For those who drop a category or drop out of school, you’ll have to repay all or a part of the monetary help you obtained. How a lot relies on the kind of monetary help and whenever you dropped the category or left college.

Regardless that the Federal Pell Grant is a grant that usually doesn’t must be repaid, you’ll have to repay all or a part of it in sure circumstances.

And let’s face it, even the perfect college students might drop a category right here and there. So this is what you could know in regards to the impression in your monetary help should you drop a category and even drop out.

Dropping a Class

Dropping a category might have an effect on your enrollment standing. Modifications in your enrollment standing might have an effect on your monetary help eligibility, relying on whenever you dropped the category.

In case you are now not enrolled full-time, the Federal Pell Grant quantity could also be decreased in proportion to your enrollment standing. The proration choices embrace full-time, three-quarters time, half-time and fewer than half-time.

Twelve credit a semester is taken into account full-time for federal scholar help functions. That is despite the fact that you must take 15 credit a semester so as to graduate inside 4 years for an undergraduate Bachelor’s diploma.

Eligibility for scholar loans just isn’t prorated, as long as you might be enrolled on at the very least a half-time foundation. In case you are enrolled at the very least half-time, you’ll be able to borrow the complete mortgage limits. For those who drop under half-time enrollment, nonetheless, you lose eligibility for federal scholar loans fully and your present loans might enter compensation.

This is How Timing Issues

For those who drop a category…

- Earlier than the beginning of the semester and earlier than monetary help is disbursed: Your monetary help might be adjusted earlier than disbursement and you’ll not owe a refund of your monetary help.

- After monetary help has been disbursed however earlier than your faculty’s add/drop deadline: your monetary help might be adjusted. Then, you might be required to repay all or a part of the monetary help you obtained.

- After monetary help has been disbursed and after the add/drop deadline: Your monetary help will not be adjusted. You should still owe tuition. At most schools, you don’t get a tuition refund should you drop a category after the add/drop date.

Faculty is dear. Listed here are methods to pay for it.

What To Do As soon as You Drop Out of School

For those who drop out of school, there’s a difficult algorithm known as Return of Title IV (R2T4) that specify how the withdrawal impacts your eligibility for federal scholar help.

The next abstract covers simply the necessities.

Federal scholar help is earned on a proportional foundation up till 60% of the way in which via the semester, at which level you might be thought of to have earned 100% of your monetary help.

Any unearned help should be repaid. For those who withdraw after reaching the 60% level, your federal scholar help is not going to need to be returned to the federal authorities. Study extra about when you must repay grants.

Federal loans should be returned earlier than grants. The purpose is to go away the coed who withdraws with as little debt as potential.

Observe that the faculty’s refund coverage doesn’t essentially match the R2T4 guidelines. Many schools don’t present refunds if a scholar drops out after the add/drop date.

Will You Need to Repay Your Pupil Loans?

For those who drop out of school or drop under half-time enrollment, you’ll have to begin making funds in your scholar loans. Your loans will enter compensation six months after you graduate, drop out of school or drop under half-time enrollment.

For those who re-enroll in faculty on at the very least a half-time foundation, you received’t need to make funds in your federal scholar loans. It’s because your federal scholar loans will as soon as once more be in an in-school deferment. For those who re-enroll throughout the six-month grace interval, your grace interval might be restored.

For those who wrestle to make funds in your scholar loans, there are just a few choices for coping with monetary problem, some short-term and a few long-term.

- Brief-term: Financial hardship deferment, unemployment deferment and basic forbearances. The deferments and forbearances droop compensation for as much as three years every. Curiosity might proceed to accrue.

- Lengthy-term:

Earnings-driven compensation plans, which base the month-to-month fee in your earnings versus the quantity you owe. Earnings-driven compensation plans typically yield a decrease month-to-month fee than prolonged or graduated compensation.

What If You Need to Repay Monetary Assist?

If you must repay your Federal Pell Grant, you should have 45 days to repay the overpayment or make passable compensation preparations.

Failing to repay the Federal Pell Grant might have an effect on your skill to return to varsity or to qualify for extra monetary help. Some schools will withhold your educational transcripts and diplomas should you owe a debt to the faculty and haven’t made passable compensation preparations.

Passable Educational Progress (SAP)

Dropping courses might have an effect on your future eligibility for federal scholar help.

