One of many issues that we, Filipinos, must maintain earlier than any worldwide journey is the journey tax. However do you know that not all vacationers need to pay this? Sure sorts of vacationers are eligible for exemption or diminished charge. On this article, we’ll sort out all these, so learn on!

WHAT’S COVERED IN THIS GUIDE?

What’s journey tax?

The Philippine journey tax (or just “journey tax”) is a levy collected from vacationers leaving the Philippines. Typically, it’s already included in your flight reserving. More often than not, it is advisable settle this by yourself on the airport.

However this quantity doesn’t go to the airline. It goes to the Philippine authorities:

- 50% of the proceeds to the Tourism Infrastructure and Enterprise Zone Authority (TIEZA)

- 40% to the Fee on Larger Training (CHED)

- 10% to the Nationwide Fee for Tradition and the Arts (NCCA)

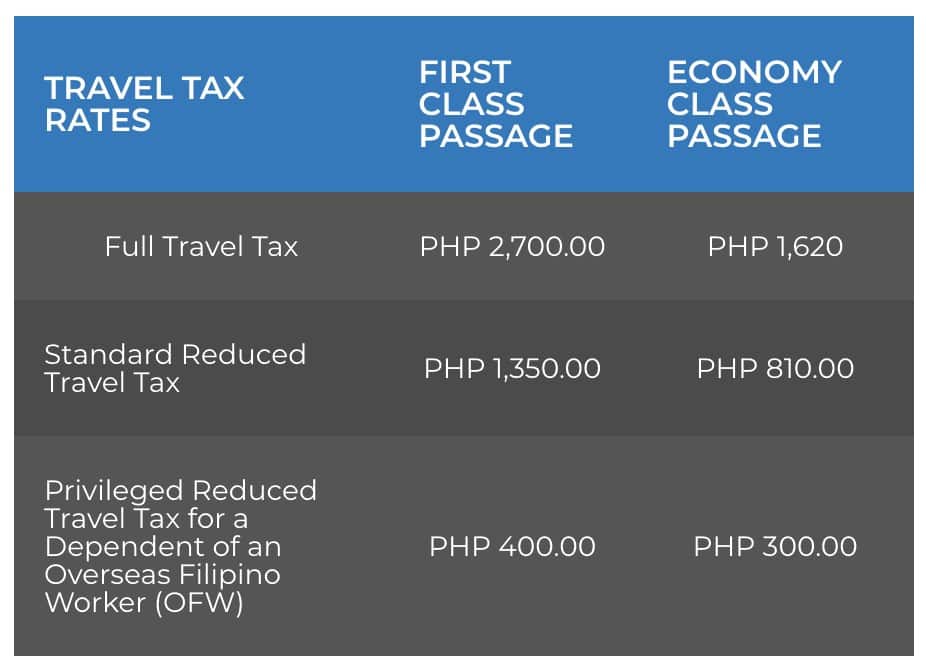

How a lot is the journey tax?

Usually, the journey tax prices PHP 1,620 for financial system class passengers or PHP 2700 for top quality passengers.

I say “most instances” as a result of some sorts of vacationers are eligible for decrease or diminished charges.

Right here’s the worth matrix:

So who can avail of the diminished journey tax?

REDUCED Journey Tax Eligibility & Necessities

Vacationers falling underneath eligible lessons will pay diminished or discounted journey tax as a substitute of the total quantity. There are two predominant classes: STANDARD diminished journey tax and PRIVILEGED diminished journey tax.

To avail of the diminished charges, you could apply on-line or on website:

- For those who don’t have a flight ticket but, accomplish this TIEZA type on-line.

- For those who’ve already booked your flight, you could file at any TIEZA journey tax workplace together with the journey tax counter on the counter.

Listed below are the eligible sorts of passengers and the corresponding paperwork it is advisable current to avail of the diminished charges.

