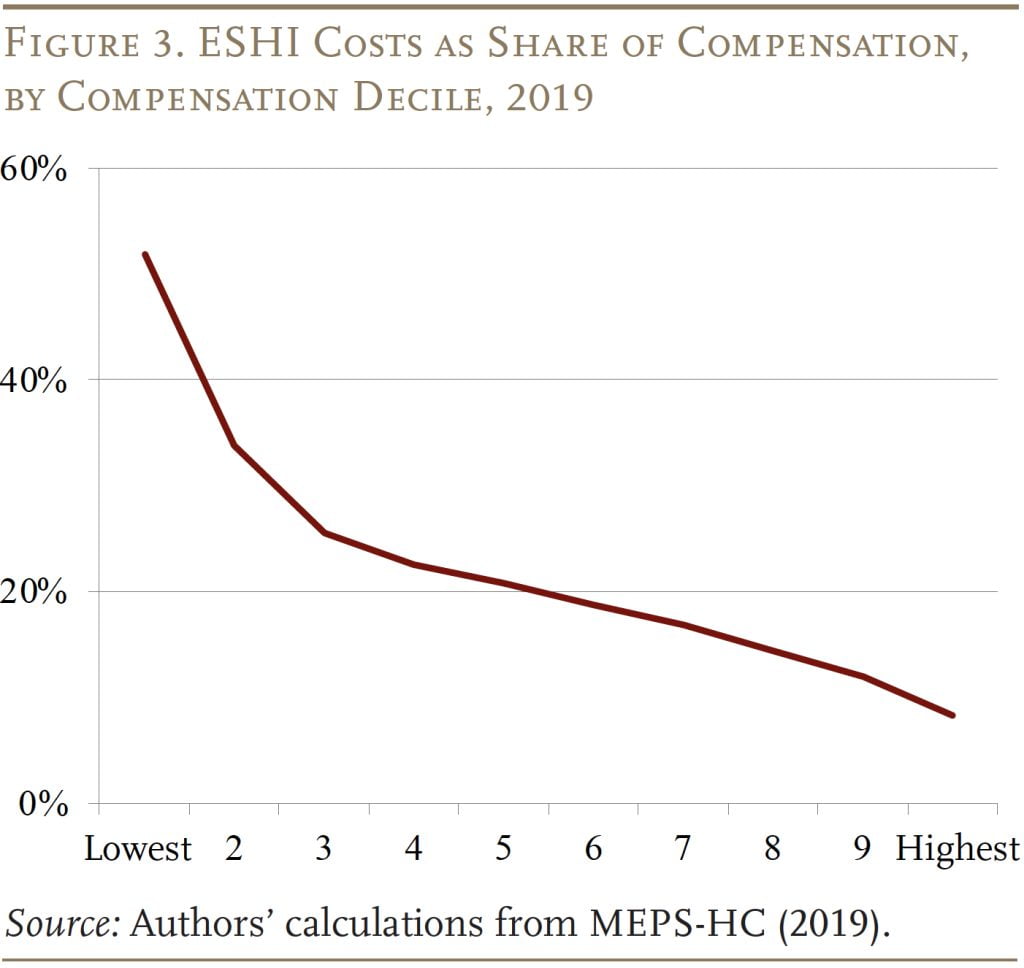

One other determinant of tendencies in ESHI prices is the make-up of the individuals. Since medical health insurance is a bigger share of compensation for decrease earners than for greater earners (see Determine 3), a decline in participation amongst decrease earners decreases the employer’s total ratio of ESHI prices to compensation.

Certainly, participation amongst decrease earners has declined – pushed nearly solely by a decline in worker take-up and never by a decline in companies providing medical health insurance. The drop in take-up might be attributed to numerous components. First, rising healthcare prices make it more durable for all staff – however notably lower-wage staff – to cowl the worker portion of medical health insurance premiums. Second, the share of premiums paid by employers declined, additional elevating premium prices. Third, the growth of Medicaid underneath the Inexpensive Care Act made it simpler for low-wage staff to go for the general public program.

All these developments inspired decrease earners to decide out of ESHI and shifted the distribution of participation to greater earners, decreasing ESHI prices as a share of compensation.

