The temporary’s key findings are:

- Public pension plans are more and more counting on different investments and energetic administration.

- However how does plan efficiency evaluate to a easy 60/40 index over numerous intervals from 2000-2023?

- Over the complete interval, plan returns are just about equivalent to the straightforward index technique, however plans have performed a lot worse for the reason that World Monetary Disaster.

- If the present method doesn’t yield increased long-term returns, a robust argument will be made for sticking with a easy, clear technique.

Introduction

Public pension plans have been shifting towards extra complicated investments prior to now 20 years, transferring a large share of property out of conventional equities, bonds, and money into different property, and increasing their reliance on exterior managers. This elevated complexity, coupled with a shift towards energetic administration, contrasts sharply with different traders, who’ve moved towards easier, passive methods, triggering a debate about whether or not the extra complicated energetic method produces increased returns.

Some latest research argue that pension plans might have performed higher investing solely in easy index funds. Critics counter that this assertion relies upon closely on the time interval analyzed. For instance, research that concentrate on the previous decade – when robust and constant inventory market development favored index funds over energetic administration – might overstate some great benefits of passive investing. Additional complicating the dialogue is pension funds’ use of lagged returns for some different property, which might distort their general reported return. To make clear this debate, this temporary investigates how the efficiency of public pensions compares to a easy passive indexing method over numerous time intervals, utilizing pension returns adjusted for lagged reporting.

The dialogue proceeds as follows. The primary part briefly discusses public plan funding practices, with a give attention to the rising use of complicated energetic administration. The second part stories on present research evaluating public plan returns with listed investing. To handle among the limitations of prior research, the third part compares the returns of public plans to a easy 60/40 index over numerous intervals since 2000. The ultimate part concludes that, general, pension funds have carried out equally to the straightforward passive technique since 2000, however have lagged behind it for the reason that World Monetary Disaster. If public plans can’t moderately anticipate increased long-term returns from a fancy energetic method, a robust argument could possibly be made that they need to keep on with a easy and clear technique.

Public Pension Funding Practices

The funding actions of public pension funds happen at two ranges: the general allocation to broad asset courses and the precise investments inside every asset class – each of which usually contain parts of energetic administration.

Concerning broad asset allocation, a public plan typically units a goal by means of its board of administrators, primarily based on inputs from outdoors consultants in addition to the plan’s personal funding employees. Because the plan portfolio diverges from the goal on account of market actions, the fund strikes cash throughout asset courses to get again to the goal, which aligns with a “stay-the-course” passive rebalancing method. However, pension funds additionally recurrently regulate their targets primarily based on their evolving beliefs about capital markets and diversification, which displays a extra energetic investing fashion.