STANDARD Decreased Journey Tax

CHILDREN: 2 years and 1 day to 12 years outdated

- Unique Passport

- Flight reserving affirmation, if issued

- If the unique passport can’t be offered, submit unique delivery certificates and photocopy of identification web page of passport

Accredited Filipino journalists on project

- Unique Passport

- Flight reserving affirmation, if issued

- Certification from the Workplace of the Press Secretary

- Certification from the station supervisor or editor

People with authorization from the President

- Unique Passport

- Flight reserving affirmation, if issued

- Written authorization from the Workplace of the President

PRIVILEGED Decreased Journey Tax

Some members of the family of Abroad Filipino Employees (OFWs) might avail of the diminished charges in the event that they’re touring to the nation the place the OFW is predicated and in a position to present the next paperwork:

OFW’s Official Partner

- Unique Passport

- Flight reserving affirmation, if issued

- OEC – Abroad Employment Certificates (unique copy) or Balik-Manggagawa Kind (licensed true copy)

- Marriage contract, unique or authenticated

- Certification that the seaman’s dependent is becoming a member of the vessel, issued by the manning company

OFW’s kids who’re single and beneath 21 years outdated (legit or illegitimate)

- Unique Passport

- Flight reserving affirmation, if issued

- OEC – Abroad Employment Certificates (unique copy) or Balik-Manggagawa Kind (licensed true copy)

- Start certificates, unique or authenticated

- Certification that the seaman’s dependent is becoming a member of the vessel, issued by the manning company

OFW’s kids with disabilities (no matter age)

- Unique Passport

- Flight reserving affirmation, if issued

- OEC – Abroad Employment Certificates (unique copy) or Balik-Manggagawa Kind (licensed true copy)

- Start certificates, unique or authenticated

- Certification that the seaman’s dependent is becoming a member of the vessel, issued by the manning company

- PWD ID card, unique copy issued by a Nationwide Council of Incapacity Affairs (NCDA) workplace

EXEMPTION Eligibility & Necessities

Some vacationers are additionally exempted from paying the journey tax altogether. TIEZA has recognized 19 sorts of passengers who’re eligible for exemption together with worldwide flight crew members, diplomats, and Philippine officers on official enterprise.

However let’s spotlight these 4 (4) classes as these are probably the most inclusive:

Abroad Filipino Employees (OFWs)

- Unique passport

- Copy of passport bio web page

- 2×2 ID picture, taken inside the previous six months (JPG solely)

- Airline ticket or flight reserving

- If employed by means of POEA, Abroad Employment Certificates (OEC)

- If immediately employed overseas, Employment Contract authenticated by the Philippine Embassy or Consulate OR Certificates of Employment issued by the Philippine Embassy or Consulate

Balikbayans whose keep within the Philippines is shorter than one 12 months

- Unique passport

- Copy of passport bio web page

- 2×2 ID picture, taken inside the previous six months (JPG solely)

- Copy of stamp of final departure from the Philippines and stamp of arrival within the Philippines, which ought to present length of no less than one (1) 12 months

- Flight ticket/reserving used to journey to the Philippines

Filipino everlasting residents overseas whose keep within the Philippines is shorter than

one 12 months

- Unique passport

- Copy of passport bio web page

- 2×2 ID picture, taken inside the previous six months (JPG solely)

- Airline ticket or flight reserving

- Copies of the stamp of final arrival within the Philippines

- Proof of everlasting residence overseas (US Inexperienced card, Canadian Kind 1000, or comparable)

- Certification of Residence, issued by the Philippine Embassy or Consulate (if the nation of residence doesn’t grant everlasting resident standing or acceptable entries within the passport)

Infants (2 years outdated and beneath)

- Unique passport

- Copy of passport bio web page

- 2×2 ID picture, taken inside the previous six months (JPG solely)

- Airline ticket or flight reserving

- If the unique passport can’t be offered, delivery certificates (unique copy)

There are 15 extra eligible varieties. To see the total checklist of eligible passengers and corresponding necessities, go to this web page.

Easy methods to Pay Journey Tax

There are a number of methods to settle the journey tax.

Possibility A: Upon reserving your flight

Some legacy airways routinely embrace the Philippine journey tax in every reserving. Most low-cost carriers don’t, however provide you with an possibility to take action.

When reserving with Cebu Pacific and AirAsia, the system will ask you if you wish to embrace the journey tax in your cost. It comes with a PHP 50 processing charge.

Possibility B: On the Airport Journey Tax Counter

That is the most typical and my most popular approach of paying.

TIEZA has journey tax counters in any respect terminals of all worldwide airports within the Philippines. At Manila’s Ninoy Aquino Worldwide Airport (NAIA) Terminal 3, you’ll discover a counter at each aisle. Simply method one and current the next:

- passport

- flight reserving affirmation

As soon as paid, you’ll be handed two copies of the official TIEZA receipt. You possibly can maintain the unique copy to your self, however the duplicate copy should be submitted to the check-in agent to be able to obtain your boarding cross.

