The stark distinction in Black and White employees’ wealth is outdated information. However now we’ve got some recent details about the wealth hole: it grows as folks age and transfer via their retirement years.

Probably the most placing deterioration in Blacks’ relative standing might be seen in non-housing wealth. This primarily consists of 401(ok)-style plans and financial savings and funding accounts and doesn’t embody the wealth inherent in retirees’ Social Safety or employer pensions.

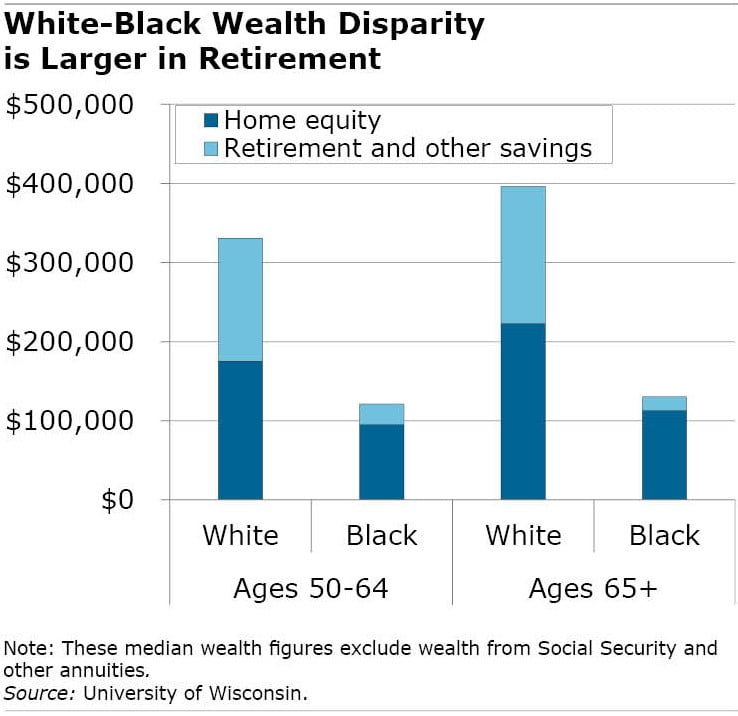

Within the closing years earlier than retirement, the standard White family between ages 50 and 64 has collected six instances extra non-housing wealth than a Black family at that age, in response to a new research.

Throughout retirement, that imbalance balloons to a tenfold distinction – about $173,000 for Whites over 65 vs. $18,000 for Black retirees.

Proudly owning a home is one other type of wealth. The White homeownership fee is constantly above 80 p.c till retirees attain their superior years. The Black homeownership fee ranges from 60 to 70 p.c for older employees and retirees, and since Black employees have a tendency to purchase cheaper homes, they construct up much less dwelling fairness through the years.

Though they’re at an obstacle right here too, the disparity in housing wealth is considerably smaller than that for non-housing wealth. However it persists. When dwelling fairness is added to retirement and different financial savings, the overall family wealth of the standard older White employee or retiree is roughly thrice greater than their Black counterparts.

Digging additional into the information, the researchers present how this dynamic performs out for every five-year improve of their ages. Not solely do White employees over 50 have extra wealth to start out with however additionally they construct it up sooner – if older Black employees accumulate wealth in any respect. As this monetary inequity carries over into retirement, it accelerates, notably for the non-housing portion of their wealth. Black retirees’ debt ranges are additionally a lot larger.

One other group that loses floor over time are the wealthiest Black households. The richer they’re, the research discovered, “the extra slowly their wealth grows relative to White households with comparable preliminary wealth.”

The researchers additionally checked out inequality when the advantages from two of Social Safety’s applications – Supplemental Safety Earnings, or SSI, and federal incapacity – are included of their evaluation. Each shrink the racial inequities in wealth. SSI, which helps the disabled and low-income Individuals over 65, has the biggest impact.

Incapacity advantages, with their progressive system for low-income retirees, are considerably extra useful to older Black employees than Whites till they begin receiving their Social Safety retirement advantages. Different analysis has proven that when folks begin their retirement advantages, which even have a progressive system, the wealth hole shrinks.

This research is an effective begin on understanding how the wealth hole evolves over a lifetime. Inheritances are one other facet of this: two out of 10 White households of their early 60s obtain inheritances – double the speed for Blacks.

Extra analysis on the channels behind the racial hole in wealth accumulation is required to seek out insurance policies that would scale back it, the researchers stated.

To learn this research by Samuel Myers, Illenin Kondo, Teegawende Zeida, and William Darity Jr., see “Social Safety Coverage Design and Racial Wealth Disparities.”

The analysis reported herein was derived in entire or partially from analysis actions carried out pursuant to a grant from the U.S. Social Safety Administration (SSA) funded as a part of the Retirement and Incapacity Analysis Consortium. The opinions and conclusions expressed are solely these of the authors and don’t characterize the opinions or coverage of SSA, any company of the federal authorities, or Boston School. Neither the USA Authorities nor any company thereof, nor any of their staff, make any guarantee, categorical or implied, or assumes any authorized legal responsibility or duty for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any particular business product, course of or service by commerce identify, trademark, producer, or in any other case doesn’t essentially represent or indicate endorsement, suggestion or favoring by the USA Authorities or any company thereof.