Household vs. Particular person Protection

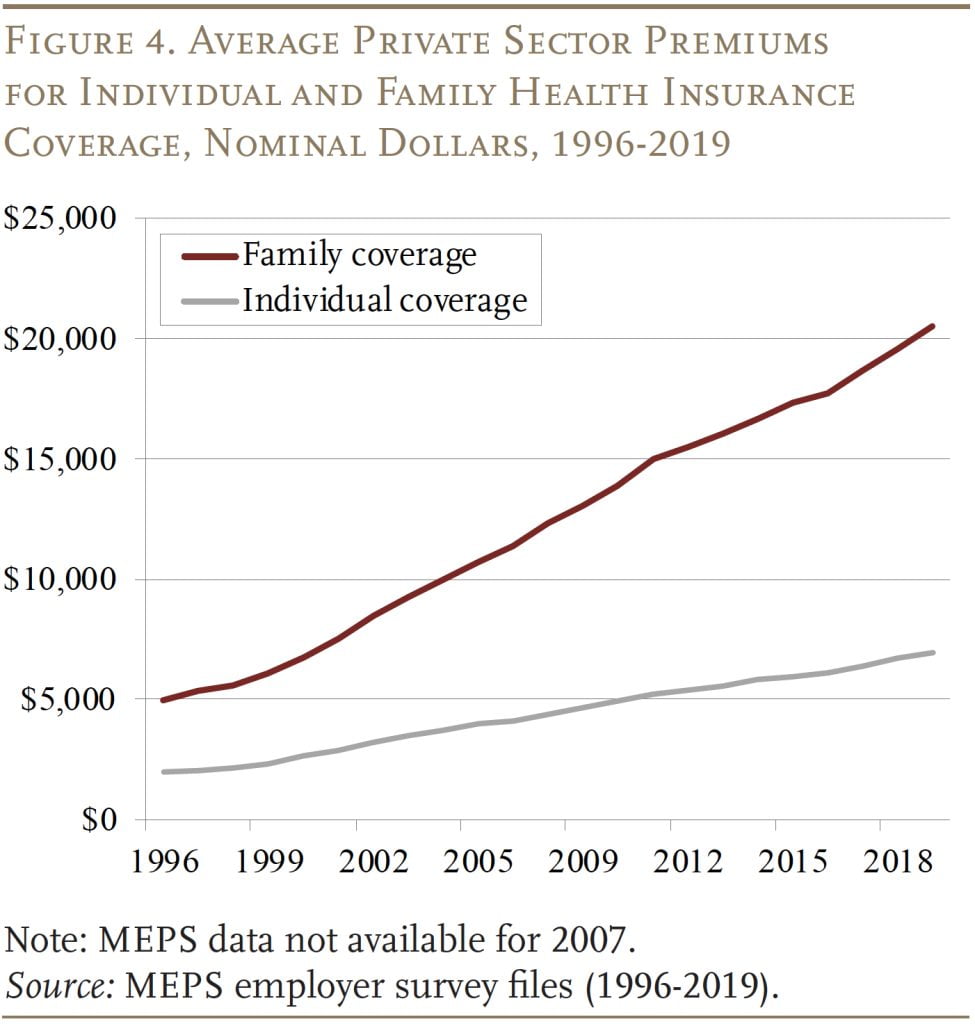

The ultimate issue that impacts the ratio of ESHI to compensation is the share of individuals that go for household plans versus particular person plans. Household plans are considerably dearer, and their prices have grown at a quicker tempo (see Determine 4).