For those who’re undecided if it’s already included in your flight ticket, examine the cost breakdown in your reserving affirmation. It ought to present you the varied taxes and costs that you just paid for, however look particularly for PH TAX that prices P1620 (P2700 for top quality) or equal quantity in overseas forex.

For those who discover it, no must pay on the airport. In any other case, don’t pay simply but since you could be double charged. As an alternative, skip the journey tax counter and line as much as the check-in counter immediately. As you examine in, the agent will let you know whether or not or not the journey tax has been settled. If not, they’ll instruct you to pay first and return to them with the receipt earlier than they may provide you with a boarding cross.

Don’t fear, you received’t need to queue up once more. Simply stroll straight to the agent while you come again.

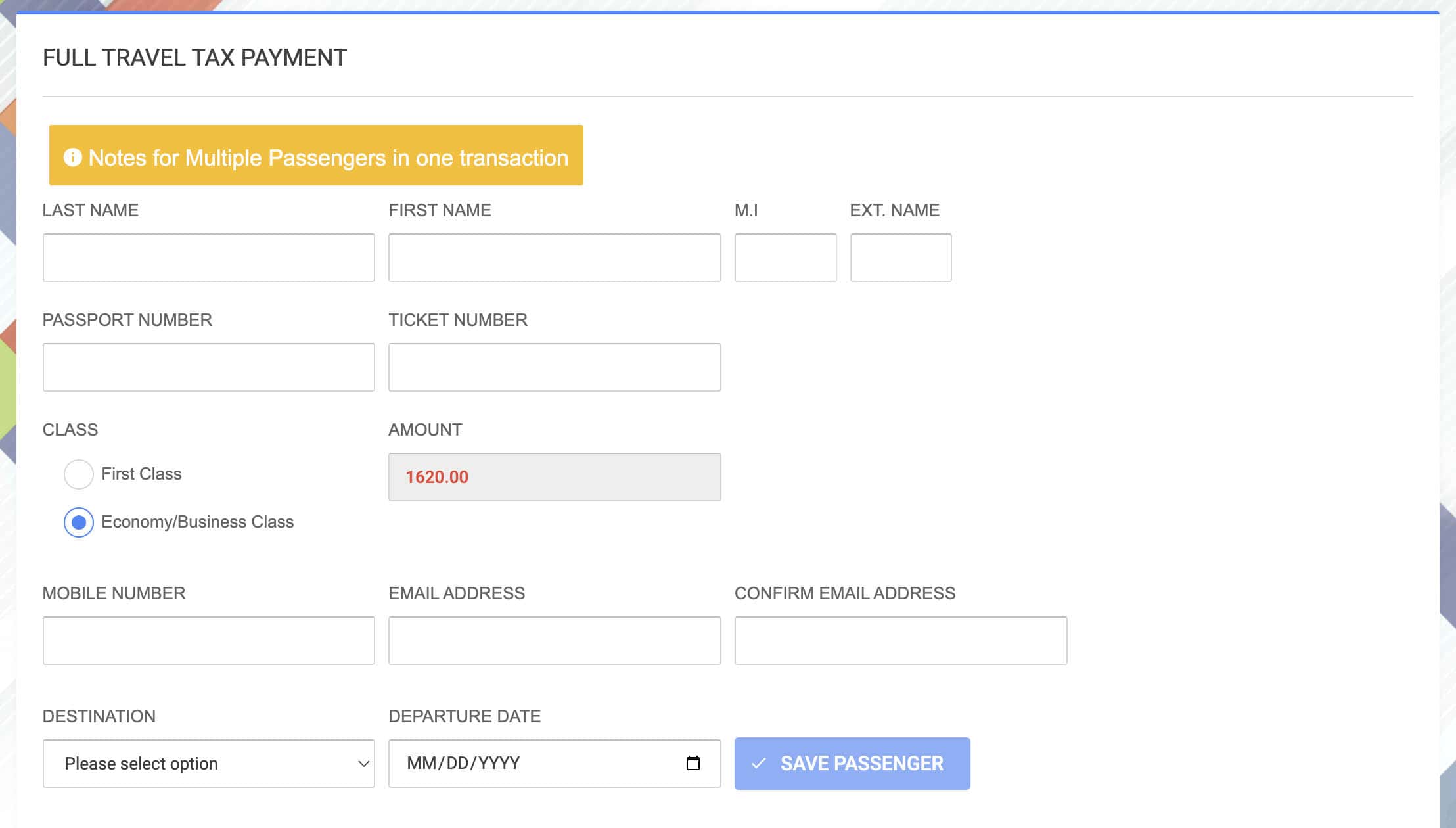

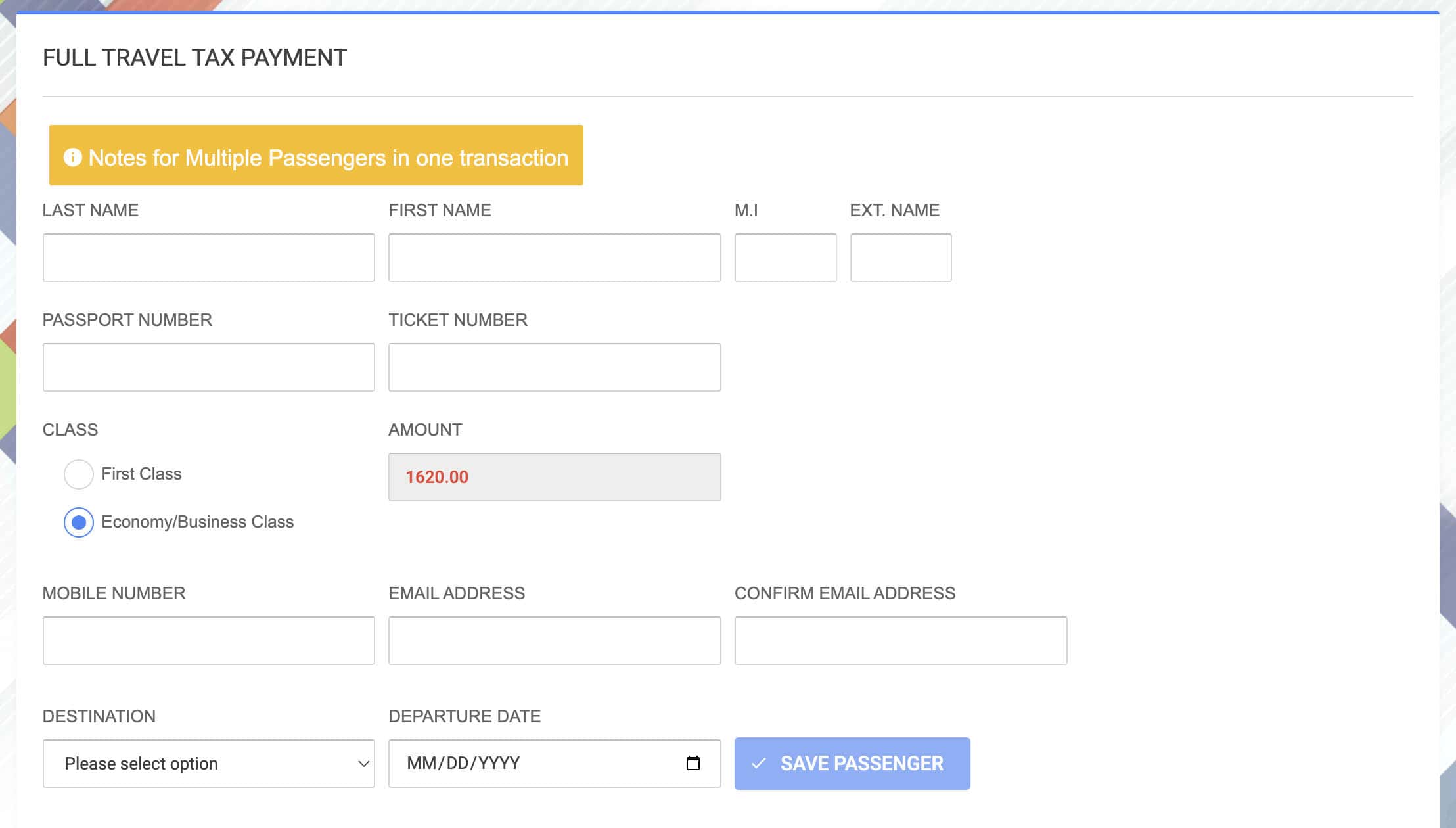

Possibility C: By way of the TIEZA Web site

You may also pay on-line prematurely. Simply go to the TIEZA Cost Web page, fill out the shape, and choose probably the most handy cost methodology for you.

