Retirement calculators may also help you intend for the long run. And over the previous few years, there have been a variety of them developed that every one supply slight variations and instruments.

Saving and investing for retirement is a long-term venture finest tackled over many years. If you would like the tailwinds of compounding progress, you might want to make investments for retirement early and sometimes.

Nonetheless, generic recommendation doesn’t reply most individuals’s greatest retirement questions. You need to know the way a lot you might want to save every month, what age you possibly can retire at, whether or not your funding portfolio is prone to run out, and what you possibly can afford to do alongside the best way.

That’s the place retirement planning calculators are available. Whether or not you’re simply beginning to make investments for retirement, or are planning to exit the workforce inside a yr or two, you possibly can profit from a retirement calculator.

Finest Retirement Calculators For 2024

We’ve examined shut to twenty retirement calculators and chosen our favorites for 2024. You may see the total checklist (in ranked order) later within the article, however listed here are our prime picks, beginning with the T.Rowe Value Retirement Revenue Calculator (it is free).

Finest Total Retirement Calculator: T.Rowe Value

With a near-perfect rating on usability, a complicated strategy to evaluation, a deep stage of customization, and a free price ticket (which was the tie-breaker), the T. Rowe Value Retirement Revenue Calculator was our prime choose for the very best general retirement planning calculator. The questions it asks are detailed sufficient to provide you a transparent thought of whether or not you’re on observe to retire, however high-level sufficient to get your reply in below 5 minutes.

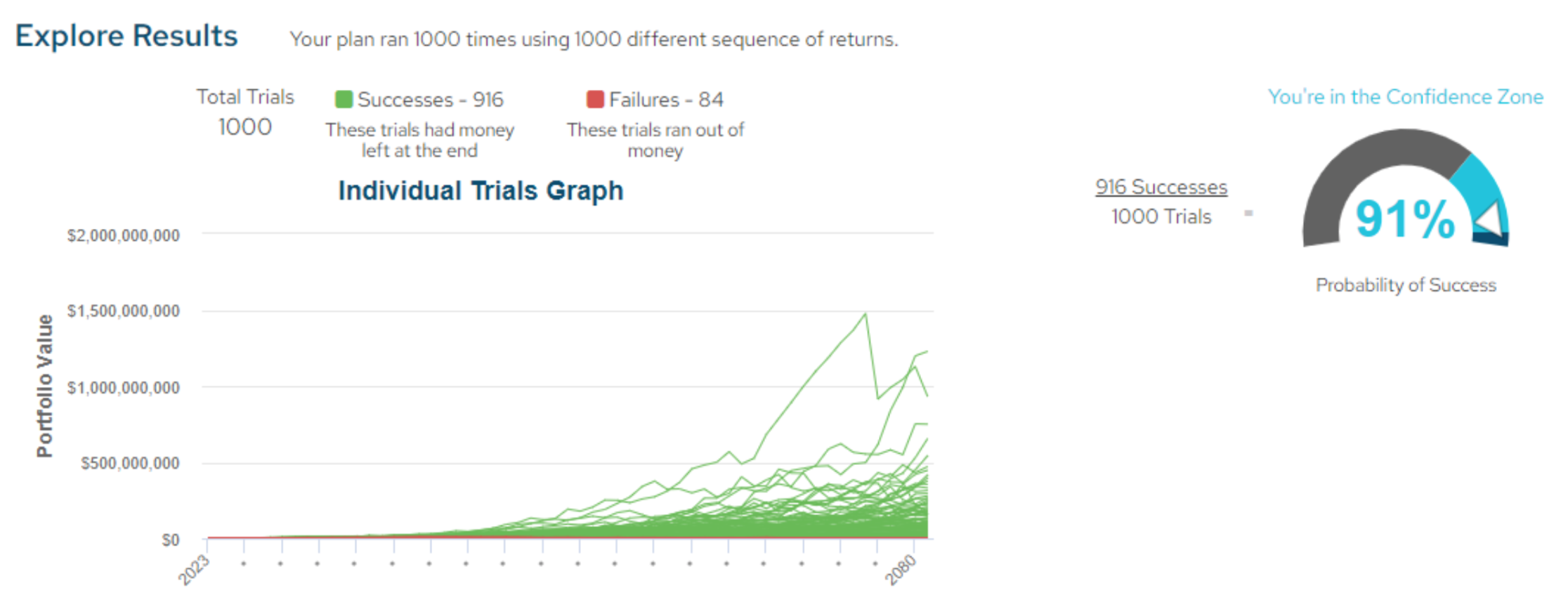

The T. Rowe Value calculator makes use of Monte Carlo simulations that can assist you perceive in case you’re prone to meet your retirement objectives or not. It additionally lets you “play” together with your assumptions (rising financial savings charges, retiring earlier or later, including money infusions, and so forth.). This offers a dynamic retirement calculator that isn’t overly burdensome.