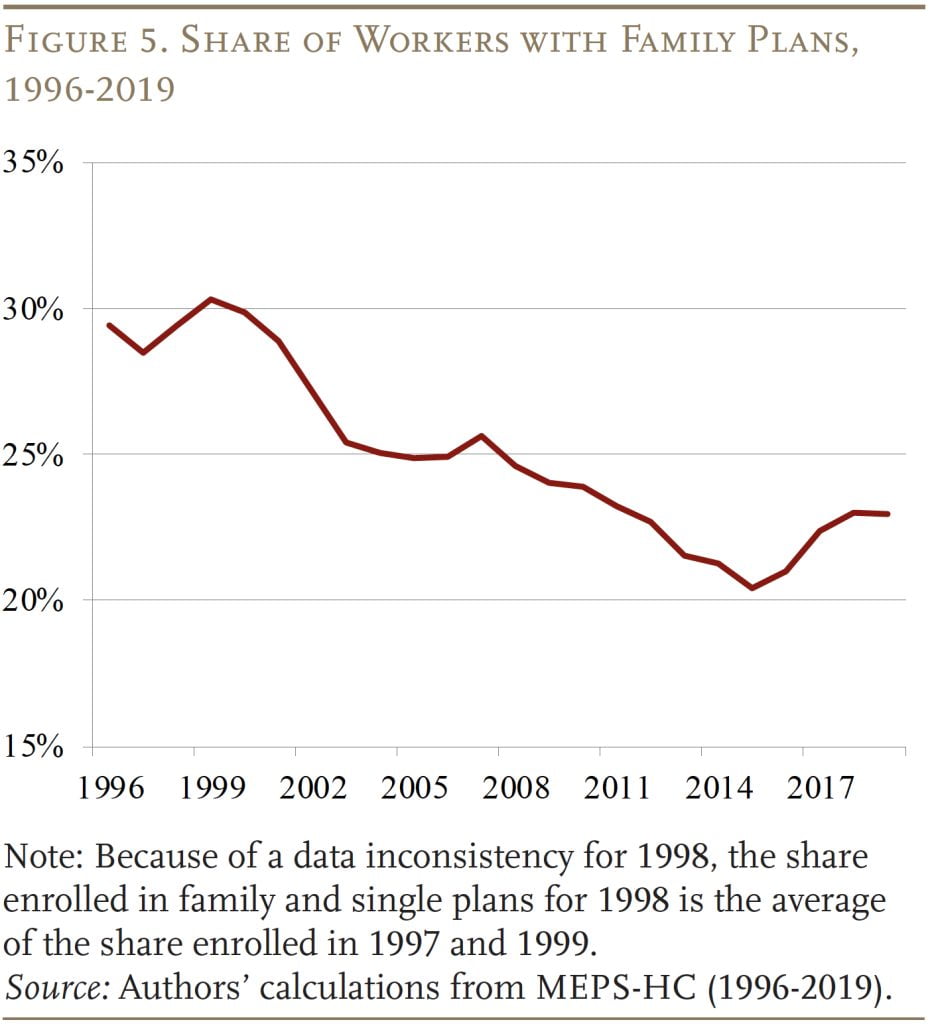

In response, the share of staff choosing household protection has declined at a gentle clip in latest many years (see Determine 5), inserting downward strain on the expansion of ESHI prices as a share of compensation. The traits of who’s choosing household protection additionally matter for ESHI prices. If a lot of the decline in household protection is pushed by lower-wage staff, then ESHI prices ought to decline considerably since household plans characterize a very giant portion of compensation for these staff.

The important thing questions are: 1) the extent to which every of those components contributed to the rise within the share of compensation paid as ESHI previous to 2005 after which to the stabilization of this share after 2005; and a pair of) whether or not this ratio will stay secure going ahead.

Knowledge

The info for the evaluation come from the Division of Well being and Human Providers’ Medical Expenditure Panel Survey (MEPS). The MEPS is a two-year panel survey that accommodates data on households, medical suppliers, and kinds and prices of medical health insurance supplied by employers. Our evaluation makes use of microdata from the 1996-2019 family survey recordsdata and the mixture information from the employer survey.

Respondents surveyed within the MEPS are interviewed 5 occasions over two calendar years. We hyperlink respondents throughout interview waves and embrace solely those that are current for all interviews. Every respondent is counted as soon as every year, so will seem twice within the information. The ultimate pattern consists of 274,163 staff for the interval 1996-2019. This evaluation stops in 2019 as a result of COVID disrupted many pre-existing tendencies in 2020.

The MEPS information – in addition to nationwide well being expenditure information – are used to quantify how a lot every of the components – total healthcare prices, the compensation distribution of ESHI individuals, and household vs. single plan enrollment – contributed to tendencies within the ESHI-to-compensation ratio.

Historic Evaluation: 1996-2005 and 2005-2019

Step one in quantifying how a lot every issue contributed to tendencies within the ESHI-to-compensation ratio (ESHI/Comp) is to estimate the next OLS regression for the 2 intervals: 1996-2005 and 2005-2019.

