We’re approaching the top of the 12 months, so now’s the time to make plans to save lots of in your taxes and affect your tax state of affairs.

I am not speaking about going Donald Trump-style and shedding plenty of cash to offset your features. I am speaking about some sensible actions you’ll be able to take in the present day that can decrease your tax invoice for the 12 months.

So, with out shedding a bunch of cash, listed here are ten alternative ways you can save in your taxes earlier than the top of the 12 months.

1. Increase Your 401k Contribution

Top-of-the-line methods to save lots of in your tax invoice in the present day is to contribute to your 401k or 403b. These accounts mean you can save pre-tax cash for retirement. The end result? You pay much less in taxes in the present day as a result of the cash grows tax free till you withdraw it in retirement.

For 2024, the 401k contribution restrict is $23,000, however in the event you’re over 50 years outdated, you can also make a further $7,500 catch up contribution.

In case you’re not on the restrict but, including to your 401k is an effective way to economize AND save in your taxes.

And bear in mind, the 401k contribution limits change every year, so verify them out right here: 401k Contribution Limits.

2. Max Out Your Conventional IRA

Alongside the identical strains as a 401k, you’ll be able to contribute to a conventional IRA and decrease your taxable earnings. Deciding whether or not to contribute to a Roth or Conventional IRA might be robust, however in the event you’re interested by simply this 12 months’s taxes, then utilizing a conventional is the way in which to go.

For 2024, you’ll be able to contribute $7,000 to an IRA in the event you’re underneath age 50, and $8,000 in the event you’re over age 50.

And bear in mind, whereas there are not any earnings limits to contribute to a conventional IRA, there are earnings limits that may stop you from deducting your contribution.

Be taught in regards to the IRA contribution and limits right here.

3. Max Out Your SEP IRA Or Solo 401k

In case you’re a facet hustler, it is important that you simply reap the benefits of a SEP IRA or Solo 401k to decrease your taxable earnings. Facet hustles are nice (and this is a listing of fifty you’ll be able to strive), but it surely’s necessary to do not forget that most of that earnings would not have taxes withheld, so you are going to face a big tax invoice in your facet hustle cash.

By contributing to a SEP IRA or Solo 401k, you’ll be able to defer a few of that cash into the long run and keep away from paying taxes on it in the present day. It is an effective way to, not solely save, however to decrease your tax invoice this 12 months.

Contributing to a SEP IRA is simple, and you are able to do so all the way in which till April 15. Establishing a solo 401k is a bit tougher, and you need to have your plan setup by the top of the 12 months to have the ability to contribute to it. However it’s also possible to save a LOT extra money.

In 2024, with a SEP IRA, it can save you 25% of your earnings, as much as $69,000 per 12 months. With a Solo 401k, it can save you as much as $69,000 per 12 months as properly!

4. Max Out Your HSA

We’re large followers of utilizing your Well being Financial savings Account to save lots of for retirement. If in case you have the flexibility to max out your HSA this 12 months, just be sure you contribute as a lot as doable. And bear in mind, in the event you can afford it, do not get your reimbursements this 12 months. Save your receipts and let the cash in your HSA develop for you.

A reminder – the HSA is like your IRA, and you’ll really make your 2024 contributions all the way in which till April 15, 2025.

