However over the past 4 years, the COLA has absolutely protected retirees.

The inflation information for August offers us a reasonably good thought in regards to the seemingly magnitude of Social Safety’s cost-of-living adjustment (COLA) for 2025. This automated indexing of advantages to maintain up with rising costs – all the time a beautiful function of our Social Safety program – has been notably priceless in mild of the latest bout of inflation.

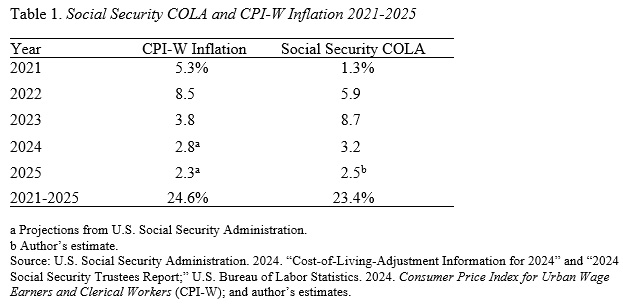

Because the COLA first impacts advantages paid after January 1, Social Safety must have figures out there earlier than the top of 2024. Because of this, the adjustment for 2025 will probably be based mostly on the rise within the CPI-W for the third quarter of 2024 over the third quarter of 2023. We all know the 2023 quantity (see Determine 1), however we’d like information for July, August, and September to calculate the third quarter common for 2024. For 2024, we now have the numbers for July and August. Assuming that the September enhance is much like that in July and August, the common for the third quarter of 2024 will probably be 308.8, which represents a 2.5-percent enhance over the third quarter of 2023. A COLA of two.5 p.c could be very near the two.6-percent projection within the 2024 Social Safety Trustees Report.

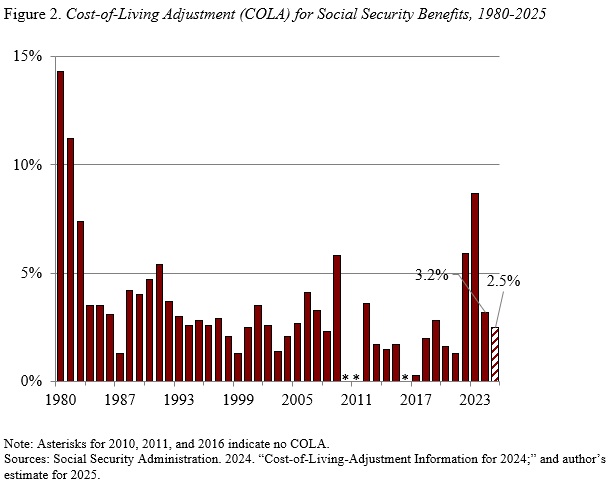

Some bemoan that this 12 months’s COLA is smaller than these prior to now few years (see Determine 2). However the adjustment is designed to compensate for rising costs, in order inflation drops, the magnitude of the required adjustment additionally falls.

When increased will increase had been required, Social Safety did its job. By design, the timing was not excellent – the COLA lagged when inflation took off, however then greater than compensated as inflation slowed (see Desk 1). The essential level, nonetheless, is that over the complete interval, the Social Safety COLA has absolutely protected retirees from the rise within the CPI-W.

Social Safety’s COLA is likely one of the most beneficial features of this system’s design. It has all the time supplied invaluable safety. Even an inflation charge as little as 2 p.c cuts the buying energy of a $1,000 profit to $600 over a 25-year retirement. The COLA prevents that erosion. However the lack of drama signifies that the COLA goes unappreciated. The one good factor that could be stated in regards to the present inflation spike – which is dangerous for all features of our lives – is that it has highlighted the worth of getting retirement advantages that sustain with costs.