ESHI/Comp = ƒ(NHE/GDP, HighComp, LowComp, FamilyPlan, (HighComp*FamilyPlan), Controls)

By way of the explanatory variables, NHE/GDP represents mixture annual nationwide well being expenditures as a share of GDP, HighComp is an indicator if a employee with ESHI is within the excessive compensation deciles (5-10) and LowComp is an indicator if the employee is within the low compensation deciles (1-4), and FamilyPlan signifies whether or not the employee has a household plan. The equation additionally contains an interplay time period of high-compensation employee and household plan, which is necessary as a result of, as mentioned above, ESHI prices would decline rather more if a lot of the shift away from household plans is pushed by lower-compensated staff. Lastly, the equation contains numerous controls, equivalent to working within the public sector, being in a union, being close to retirement, marital standing, and gender.

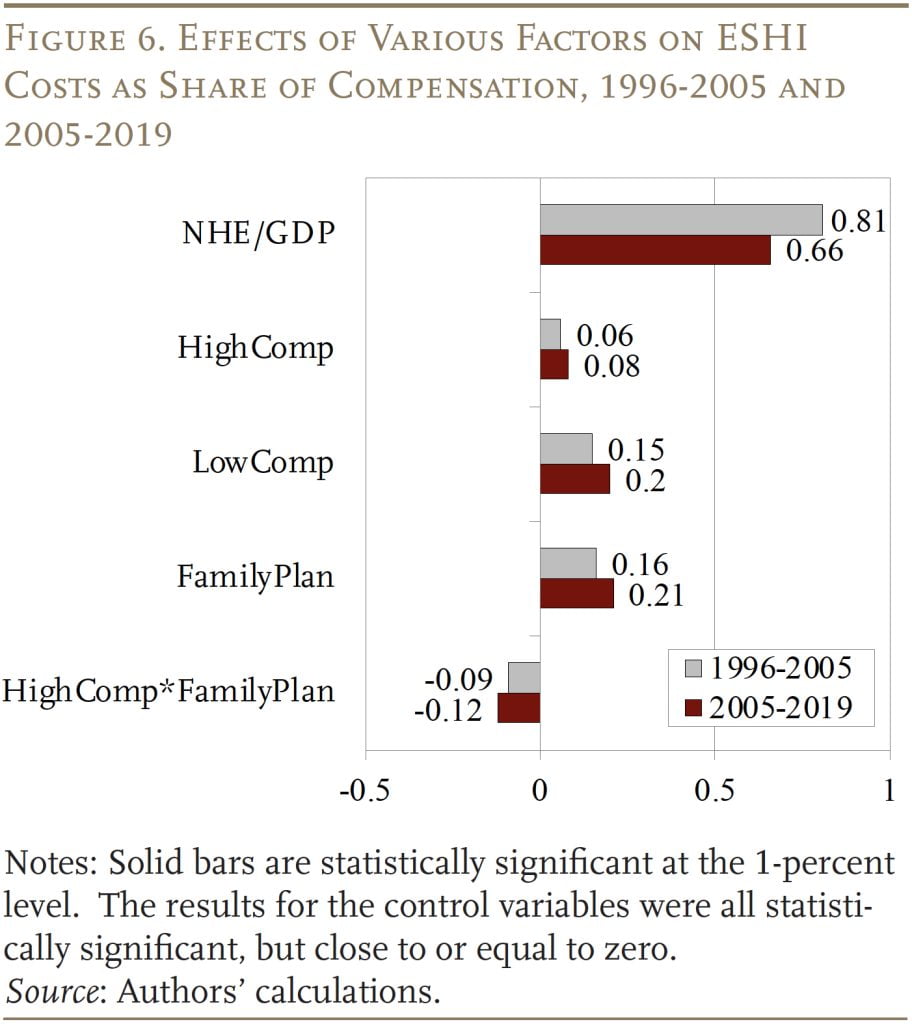

The outcomes are as anticipated (see Determine 6). As NHE as a share of GDP will increase, so does the ratio of ESHI to compensation, though the impact is smaller between 2005-2019 as different components develop in significance. Elevated participation has a smaller impact on the ratio if it happens amongst higher-compensated staff than lower-compensated staff. This sample is per the truth that ESHI represents a smaller share of the compensation of upper earners. The upper the share of staff enrolled in a household plan, the upper ESHI prices are as a share of contributions, since household plans are dearer. However, if a bigger share of these with a household plan are higher-compensated staff, common ESHI prices won’t go up by as a lot. All of the coefficients are constant throughout the 2 intervals examined.