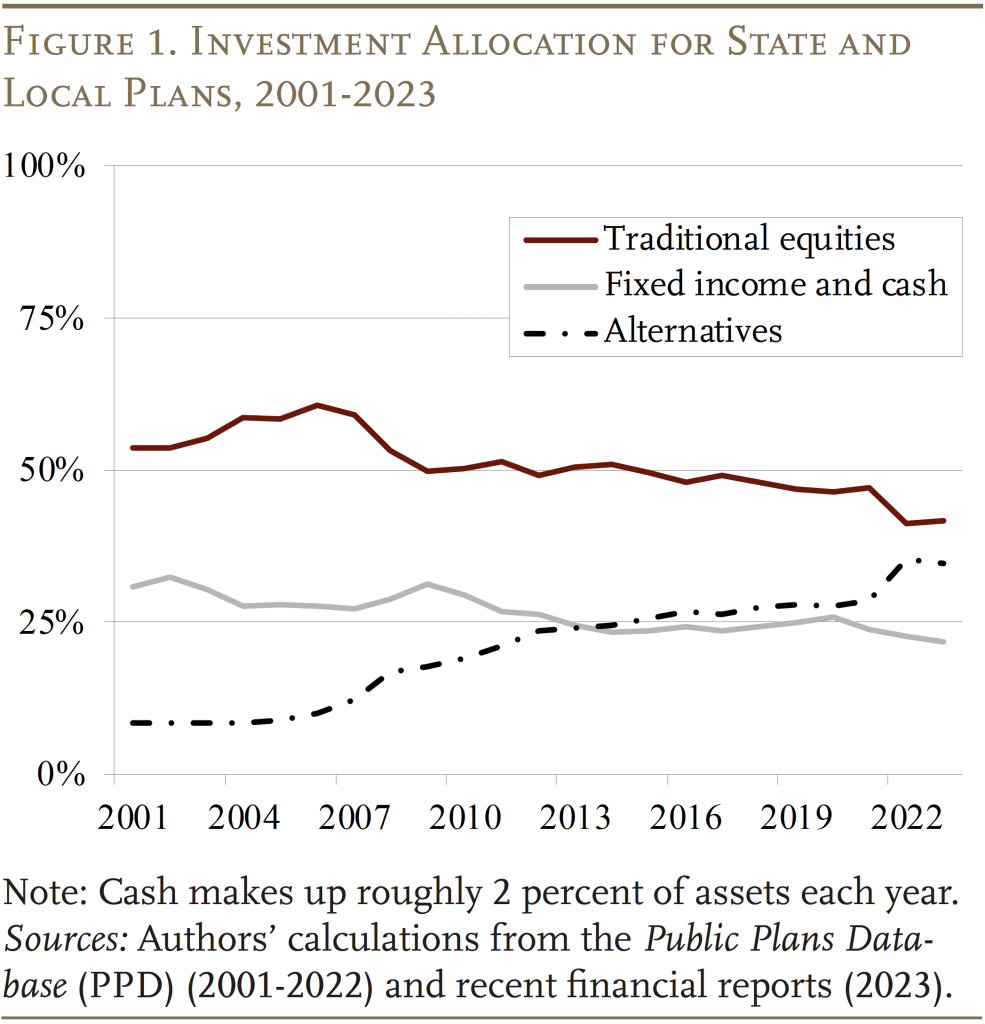

Lately, pension plans have been shifting their targets from conventional equities and bonds to different property, corresponding to non-public equities, hedge funds, actual property, and commodities. Whereas their monetary stories usually cite diversification and threat discount as the explanations for this shift, prior research counsel that reaching for increased returns is the primary motivation. On the similar time, sharp declines within the worth of conventional shares and bonds – as in 2008, 2009, and 2022 – have additionally contributed to the rising share of pension fund property held in options (see Determine 1).

Along with actively altering their high-level asset allocation, most plans rent exterior managers to actively handle investments inside every asset class. Investments in options are – virtually by definition – actively managed by outdoors traders. However, many pension funds additionally use exterior managers to actively handle investments in additional conventional asset courses. The query is whether or not all this shuffling of investments and larger reliance on complicated property – which comes with increased charges and extra employees – is best than sticking with index funds of conventional shares and bonds.

Findings from Prior Analysis

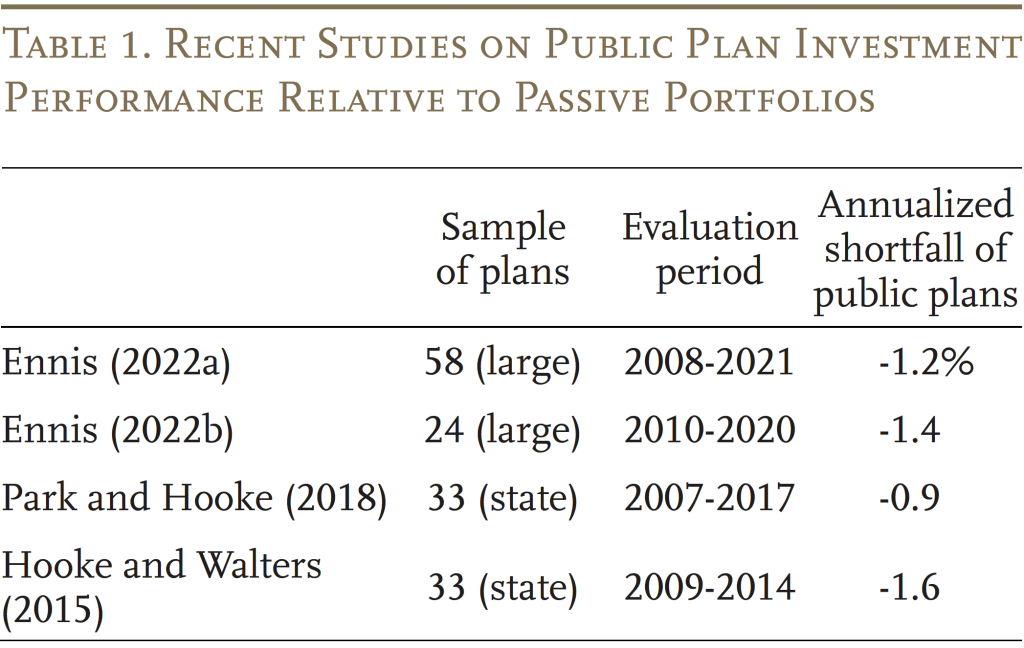

Some latest research have argued that public pensions might get increased after-fee returns by investing solely in passive index funds (see Desk 1). Typically, these analyses evaluate a easy index portfolio (e.g., conventional shares and bonds that mirror the general threat profile of public plans) to that of a pattern of enormous public plans over a 5- to 10-year interval beginning after 2007. Their outcomes constantly present that public plans in combination underperform index portfolios by 0.9 % to 1.6 % annualized.

Importantly, some dismiss these findings as being depending on the interval examined. Certainly, a major limitation is that they give attention to the years after the World Monetary Disaster, throughout which easy passive investing has trumped complicated energetic investing. As well as, the research don’t embody the 2022 downturn – when many plans reported a lot increased returns than easy listed portfolios. Though, these increased returns might doubtlessly be associated to how pension funds report their returns, which raises one other concern with present research – that almost all depend on knowledge that use lagged returns for personal property.

