The transient’s key findings are:

- The 2024 Trustees Report confirmed a slight drop within the 75-year deficit, however the depletion date for the retirement belief fund stays at 2033.

- The prospect of a 21-percent profit minimize solely 9 years away ought to focus our consideration on restoring steadiness to this system.

- Additional delay has actual prices:

- choices like investing a part of the belief fund in equities are disappearing because the belief fund slides in the direction of zero;

- the burden of tax will increase or profit cuts totally shifts to Millennials and subsequent generations; and

- ready creates a disaster, so any repair ought to embrace automated changes to revive steadiness so we by no means get on this mess once more.

Introduction

The 2024 Trustees Report barely lowered the projected 75-year deficit to three.50 p.c of taxable payroll, in comparison with 3.61 p.c in 2023. The advance is attributable primarily to an upward revision within the fee of productiveness progress over the projection interval and an additional discount within the assumed incapacity incidence fee. These optimistic developments are partially offset by a decrease assumed long-term fertility fee.

The projected depletion date for the Previous-Age and Survivors Insurance coverage (OASI) belief fund property didn’t change; it stays at 2033. Sure, the Incapacity Insurance coverage (DI) belief fund has sufficient to pay advantages for the complete 75-year interval, so the date of depletion for the mixed OASDI belief funds has moved again a 12 months to 2035. However combining the 2 techniques would require a change within the legislation; therefore, underneath present legislation, the action-forcing date is 2033 – 9 years from now.

This transient updates the numbers for 2024, however emphasizes that – regardless of the small enchancment within the outlook – Congress nonetheless should act rapidly to keep away from draconian profit cuts. To that finish, the dialogue identifies three points: 1) choices, corresponding to investing a portion of the belief fund in equities, that disappear because the belief fund slides in the direction of zero; 2) the rise within the burden positioned on future generations as Boomers and Gen Xers keep away from tax hikes or profit cuts; and three) so we by no means get on this mess once more, the necessity to embrace an automated adjustment mechanism as a part of any monetary bundle. Fixing Social Safety sooner slightly than later would hold extra choices open, distribute the burden extra equitably throughout cohorts, and most significantly, restore confidence within the nation’s main retirement program.

The 2024 Report

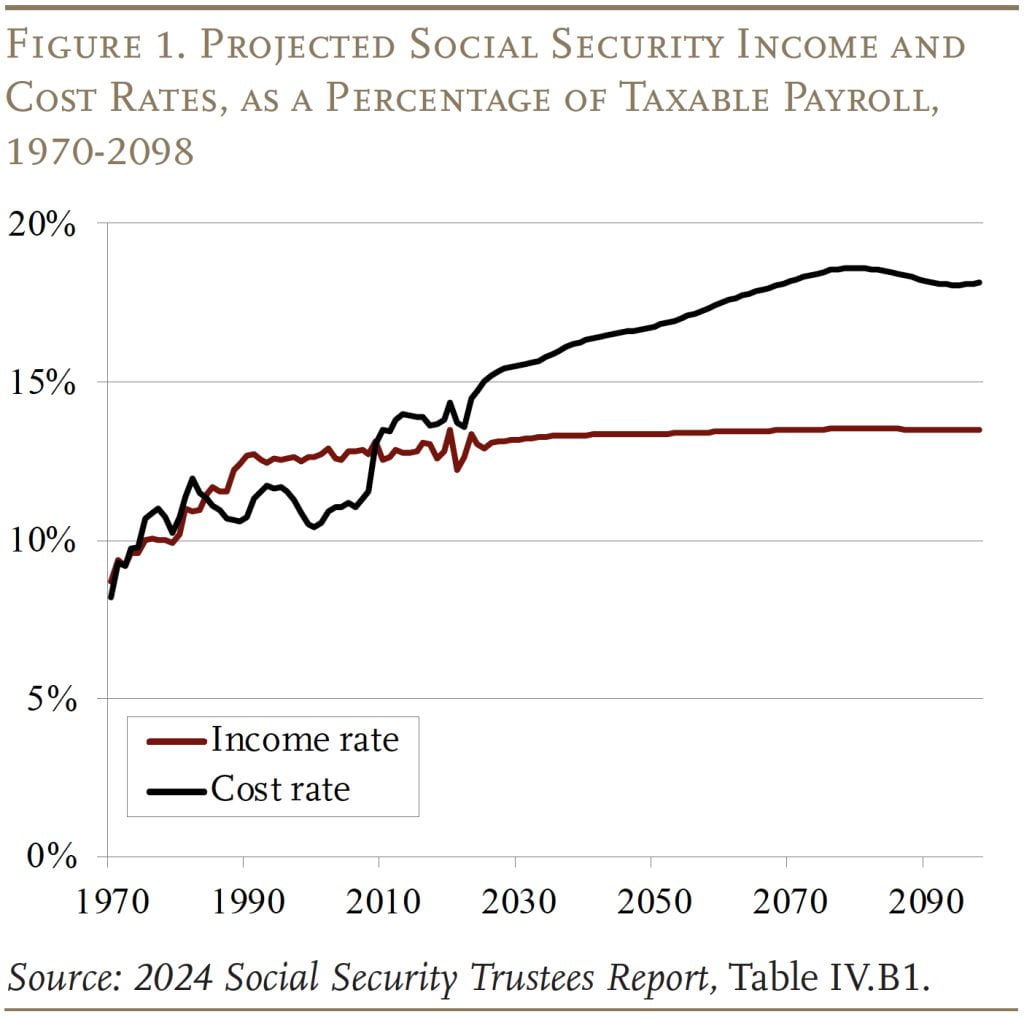

Underneath the Trustees’ intermediate assumptions, the price of the OASDI program rises quickly from 14.7 p.c of taxable payrolls in the present day to 16.3 p.c in 2040, drifts as much as about 18.6 p.c in 2080, after which declines barely (see Determine 1).