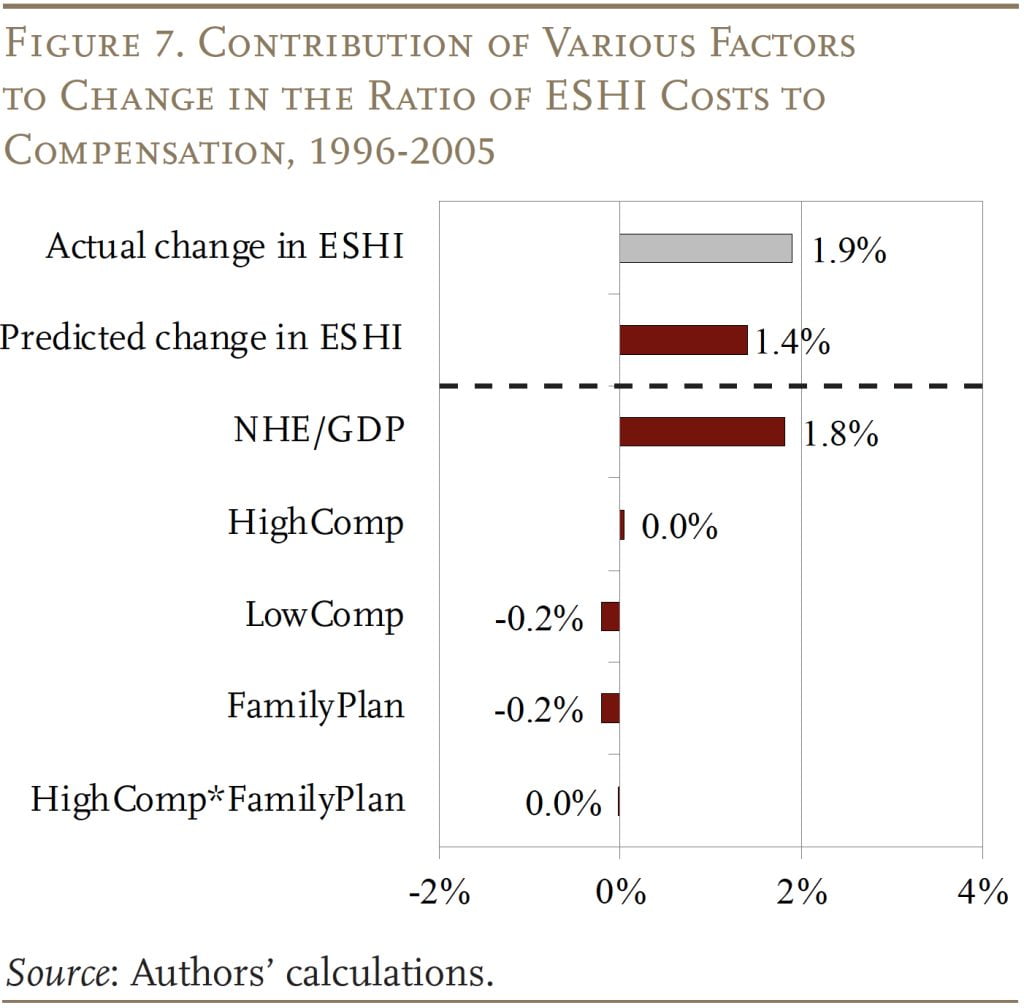

The outcomes from these OLS equations represent the idea for figuring out the contribution of every issue to the change within the ratio of ESHI to compensation over every of the 2 intervals. The train includes multiplying the coefficients from the regressions by the change in every issue over the interval. For instance, to find out the contribution of nationwide well being expenditures to ESHI tendencies throughout 1996-2005, the change in NHE expenditures as a share of GDP over the interval (0.022) is multiplied by the coefficient for NHE/GDP (0.81) to get 1.8 share factors (see Determine 7). However related calculations additionally present that pushing within the different route are: 1) a decline within the share of decrease earners who’ve employer medical health insurance; and a pair of) a decline within the share of staff enrolled in household plans. These two tendencies every diminished ESHI as a share of compensation by 0.2 share factors. On web, the components mixed clarify 1.4 of the 1.9-percentage-point progress in ESHI as a share of compensation over the 1996-2005 interval.

