Should you make $60,000 per 12 months, what do you truly take house? You already know it isn’t the complete $60,000. However, if you’re within the 22% tax bracket, does that imply you’ll pay $13,200 in taxes? That might appear to be the intuitive reply since $60,000 multiplied by 0.22 equals $13,200.

However, in reality, what you’ll pay in earnings taxes will most likely be a lot decrease than that. To grasp why, you want to perceive the distinction between marginal tax charges and efficient tax charges which we’ll clarify on this article.

Nonetheless, calculating your earnings tax funds alone does not provide you with a real image of how a lot you will actually pay in taxes this 12 months. There are a number of different issues to think about if you wish to what you successfully pay in taxes as a proportion of your take-home pay. On this article, we’ll clarify discover out what you’re actually taking house in earnings.

Federal And State Taxes

All through this information, we’re going to make use of somebody incomes $60,000 per 12 months as our pattern case. That’s $5,000 per thirty days. We all know that isn’t their take-home pay. However what are they really taking house as soon as federal and state taxes come into play?

To maintain the instance easy, we’ll solely regulate for the usual deduction. Additionally, we’ll assume it is a single, wage-earning individual of their mid-30s (i.e., not retired). We first must know what tax bracket this individual falls into. For 2024, the federal tax brackets are:

You’d assume that our pattern taxpayer would fall into the 22% tax bracket based mostly on their earnings of $60,000. Nonetheless, efficient tax charges, aren’t calculated by merely multiplying earnings ($60,000) by tax bracket (22%). No, discovering efficient tax charges is a bit more complicated than that.

In reality, they’d truly solely fall into the 12% tax bracket.

Calculating Federal Efficient Tax Charges

First, we have to subtract the usual deduction. For 2024, the federal commonplace deductions are $14,600 for single filers and $29,200 for married filers submitting collectively. Since our tax filer is single, they’d deduct $14,600 from their earnings.

$60,000 – $13,850 = $45,400

So we discover that solely $45,400 of our pattern taxpayer’s complete earnings is definitely taxable earnings. Now we will start making use of the tax charges. The ten% tax charge is calculated on the primary $11,000 of our taxpayer’s earnings.

$11,600 x .10 = $1,160

Subsequent we subtract $11,600 from $45,400 to get the taxable quantity for the 12% tax charge (since that is the precise bracket you fall in when you subtract the usual deduction):

$45,400 – $11,600 = $33,800

$33,800 x .12 = $4,056

This offers us a tax invoice of $1,160 + $4,056 = $5,216. That is a lot decrease than the $13,200 we might get by doing a straight 22% calculation on the overall earnings.

In reality, by dividing $5,216 by $60,000, you will discover that the efficient tax charge on this instance is definitely solely 8.7%.

Including In State Taxes

Whereas the numbers lined above are what most individuals are referring to after they talk about efficient tax charges, what you’ll truly pay in taxes this 12 months is way larger.

Presently, all however seven states additionally cost private earnings taxes. Under are the state tax brackets for a single filer in New York state:

Let’s faux that our pattern taxpayer lives in New York and let’s add their states taxes into the efficient tax charges calculation.

The state commonplace deduction could also be completely different from the federal. However, for simplicity, we’ll use the identical quantity. So we’re nonetheless working with $45,400 because the taxable earnings quantity.

We will see this places us into the 5.85% marginal tax charge. Now let’s do the calculations to search out the efficient tax charge.

First $8,500 x 0.040 = $340

$11,700 – $8,500 = $3,200 x .045 = $144

$13,900 – $11,700 = $2,200 x .0525 = $115.50

$45,400 – $13,900 = $31,500 x .0585 = $1,842.75

The numbers above mix for a complete state tax invoice of $2,442.25. That is a lot decrease than the federal tax invoice, which is sensible as a result of state tax charges are decrease. Including federal and state taxes collectively, we discover that our complete earnings tax invoice is $7,658.25 ($5,216 federal taxes + $2,442.25 state taxes = $7,658.25).