The calculator focuses completely on retirement, so that you shouldn’t use it for all of your monetary planning wants. However in case you’re questioning whether or not you’re on observe to retire, it should assist you discover the reply.

Finest Free Retirement Planning Software: Empower

Whereas the T. Rowe Value retirement planning calculator solutions whether or not you possibly can retire, Empower helps you dig into your retirement planning questions. Empower lets you do detailed state of affairs planning based mostly in your precise monetary state of affairs. By utilizing real-time knowledge out of your monetary accounts (together with your spending accounts), you possibly can dig into actual particulars as an alternative of hypotheticals. Even higher, the instruments are free to make use of, and Empower lives in your telephone or laptop, so you possibly can evaluation the outcomes at your leisure.

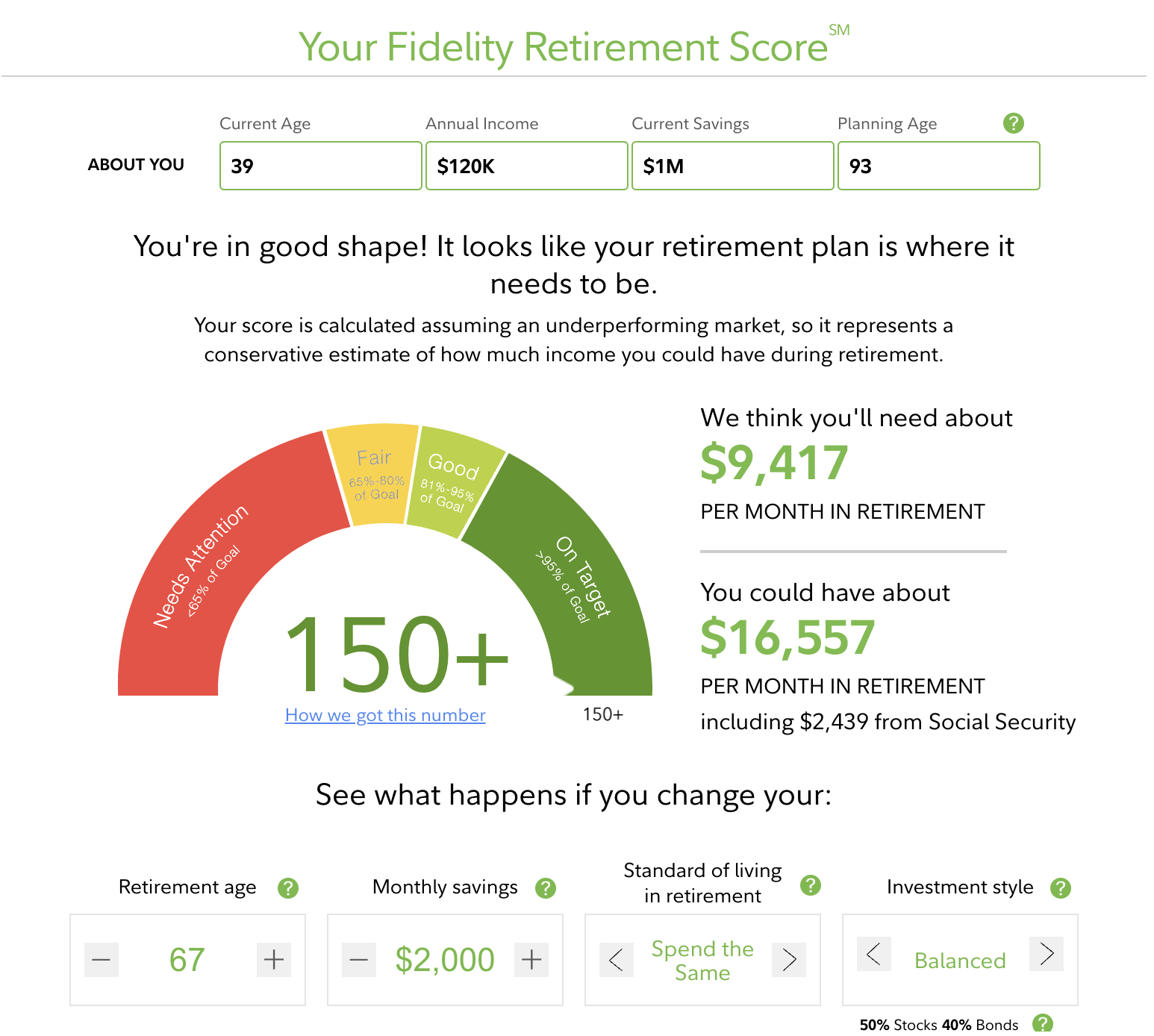

Finest For Fast Evaluation: Constancy’s Retirement Rating

By answering six fast questions, you possibly can obtain Constancy’s Retirement Rating. The rating reveals the likelihood that your cash will outlive you (based mostly in your responses to the questions). In the event you’re not planning to retire within the subsequent few many years, Constancy’s calculator lets you realize whether or not you’re on observe for retirement. It’s not designed for detailed retirement planning, however it should present you if you might want to save extra aggressively, or in case you can take your foot off the fuel.

Finest For Complete Life Planning: Maxifi

Maxifi takes the prize for finest complete life planning instrument. It integrates tax planning, life occasions, and modifications to revenue and bills right into a complete monetary and retirement plan. It takes your present monetary objectives as severely as your future retirement objectives.

Maxifi prices $109 per yr, however it’s cash properly spent in case you use the software program to make higher monetary selections. If not, don’t waste your time and cash digging into the instrument.

A couple of years in the past, only a few firms supplied complete monetary planning for on a regular basis folks. On this evaluation, we reviewed 4 easy-to-use instruments that provide the flexibility to contemplate all types of life occasions in your evaluation. All 5 acquired scores that allowed them to tie for second place general. Along with Maxifi, ProjectionLab, New Retirement, and OnTrajectory all supply sound monetary planning instruments that will let you take into account retirement together with the remainder of your life. We fortunately suggest any of those instruments for private finance aficionados who need to reply life’s greatest monetary questions.

Retirement Planning Calculators Particulars