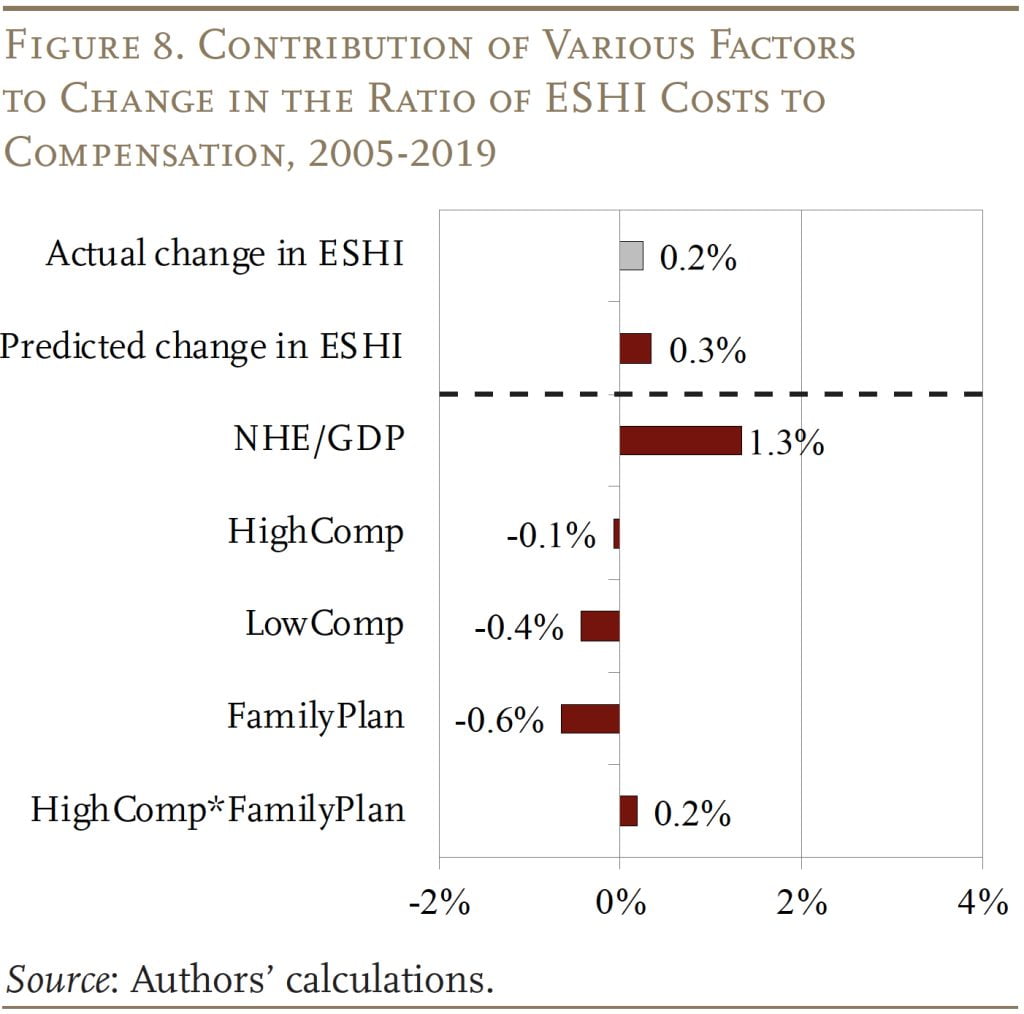

The train is repeated for the interval 2005-2019, when ESHI as a share of compensation slowed (see Determine 8). Though progress slowed, NHE/GDP nonetheless elevated ESHI as a share of compensation by 1.3 share factors. As soon as once more, the continued decline in decrease earners taking part in employer medical health insurance pushed down ESHI prices. The impact throughout this era, nevertheless, is far bigger, decreasing the ESHI-to-compensation ratio by 0.4 share factors. The share of upper earners additionally decreased barely, pushing the ratio of ESHI to compensation down by 0.1 share factors. The decline in household plan enrollment had competing results, as a result of greater earners additionally opted out of household plans throughout this era; the mixed impact was -0.4 share factors. On web, the impression of the varied components predicted ESHI as a share of compensation grew by solely 0.3 share factors, nearly similar to the 0.2-percentage-point progress noticed over the 2005-2019 interval.

In brief, three main components – mixture well being expenditures, distribution of ESHI participation, and household plan enrollment – can clarify each the expansion in ESHI as a share of compensation between 1996-2005 in addition to the slowdown between 2005-2019. The most important driver of the ESHI-to-compensation ratio is NHE as a share of GDP. However fewer decrease earners with ESHI and a decline in household plan participation has positioned rising downward strain on the ratio.