Keep in mind, efficient tax charges are calculated by dividing precise earnings taxes paid by complete earnings. So after dividing $7,658.25 by $60,000, you will discover that the efficient tax charge on this instance is 12.76% ($7,658.25 / $60,000 = 0.1276).

Facet Notice On State Taxes

Tax brackets pay an enormous half in what taxes you pay in each state. Nevertheless it’s additionally the main explanation for misinformation. For instance, media pundits at all times wish to “bash” California for having excessive taxes – the highest tax bracket in California is 12.30%. However, that solely applies to earnings over $677,751!

For “normal” incomes, California is fairly regular examine to different states. Let’s take Alabama as a comparability. Alabama expenses 5% earnings tax on all earnings over $3,000. California strikes from 4% to six% on the $37,700 mark. Principally, if you happen to earn lower than $37,000, you’d pay much less taxes in California than you’ll in Alabama.

FICA Taxes

However we aren’t accomplished but. To calculate how a lot we successfully pay in taxes as a proportion altogether, we nonetheless want so as to add in just a few different taxes. First, we have to contemplate how a lot you pay in FICA taxes, which go to Social Safety (6.2%) and Medicare (1.45%).

To calculate FICA, we merely take $60,000 and multiply by 7.65%.

$60,000 x .0765 = $4,590

Including that $4,590 to the $7,658.25 paid in federal and state earnings taxes, we discover that our complete tax invoice has now risen to $12,248.25. And that will give us a brand new efficient tax charge of 20.41%.

Notice: That is nonetheless lower than the potential 22% tax bracket somebody incomes $60,000 may assume they face.

Gross sales And Excise Taxes

Gross sales taxes are usually not based mostly in your wages or earnings. They’re as an alternative calculated on the quantity of the acquisition solely. See how a lot you pay in your space in state and native gross sales taxes.

Excise taxes are taxes charged on particular items or companies like gasoline, airline tickets, or your property.

Lastly, property tax (which may be thought-about an excise tax) is predicated on the annual property evaluation of your house, which might change from 12 months to 12 months. Once more, it isn’t dependent in your earnings.

How A lot Do Individuals Pay In Taxes General?

Since gross sales and excise taxes will range based mostly in your consumption and property measurement, it may be troublesome to precisely calculate somebody’s complete tax invoice. Plus, any tax credit and/or deductions that you just qualify for will cut back how a lot you truly pay to Uncle Sam.

