The temporary’s key findings are:

- State auto-IRA packages assist employees construct retirement financial savings, although contributors can withdraw their contributions with out taxes or penalties.

- However a brand new CRR survey of low- to moderate-income employees exhibits that solely 10 % would faucet such an account for an emergency.

- Most employees favor to maintain the financial savings intact for retirement and have misperceptions about taxes and penalties.

- Whether or not the withdrawal course of is described as “hard” or “easy” had little impact on withdrawals.

- However the “easy access” framing did make employees extra enthused about auto-IRAs, which might assist participation.

Introduction

The simplest technique to save for retirement is thru a workplace-based retirement plan, however many employees lack entry to at least one. To assist shut this hole, a lot of states have adopted packages that require employers and not using a plan to auto-enroll their employees in an Particular person Retirement Account (IRA).

These accounts use the Roth construction, so employees pay taxes on their contributions up entrance, permitting them to withdraw contributions at any time with out taxes or penalties. Such flexibility could also be particularly beneficial to lower-paid employees, who usually lack precautionary financial savings for emergencies. Nonetheless, a number of elements might stop them from taking cash out – a need to go away retirement financial savings intact, misperceptions about taxes and penalties, and the potential administrative trouble of withdrawing funds.

This temporary, which relies on a current paper, asks a bunch of low- and moderate-income employees whether or not they would faucet auto-IRA financial savings in an emergency and if not, why? It additionally exams whether or not the best way the withdrawal course of is described impacts employees’ withdrawal intentions.1

The dialogue proceeds as follows. The primary part gives background on the state packages. The second part summarizes the survey used on this evaluation. The third part presents the outcomes. The ultimate part concludes that many employees might keep away from tapping their auto-IRAs in an emergency on account of a need to maintain retirement financial savings intact and misperceptions about taxes and penalties. Describing account property as both tougher to faucet or extra simply accessible has little impression on withdrawal intentions, however the easy-access framing makes employees extra enthusiastic in regards to the auto-IRA, which might enhance participation in this system.

Background

At any cut-off date, solely about half of personal sector employees are lined by an employer-sponsored retirement plan and only a few save with out them.2 Within the absence of a federal resolution, states have taken the initiative. At present, ten states have carried out auto-IRA packages, whereas one other six are within the planning levels.3 Notably, the Roth construction of those IRAs implies that contributors can withdraw their contributions tax-free at any time, although their funding earnings could also be topic to taxes and/or penalties.4

Whereas auto-IRAs are meant for retirement saving, many contributors may benefit from the flexibility to withdraw their funds in an emergency.5 Auto-IRA contributors are inclined to have decrease incomes and fewer liquidity than their counterparts in conventional employer plans – so the flexibility to faucet their accounts might notably assist them keep away from utilizing high-cost types of borrowing. Recognizing this want for precautionary financial savings, one state auto-IRA program, MarylandSaves, diverts the primary $1,000 of contributions right into a separate account earmarked for emergencies.

For a number of causes, nevertheless, it stays unclear whether or not auto-IRA contributors will select to faucet their accounts when in want. First, except this system has an express precautionary financial savings part, contributors might take into account funds in an auto-IRA as earmarked for retirement and select to not take withdrawals.6 Second, employees might not perceive the excellence between Roth and conventional retirement accounts, which might cause them to overestimate the taxes and penalties for early withdrawals from auto-IRAs. Lastly, employees might discover it cumbersome to submit the paperwork to provoke withdrawals, particularly throughout an emergency. Including to this ambiguity, program web sites for the varied reside auto-IRA packages use totally different language to explain the withdrawal course of, with some packages seeming to encourage withdrawals greater than others.

Provided that the reside auto-IRA packages are nonetheless at an early stage, little real-world proof exists on participant withdrawal habits. Therefore, this research makes use of a survey to discover whether or not employees are probably to make use of auto-IRA accounts for precautionary financial savings and, if not, what are the explanations; it additionally exams whether or not the communications method issues.