Under is a full checklist of the retirement planning calculators that we examined — their usability rankings, costs, and the ultimate rating assigned to them. Some scores point out a multi-way tie, however the descriptions above present extra element on why sure instruments had been ranked above others.

|

|

Sturdy calculator estimates whether or not your portfolio can help your retirement wants, and lets you play together with your assumptions. It makes use of Monte Carlo simulations to offer an estimate of the frequency that your portfolio will final to your complete life. |

|||

|

|

A premium monetary planning software program designed that can assist you make higher selections in the present day with out jeopardizing your future objectives. Maxifi offers deep insights into the dangers and rewards of dipping into your financial savings to satisfy a short-term objective vs. holding off. |

|||

|

|

Monetary planning software program that not solely offers detailed retirement projections, it additionally helps you observe progress towards vital life objectives alongside the best way. If you wish to perceive how massive life-style selections will have an effect on your retirement, OnTrajectory may also help. |

|||

|

Absolutely customizable monetary planning software program for people who find themselves pursuing Monetary Independence and early retirement. Means that you can account for big bills (kids’s faculty, dwelling upgrades, and so forth), modifications in revenue, spending, and extra. Click on right here to learn our ProjectionLab Evaluate. |

||||

|

Complete monetary planning software program providing detailed monetary plans even with the free model. The upgraded model lets you plug in a whole bunch of monetary particulars to personalize your plan. Click on right here to learn our NewRetirement Evaluate. |

||||

|

Retirement planning, budgeting, and web value monitoring app. Join your monetary accounts to the app, and construct a monetary plan based mostly in your precise account balances. Click on right here to learn our Empower Evaluate. |

||||

|

|

A easy calculator that forecasts your anticipated retirement wants, and your probability of assembly them. Restricted means to play with the numbers and there are many assumptions associated to returns and inflation. Nonetheless, an incredible instrument for individuals who simply need to know whether or not they’re on observe. |

|||

|

|

A retirement calculator based mostly in your present spending and your anticipated spending in retirement. For individuals who need to do monetary planning on their very own. If you do not have an in depth understanding of your present spending, that is in all probability not the proper instrument for you. |

|||

|

|

A Monte Carlo simulator designed to assist early retirees resolve when their portfolio is massive sufficient to help their retirement wants. You may mannequin dozens of situations that can assist you resolve whether or not you possibly can depart your job to retire. |