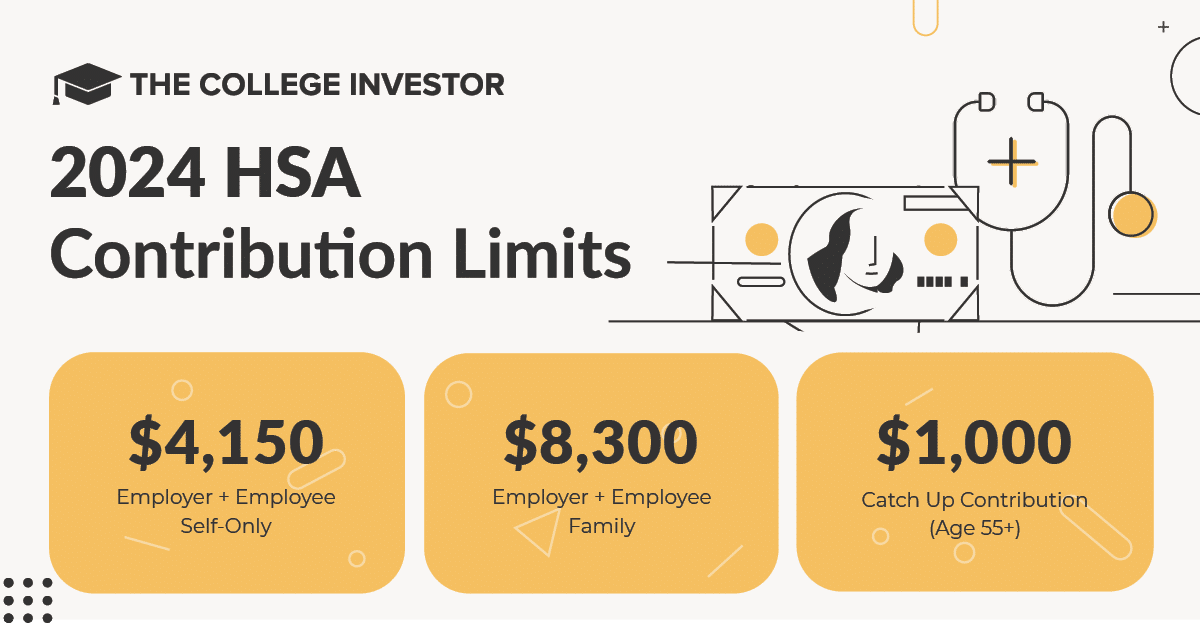

In 2024, you’ll be able to contribute as much as $4,150 in the event you’re single, and $8,300 in the event you’re a household. In case you’re over 55, you additionally get a $1,000 catch-up contribution. Learn the total HSA Contribution Limits right here.

5. Save For Your Kids’s School

Contributing to your kid’s 529 plan is an effective way to save lots of for school, but it surely’s additionally a possible tax profit to you. In case you reside in one of many 32 states that provides tax deferred 529 plan contributions, this may be an effective way to decrease your state earnings tax invoice.

Whereas the Federal authorities would not supply any deductions for contributing to a 529, many states do.

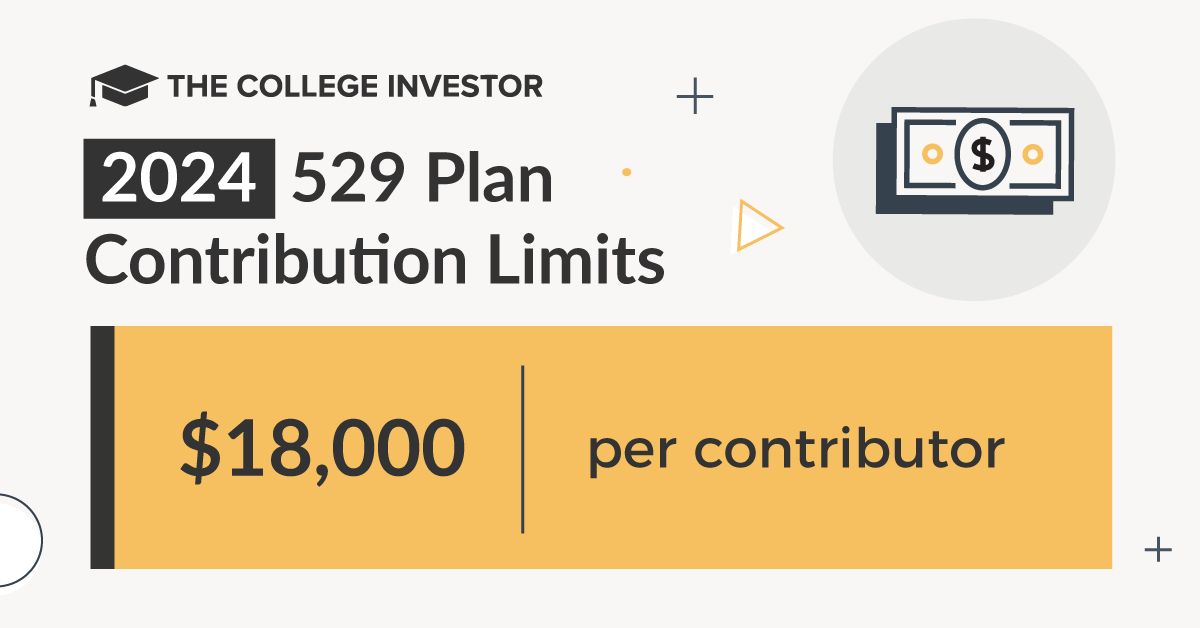

Contributions to a 529 plan are thought-about presents, and so the boundaries for contribution are based mostly on the reward tax exemption.