Assessing Pension Fund Efficiency Since 2000

The next evaluation helps make clear the present debate in two methods. First, to precisely assess fund efficiency, we right for the inclusion of lagged returns for personal property (see Appendix A). Second, to current a extra full image of pension plan efficiency, we assess the corrected returns over numerous intervals between June 2000 and June 2023 – the complete interval of the available knowledge. We evaluate pension fund returns to a hypothetical easy index portfolio of 60 % US shares (Russell 3000 Whole Return Index) and 40 % US bonds (Bloomberg US Mixture Bond Index), with a 10-basis level administration charge.

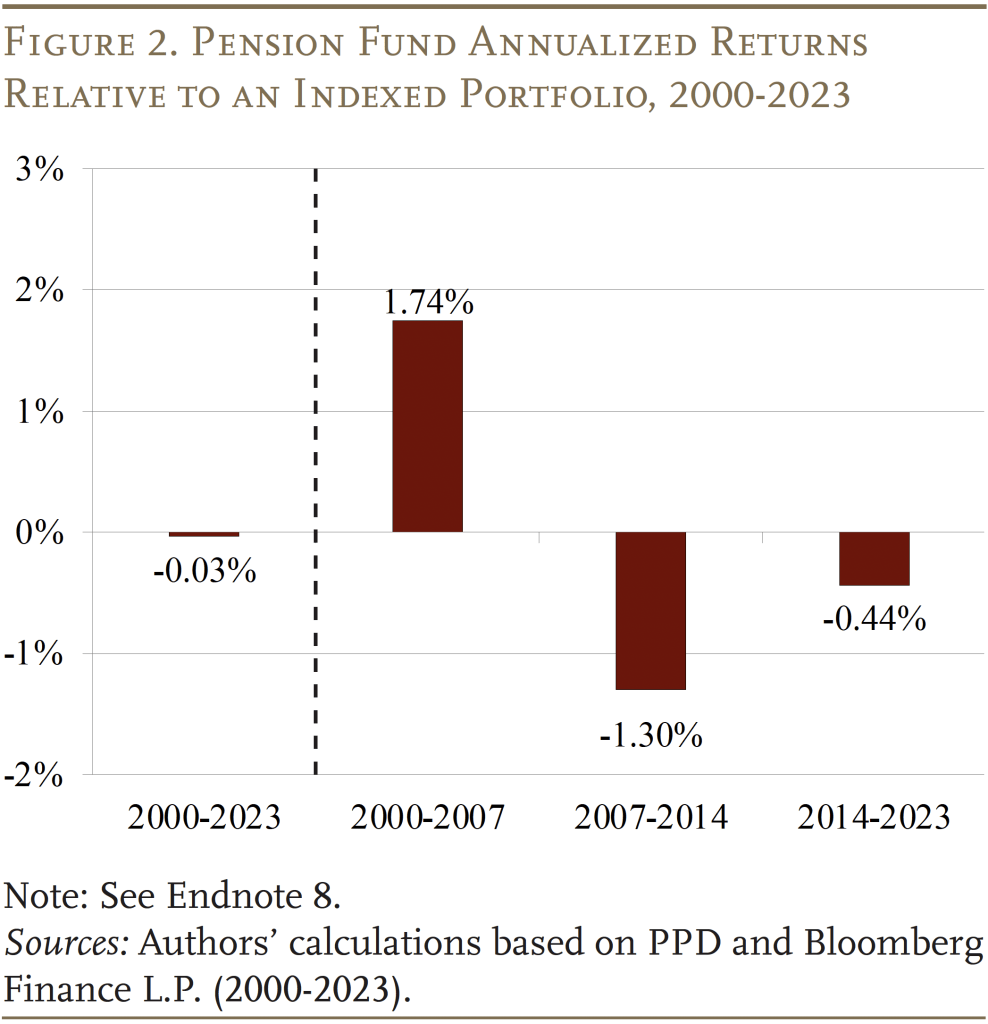

To start, Determine 2 reveals pension plan efficiency over the long-term (June 2000 to June 2023) and three sub-periods: pre-crisis (June 2000 to June 2007), early post-crisis (June 2007 to June 2014) and later post-crisis (June 2014 to June 2023). The metric proven is the distinction between the annualized return for public plans and the listed portfolios – constructive values point out increased returns by public plans. The important thing takeaway is that the long-term annualized return for pension funds is nearly the identical as that of the 60/40 portfolio (about 6.1 % for each). Nevertheless, the outcomes additionally reveal an fascinating two-part story underlying this comparable efficiency – pension funds did a lot better than the index funds pre-crisis and far worse post-crisis.