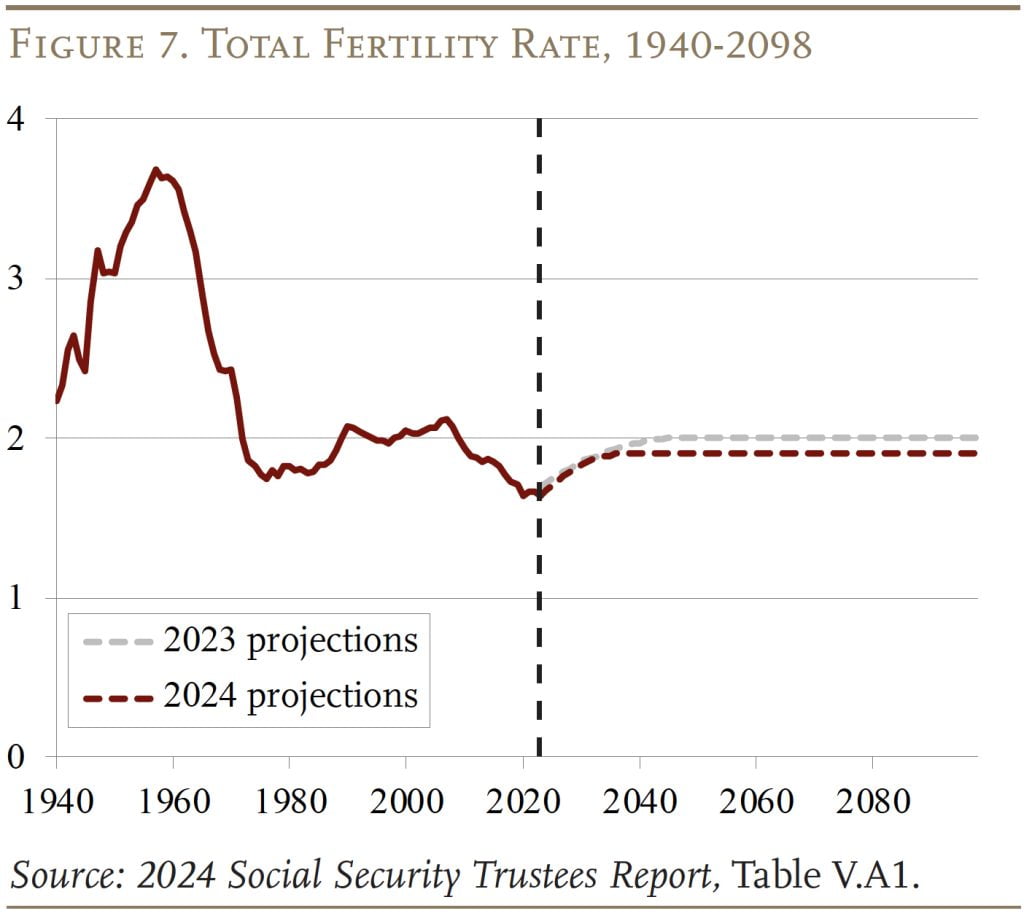

The rise in prices is pushed by demographics, particularly the drop within the whole fertility fee after the Child Increase (these born between 1946 and 1964). Girls of childbearing age in 1964 had a mean of three.2 kids; by 1974 that quantity had dropped to 1.8. The mixed results of the retirement of Child Boomers and a slow-growing labor drive because of the decline in fertility scale back the ratio of staff to retirees from about 3:1 to 2:1 and lift prices commensurately. The growing hole between the revenue and price charges signifies that the system is going through a 75-year deficit.

The 75-year money move deficit is mitigated within the brief time period by the property within the belief fund, which presently equal about two years of advantages. These property are the results of annual surpluses as a consequence of reforms enacted in 1983. Since 2010, nonetheless, when Social Safety’s value fee began to exceed the revenue fee, the federal government has been tapping the curiosity on belief fund property to cowl advantages. And, in 2021, as taxes and curiosity fell in need of annual advantages, the federal government began to attract down belief fund property. These drawdowns will proceed till the OASI belief fund is depleted in 2033.

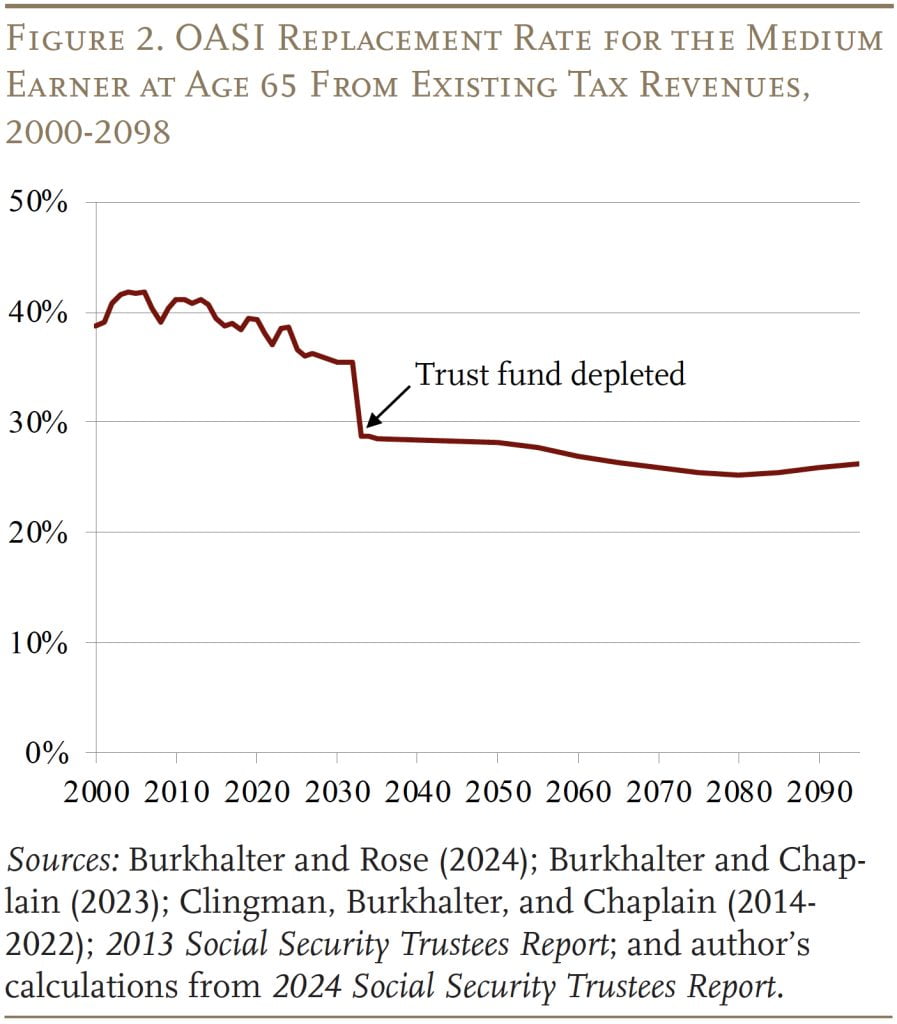

It’s essential to emphasise that the depletion of the belief fund doesn’t imply that OASI has run out of cash. On the time of the depletion, payroll tax revenues hold rolling in and might cowl 79 p.c of presently legislated advantages, declining to 71 p.c by the top of the projection interval. (If the OASI and DI belief funds had been merged, the protection numbers can be 83 p.c, declining to 73 p.c.) Relying solely on present tax revenues, nonetheless, signifies that the substitute fee – retirement advantages relative to pre-retirement earnings – for the standard age-65 employee would drop instantly from about 36 p.c to about 29 p.c – a stage not seen because the Fifties (see Determine 2). (Observe that the substitute fee for these claiming at 65 has already declined because of the rise within the Full Retirement Age from 65 to 67.)

