Critiques and proposals are unbiased and merchandise are independently chosen. Postmedia could earn an affiliate fee from purchases made by hyperlinks on this web page.

Article content material

Extra Financial institution of Canada rate of interest cuts can’t come quickly sufficient for an rising quantity of people that say they’re worse off financially on a number of fronts, says a brand new survey.

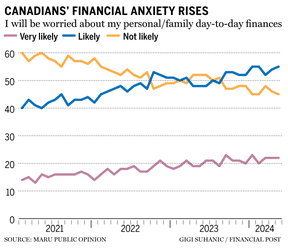

Fifty-five per cent of Canadians indicated they’re apprehensive about their private and day-to-day household funds, which ties the very best studying recorded by Maru Public Opinion because it began its Family Outlook Index 4 years in the past.

Article content material

The variety of folks apprehensive about their private funds has been on a gentle march upward since early 2021, when 40 per cent of individuals harboured such issues.

John Wright, government vice-president at Maru Public Opinion, hyperlinks the inexorable rise within the measure to the acceleration of inflation, which rose from 3.1 per cent in June 2021 to a peak of 8.1 per cent a 12 months later.

“It’s one thing folks haven’t been capable of shake off,” he mentioned.

Maru had much more dangerous information. For instance, 28 per cent of Canadians mentioned they had been worse off financially in Could, up from 25 per cent the month earlier than and 23 per cent initially of the 12 months. And a file variety of folks mentioned they’re struggling to make ends meet — 43 per cent in comparison with 37 per cent in March — the ballot of 1,500 grownup Canadians from Could 31 to June 3 mentioned.

“Throughout COVID, many individuals didn’t have the bills they’d. Vehicles had been sitting in driveways. They had been working from house. It was dangerous with the virus, however fairly good with funds,” Wright mentioned. “The final six to eight months, they started to appreciate the price of residing was far more than they anticipated. They’re into credit score debt in a big manner.”

Article content material

The most recent Maru ballot was taken days earlier than the Financial institution of Canada made its first rate of interest minimize in 4 years. On June 5, the central financial institution minimize 25 foundation factors off its benchmark borrowing fee to 4.75 per cent from a two-decade-plus excessive of 5 per cent.

Wright thinks extra cuts might be wanted earlier than folks shift their monetary outlook.

“I do know folks might be happy, however at 25 foundation factors, that’s not going to make a huge impact on folks’s lives,” he mentioned.

All this private “pocketbook pessimism” has pulled the Family Outlook Index down after it had began to rise from its all-time low on the finish of final 12 months.

The index slipped to 85 in Could from 86 in April. The bottom quantity for the index is 100. A end result above 100 signifies optimism, and under 100, pessimism. Maru compiles its family index every month by asking a panel of individuals a collection of questions concerning the financial system’s prospects over the following 60 days.

Really useful from Editorial

On the financial system entrance, 34 per cent suppose it’s heading in the right direction, up three share factors from the earlier ballot. That introduced the studying again to the place it was two months in the past, Wright mentioned, noting {that a} vital variety of folks — 66 per cent — nonetheless consider the financial system is on the unsuitable monitor.

“On the nationwide entrance, nothing has modified, however on the private entrance, folks proceed to wrestle,” he mentioned.

• Electronic mail: gmvsuhanic@postmedia.com

Bookmark our web site and help our journalism: Don’t miss the enterprise information you might want to know — add financialpost.com to your bookmarks and join our newsletters right here.

Share this text in your social community