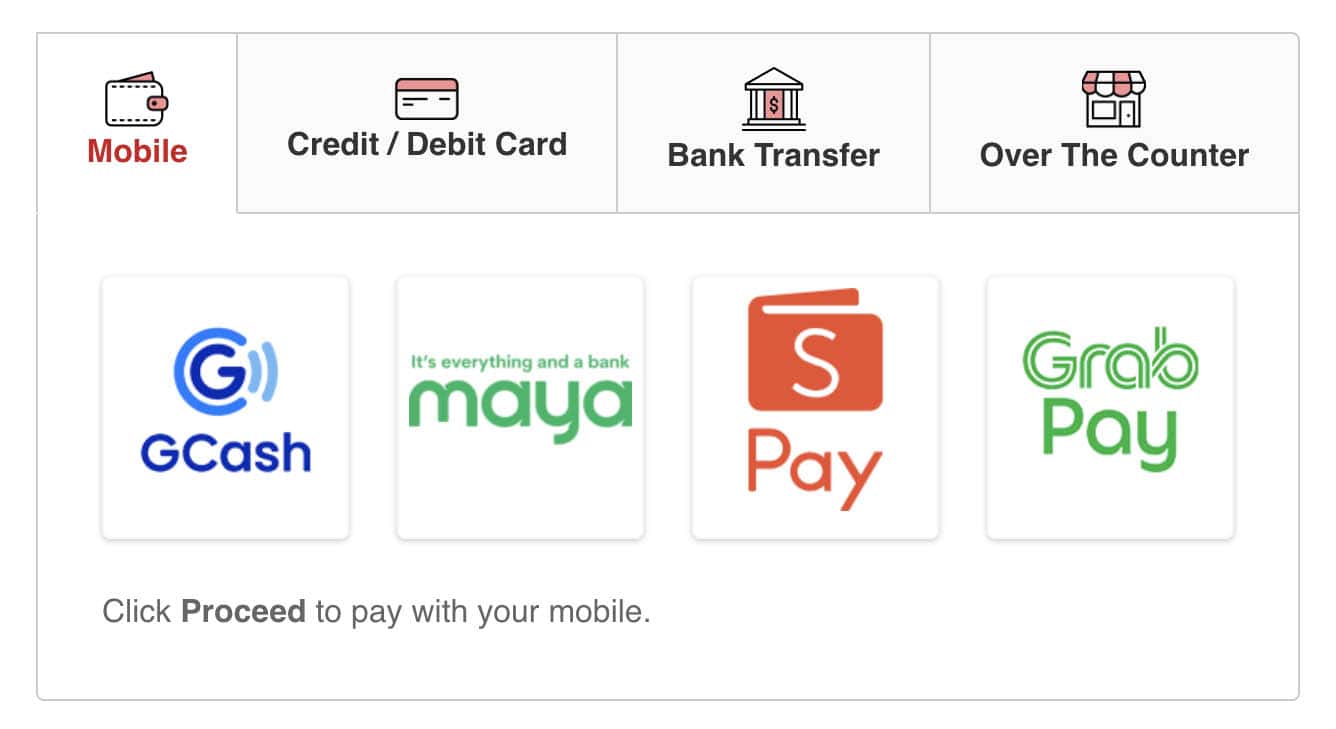

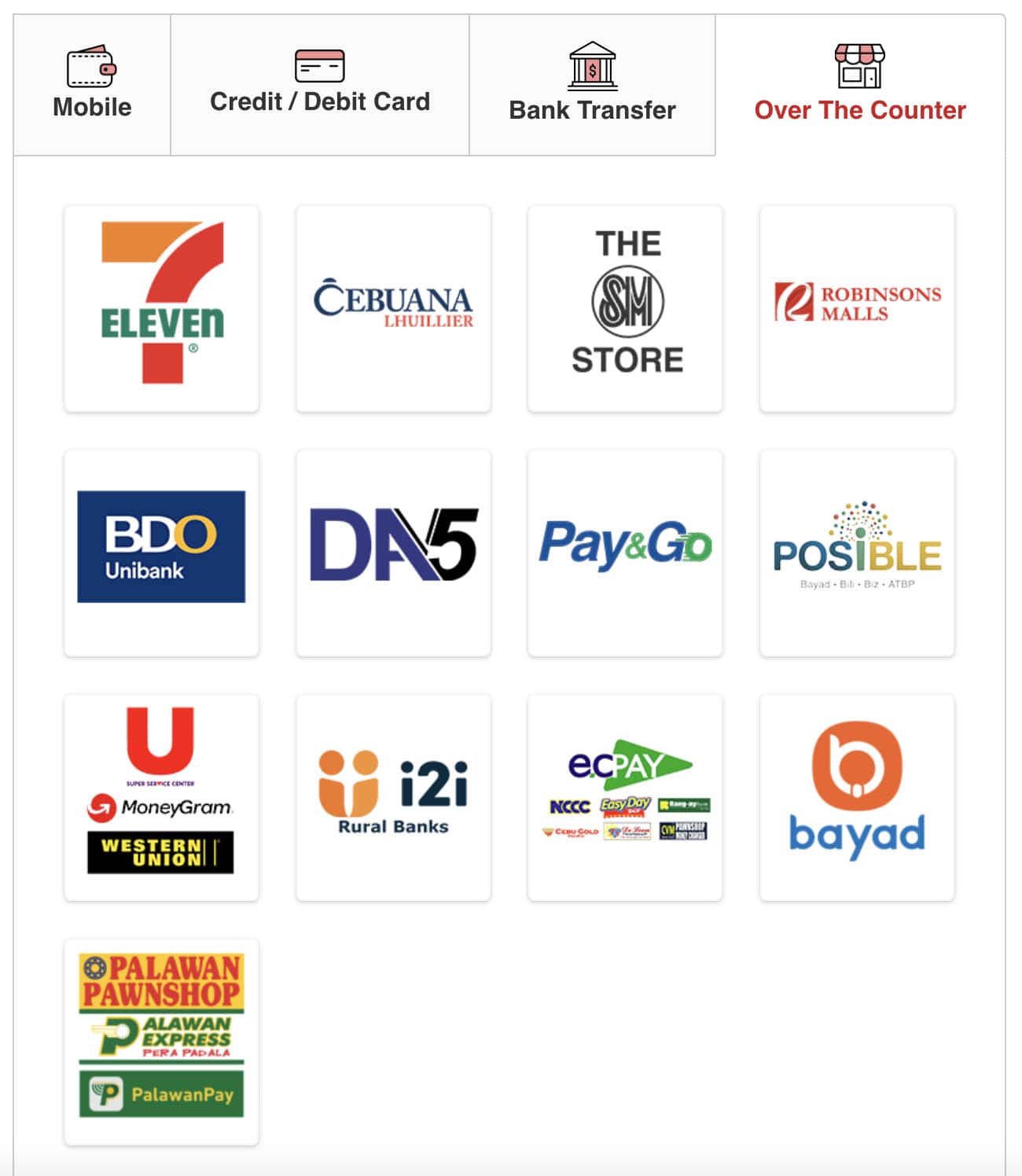

You possibly can pay by means of any of the next:

- E-wallet: GCash, GrabPay, Maya, ShopeePay

- Bank card: Visa, MasterCard

- Financial institution Switch: BDO, BPI, UnionBank, Metrobank, RCBC, Maybank, Instapay

- Over the Counter: 7-Eleven, Cebuana Lhuiller, Western Union, Bayad Heart, EC Pay, The SM Retailer, Robinsons Malls, and so on.