Outlook for the Future: 2019-2031

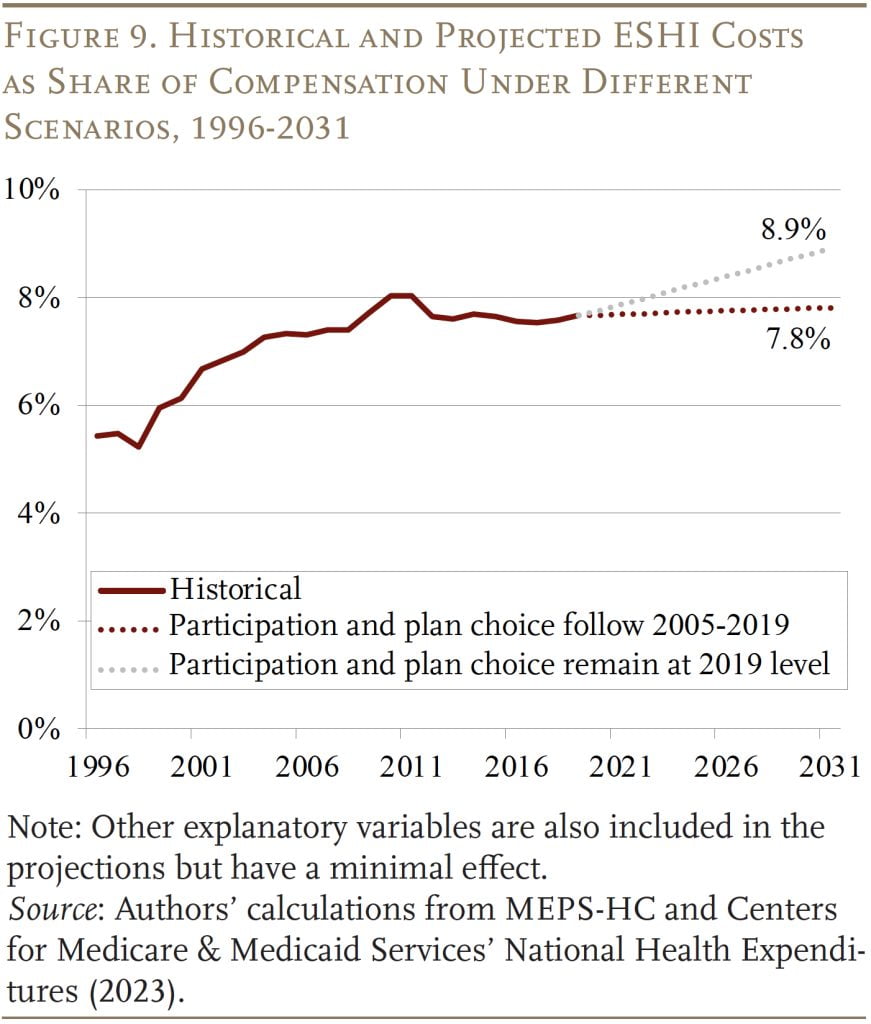

Projecting the ESHI-to-compensation ratio in 2031 requires projections for every of the contributing components. For a very powerful issue, NHE as a share of GDP, CMS supplies projections that incorporate the latest tendencies and potential legislative impacts. These estimates present that the NHE-to-GDP ratio will improve from 17.6 % in 2019 to 19.6 % in 2031. For the opposite two main components – ESHI participation and demand for household plans – our baseline assumption is that each will proceed to say no on the price noticed between 2005-2019.

The anticipated values for participation and plan kind are decided just by multiplying the coefficient estimate (common annual change) from the equation by 12 (variety of years from 2019 to 2031) and including it to the extent in 2019. For instance, the share of staff with a household plan declined by a mean of 0.2 share factors per yr over the interval 2005-2019. If this development continues, solely 21.7 % of staff would have a household plan in 2031. Comparable projections are made for all of the components that might have an effect on ESHI as a share of compensation. An alternate assumption is that ESHI participation and demand for household plans stay at 2019 ranges.

The projections underneath the 2 situations are proven in Determine 9. If latest declines in ESHI participation amongst lower-compensated staff and household plans proceed till 2031, the ratio of ESHI to compensation will stabilize at 7.8 %, largely cancelling out the impact of rising NHE/GDP in future years. In distinction, if latest tendencies have performed out in order that the declines in ESHI participation and household plan protection stay at 2019 ranges, the ratio of ESHI to compensation might improve to eight.9 %.