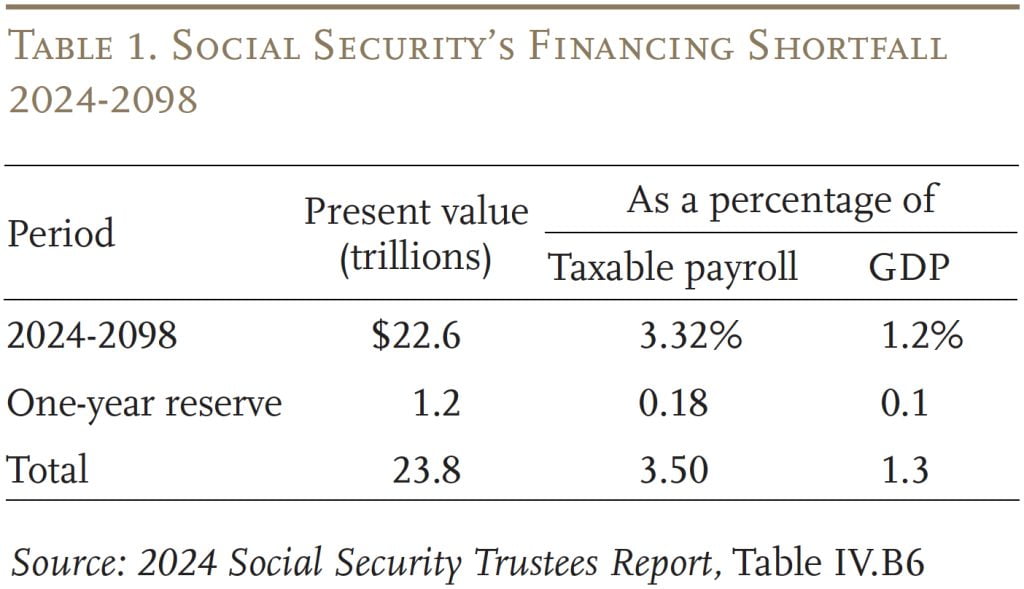

Shifting from money flows to the 75-year deficit requires calculating the distinction between the current discounted worth of scheduled advantages and the current discounted worth of future taxes plus the property within the belief fund. This calculation for the OASDI program exhibits that Social Safety’s long-run deficit is projected to equal 3.50 p.c of lined payroll earnings. That determine signifies that if payroll taxes had been raised instantly by 3.50 proportion factors – 1.75 proportion factors every for the worker and the employer – the federal government may pay scheduled advantages via 2098, with a one-year reserve on the finish.

At this level, fixing the 75-year funding hole isn’t the top of the story when it comes to required tax will increase. Sooner or later, as soon as the ratio of retirees to staff stabilizes and prices stay comparatively fixed as a proportion of payroll, any answer that solves the issue for 75 years will roughly remedy the issue completely. However, throughout this era of transition, any bundle of coverage modifications that restores steadiness just for the following 75 years will present a deficit within the following 12 months because the projection interval picks up a 12 months with a big destructive steadiness. Thus, eliminating the 75-year shortfall ought to be considered as step one towards “sustainable solvency.”

Some commentators cite Social Safety’s monetary shortfall over the following 75 years when it comes to {dollars} – $22.6 trillion (see Desk 1). Though this quantity seems very massive, the financial system – and, subsequently, taxable payrolls – will even be rising. Thus, the scary $22.6 trillion might be eradicated – and a one-year reserve created – just by elevating the payroll tax by 3.5 proportion factors.

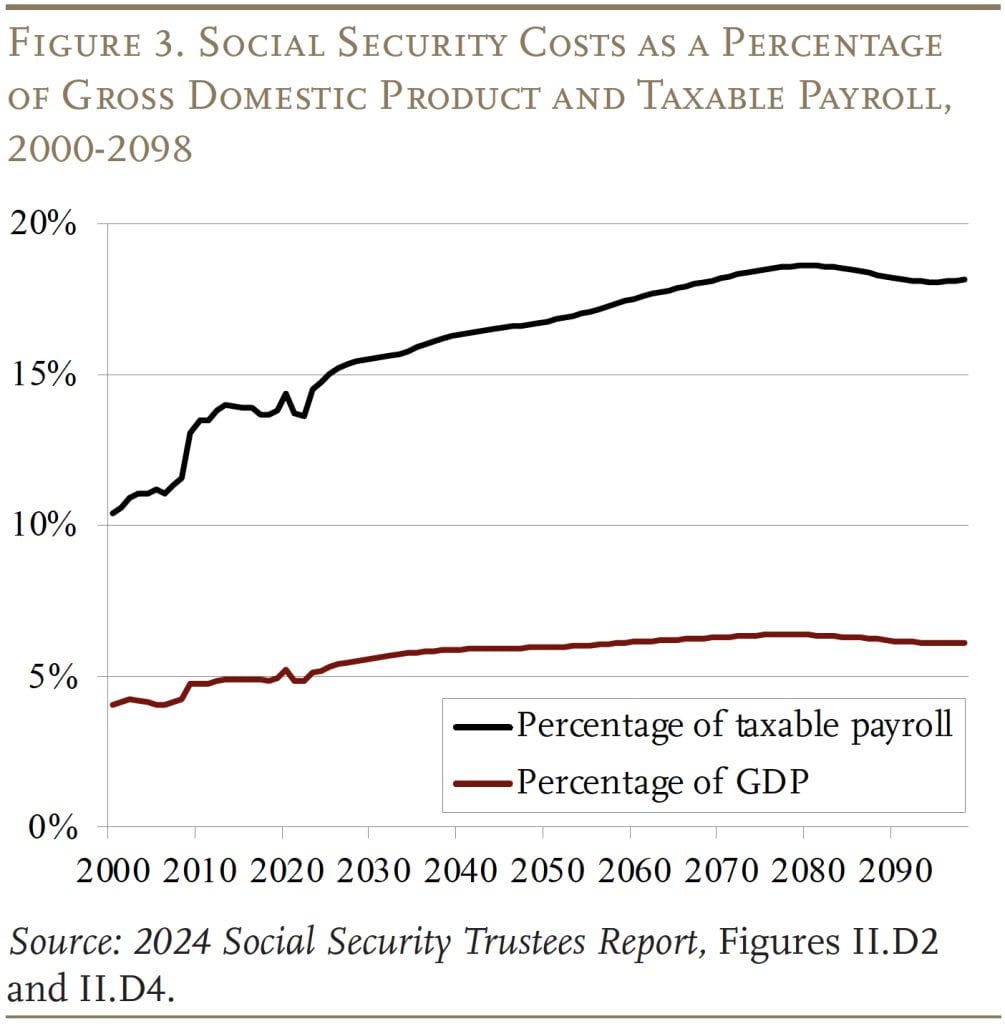

The Trustees additionally report Social Safety’s shortfall as a proportion of GDP. The price of this system is projected to rise from about 5 p.c of GDP in the present day to about 6 p.c of GDP because the Child Boomers retire (see Determine 3). The rationale why prices as a proportion of taxable payroll hold rising – whereas prices as a proportion of GDP roughly stabilize – is that taxable payroll is projected to say no as a share of whole compensation as a consequence of continued progress in well being advantages.

