One of many investing methods rising in recognition with the rich is Direct Indexing. Earlier than my consulting stint at a fintech startup in 2024, I had by no means actually heard of Direct Indexing. If I did, I probably assumed it merely meant instantly investing in index funds, which many people already do.

Nevertheless, Direct Indexing is extra than simply shopping for index funds. It’s an funding technique that permits traders to buy particular person shares that make up an index quite than shopping for a standard index fund or exchange-traded fund (ETF). This strategy permits traders to instantly personal a custom-made portfolio of the particular securities inside the index, offering higher management over the portfolio’s composition and tax administration.

Let us take a look at the advantages and downsides of Direct Indexing to get a greater understanding of what it’s. In a means, Direct Indexing is solely a brand new approach to bundle and market funding administration companies to purchasers.

Advantages of Direct Indexing

- Personalization: Direct Indexing means that you can align your portfolio together with your particular values and monetary objectives. For instance, you possibly can exclude all “sin stocks” out of your portfolio if you want.

- Tax Optimization: This technique affords alternatives for tax-loss harvesting that will not be out there with conventional index funds. Tax-loss harvesting helps decrease capital features tax legal responsibility, thereby boosting potential returns.

- Management: Buyers have extra management over their investments, permitting them to handle their publicity to specific sectors or firms. As an alternative of following the S&P 500 index managers’ selections on firm choice and weighting, you possibly can set sector weighting limits, for instance.

Drawbacks of Direct Indexing

- Complexity: Managing a portfolio of particular person shares is extra complicated than investing in a single fund. Due to this fact, most traders don’t do it themselves however pay an funding supervisor to deal with it, which ends up in further charges.

- Price: The administration charges and buying and selling prices related to Direct Indexing may be increased than these of conventional index funds or ETFs, though these prices could also be offset by tax advantages.

- Minimal Funding: Direct Indexing typically requires the next minimal funding, making it much less accessible for some traders.

- Efficiency Uncertainty: It is exhausting to outperform inventory indices just like the S&P 500 over the long run. The extra an investor customizes with Direct Indexing, probably, the higher the underperformance over time.

Who Ought to Take into account Direct Indexing?

Direct indexing is especially suited to high-net-worth people, these in increased tax brackets, or traders searching for extra management over their portfolios and prepared to pay for the customization and tax advantages it affords.

For instance, in case you are within the 37% marginal revenue tax bracket, face a 20% long-term capital features tax, and have a internet price of $20 million, you may need robust preferences on your investments. Suppose your mother and father had been hooked on tobacco and each died of lung most cancers earlier than age 60; because of this, you’d by no means wish to personal tobacco shares.

An funding supervisor might customise your portfolio to carefully observe the S&P 500 index whereas excluding all tobacco and tobacco-related shares. They may additionally usually conduct tax-loss harvesting to assist decrease your capital features tax legal responsibility.

Nevertheless, in case you are in a tax bracket the place you pay a 0% capital features tax charge and do not have particular preferences on your investments, direct indexing could not justify the extra price.

This state of affairs is much like how the mortgage curiosity deduction was extra advantageous for these in increased tax brackets earlier than the SALT cap was enacted in 2018. Whether or not the SALT cap shall be repealed or its $10,000 deduction restrict elevated stays to be seen, particularly given its disproportionate affect on residents of high-cost, high-tax states.

Extra Individuals Will Acquire Entry to Direct Indexing Over Time

Fortunately, you don’t have to be price $20 million to entry the Direct Indexing technique. In the event you’re a part of the mass prosperous class with $250,000 to $2 million in investable property, you have already got sufficient. As extra fintech firms develop their product choices, much more traders will have the ability to entry Direct Indexing.

Simply as buying and selling commissions ultimately dropped to zero, it’s solely a matter of time earlier than Direct Indexing turns into broadly out there to anybody . Now, if solely actual property commissions might hurry up and in addition turn out to be extra cheap.

Which Funding Managers Supply Direct Indexing

So that you consider in the advantages of Direct Indexing and need in. Under are the varied corporations that provide Direct Indexing companies, the minimal it is advisable get began, and the beginning payment.

As you possibly can see, the minimal funding quantity to get began ranges from as little as $100,000 at Charles Schwab and Constancy to $250,000 at J.P. Morgan, Morgan Stanley, and different conventional wealth manages.

In the meantime, the beginning payment ranges between 0.20% to 0.4%, which can get negated by the extra funding return projected by way of direct indexing tax administration. The payment is often on high of the fee to carry an index fund or ETF (minimal) or inventory (zero).