|||

|

|

The Monetary Mentor’s Final Retirement Calculator solutions the massive retirement questions. In the event you’re beginning to get a deal with in your monetary particulars, this calculator can present you whether or not you are on the trail towards a financially sound retirement. It’s possible you’ll have to dig round to search out particulars like your tax charge, however as soon as you realize these particulars you possibly can construct a easy however sound retirement plan. |

|||

|

A easy calculator designed that can assist you determine the steadiness between spending and saving for retirement. The instrument is straightforward to make use of, however would not supply a lot in the best way of customization (until you need to change your inputs). |

|||

|

Tremendous easy retirement calculator that reveals your anticipated nest egg at retirement, and the way a lot you are anticipated to want. The calculator is simplistic, however in case you’re new to investing or eager about retirement, it can provide you a directional tackle whether or not you are on observe to retire. Click on right here to learn our Stash Evaluate. |

||||

|

|

WalletBurst affords a easy have a look at the connection between your spending, your property, and your means to retire. In case your primary query is when you possibly can stop your job, WalletBurst is the instrument for you. |

|||

|

|

The Full Retirement Planner helps you create a customized retirement plan based mostly in your present monetary state of affairs and your retirement aspirations. It permits for detailed planning, however it’s best suited to individuals who have already got understanding of their funds. |

|||

|

|

Utilizing easy assumptions, the AARP Retirement Nest Egg Calculator calculates a month-to-month financial savings charge required to retire at a selected age. Sadly, the built-in assumptions appear to be biased in the direction of very low returns (particularly through the retirement years). In contrast with different calculators, the instrument might recommend too massive of a required nest egg. |

|||

|

|

One of many authentic instruments designed to assist early retirees resolve whether or not they can retire. The calculator makes use of tons of knowledge and lets you mannequin many alternative situations. Nonetheless, the person interface is caught in 2002, and the jargon makes the calculator exhausting to make use of. |

A Few Caveats About Our Judgment Standards

Every calculator offered on this article needed to meet sure “desk stakes” standards to be included. These standards embrace having clear and honest assumptions (particularly associated to funding progress and inflation).

Calculators utilizing easy assumptions (equivalent to not accounting for volatility) had been allowed so long as assumptions surrounding progress and inflation had been displayed. Such calculators are finest for folks with 20 years or extra till retirement.

It additionally wanted to offer particulars about an investor’s anticipated web value at retirement and their portfolio’s anticipated longevity following retirement. Calculators that didn’t present each of these particulars had been excluded. We additionally excluded instruments that require you to have a retirement account with the brokerage with a view to use the instrument.

If the calculator met these standards, it was allowed into the checklist of thought-about instruments. At that time, a very powerful criterion for judging these calculators was usability for the typical individual. This accounted for two-thirds of the general rating. A typical individual ought to be capable of soar into the calculator and get comprehensible outcomes utilizing moderately correct estimates of their monetary state of affairs. Any calculator that required customers to wade via jargon or text-heavy pages was discounted on the usability entrance.

The opposite criterion for judging the calculator was robustness. Calculators that accounted for extra funding situations, higher refinement of assumptions, or higher simulations of threat had been deemed higher than these with fewer choices. Most calculators will let you “play together with your assumptions” to see what you will get on observe for retirement. However that’s solely the primary a part of robustness. You might also need to see how your present resolution (to improve a home, have a baby, take day off of labor, and so forth.) is prone to have an effect on your retirement plan. Some calculators allowed you to do that, however others didn’t.

Whereas robustness is vital, it solely accounted for a 3rd of the general rating for a number of causes. First, most individuals don’t want extremely detailed monetary retirement calculations till the last decade earlier than they retire. Until you’re pursuing extraordinarily early retirement, you in all probability don’t want an in depth monetary calculator till you’re 50-60 years previous. Moreover, most individuals received’t use the refinement options. A couple of curious folks might use the refinement options based mostly on their present life objectives, however most individuals received’t. In the event you’re somebody who rigorously tracks your web value or religiously makes use of your budgeting app, you might discover it exhausting to consider that individuals don’t love spending time on monetary instruments. Nonetheless, most individuals who need a sturdy evaluation pays a monetary planner for an evaluation slightly than analysis instruments themselves.

Retirement Calculator Wrap-Up

Irrespective of which retirement calculator you select, it’s best to at all times spend someday every year in your retirement plan that can assist you keep on observe. It’s possible you’ll not have to construct a complete plan, however a high-level retirement goal may also help you reside properly in the present day and tomorrow. In the event you’re extra targeted in your day-to-day private funds think about using considered one of these budgeting apps and these investing apps that can assist you take day by day steps to construct your monetary well being.