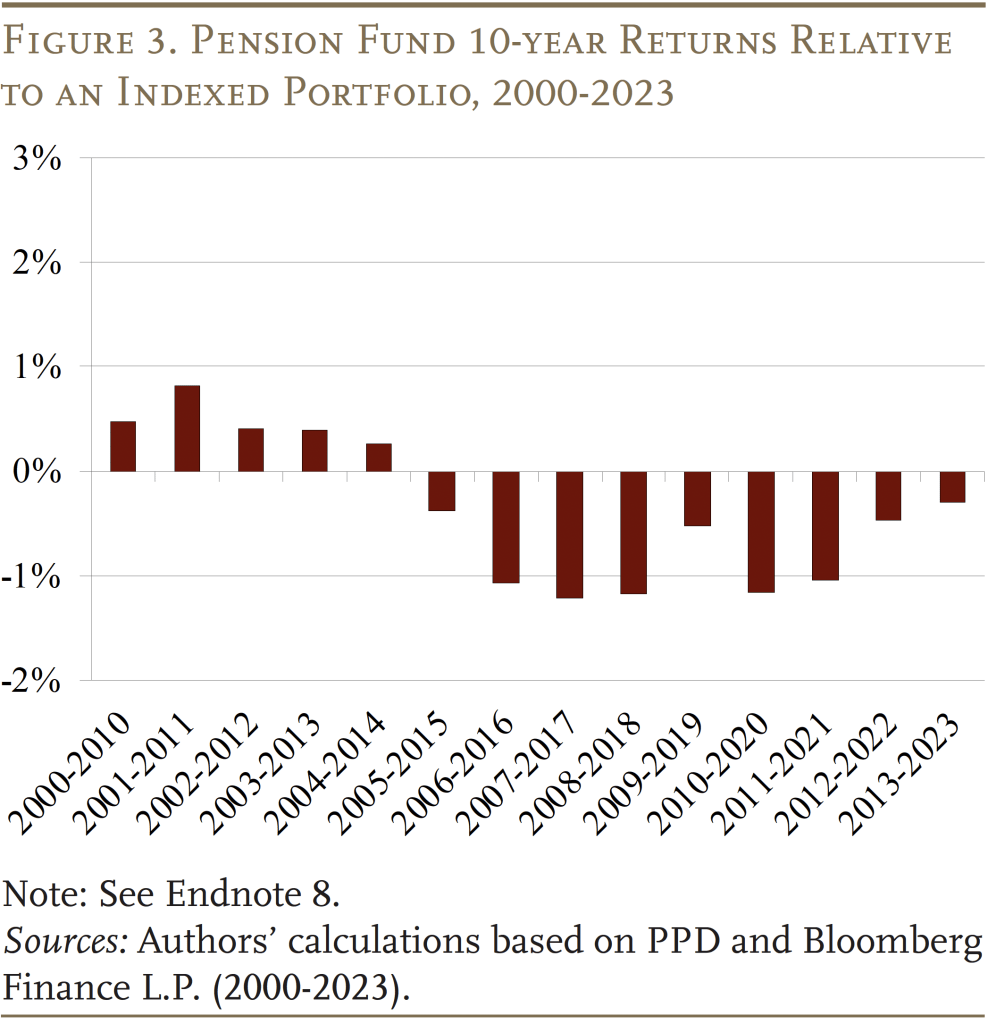

Subsequent, we evaluate efficiency over every 10-year interval between 2000 to 2023 (see Determine 3). Pension funds underperform in over half of the 10-year intervals, and the two-part story emerges once more with plans constantly doing higher by means of 2014 and falling quick afterward.