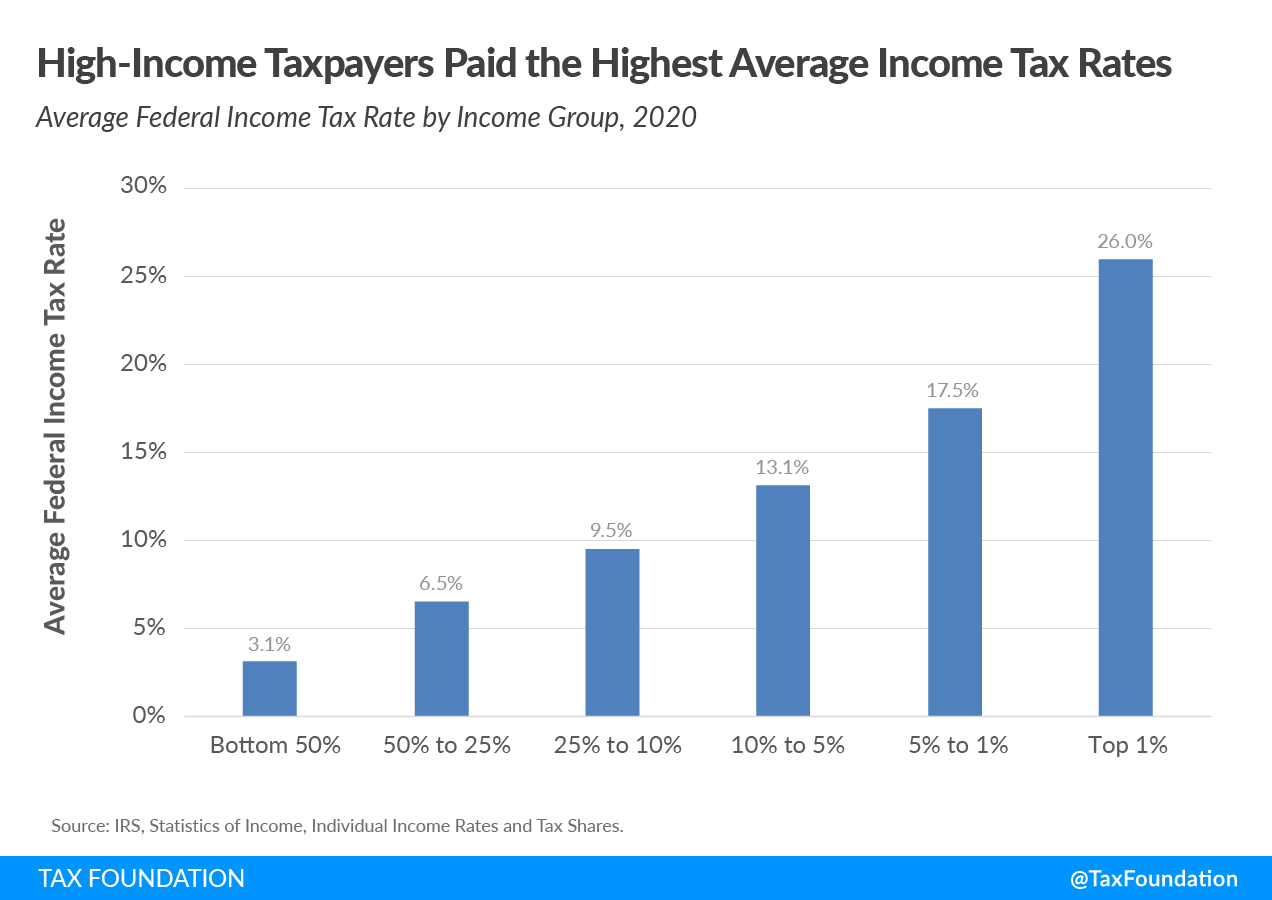

However a Tax Basis examine reveals how a lot the typical individual pays general in taxes after earnings taxes, FICA, enterprise taxes, excise taxes, and deductions and credit have all been accounted for. These have been the typical complete tax charges for varied earnings ranges:

- Lower than $10,000: 10.6%

- $10,000 to $20,000: 0.4%

- $20,000 to $30,000: 4.1%

- $30,000 to $40,000: 8.5%

- $40,000 to $50,000: 11.7%

- $50,000 to $75,000: 15.2%

- $75,000 to $100,000: 17.7%

- $100,000 to $200,000: 21.6%

- $200,000 to $500,000: 26.8%

- $500,000 to $1 million: 31.5%

- Above $1 million: 33.1%

Fortunately, this Tax Basis information signifies that efficient tax charges will nonetheless be decrease than the best marginal tax charges for nearly all Individuals (even in spite of everything “extra” taxes have been taken under consideration).

Ultimate Ideas

Based mostly on the Tax Basis information proven above, the everyday American employee incomes $60,000 can count on about 15.2% of their earnings to go in direction of taxes every year — or $9,120. That is fairly near our instance the place we calculated state and federal taxes to return in at 13.24%.

So it is clear that taxes nonetheless take a big chunk out of our take-home pay. After which different wants akin to healthcare and utilities can cut back how a lot of our cash is out there for discretionary spending even additional.

However by profiting from all of the tax credit and deductions that you just’re entitled to, you possibly can considerably cut back how a lot you successfully pay in taxes this 12 months and past. Remember to take a look at our listing of high tax software program suppliers that may assist you uncover all of the tax breaks you deserve.