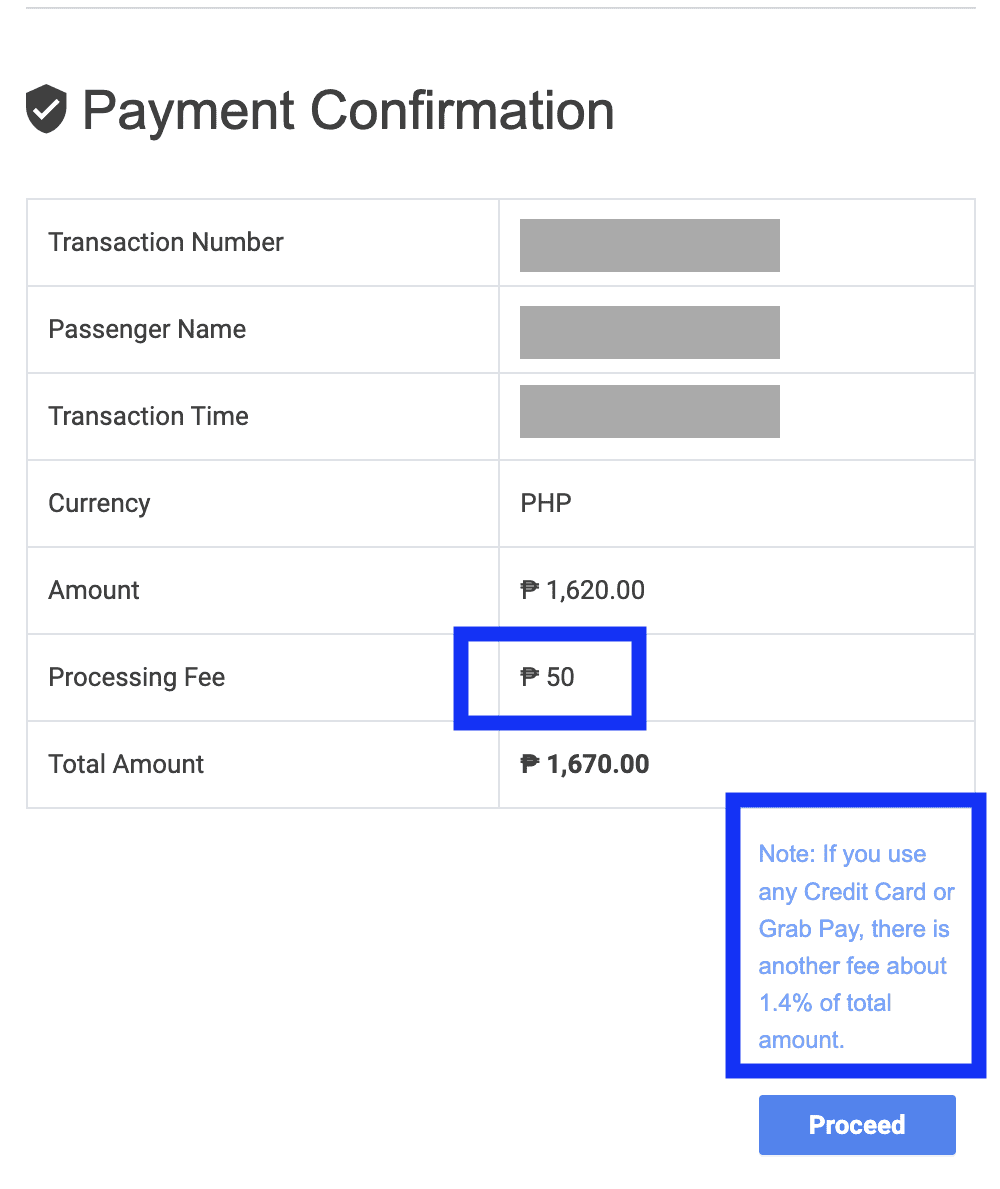

⚠️ Word: The TIEZA web site expenses a processing charge of PHP 50. As well as, paying by way of GrabPay and bank card entails further cost of 1.4% of whole quantity.

Journey Tax Refund

You possibly can file for a refund in case you paid while you’re not presupposed to otherwise you paid greater than what you’re presupposed to.

Listed below are the appropriate causes or instances for a refund:

- You didn’t get to journey as a result of the flight was cancelled, you have been offloaded, otherwise you simply selected to not for no matter motive.

- You’re a non-immigrant foreigner who should not topic to the Philippine journey tax.

- You’re eligible for journey tax exemption.

- You’re eligible for diminished journey tax however you paid the total quantity. On this case, you will get a partial refund.

- You paid for first-class passage however you have been downgraded to financial system class. Partial refund applies.

- You paid the journey tax TWICE for a similar ticket.

For those who paid the journey tax on the airport counter, you will get the refund on the identical day or on the newest, inside the subsequent 24 hours. For those who paid it by way of different channels, it would take longer to course of, relying in your chosen cost methodology.

Typically, listed here are the necessities it is advisable current to say a refund:

- unique passport

- TIEZA refund type no. 353

- TIEZA journey tax receipt

- airline ticket exhibiting you paid the journey tax (if included within the flight cost)

However relying in your motive, there could also be further paperwork it is advisable current to assist your case. You will discover the full checklist of necessities right here.

You possibly can file for a refund declare inside 2 YEARS from the date of cost. In case you have unflown tickets from final 12 months or so, you may nonetheless get a refund for that now.

Updates Log

2024 • 5 • 9: Unique publication