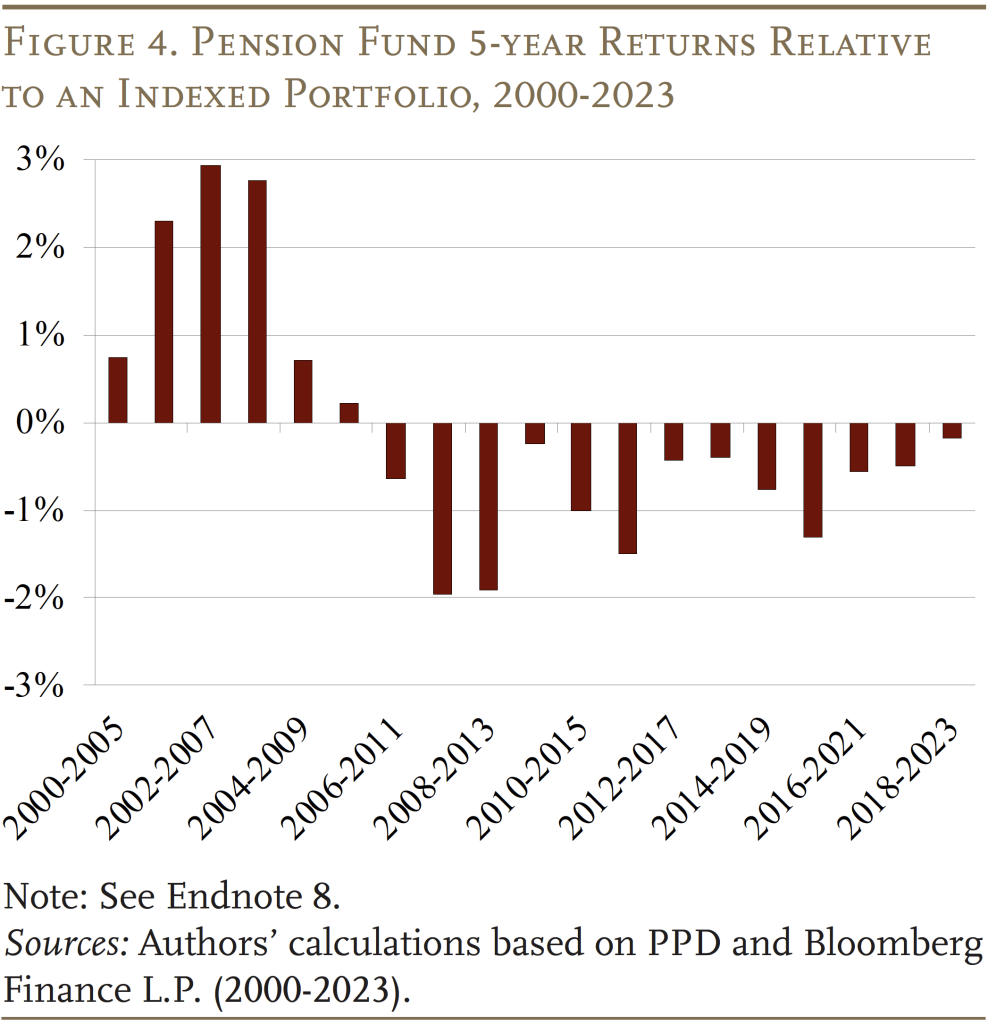

Lastly, Determine 4 presents the outcomes for every 5-year interval between 2000 and 2023. Once more, the general outcomes are comparable. Pension funds underperform in two-thirds of the intervals – doing higher by means of 2010 earlier than falling quick every year afterward. (See Appendix B for extra particulars on how tendencies in asset allocation have an effect on the outcomes).

Importantly, these outcomes probably overstate the efficiency of pension funds on account of prices related to complicated energetic funding approaches, corresponding to salaries for a bigger in-house funding employees, and sure unreported charges for different investments.

Conclusion

The general shift towards extra complicated actively managed property has raised issues over pension fund funding practices. Whereas latest research have argued that plans might have performed higher relying solely on easy index funds, the research have been critiqued as being too depending on the interval examined and utilizing lagged reported returns.

This temporary investigates public plan efficiency over numerous intervals since 2000 utilizing returns adjusted for lagged reporting. Whereas pension funds outperformed the straightforward portfolio previous to the World Monetary Disaster, they fell quick thereafter. In consequence, pension funds’ annualized combination returns since 2000 have been just about equivalent to a easy 60-40 index portfolio.

If public plans can’t moderately anticipate increased long-term returns from a fancy energetic method, they need to keep on with a easy and clear technique.

References

Andonov, Aleksandar, Rob M. M. J. Bauer, and Ok. J. Martijn Cremers. 2017. “Pension Fund Asset Allocation and Legal responsibility Low cost Charges.” The Evaluate of Monetary Research 30(8): 2555-2595.

Aubry, Jean-Pierre. 2022. “Public Pension Funding Replace: Have Alternate options Helped or Damage?” Problem in Temporary 22-20. Chestnut Hill, MA: Middle for Retirement Analysis at Boston School.

Aubry, Jean-Pierre and Caroline V. Crawford. 2019. “Influence of Public Sector Assumed Returns on Funding Decisions.” State and Native Plans Problem in Temporary 63. Chestnut Hill, MA: Middle for Retirement Analysis at Boston School.

Aubry, Jean-Pierre and Kevin Wandrei. 2019. “Sustaining Goal Allocations: Results on Plan Efficiency.” State and Native Plans Problem in Temporary 64. Chestnut Hill, MA: Middle for Retirement Analysis at Boston School.

Aubry, Jean-Pierre and Kevin Wandrei. 2020. “Inside vs. Exterior Administration for State and Native Pension Plans.” State and Native Plans Problem in Temporary 75. Chestnut Hill, MA: Middle for Retirement Analysis at Boston School.

Beath, Alexander and Chris Flynn. 2023. “Asset Allocation and Fund Efficiency of Outlined Profit Pension Funds in The USA Between 1998-2021.” Toronto, ON: CEM Benchmarking.

Bloomberg Finance L.P. Bloomberg Terminal, 2000-2023. New York, NY.

CPP Investments. 2024. Annual Report. Toronto, Ontario.

Ennis, Richard. 2022a. “Pulling Again the Curtain on Public Pension Fund Efficiency.” Working Paper.

Ennis, Richard M. 2022b. “Price, Efficiency, and Benchmark Bias of Public Pension Funds in the US: An Unflattering Portrait.” The Journal of Portfolio Administration 48(5): 138-150.

Florida State Board of Administration. 2022. “Funding Efficiency Studies.” Tallahassee, FL.