Now that we’re conscious of the number of corporations providing Direct Indexing, let’s delve deeper into the tax administration facet. The advantages of personalization and management are easy: you set your funding parameters, and your funding managers will try to take a position based on these tips.

Understanding Tax-Loss Harvesting

Tax-loss harvesting is a method designed to scale back your taxes by offsetting capital features with capital losses. The higher your revenue and the wealthier you get, usually, the higher your tax legal responsibility. Rationally, all of us wish to preserve extra of our hard-earned cash than giving it away to the federal government. And the extra we disagree with the federal government’s insurance policies, the extra we are going to wish to decrease taxes.

Fundamental tax-loss harvesting is comparatively easy and may be performed independently. As your revenue will increase, triggering capital features taxes—extra superior strategies turn out to be out there, typically requiring a portfolio administration payment.

Fundamental Tax-Loss Harvesting

Every year, the federal government means that you can “realize” as much as $3,000 in losses to scale back your taxable revenue. This discount instantly decreases the quantity of taxes you owe.

For instance, should you invested $10,000 in a inventory that depreciated to $7,000, you may promote your shares at $7,000 earlier than December thirty first to scale back your taxable revenue by $3,000. You possibly can carry over $3,000 in annual losses till it’s exhausted.

Anyone who does their very own taxes or has somebody do their taxes for you possibly can simply conduct fundamental tax-loss harvesting.

Superior Tax-Loss Harvesting

Superior tax-loss harvesting, nonetheless, is barely extra sophisticated. It might’t be used to scale back your revenue instantly, however it may be utilized to cut back capital features taxes.

For example, should you purchased a inventory for $100,000 and offered it for $150,000, you’d have a realized capital achieve of $50,000. This achieve could be topic to taxes primarily based in your holding interval:

- Brief-term capital features: If the inventory was held for lower than a yr, the achieve could be taxed at your marginal federal revenue tax charge, which is identical charge as your common revenue.

- Lengthy-term capital features: If the holding interval exceeds one yr, the achieve could be taxed at a decrease long-term capital features charge, which is usually extra favorable than your marginal charge.

To mitigate capital features taxes, you possibly can make the most of tax-loss harvesting by promoting a inventory that has declined in worth to offset the features from a inventory that has appreciated. There is no such thing as a restrict on how a lot in features you possibly can offset with realized losses. Nevertheless, when you promote a inventory, you have to wait 30 days earlier than repurchasing it to keep away from the “wash sale” rule.

When To Use Tax-Loss Harvesting

Within the instance above, to offset $50,000 in capital features, you would wish to promote securities at a loss inside the identical calendar yr. The deadline for realizing these losses is December thirty first, guaranteeing they will offset capital features for that particular yr.

For example, should you had $50,000 in capital features in 2023, promoting shares in 2024 with $50,000 in losses would not eradicate your 2023 features. The capital features tax would nonetheless apply when submitting your 2023 taxes. To offset the features in 2023, you’d have wanted to promote shares in 2023 with $50,000 in losses.

Nevertheless, as an example you had $50,000 in capital features after promoting inventory in 2024. Even should you did not incur any capital losses in 2024, you may use capital losses from earlier years to offset these features.

Sustaining correct data of those losses is essential, particularly should you’re managing your personal investments. In the event you rent an funding supervisor, they are going to monitor and apply these losses for you.

Essential Level: Capital Losses Can Be Carried Ahead Indefinitely

In different phrases, capital losses may be carried ahead indefinitely to offset future capital features, offered they have not already been used to offset features or cut back taxable revenue in prior years.

Throughout a number of years in my 20s, I used to be unaware of this. I mistakenly believed that I might solely carry over a $3,000 loss to deduct towards my revenue every year. Because of this, I paid 1000’s of {dollars} in capital features taxes that I did not must pay. If I had a wealth supervisor to help me with my investments, I might have saved a big amount of cash.

Whereas the best holding interval for shares could also be indefinite, promoting often may help fund your required bills. Tax-loss harvesting goals to reduce capital features taxes, enhancing your total return and offering extra post-tax shopping for energy.

The upper your revenue tax bracket, the extra helpful tax-loss harvesting turns into.

Tax Bracket Impression And Direct Indexing

Your marginal federal revenue tax bracket instantly influences your tax legal responsibility. Shielding your capital features from taxes turns into extra advantageous as you progress into increased tax brackets.