Conclusion

The rising value of employer contributions to worker medical health insurance was a significant cause for wage stagnation and the erosion of the Social Safety wage base. Each these results had been evident within the many years earlier than 2005, as ESHI elevated as a share of compensation. Thankfully, the ratio of ESHI contributions to compensation plateaued after 2005, stabilizing wages and halting the erosion of the share of labor compensation topic to Social Safety’s taxable base.

The expansion in NHE was the key driver of the ESHI-to-compensation ratio each earlier than and after 2005, however after 2005 this impression was largely offset by the decline in participation amongst decrease earners and the decline in demand for household plans. Wanting ahead, CMS tasks that NHE as a share of GDP will develop from 17.6 % in 2019 to 19.6 % in 2031. If nothing else adjustments, ESHI as a share of compensation will improve as properly. However, if ESHI participation and demand for household plans proceed to say no as they’ve lately, these two components ought to offset the expansion in healthcare expenditures and the ratio of ESHI to compensation ought to stay secure.

References

Company for Well being Analysis and High quality. Medical Expenditure Panel Survey, 1996-2019. Washington, DC: U.S. Division of Well being and Human Providers.

Burtless, Gary and Sveta Milusheva. 2013. “Results of Employer-Sponsored Well being Insurance coverage Prices on Social Safety Taxable Wages.” Social Safety Bulletin 73(1): 83-108.

Case, Anne and Angus Deaton. 2020. Deaths of Despair and the Way forward for Capitalism. Princeton, NJ: Princeton College Press.

Facilities for Medicare & Medicaid Providers. 2023. “Nationwide Well being Expenditure Knowledge.” Baltimore, MD: Analysis, Statistics, Knowledge & Programs.

Chen, Anqi, Alicia H. Munnell, and Diana Horvath. 2023. “How Will Employer Well being Insurance coverage Have an effect on Wages and Social Safety Funds?” Working Paper 2023-12. Chestnut Hill, MA: Middle for Retirement Analysis at Boston Faculty.

Chernew, Michael, David M. Cutler, and Patricia Seliger Keenan. 2005. “Growing Well being Insurance coverage Prices and the Decline in Insurance coverage Protection.” Well being Providers Analysis 40(4): 1021-1039.

Cooper, Philip F. and Barbara Steinberg Schone. 1997. “Extra Gives, Fewer Takers for Employment-Based mostly Well being Insurance coverage: 1987 and 1996.” Well being Affairs 16(6): 142-149.

Cutler, David M. 2002. “Equality, Effectivity, and Market Fundamentals: The Dynamics of Worldwide Medical-Care Reform.” Journal of Financial Literature 40(3): 881-906.

Farber, H. S. and H. Levy. 2000. “Latest Developments in Employer-Sponsored Well being Insurance coverage Protection: are Unhealthy Jobs Getting Worse?” Journal Well being Economics 19(1): 93-119.

Fronstin, Paul and S. C. Snider. 1996. “An Examination of the Decline in Employment-Based mostly Well being Insurance coverage Between 1988 and 1993.” Inquiry 33(4): 317-325.

Gabel, Jon, Larry Levitt, Erin Holve, Jeremy Pickreign, Heidi Whitmore, Kelley Dhont, Samantha Hawkins, and Diane Rowland. 2002. “Job-Based mostly Well being Advantages in 2002: Some Vital Developments.” Well being Affairs 21(5): 143-151.

Glied, Sherry and Kathrine Jack. 2003. “Macroeconomic Situations, Well being Care Prices, and the Distribution of Well being Insurance coverage.” Working Paper 10029. Cambridge, MA: Nationwide Bureau of Financial Analysis.

Groshen, Erica L. and Harry J. Holzer. 2019. “Enhancing Employment and Earnings in Twenty-First Century Labor Markets: An Introduction.” The Russell Sage Basis Journal of the Social Sciences 5(5): 1-19.

Gruber, Jonathan and Robin McKnight. 2003. “Why Did Worker Well being Insurance coverage Contributions Rise?” Journal of Well being Economics 22: 1085-1104.

Kaiser Household Basis. 2023. “Standing of State Medicaid Choices: Interactive Map.” San Francisco, CA.

Kronick, R. and T. Gilmer. 1999. “Explaining the Decline in Well being Insurance coverage Protection.” Well being Affairs 18(2): 30-47.