Hildebrand, Philipp, Jean Boivin, Wei Li, Alex Brazier, Christopher Kaminker, and Vivek Paul. 2023. “2024 Funding Outlook, Grabbing the Wheel: Placing Cash to Work.” New York, NY: BlackRock Funding Institute.

Hooke, Jeff C. and John Walters. 2015. “Wall Road Charges and Funding Returns for 33 State Pension Funds.” Maryland Coverage Report No. 2015-05. Rockville, MD: The Maryland Public Coverage Institute.

Funding Firm Institute. 2022. “Developments within the Bills and Charges of Funds.” ICI Analysis Perspective 29(3). Washington, DC.

Ligon, Cheyenne and Douglas Appell. 2024. “For Some Pension Funds, Lively Investing Is As soon as Once more Engaging.” (February 7). New York, NY: Pensions & Investments.

Mitchell, Justin. 2023. “‘The place Is the Cash?’: Ohio Academics’ Pension Board Member Confronts Callan CEO.” (March 23). New York, NY: FundFire.

Park, Carol and Jeff Hooke. 2018. “2018 State Pension Fund Funding Efficiency Report.” Maryland Coverage Report No. 2018-02. Rockville, MD: The Maryland Public Coverage Institute.

Public Plans Database. 2001-2023. Middle for Retirement Analysis at Boston School, MissionSquare Analysis Institute, Nationwide Affiliation of State Retirement Directors, and the Authorities Finance Officers Affiliation.

Appendix A: Correcting Returns for Lagged Reporting

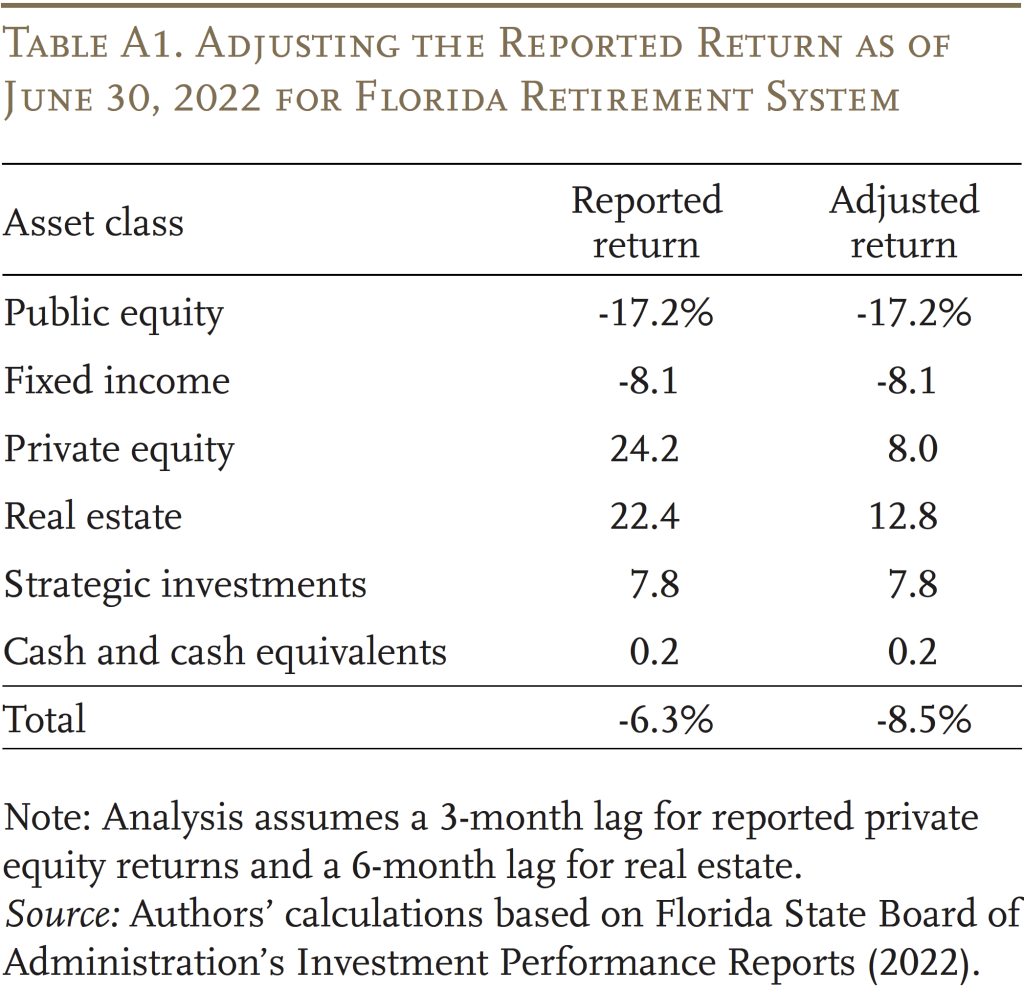

The broad shift away from conventional shares and bonds makes the evaluation of public pension fund funding efficiency more difficult in two methods. First, an growing share of their investments are illiquid and valued primarily based on professional value determinations. Second, reported pension fund returns usually embody lagged knowledge on the efficiency of their non-public property. Whereas we can’t regulate for the subjective nature of sure asset valuations, we are able to regulate for the explicitly lagged knowledge for personal property. For instance, the Florida Retirement System reported a portfolio return of -6.3 % as of June 30, 2022 (see Desk A1). Nevertheless, the return was calculated utilizing lagged annual returns for its holdings of personal fairness and actual property. Updating the pension fund’s reported portfolio return to incorporate the precise June 30 returns for personal fairness and actual property (on this case, taken from subsequent quarterly funding stories) reduces it to -8.5 %.