2024 Report in Perspective

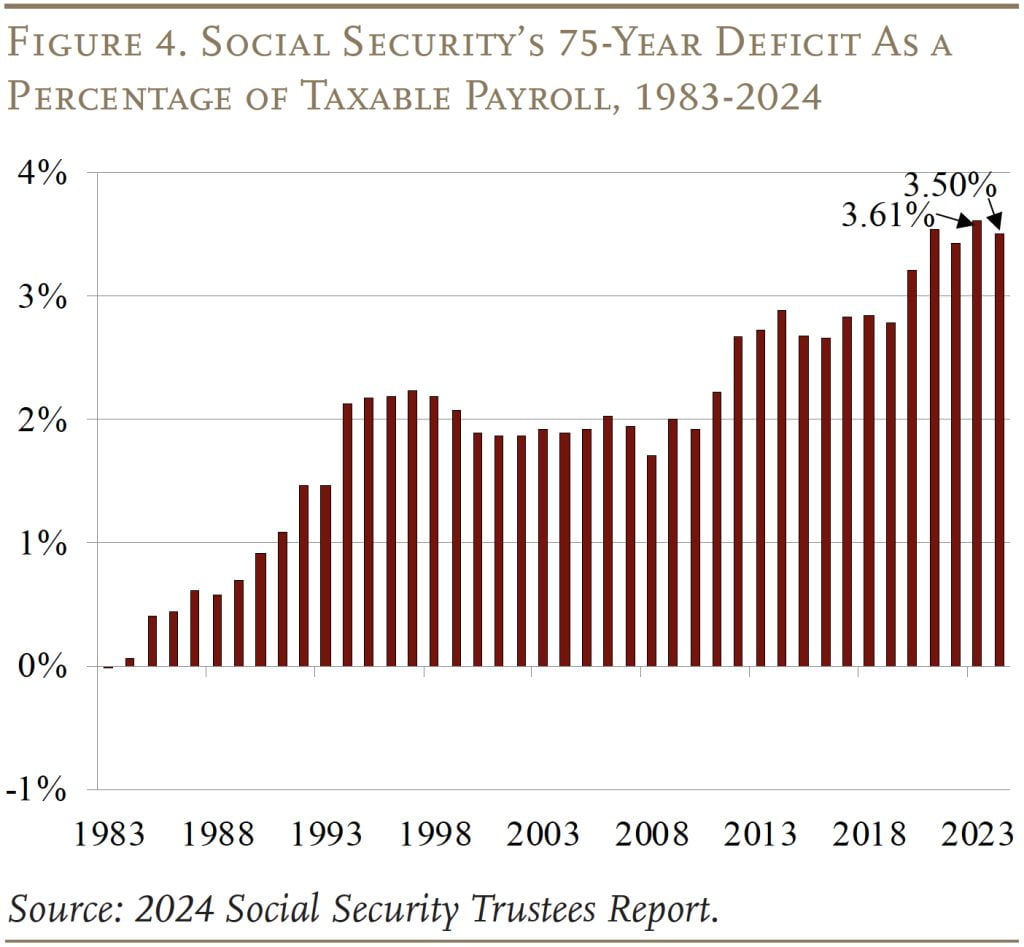

The 75-year deficits within the final 4 Trustees Reviews are the biggest since 1983 when Congress enacted main laws to revive steadiness (see Determine 4). The primary query is why did the deficit develop over the interval 1983-2024, and a secondary query is why did it decline barely since final 12 months’s Report.

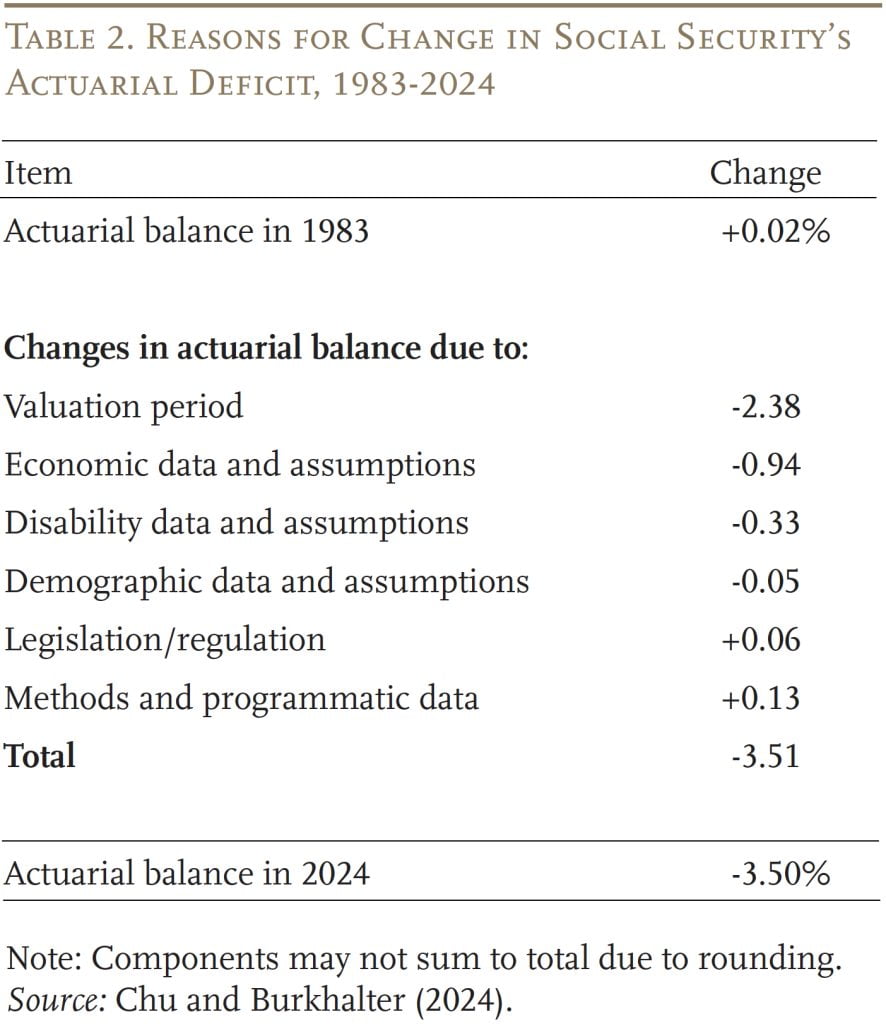

Modifications in 75-12 months Deficit Since 1983

Social Safety moved from a projected 75-year actuarial surplus of 0.02 p.c of taxable payroll within the 1983 Report back to a projected deficit of three.50 p.c within the 2024 Report. As proven in Desk 2, main the listing of causes is advancing the valuation interval. Every time it strikes out one 12 months, it picks up a 12 months with a big destructive steadiness. The cumulative impact over the past 41 years has been to extend the 75-year deficit by 2.38 p.c of taxable payrolls. That’s, greater than two-thirds of the 41-year change within the OASDI deficit is attributable to easily transferring the valuation interval ahead.

A worsening of financial assumptions – primarily a decline in assumed productiveness progress and the affect of the Nice Recession – have additionally contributed to the rising deficit. One other contributor over the previous 41 years has been will increase in incapacity rolls, though that image has modified dramatically lately. Lastly, altering demographic assumptions – most significantly, the discount within the assumed fertility fee this 12 months – has additionally added to the 41-year change.

Partially offsetting the destructive components has been a discount within the actuarial deficit as a consequence of: 1) legislative and regulatory modifications and a couple of) methodological enhancements and up to date information. The web impact in 2024 of all these modifications is a 75-year deficit equal to three.50 p.c of taxable payrolls.