You’ll be able to contribute as much as $18,000 per youngster, per 12 months, per individual gifting. So, married {couples} might contribute $36,000 per youngster, per 12 months. There’s additionally a 5 12 months contribution rule, the place you may give a full $90,000 per youngster in a single lump sum, and it counts as a contribution for the following 5 years.

Be taught extra about 529 Plan Contribution Limits right here.

6. Make Vitality Environment friendly Enhancements To Your House

In case you make vitality environment friendly enhancements to your own home, you’ll be able to qualify for tax credit that may aid you save in your taxes this 12 months.

In 2024, you’ll be able to rise up to $3,200 in tax credit, relying on what you do.

The utmost credit score you’ll be able to declare this 12 months is:

- $1,200 for vitality property prices and sure vitality environment friendly dwelling enhancements, with limits on doorways ($250 per door and $500 complete), home windows ($600) and residential vitality audits ($150)

- $2,000 per 12 months for certified warmth pumps, biomass stoves or biomass boilers

All of those credit will help you offset your earnings and might present nice financial savings. Be taught extra about these tax credit right here.

7. Maximize Your Work-Associated Expense Deductions

The actual fact is, most individuals are horrible about protecting observe of their bills. I am not saying that you must spend extra so you’ll be able to deduct your bills – I am merely saying it’s worthwhile to maintain observe and deduct what’s right.

Some work associated deductions you can probably take:

- Transportation and journey – mileage is one which lots of people miss or neglect to calculate

- Meals and leisure

- Union {and professional} dues

- Uniforms, in case your employer would not reimburse you they usually cannot be worn outdoors of labor

- Work-related academic bills, particularly if persevering with training is required by your job

The identical guidelines apply in the event you work for your self. For instance, in the event you drive for Uber or Lyft, you ought to be protecting correct observe of your mileage and bills associated to driving. These will all offset your earnings and assist decrease your tax invoice.

So, maintain observe of your bills and get monetary savings.

8. Donate To Charity

One other nice method to save is just by donating to charity. Your donations of each money and issues might be deducted out of your taxes. Nevertheless, for 2024, there is no such thing as a method to declare charitable contributions with out itemizing your tax return.

So, proper now, begin performing some fall cleansing, get organized, and see what you do not want anymore. Some guidelines of thumb embrace:

- Garments you have not worn in a 12 months

- Previous youngsters’s garments or toys they do not use anymore

- Objects sitting in your storage unused for a 12 months

Take these things to an area charity, save your receipt, and deduct your donation in your tax return.

9. Promote Your Loser Shares…

Now, I do know I discussed up prime to not be a loser like Donald Trump and take large losses merely to keep away from taxes. However…even good buyers have poor performing shares. Now’s a good time to have a look at your portfolio and promote some losers to take the capital loss.

This technique is named tax loss harvesting.

It may be an efficient technique, particularly if in case you have loads of capital features in your portfolio from earlier within the 12 months.

Once you do it, ensure you’re being aware of the capital features tax brackets.

However on the flip facet…

10. Wait To Rebalance Your Portfolio

This sounds odd, however wait till the brand new 12 months to rebalance your portfolio. You see, many mutual funds and ETFs pay out their dividends and capital features in December. In case you promote your losers on the finish of the 12 months, merely wait till January earlier than deploying that cash.

In case you purchase right into a mutual fund or ETF proper earlier than the distribution, you’re successfully shopping for your self a tax burden. Because the distributions are part of the Web Asset Worth (NAV) anyway, you are not lacking a lot by ready only a couple weeks.

This is our information to rebalancing your portfolio throughout a number of accounts.

Issues To Think about For Subsequent 12 months

There are some belongings you simply cannot change this 12 months (possibly you’ve got already bought some shares or had different features), however proper now’s usually open enrollment for many individuals. And which means there are modifications you can make for subsequent 12 months.

If decreasing your taxable earnings is a objective for you, contemplate making these modifications throughout open enrollment:

- Maximize Your 401k Contribution

- Select a Excessive Deductible Well being Care Plan with an HSA

- Maximize Your HSA

- If in case you have youngsters, reap the benefits of a Dependent Spending Account for youngster care prices

- In case you commute to work, contemplate a Transportation Spending Account if eligible

What else? What are you doing to decrease your taxable earnings every year?