For example, in case your family revenue is $800,000 (high 1% revenue), putting you within the 37% federal marginal revenue tax bracket, a $50,000 short-term capital achieve from promoting Google inventory would end in an $18,500 tax legal responsibility. Conversely, a $50,000 long-term capital achieve could be taxed at 20%, amounting to a $10,000 tax legal responsibility.

Now, as an example your married family earns a middle-class revenue of $80,000, putting you within the 12% federal marginal revenue tax bracket. A $50,000 short-term capital achieve from promoting Google inventory would incur an $11,000 tax legal responsibility—$7,500 lower than should you had been making $800,000 a yr. In the meantime, a $50,000 long-term capital achieve could be taxed at 15%, or $7,500.

Normally, attempt to maintain securities for longer than a yr to qualify for the decrease long-term capital features tax charge. Because the examples illustrate, the upper your revenue, the higher your tax legal responsibility, making direct indexing and its tax administration methods extra helpful.

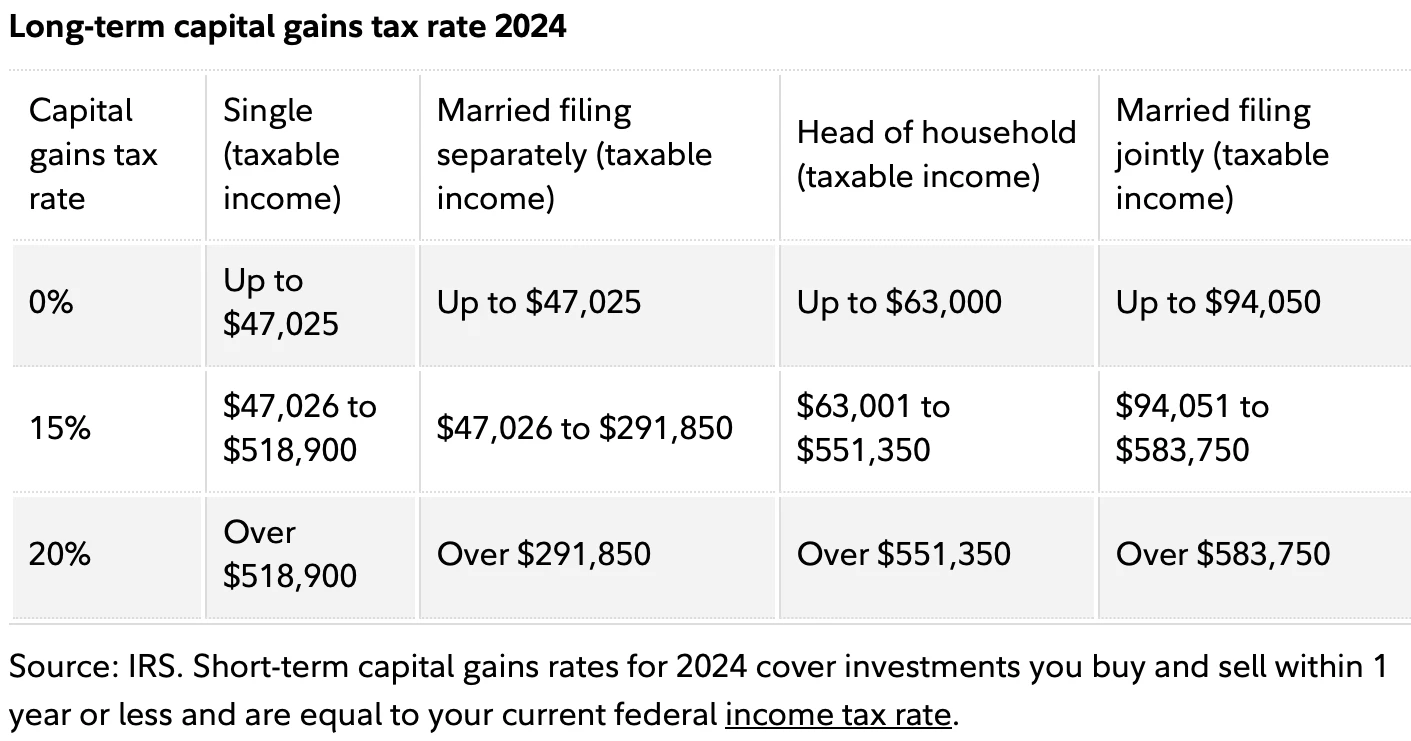

Under are the revenue thresholds by family kind for long-term capital features tax charges in 2024.