Modifications from Final 12 months’s Report

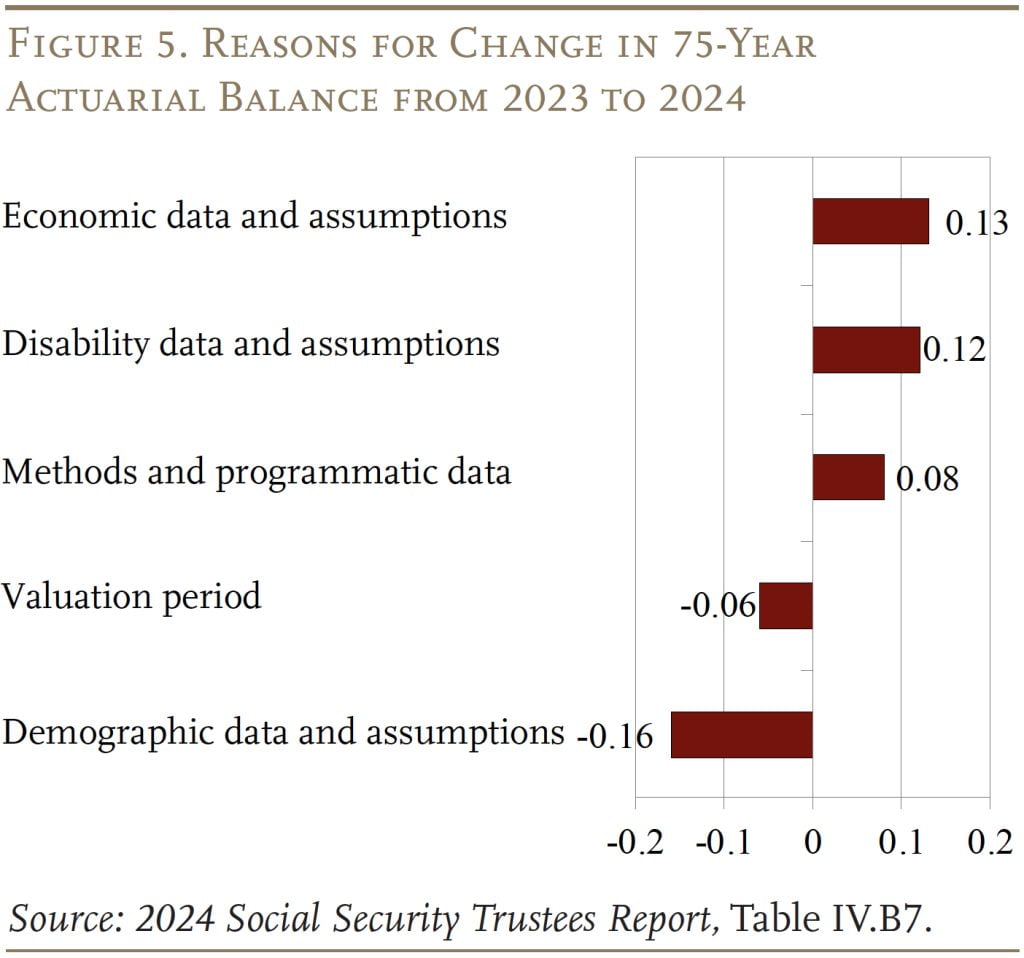

The three.50 p.c of taxable payrolls within the 2023 Report is barely decrease than the three.61 p.c in final 12 months’s Report (see Determine 5). This shift is primarily a results of modifications in three assumptions – the financial system, incapacity incidence, and fertility. The primary two enhance the long-term monetary outlook, whereas the change within the fertility assumption worsened it.

Economic system. Better-than-anticipated progress final 12 months led to a rise within the assumed stage of productiveness progress over the projection interval, and up to date information on instructional attainment led to greater assumed labor drive participation. As well as, new information on the quantity and age of lined staff improved the actuarial steadiness.

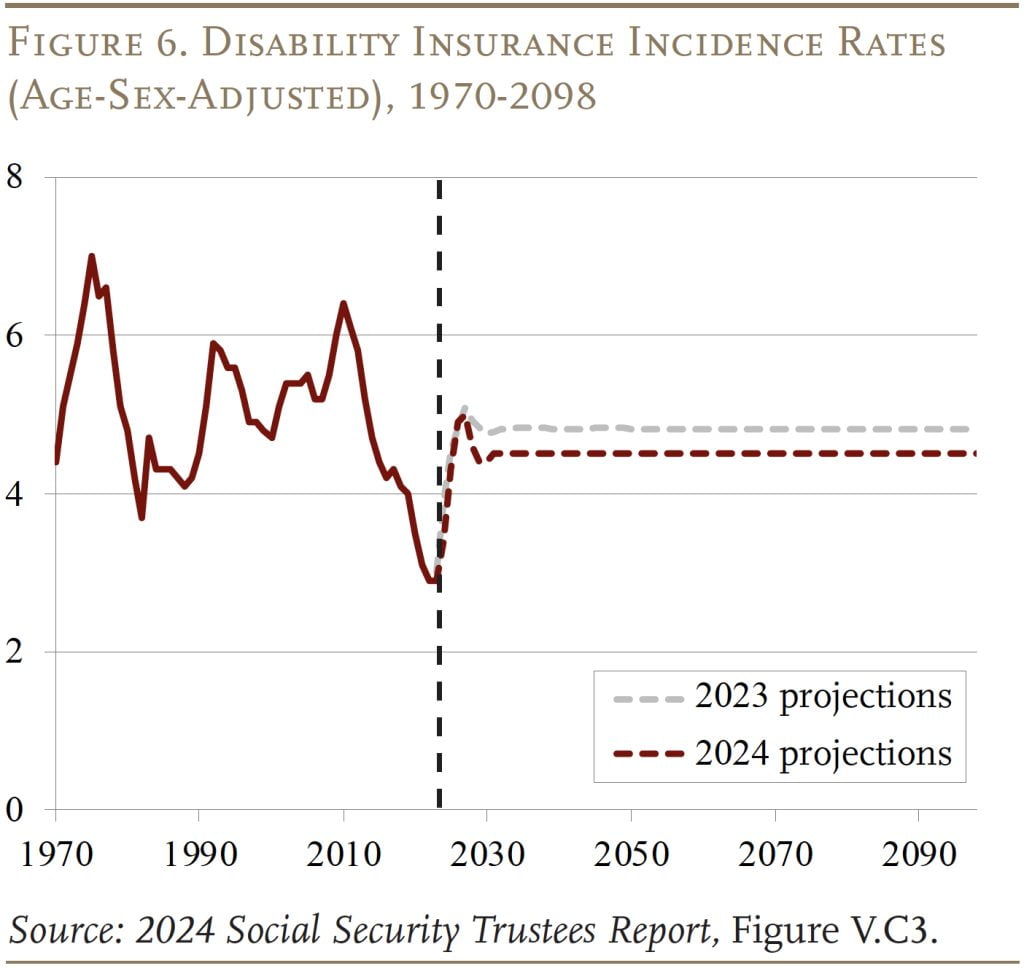

Incapacity incidence. The DI incidence fee (new awards relative to the insured inhabitants) has continued to drop (see Determine 6), pushed largely by the energy of the financial system and a stricter course of for awarding advantages on enchantment. In response, the Trustees lowered the final word fee for the projections. As well as, with a decrease prevalence of incapacity, the mannequin produced greater labor drive participation and employment charges.