Information and Methodology

The survey was administered by NORC on the College of Chicago to their nationally consultant AmeriSpeak panel. Members had been eligible if they’d revenue under $85,000 (the underside three quintiles of family revenue).7 The survey was fielded on-line in August 2023 and included 3,213 respondents who had been randomly assigned to 2 teams.8

Each teams had been requested whether or not they would withdraw funds from a hypothetical IRA in an emergency to cowl a $400 expense – a generally used benchmark of monetary fragility.9 Respondents who selected to not faucet their accounts had been requested why not. Lastly, all respondents had been requested how having some financial savings in an auto-IRA would have an effect on their monetary well-being.

The excellence between the 2 teams was that they got totally different descriptions of the method for withdrawing cash from the IRA. This design allowed us to check the impression of two totally different communication approaches on contributors’ meant withdrawals and enthusiasm for the auto-IRA.

Group 1: Taxes and Penalties. Respondents within the first group had been instructed to think about a hypothetical state of affairs wherein they’ve some financial savings in an IRA. They weren’t instructed that the account is a Roth; as a substitute, they had been knowledgeable that withdrawals might set off taxes and penalties.10 Respondents had been then requested how they might cowl a $400 emergency expense on this hypothetical state of affairs – which included the choice of “withdrawing money from my retirement plan/account.”

A number of of the reside auto-IRA packages have comparable wording about withdrawals on their web sites.11 Whereas this assertion is usually adopted by a clarification that contributors can all the time entry their contributions tax-free, having contributors first learn in regards to the potential for taxes and penalties might cause them to overestimate the price of withdrawing funds in an emergency and nudge them towards different, extra expensive coping methods comparable to taking up excessive interest-rate debt.

Group 2: Simple Entry. Respondents within the second group had been additionally requested to think about a hypothetical state of affairs with financial savings in an IRA. Nonetheless, the framing of the withdrawal course of for this group excluded any point out of taxes and penalties; as a substitute, respondents had been instructed that they might faucet their financial savings simply at any time by going surfing or calling a hotline. As earlier than, respondents had been then requested how they might cowl the $400 emergency expense on this state of affairs.

A few reside auto-IRA packages presently have comparable wording on their web sites.12 The inverse of Group 1, these packages first describe the withdrawal course of as “simple” then clearly clarify how contributions could also be withdrawn tax-free, whereas noting that funding earnings are handled otherwise.

Outcomes

This dialogue begins with the core train, which mixes the responses from the 2 teams to evaluate how many individuals intend to faucet their hypothetical IRA in an emergency and, for many who select to not, the the reason why.13 It then turns to the communications take a look at outcomes.

Utilizing Auto-IRAs as Precautionary Financial savings

The outcomes present that 10 % of all respondents reported that they might withdraw cash from their retirement account to cowl a $400 expense (see Determine 1).14 Unsurprisingly, lower-income respondents had been extra more likely to say they might faucet their retirement accounts.15

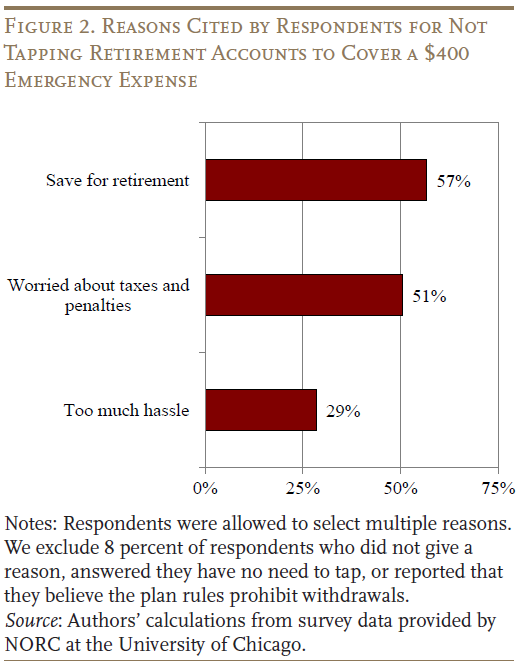

Members not tapping their accounts cited varied the reason why; once more, these outcomes are mixed for each teams (see Determine 2). The 2 most typical causes are wanting to avoid wasting the funds for retirement and worries about taxes and penalties. A smaller share of respondents take into account the withdrawal course of too difficult. Provided that many employees had been frightened in regards to the perceived tax implications of withdrawing, the following query is whether or not the wording of program communications (“Taxes and Penalties” vs. “Easy Access”) affected meant habits.