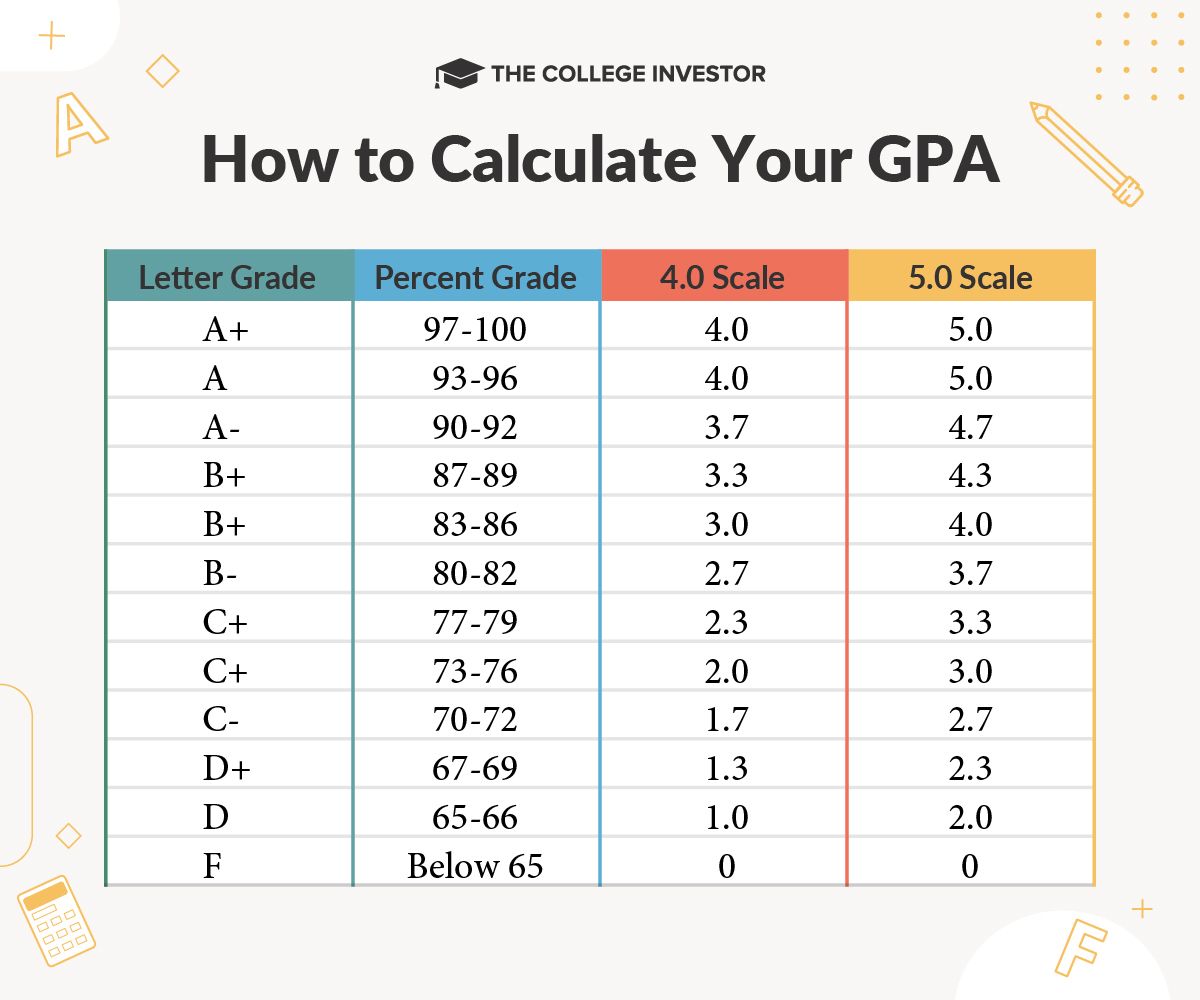

You need to preserve Passable Educational Progress (SAP) to be eligible for federal scholar help. SAP requires you to take care of at the very least a 2.0 GPA on a 4.0 scale.

It additionally requires you to be taking and passing sufficient courses to be on monitor to graduate inside 150% of the conventional time frame on your diploma (e.g., inside 6 years for a Bachelor’s diploma and inside 3 years for an Affiliate’s diploma).

Dropping courses might trigger you to now not make SAP, jeopardizing future help eligibility.

What to Do Earlier than You Drop a Class or Drop Out

Earlier than you drop a category or drop out, contact the faculty’s monetary help workplace to ask in regards to the impression in your monetary help.

You must also discover different choices moreover dropping a category or dropping out. Most schools have educational assist providers, similar to free tutoring, writing facilities and educational counseling facilities, that may assist you to take care of educational challenges.

The monetary help workplace may additionally supply emergency monetary help funds in case you are pondering of dropping out due to cash issues. The purpose of emergency help is to assist maintain you at school, in order that small monetary issues don’t escalate.

Steadily Requested Questions

What occurs should you fail a category? Do you must repay your grants?

For those who fail a category, you don’t need to repay your grants. It is just should you drop a category or drop out of school that you’ll have to repay your grants.

For those who fail a category, nonetheless, you might lose eligibility for future grants in case you are now not sustaining Passable Educational Progress.

For those who fail a category, you do need to make funds in your scholar loans after you graduate or drop under half-time enrollment, the identical as should you handed the category. You don’t get a refund for failing a category.

Can I get a Federal Pell Grant at a couple of faculty?

You can not get a Federal Pell Grant at two schools on the similar time. For those who occur to obtain a Federal Pell Grant at two or extra schools, you’ll have to repay the additional Federal Pell Grants. When a scholar receives two or extra Federal Pell Grants on the similar time, it’s flagged in a federal database that tracks the federal grants and loans obtained by every scholar and the faculty monetary help directors might be notified.

What about personal scholarships?

Personal scholarships have their very own guidelines. Some scholarships undertake guidelines like those for federal scholar help. Others require you to repay the cash in-full should you drop out. Verify with the personal scholarship supplier for his or her guidelines.