Fertility. The entire fertility fee has been declining sharply (see Determine 7), and up to date surveys of start expectations present girls planning on fewer kids than previously. This development displays a bunch of things together with decrease marriage charges, excessive value of childcare, issues about financial alternative, and decrease fertility in international locations from which new immigrants are arriving. In recognition that fertility is unlikely to rebound to earlier ranges, the Trustees lowered the final word fee from 2.0 to 1.9 kids per girl, and moved up the date when the final word fee is achieved from 2056 to 2040. These modifications decreased the actuarial steadiness.

The main focus right here, nonetheless, isn’t year-to-year modifications within the 75-year projections however slightly the upcoming exhaustion of the OASI belief fund and the price of delaying Congressional motion.

Delay Has Actual Prices

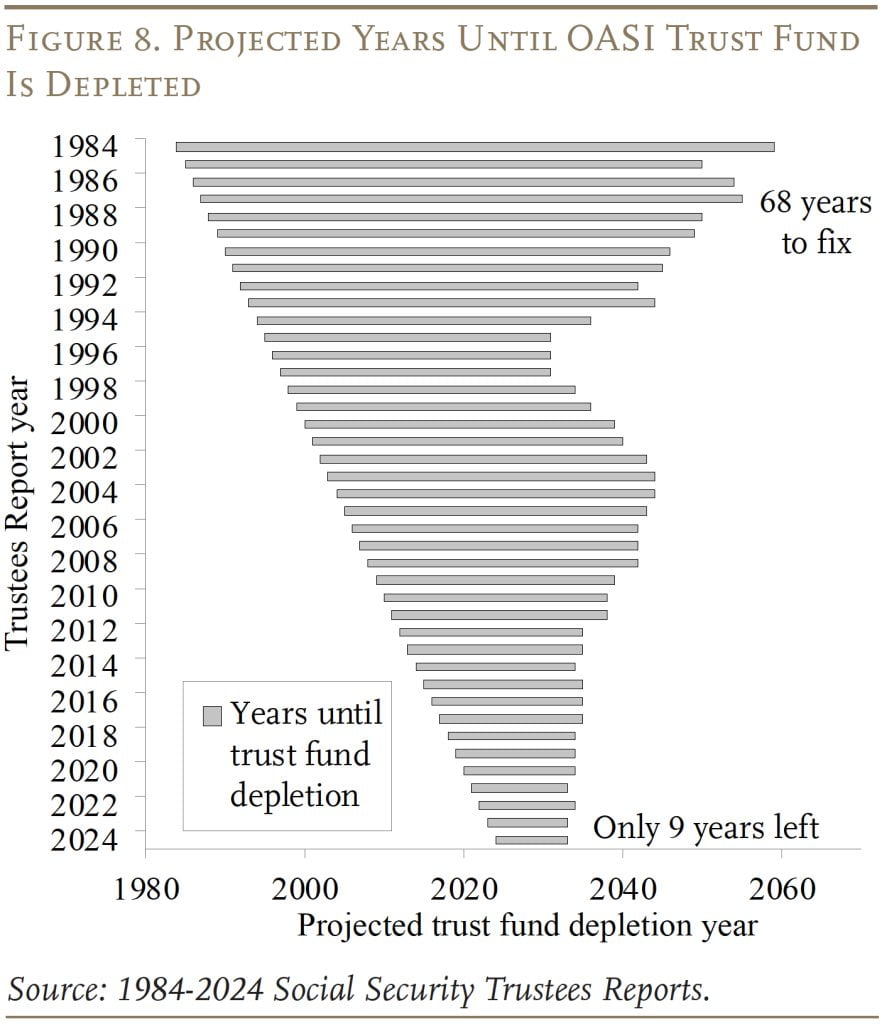

The depletion of the OASI belief fund isn’t information. Just about from the day the belief fund started accumulating property, the Trustees have projected its depletion. However time is getting brief: whereas we used to have 68 years to determine how one can keep away from depletion of the OASI belief fund, we now have 9 years (see Determine 8).

Failure to behave has critical implications. It undermines Individuals’ confidence within the spine of our retirement system and causes some to say their advantages early, hoping that these on the rolls could also be spared future cuts. Equally necessary, delaying motion signifies that some choices disappear, the eventual modifications should be extra abrupt, and fewer of the present grownup generations take part within the repair. The next discusses one of many choices that disappears with delay, explores the affect on the allocation of prices throughout cohorts, and, in order that we by no means discover ourselves on this predicament once more, argues that any financing bundle ought to embrace an automated adjustment mechanism.

Investing the Belief Fund in Equities

One disappearing choice is the possibility to take a position a portion of belief fund reserves in equities, an concept that – ultimately – seems to have appreciable assist. Since fairness funding has greater anticipated returns relative to safer property, Social Safety would probably want much less in tax will increase or profit cuts to realize long-term solvency. Certainly, if Social Safety had begun investing 40 p.c of its property in equities in 1984 and even 1997, the belief fund wouldn’t be operating out of cash in the present day. Furthermore, economists additionally argue that environment friendly risk-sharing throughout a lifecycle requires people to bear extra monetary danger when younger and fewer when previous, and because the younger have little in the way in which of economic property, investing the belief fund in equities is one method to obtain that aim.

The actual world gives a convincing case that governments can spend money on equities in a wise method. Canada has a big actively managed fund, follows fiduciary requirements, and makes use of conservative return assumptions. In the US, the Railroad Retirement system has additionally invested in a broad array of property with out interfering within the non-public market, as has the Federal Thrift Financial savings Plan, the place the federal government performs an basically passive position.

Investing belief fund property in equities, nonetheless, requires having a significant belief fund. As famous, Social Safety’s belief fund is rapidly heading in the direction of zero. If policymakers wait till 2033 to repair the system, recreating a belief fund would require a tax hike to cowl each this system’s present prices and to provide an annual surplus to construct up reserves. It’s not clear that the political will exists to make such a transfer, and, certainly, with prices – as a proportion of taxable payrolls – scheduled to stage off, it’s arduous to argue that in the present day’s staff ought to pay extra to construct up a belief fund in order that tomorrow’s staff would pay much less.