Restrictions and Guidelines for Tax-Loss Harvesting

Hopefully, my examples clarify the advantages of tax-loss harvesting. For large capital features and losses, tax-loss harvesting makes a number of sense to enhance returns. I am going to at all times bear in mind dropping huge bucks on my investments, and utilizing these losses to salvage any future capital features.

Nevertheless, tax-loss harvesting can get sophisticated in a short time should you have interaction in lots of transactions over time. By December thirty first, it is advisable resolve which underperforming shares to promote to offset capital features and decrease taxes. That is the place having a wealth advisor managing your investments turns into extra helpful.

For do-it-yourself traders, the problem lies within the time, expertise, and information wanted for efficient investing. In the event you plan to have interaction in tax-loss harvesting, let’s recap the necessities to make issues crystal clear.

Annual Tax Deduction Carryover Restrict is $3,000

- If in case you have $50,000 in capital losses and $30,000 in whole capital features for the yr, you should use $30,000 in capital losses to offset the corresponding features, leaving you with $20,000 in remaining capital loss.

- You possibly can carry over the remaining $20,000 in losses indefinitely to offset future features. In years with out capital features, you should use your capital loss carryover to deduct as much as $3,000 a yr towards your revenue till it’s exhausted.

No Expiration Date on Capital Losses

- If in case you have $90,000 in capital losses from promoting shares throughout a bear market and 0 capital features that yr, you possibly can carry these losses ahead to offset future revenue or capital features. Happily, capital losses by no means expire.

The Wash Sale Rule Nullifies Tax-Loss Harvesting Advantages

- A loss is disallowed if, inside 30 days of promoting the funding, you or your partner reinvest in an similar or “substantially similar” inventory or fund.

Losses Should First Offset Beneficial properties of the Identical Kind

- Brief-term capital losses should first offset short-term capital features, and long-term capital losses should offset long-term features. If losses exceed features, the remaining capital-loss stability can offset private revenue as much as a restricted quantity. For detailed recommendation, seek the advice of a tax skilled.

Direct Indexing Conclusion

Personalization, management, and tax optimization are the important thing advantages of Direct Indexing. With this strategy, you do not have to spend money on sectors or firms that do not align together with your beliefs. Nor do it’s important to blindly observe the sector weightings of an index fund or ETF as they alter over time. This represents the personalization and management features of Direct Indexing.

In the event you’re targeted on return optimization, the tax-loss harvesting function of Direct Indexing is most tasty. In line with researchers at MIT and Chapman College, tax-loss harvesting yielded an further 1% annual return on common from 1928 to 2018. Even when Direct Indexing prices as much as 0.4% yearly, the advantages of tax-loss harvesting nonetheless outweigh the fee.

The easiest way to keep away from paying capital features taxes is to chorus from promoting. Borrow out of your property like billionaires to pay much less taxes. Nevertheless, when it is advisable promote shares to reinforce your life, bear in mind the benefits of tax-loss promoting, as it might probably considerably cut back your tax liabilities.

Direct Indexing affords a compelling approach to optimize returns by way of tax-loss harvesting and portfolio customization. As tax legal guidelines turn out to be extra complicated and traders search methods to align their portfolios with private values, Direct Indexing offers a robust instrument for each superior and on a regular basis traders.

Reader Questions

Have you ever used the technique of Direct Indexing earlier than? Was this the primary time you’ve heard of it? Do you suppose the advantages of tax-loss harvesting justify the extra charges related to Direct Indexing? I consider that ultimately, Direct Indexing will turn out to be out there to a broader viewers at a decrease price.

With inventory market volatility returning and a possible recession looming, it is extra essential than ever to get a monetary checkup. Empower is at the moment providing a free monetary session with no obligation for a restricted time.

If in case you have over $250,000 in investable property, do not miss this chance. Schedule an appointment with an Empower skilled right here. Full your two video calls with the advisor earlier than October 31, 2024, and you will obtain a free $100 Visa reward card. There is no such thing as a obligation to make use of their companies after.

Empower affords a proprietary indexing methodology known as Good Weighting to its purchasers. Good Weighting samples particular person U.S. shares to create an index that equally weights financial sector, fashion, and measurement. The aim is to attain a greater risk-adjusted return.

The assertion is offered to you by Monetary Samurai (“Promoter”) who has entered right into a written referral settlement with Empower Advisory Group, LLC (“EAG”). Click on right here to study extra.