Taxes and Penalties vs. Simple Entry

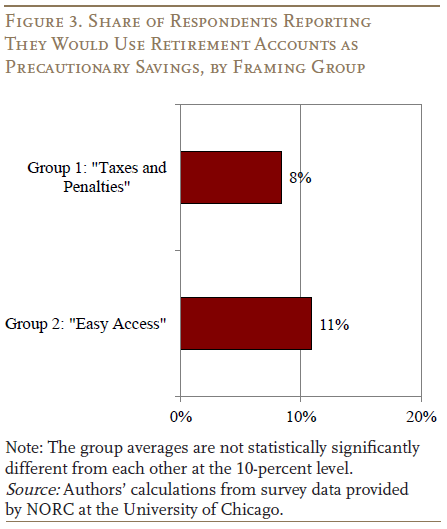

Opposite to expectations, framing the account as simply accessible didn’t appear to extend withdrawals – the distinction between the 2 teams just isn’t statistically vital (see Determine 3).16 Clearly, auto-IRA contributors want greater than a shift in language to divert them from acquainted types of borrowing in an emergency.

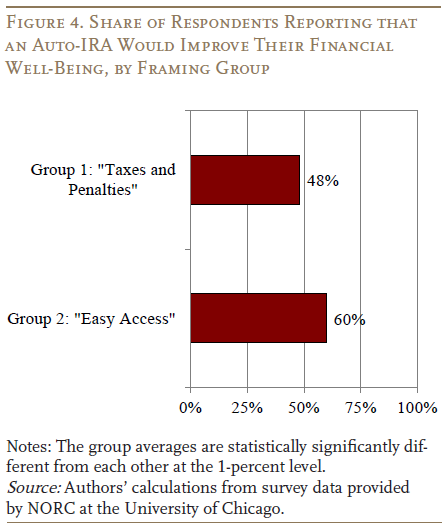

No matter whether or not employees view auto-IRAs as onerous or simple to entry, this system might assist them meet long-run saving objectives and really feel safer. Certainly, as proven in Determine 4, substantial shares of respondents in each teams mentioned that having some financial savings in an auto-IRA would enhance their monetary well-being (the remainder reported no impression).17 Whereas 48 % of respondents within the “Taxes and Penalties” group reported that having an auto-IRA would enhance their well-being, 60 % of these within the “Easy Access” group did so, and this distinction is statistically vital.

Conclusion

Auto-IRA packages present a retirement financial savings automobile for employees whose employer doesn’t supply one, and may serve a secondary objective as precautionary saving, serving to employees keep away from high-cost types of borrowing. Nonetheless, households might chorus from tapping their accounts in an emergency as a result of they wish to save for retirement, are frightened about perceived taxes and penalties, or assume the method will probably be an excessive amount of trouble.

Utilizing a survey focusing on low- to moderate-income employees, this temporary finds that 10 % of employees say that they might use auto-IRA financial savings to cowl an sudden $400 expense if they’d entry to this system. The first deterrents to tapping auto-IRAs are a need to avoid wasting for retirement and concern about perceived taxes and penalties. Describing auto-IRAs as simply accessible on program web sites might be not sufficient to alter withdrawal habits and divert contributors from acquainted types of borrowing. Nonetheless, in comparison with another framing that cautions of potential tax penalties from withdrawals, the easy-access framing does enhance employees’ enthusiasm for this system. Since contributors are extra happy once they consider they will entry their accounts simply, educating employees about this system’s Roth construction would possibly enhance take-up and in the end result in extra retirement financial savings.