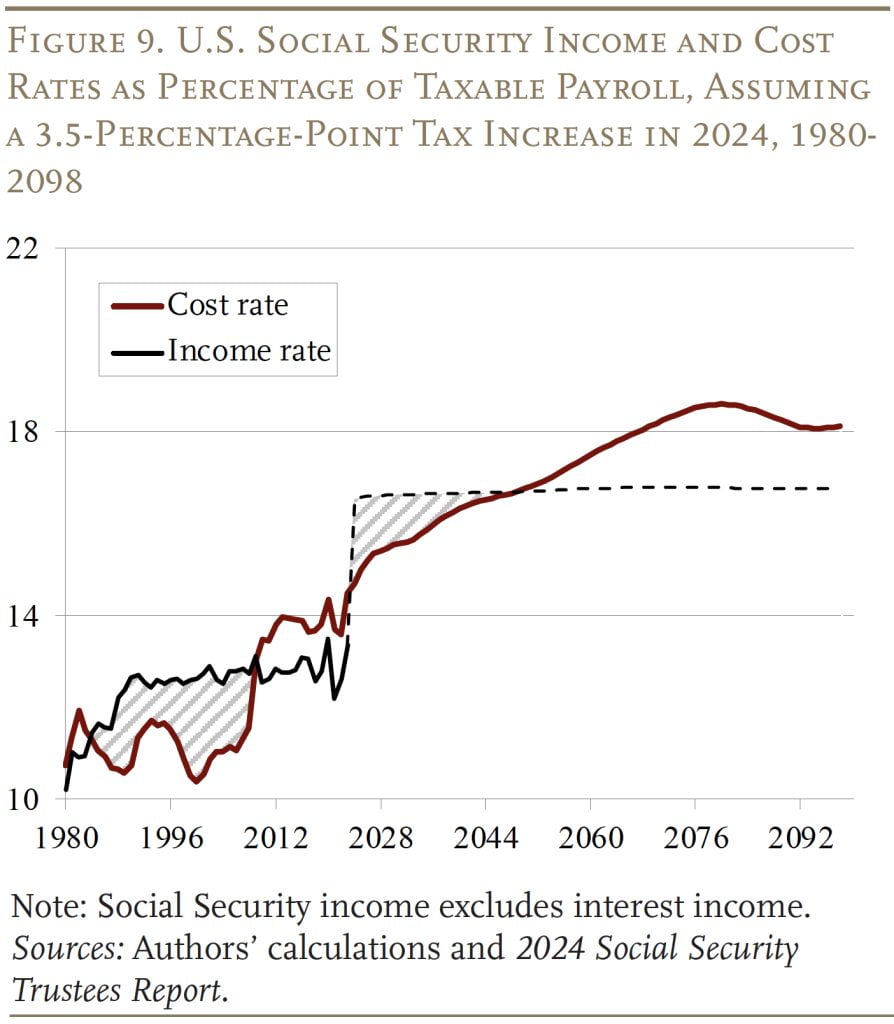

The excellent news is that, in 2024, Social Safety reserves equal $2.6 trillion {dollars}, roughly two and a half occasions annual prices. Combining these balances with a 3.5-percentage-point enhance within the payroll tax would produce a considerable belief fund over the following decade (see Determine 9). Sure, the annual surpluses – the shaded space – are barely smaller than the surpluses that emerged from the 1983 laws, however this time we’re beginning with S2.6 trillion, whereas in 1984 we had been beginning with zero. Investing a portion of those property in equities may assist cowl prices over the following 75 years and past. However to reap the benefits of this feature, Congress has to behave sooner slightly than later, earlier than the belief fund hits zero.

Distributing the Burden Pretty Throughout Generations

Some commentators recommend that delay raises the associated fee. That conclusion is just not right. The price is the distinction between Social Safety’s value and revenue charges, as proven by the 2 strains reported in Determine 1; prices and revenues don’t change because of congressional inaction. The completely different numbers that commentators spotlight merely replicate completely different 75-year projection intervals – for instance, 2015-2089 versus 2024-2098.

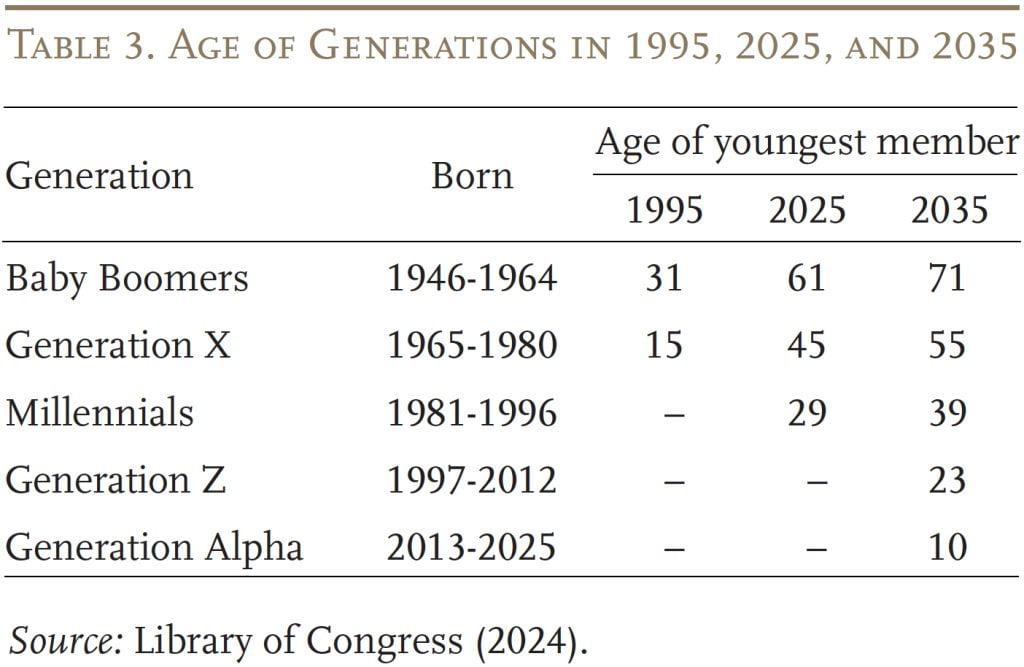

What’s impacted by delay is the generations who will foot the invoice. For instance, if the change had been made within the early Nineteen Nineties when a major long-term shortfall first re-emerged, the Child Increase would have shared extra of the burden with subsequent generations. At this level, the youngest Boomer is age 60, so the Boomer cohort won’t be affected by any enhance within the payroll tax and they’re virtually definitely protected against any advantages cuts (see Desk 3). The one method to extract a contribution from the Boomers can be to make some delay or minimize within the annual cost-of-living adjustment to Social Safety retirement advantages.

It’s not solely the Boomers, nonetheless, who’re disappearing from the labor drive. If Congress fails to behave till 2035, the youngest member of Era X will probably be 55. At that time, Gen Xers will contribute virtually nothing when it comes to extra taxes and can almost certainly be grandfathered from profit reductions. The results of the nice fortune accorded Boomers and Gen Xers is that Millennials and subsequent generations must pay the complete value of fixing Social Safety to take care of 75-year solvency via 2098 which, with modifications starting in 2035, would require a tax enhance in extra of 4 p.c or a 25-percent discount in all advantages (versus 21 p.c if motion had been taken in the present day). It’s unlikely that such an consequence can be the results of a cautious coverage deliberation. It’s capricious and unfair and will get worse the longer the delay.