For the evaluation, we make an identical adjustment for the general public plan universe in combination (moderately than simply a person plan). First, we presume a 3-month lag within the reporting of personal fairness and an 8-month lag for actual property. Second, we decide the connection between the non-public asset return reported by pension funds (in combination) and the return on a associated market index. Lastly, we use this relationship to shift reported pension fund returns ahead. For instance, for pension funds that report June 30 annual returns, we evaluate their reported annual return for personal fairness (which is lagged) to the March 31 annual return for a non-public fairness index. This offers the connection between the efficiency of pension funds’ non-public fairness and the efficiency of the index. Then, we apply that relationship to the index’s June 30 annual return to estimate the June 30 return for the non-public fairness held by pension funds.

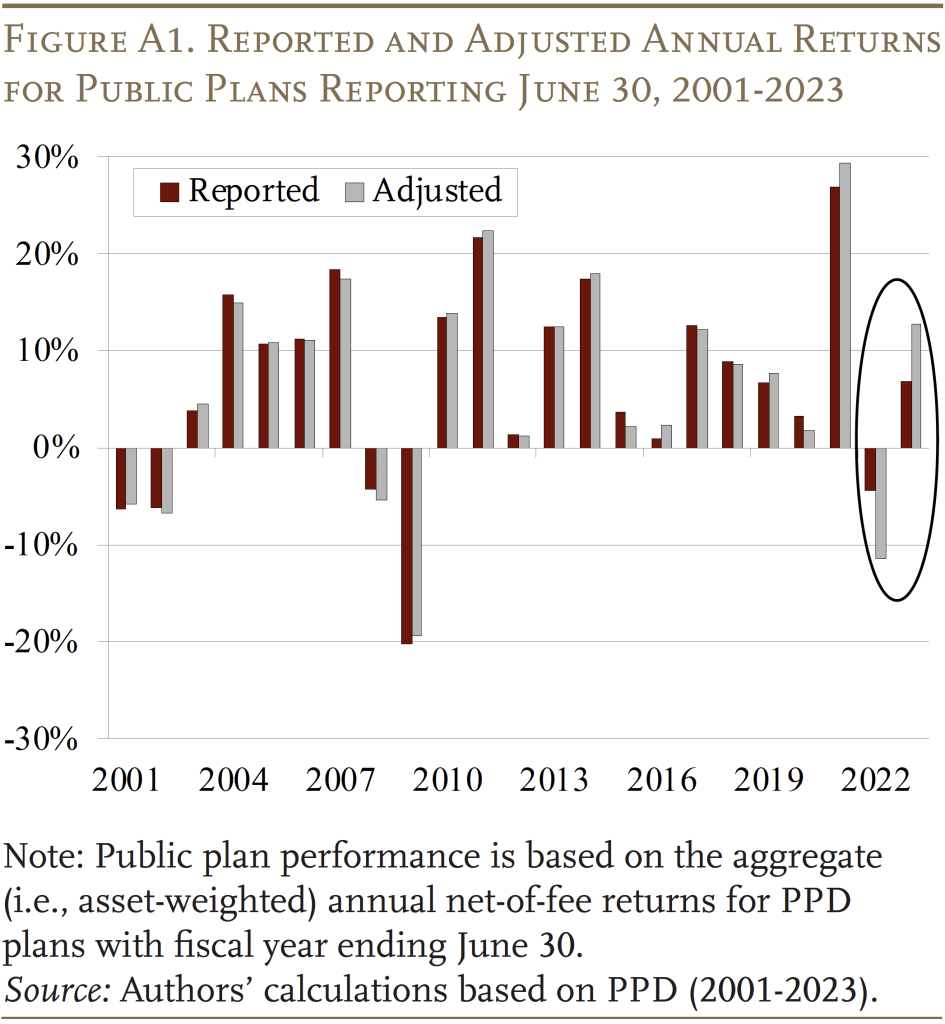

Determine A1 reveals the reported and adjusted annual returns for the general public plan universe in combination. Curiously, the outcomes present that the adjusted returns are fairly much like precise returns for all years besides 2022 and 2023. The reason being twofold. First, the share of complete property invested in options – particularly non-public fairness and unlisted actual property – has steadily grown since 2000, making the potential affect of the lagged reporting extra important within the later years of our evaluation interval. However, the extra essential – and, considerably idiosyncratic – motive is the exact timing and length of market swings (i.e., the change over the lagged interval have to be meaningfully completely different than the change over the precise reporting interval). For instance, utilizing the general public fairness markets as an indicator for asset valuations extra typically, the return on the Russell 3000 from March 2021 to March 2022 was a lot increased than the return from June 2021 to June 2022. The returns for personal fairness and actual property adopted an identical sample, which, if left unadjusted, would overstate the general efficiency of public plans for any interval ending in 2022.