References

Beshears, John, James J. Choi, Christopher Harris, David Laibson, Brigitte C. Madrian, and Jung Sakong. 2020. “Which Early Withdrawal Penalty Attracts the Most Deposits to a Commitment Savings Account?” Journal of Public Economics 183: 104144.

California State Treasurer. 2023. CalSavers 2023 Experiences. Sacramento, CA: CalSavers Retirement Financial savings Board.

Middle for Retirement Analysis at Boston School. 2015. “Report on the Design of Connecticut’s Retirement Security Program.” Particular Report. Chestnut Hill, MA.

Middle for Retirement Analysis at Boston School. 2024. Closing the Protection Hole. Chestnut Hill, MA.

Chalmers, John, Olivia S. Mitchell, Jonathan Reuter, and Mingli Zhong. 2021. “Auto-Enrollment Retirement Plans for the People: Choices and Outcomes in OregonSaves.” Working Paper 28469. Cambridge, MA: Nationwide Bureau of Financial Analysis.

Chen, Anqi. 2019. “Why Are So Many Households Unable to Cover a $400 Unexpected Expense?” Problem in Temporary 19-11. Chestnut Hill, MA: Middle for Retirement Analysis at Boston School.

Dushi, Irena, and Brad Trenkamp. 2021. “Improving the Measurement of Retirement Income of the Aged Population.” ORES Working Paper Sequence 116. Washington, DC: Social Safety Administration.

Georgetown Middle for Retirement Initiatives. 2024. State Program Efficiency Information – Present 12 months. Georgetown Middle for Retirement Initiatives.

Guttman-Kenney, Benedict, Paul D. Adams, Stefan Hunt, David Laibson, Neil Stewart, and Jesse Leary. 2023. “The Semblance of Success in Nudging Consumers to Pay Down Credit Card Debt.” Working Paper 31926. Cambridge, MA: Nationwide Bureau of Financial Analysis.

Illinois State Treasurer. 2023. Safe Selection Efficiency Dashboards. Springfield, IL.

Liu, Siyan and Laura D. Quinby. 2024. “Would Auto-IRAs Affect How Low-Income Households Cope with Emergency Expenses?” Working Paper 2024-11. Chestnut Hill, MA: Middle for Retirement Analysis at Boston School.

Oregon Retirement Financial savings Board. 2023. Month-to-month OregonSaves Program Information Experiences. Salem, OR: Oregon State Treasury.

Quinby, Laura D., Alicia H. Munnell, Wenliang Hou, Anek Belbase, and Geoffrey T. Sanzenbacher. 2020. “Participation and Preretirement Withdrawals in Oregon’s Auto-IRA.” Journal of Retirement 8(1): 8-21.

Sabelhaus, John. 2022. “The Current State of U.S. Workplace Retirement Plan Coverage.” Working Paper No. 2022-07. Philadelphia, PA: Wharton Pension Analysis Council of the College of Pennsylvania.

Scott, John, and Andrew Blevins. 2020. “Oregon State Retirement Program Growing during Pandemic—despite Some Worker Withdrawals.” The Pew Charitable Trusts. October 20, 2020.

Scott, John, and Mark Hines. 2022. “Many in Illinois Retirement Savings Program Feel Their Financial Security Is Improving.” The Pew Charitable Trusts. April 18, 2022.

Thaler, Richard H. 1985. “Mental Accounting and Consumer Choice.” Advertising Science 4: 199-214.

Thaler, Richard H. 1999. “Mental Accounting Matters.” Journal of Behavioral Choice Making 12(3): 183-206.

U.S. Board of Governors of the Federal Reserve System. Survey of Family Economics and Decisionmaking, 2022. Washington, DC.

U.S. Census Bureau. 2023. Present Inhabitants Survey Annual Social and Financial Complement. Washington, DC.