Stopping Future Crises

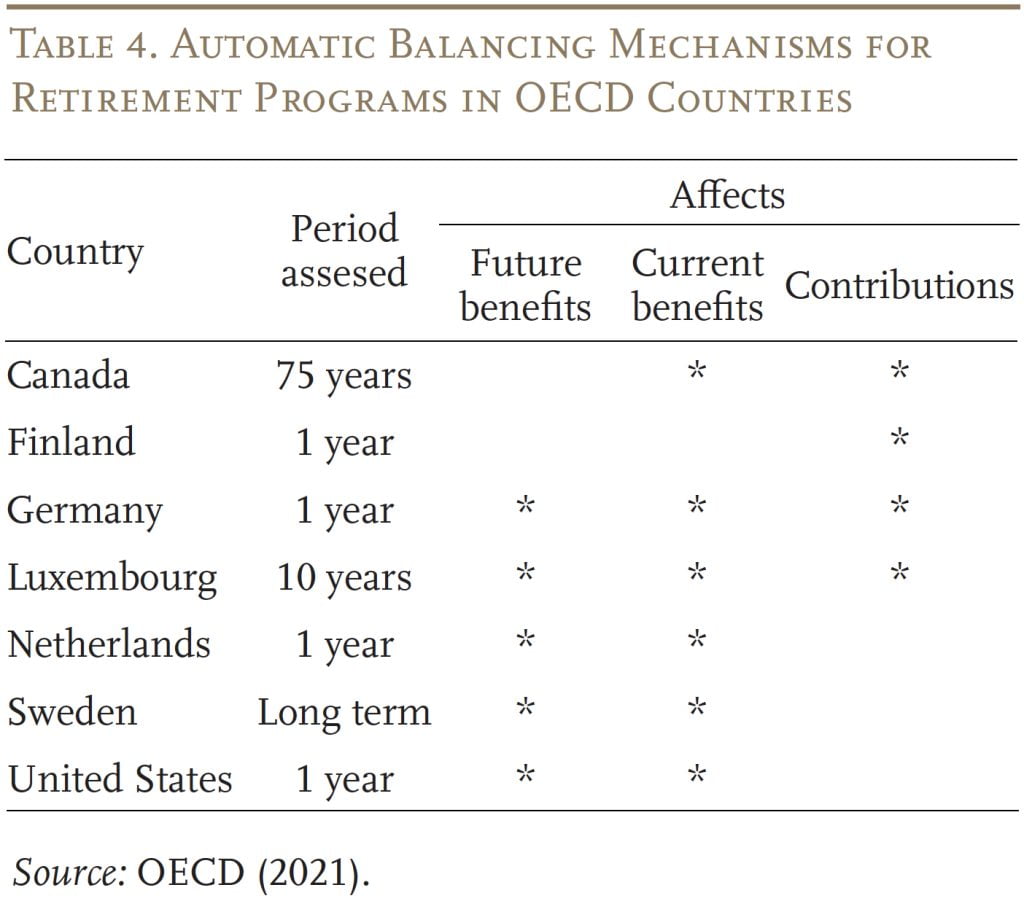

One method to keep away from repeated crises and restore confidence within the monetary stability of the Social Safety program is for any bundle of options to incorporate a mechanism that mechanically adjusts revenues and advantages if shortfalls emerge. As of the newest OECD report on retirement packages, many international locations have mechanisms that hyperlink the parameters of their packages to modifications in both financial or demographic developments, and 7 have automated balancing mechanisms explicitly designed to make sure that the retirement plans are totally financed (see Desk 4).

Curiously, the US is included on this listing. We, in reality, do have a mechanism to make sure that the system is totally funded. When the belief fund is depleted, Social Safety should minimize advantages to the extent of incoming revenues – therefore, the projected 21-percent profit minimize in 2033. This mechanism, nonetheless, is a draconian method to spur motion and doesn’t appear very efficient, besides at creating nice nervousness amongst older staff and retirees.

The Canadians have a way more civilized strategy – maybe one that might function a mannequin for the US. It’s a backstop association that’s activated solely within the absence of a political settlement. Mechanically it really works as follows. Each three years, the Chief Actuary estimates the minimal contribution fee wanted to finance the system over 75 years. If the required fee exceeds the legislated fee and policymakers can not agree on an answer, the backstop kicks in. In that case, the cost-of-living adjustment is frozen, and contribution charges are elevated by 50 p.c of the distinction between the legislated and the required fee for 3 years till the Chief Actuary’s following report. The mechanism thus avoids uncertainty in regards to the system’s monetary stability over time if policymakers fail to behave.

The USA doesn’t must undertake the specifics of the Canadian backstop mechanism, however together with some automated adjustment within the face of inaction would enhance confidence within the long-term stability of the Social Safety program.

Briefly, fixing Social Safety sooner slightly than later would restore confidence within the nation’s main retirement program, give folks time to regulate to wanted modifications, retain a variety of choices which are quick disappearing, and distribute the burden extra equitably throughout cohorts. Furthermore, to keep away from future crises of our making, any monetary repair ought to embrace an adjustment mechanism that mechanically restores steadiness if policymakers fail to behave.

Conclusion

The 2024 Trustees Report confirms what has been evident for nearly three a long time – particularly, Social Safety is going through a long-term financing shortfall that equals 1 p.c of GDP. The modifications required to repair the system are effectively throughout the bounds of fluctuations in spending on different packages previously. Furthermore, motion must be taken earlier than the OASI belief fund is depleted in 2033 to keep away from a precipitous minimize in advantages. Individuals assist this program; their representatives ought to repair its funds.

References

Burkhalter, Kyle and Karen Rose. 2024. “Alternative Charges for Hypothetical Retired Staff.” Actuarial Observe Quantity 2024.9. Baltimore, MD: U.S. Social Safety Administration.

Burkhalter, Kyle and Chris Chaplain. 2023. “Alternative Charges for Hypothetical Retired Staff.” Actuarial Observe Quantity 2023.9. Baltimore, MD: U.S. Social Safety Administration.

Burtless, Gary, Anqi Chen, Wenliang Hou, and Alicia H. Munnell. 2017. “How Would Investing in Equities Have Affected the Social Safety Belief Fund?” Working Paper 2016-6. Chestnut Hill, MA: Heart for Retirement Analysis at Boston School.

Chu, Sharon and Kyle Burkhalter. 2024. “Disaggregation of Modifications within the Lengthy-Vary Actuarial Steadiness for the Previous Age, Survivors, and Incapacity Insurance coverage (OASDI) Program Since 1983.” Actuarial Observe Quantity 2024.8. Baltimore, MD: U.S. Social Safety Administration.

Clingman, Michael, Kyle Burkhalter, and Chris Chaplain. 2014-2022. “Alternative Charges for Hypothetical Retired Staff.” Actuarial Observe Quantity 9. Baltimore, MD: U.S. Social Safety Administration.

Liu, Siyan and Laura D. Quinby. 2023. “What Components Clarify the Drop in Incapacity Insurance coverage Rolls from 2015 to 2019?” Working Paper 2023-7. Chestnut Hill, MA: Heart for Retirement Analysis at Boston School.

Library of Congress. 2024. “Doing Client Analysis: A Useful resource Information.” Washington, DC.

Munnell, Alicia H. and Michael Wicklein. 2023. “Ought to Social Safety Put money into Equities?” Concern in Transient 23-14. Chestnut Hill, MA: Heart for Retirement Analysis at Boston School.

Organisation for Financial Cooperation and Improvement (OECD). 2021. “Pensions at a Look.” Paris, France.

U.S. Social Safety Administration. 1983-2024. The Annual Reviews of the Board of Trustees of the Federal Previous-Age and Survivors Insurance coverage and Federal Incapacity Insurance coverage Belief Funds. Washington, DC: U.S. Authorities Printing Workplace.