Appendix B: A Deeper Dive into the Outcomes

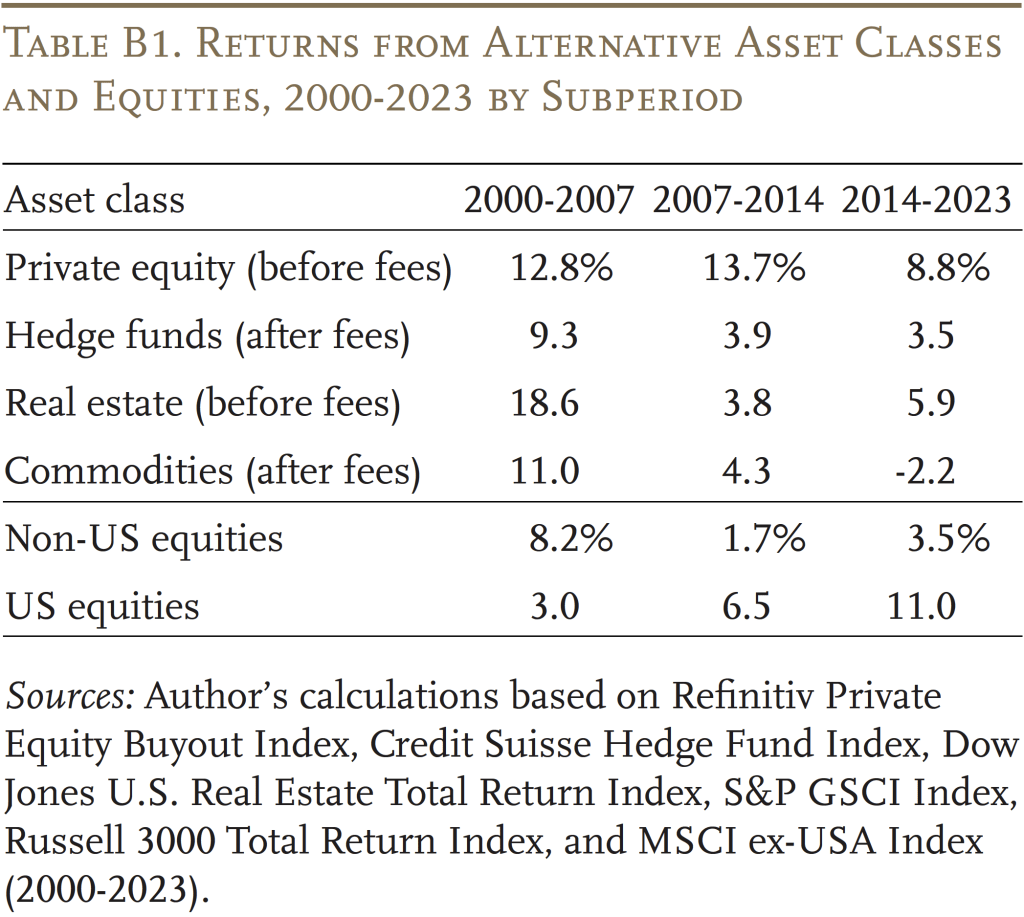

The primary driver behind public plans’ efficiency relative to the index portfolio is how properly the varied dangerous asset courses do relative to home shares. From 2000 to 2007, the efficiency for every type of dangerous property – together with non-public fairness, actual property, hedge funds, commodities, and worldwide shares – considerably outpaced that of home equities (see Desk B1). Despite the fact that these asset courses made up a smaller share of pension fund portfolios throughout that interval, they helped enhance efficiency relative to a easy 60/40 portfolio of home shares and bonds. Nevertheless, since 2007, most dangerous asset courses – particularly hedge funds, commodities, and worldwide shares – have underperformed home shares. Sadly, this weaker efficiency has occurred simply as public pensions have been growing their reliance on these asset courses, exacerbating their drag on the funds’ complete returns.

Additionally contributing to public plans’ relative efficiency is the way in which that plans shifted their allocation following main downturns within the fairness markets. After the dot-com bust in 2002, plans moved extra money again into shares and out of bonds, with little exercise within the different asset courses, to take care of a comparatively constant allocation to equities. Though this maneuver didn’t assist public plans beat the index portfolio straight, the rebalancing again in direction of shares was much like the constant fairness allocation of the index portfolio and helped plans achieve from the next rebound in fairness markets. In distinction, in the course of the 2008-2009 monetary disaster, pension funds moved cash out of equities as a part of their shift away from conventional shares and bonds into options. Relative to the constant fairness allocation of the index portfolio, the timing of the shift probably locked in among the fairness losses and excluded plans from the rebound of fairness values within the post-crisis years.